USDT, USDC exchange balance going in opposite directions

Often overlooked in the cryptocurrency market, stablecoins can be used to determine the current state of the market. Stablecoin balances on exchanges represent “dry powder,” or idle liquidity that can be a powerful driving force in the market.

Only recently has total stablecoin balance on exchanges become an important factor in the market. Stablecoin volumes on exchanges remained relatively flat through 2020, with outflows roughly equal to inflows.

However, after the 2020 COVID-19 pandemic, the market saw an exponential increase in stablecoin balances on exchanges. A modest growth in 2020 turned into a parabolic rise in early 2021, according to his Glassnode data analyzed by CryptoSlate.

The two main drivers behind this growth were USD Coin and USDT.

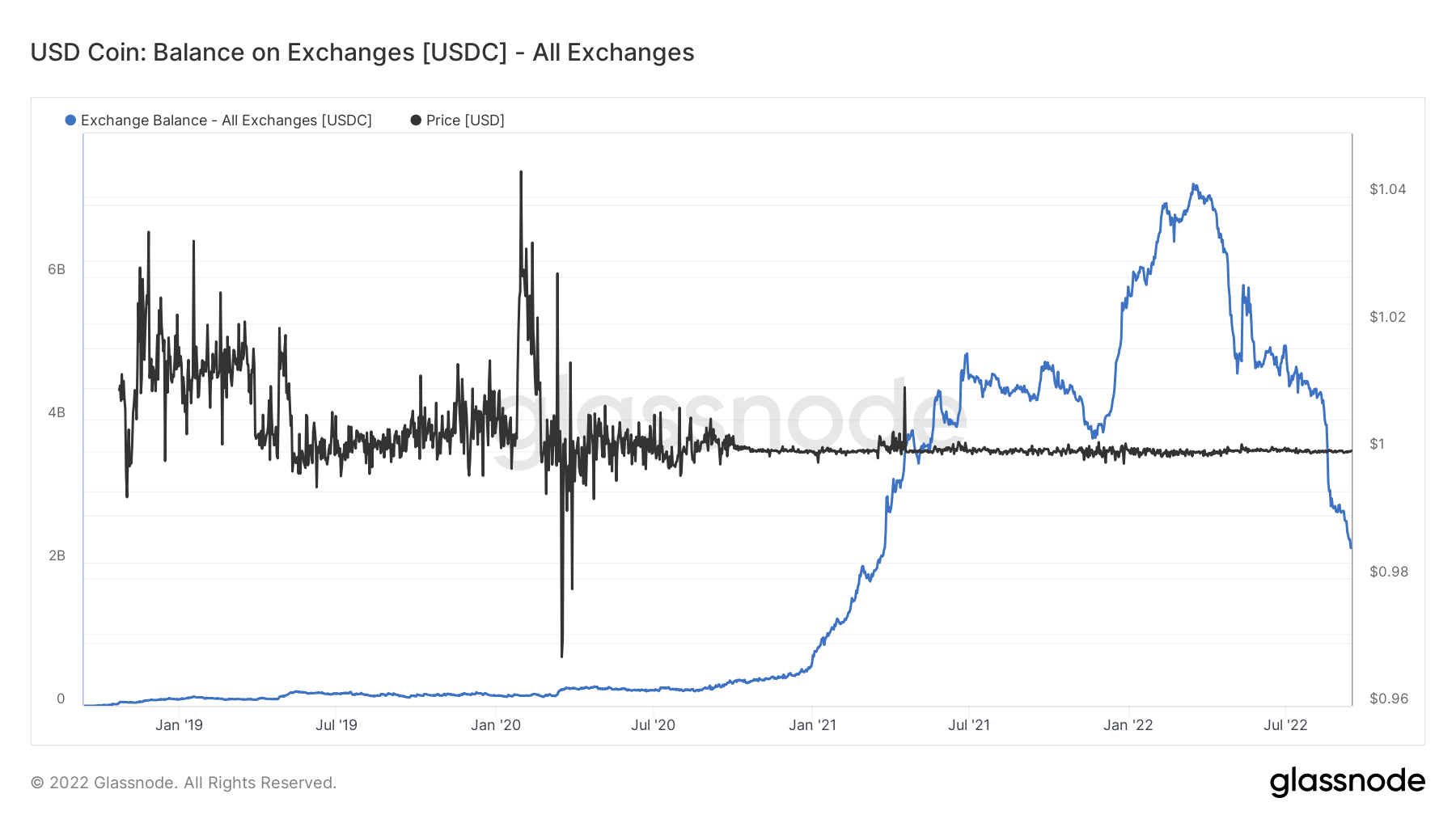

Circle’s USD Coin stood out among most of the other stablecoins most likely to be dominated by Tether’s USDT. It peaked in February 2022 with over $7 billion USDC placed on exchanges. It came surprisingly close to USDT, with its exchange balance at about $10 billion.

However, USDC could not sustain its growth. Since February 2022, stablecoin exchange balances have been continuously declining and are now reaching his $2.1 billion level set at the beginning of 2021.

