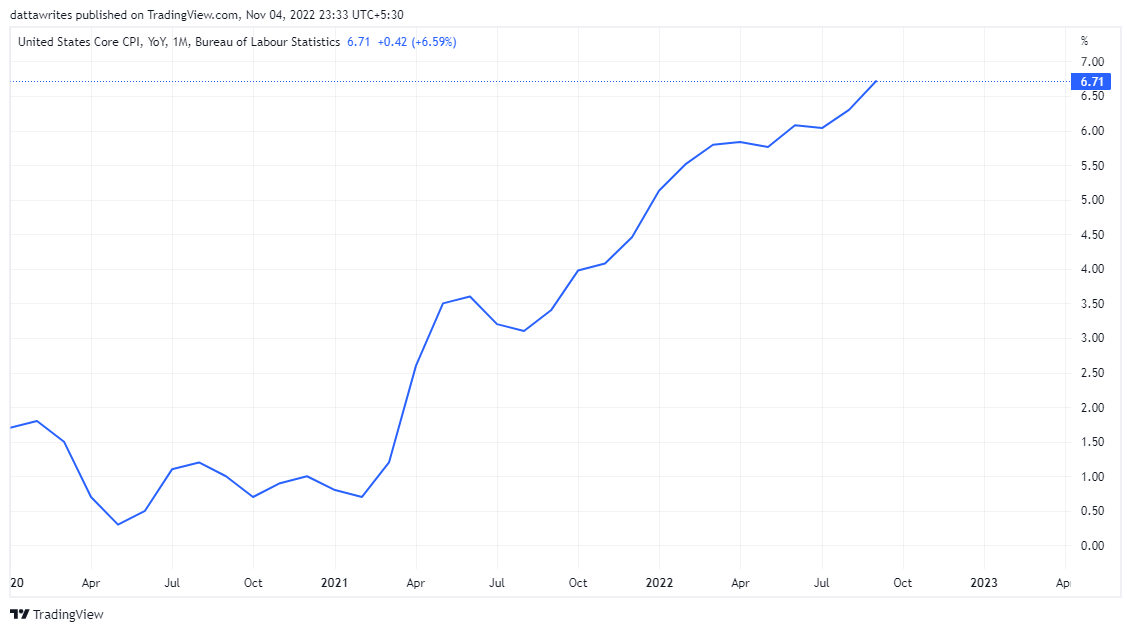

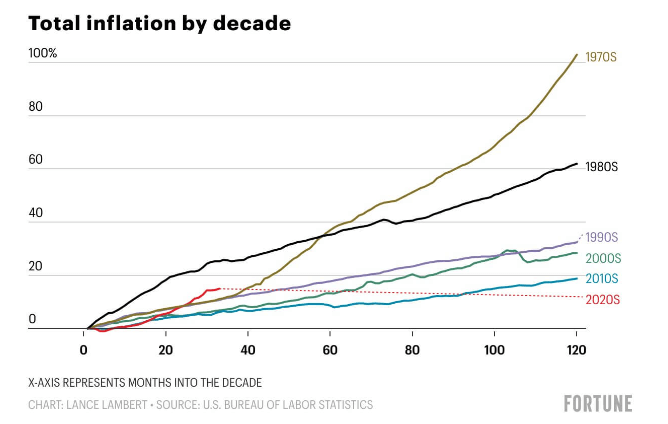

US inflation breaking barriers in the 2020s; started faster than 70s, 80s trend

Inflation is now a global intruder, threatening to disrupt the growth and calm waters of established economies like Europe and the United States.

MeRising energy, fuel oil and gasoline prices are the main contributors to the current staggering rate of inflation.