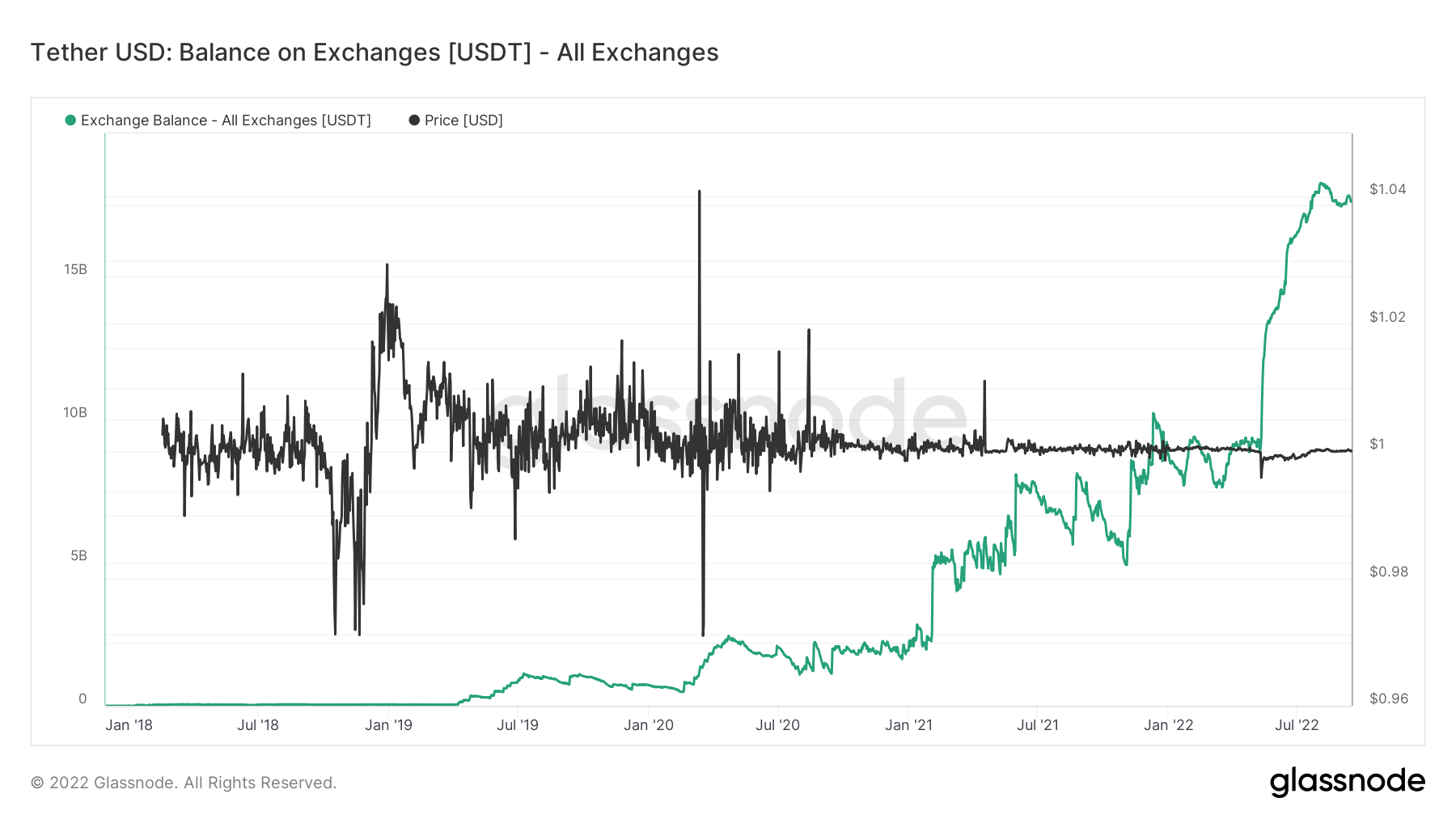

The declining presence of USDC on exchanges contrasts with USDT. The Tether stablecoin powerhouse has doubled its exchange balance in 2022 and now stands at around $17.7 billion.

The gap between USDC and USDT balances can get even bigger as the quarter progresses. As CryptoSlate previously covered, his USDC off Binance hit an annual high at the beginning of his September. In the first week of September, he drained about $1 billion per day from his USDC hot wallet on Binance.

While this was in line with industry-wide trends, USDC was topping the charts when it came to outflows. stop supporting USDC. The exchange said it will convert customer holdings of USDC, USDP, and TUSD into the native BUSD stablecoin to increase liquidity and capital efficiency.

Binance is the largest cryptocurrency exchange by trading volume and the largest exchange by USDC balance. The removal of USDC support has hit stablecoins hard.

Another key factor that has further deepened the divergence between USDC and USDT is Tether’s recent commitment to transparency. The company has been widely criticized for avoiding audits of its cash reserves and confirming claims that USDT is backed by fiat reserves.

The company, started by Paolo Ardoino, CTO of Tether, recently stepped up its efforts to present transparent insights on its reserves, daily value of legal tender and gold reserves.