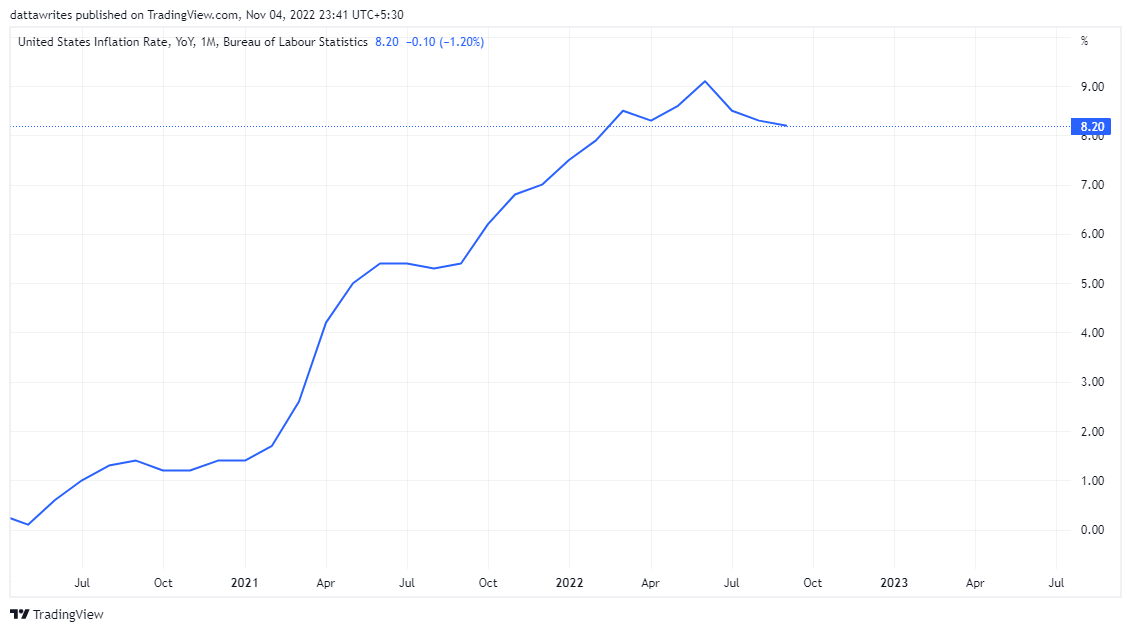

The US economy is currently experiencing the highest rate of inflation in 40 years.data sponsored As of the last September publication by the US Department of Labor, inflation in the country currently stands at 8.2%.

Surprising Inflation Rise from 2020 to 2022

In the United States, inflation hit 7.5% earlier this year and reached 9.0% by June, well above the 5.4% and 0.6% recorded in June 2021 and June 2020.

May 2020 represents the month with the lowest inflation rate of 0.1% from 2020 to 2022. However, the low figure jumped 5.0% in May 2021. Twelve months later, inflation had already reached 8.5% for him, in preparation for the next month’s big rise.

This alarming increase in looting is damaging both the current and future state of the US economy and the nation’s citizens. Inflation reduces the purchasing power of consumers as commodity prices generally rise. The Consumer Price Index (CPI) is up 15.05% since January 2020.

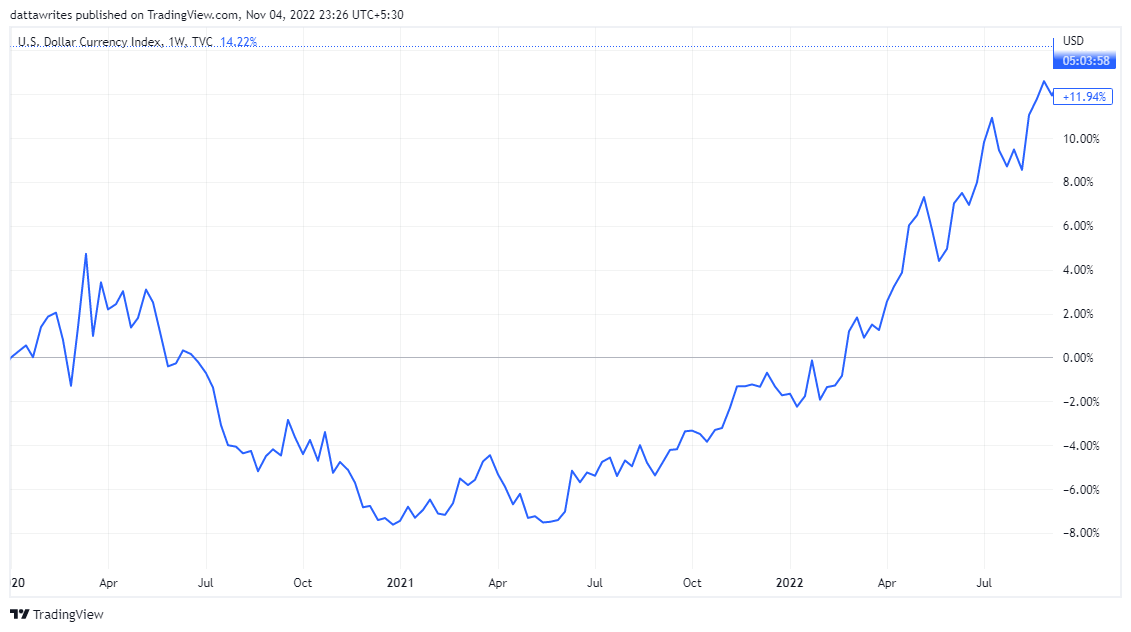

So, in the long term, the US dollar could weaken if inflation is not contained.

Still, the US dollar is doing well against the EUR and GBP. Moreover, this is due to general inflation that has affected the major economies of Europe and the UK.

Are current inflation trends similar to what caused inflation in the 70s and 80s?

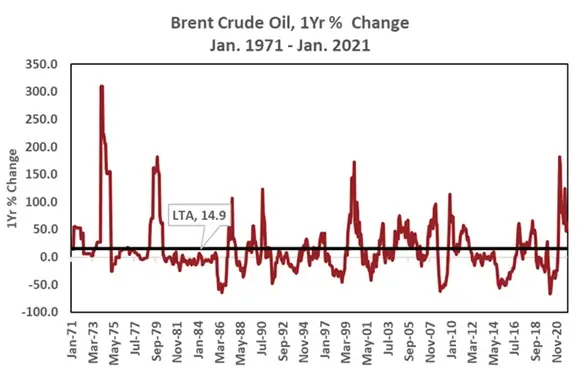

Several recent comparisons have been made between the causes of inflation in the current decade and those of the 1970s and 1980s, when the US economy faced high rates of inflation.

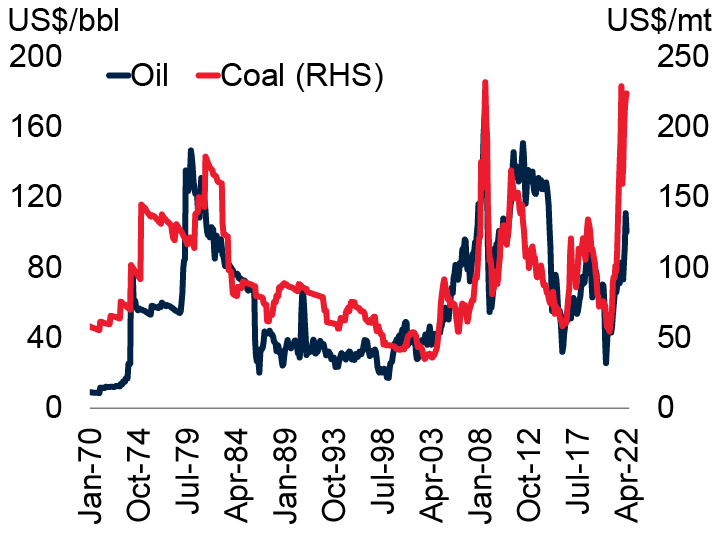

According to reports, oil prices soared by 300% and 180% in 1974 and 1979 respectively. During that period, too, geopolitical tensions contributed to energy shocks and oil price volatility.

At that time, inflation was caused by OPECAn increase in oil prices known as an oil boom by its members. In the past, most of the world’s economies were heavily dependent on oil before looking for alternatives in the current era.

Other factors that contributed to inflation in the ’70s and ’80s included low interest rates, weak economic growth, and declining inflationary pressures.

But there are indications that the recent inflation of the current decade has started faster than those recorded in previous decades.

The US has experienced 15% inflation for 33 months in the last decade. If this trend continues, it will grow by 50% over the next decade.

The Fed’s Response to Inflation; Rising Interest Rates and Impact on U.S. Jobs

In response to general inflation, the Federal Reserve has raised interest rates at various times during the year. Recently, the Fed said he raised rates by 75 basis points for the fourth time in a row since November 1st at its 2nd meeting.

Meanwhile, the rise is a key strength of the US dollar’s strong performance against the EUR and GBP, highlighting the impressive 14.57% growth in the US Dollar Index (DXY).

However, if the Fed slow down Regarding rate hikes in early 2023.

Simply put, the Fed’s approach is an attempt to destroy demand while encouraging businesses and individuals to save.

At every opportunity, business owners cut spending, which can stagnate employment rates and leave workers’ wages at the status quo, discouraging further spending.

Cryptocurrency reaction to inflation

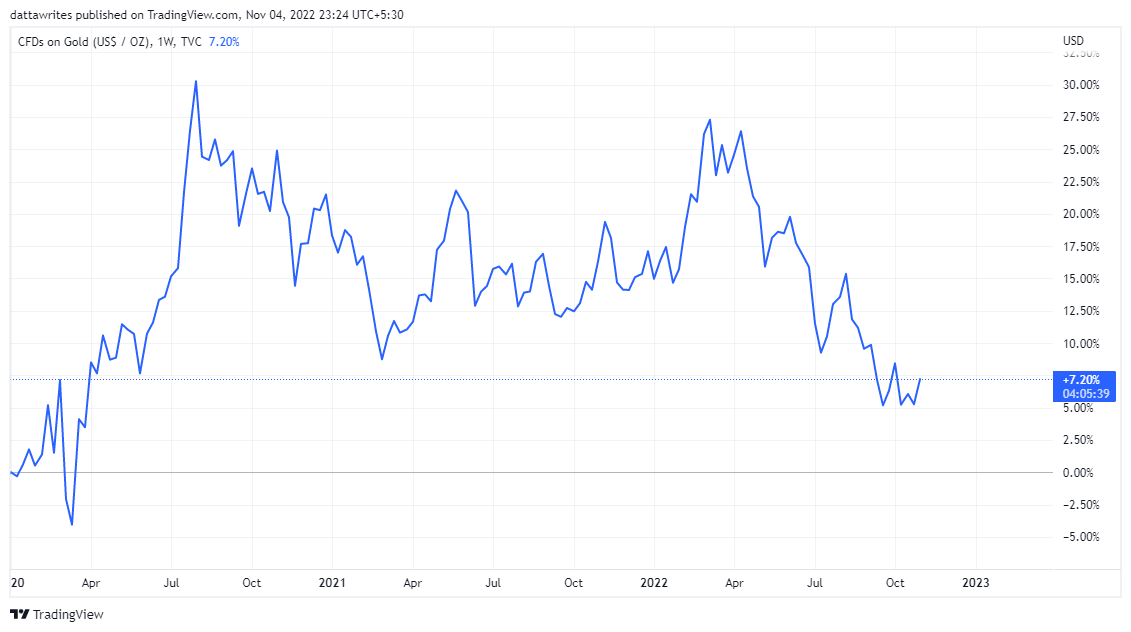

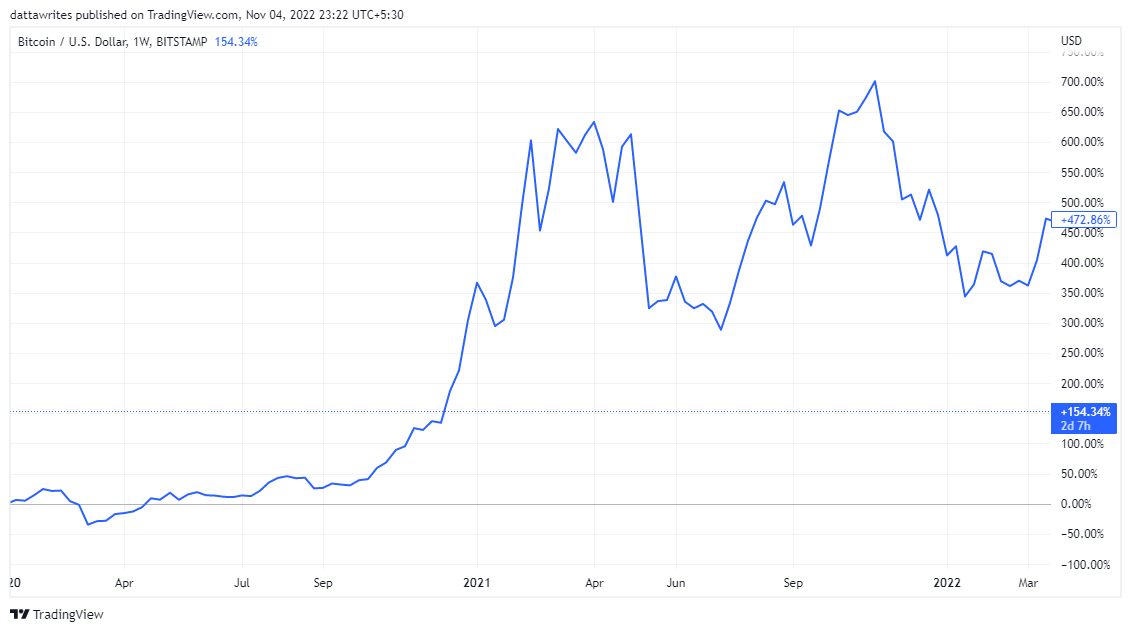

Since the start of 2020, Bitcoin is up 184.28%, while gold is up only 5.38%. These numbers reflect how cryptocurrency assets have surged as opposed to traditional assets like gold.

Historically, assets like gold have gained importance as inflation hedges. However, cryptocurrencies have proven to be an ideal choice compared to gold as an investment against severe inflation.