What happens to our assets in a stagflationary environment? Will smart money eventually move into BTC?

Inflation has become one of the most pressing global economic problems today. Rising prices have dramatically reduced both overall wealth and purchasing power in most of the developed world.

Inflation is certainly one of the biggest drivers of the economic crisis, but a greater danger of stagflation is on the horizon.

Stagflation and its impact on the market

First coined in 1965, the term stagflation describes an economic cycle with persistently high inflation coupled with high unemployment and stagnant demand in a country’s economy. The term was popularized in his 1970s as the United States plunged into a protracted oil crisis.

Since the 1970s, stagflation has been repeated in developed countries. Many economists and analysts believe the US is about to enter a period of stagflation in her 2022. This is because it is becoming increasingly difficult to deal with inflation and rising unemployment.

One way to measure stagflation is the real interest rate (the interest rate adjusted for inflation). Looking at the real interest rate shows the real yield on assets and the real rate of return, revealing the true direction of the economy.

according to U.S. Bureau of Labor Statistics, the consumer price index (CPI) recorded 8.5% inflation in July. His CPI in July registered a meager 1.3% rise from his May figure, prompting many policymakers to ignore the current severity of inflation.

Real interest rates, however, paint a much different picture.

Currently, the 10-year US Treasury yield is 2.8%. At 8.5% inflation, the real yield of US Treasury Bills is 5.7%.

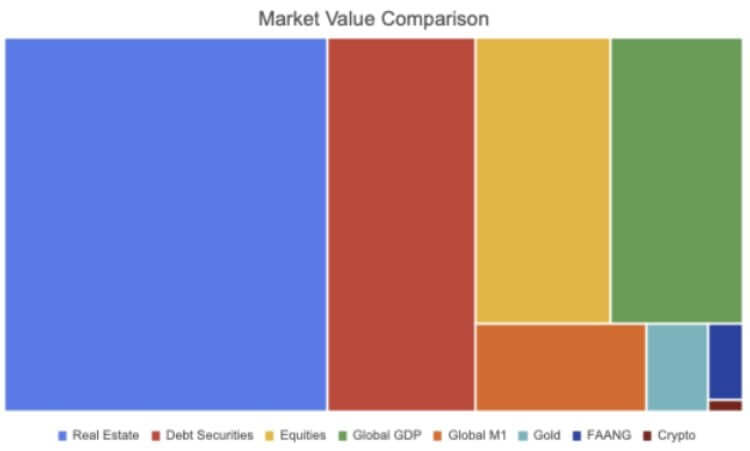

By 2021, the global bond market is estimated to be around $119 trillion.according to Securities Industry and Financial Markets Association of America (SIFMA), of which about $46 trillion is from the US market. All fixed income market SFIMA tracks, including mortgage-backed securities (MBS), corporate bonds, municipal bonds, federal agency securities, asset-backed securities (ABS), and money market, are now negative return when adjusted for inflation.

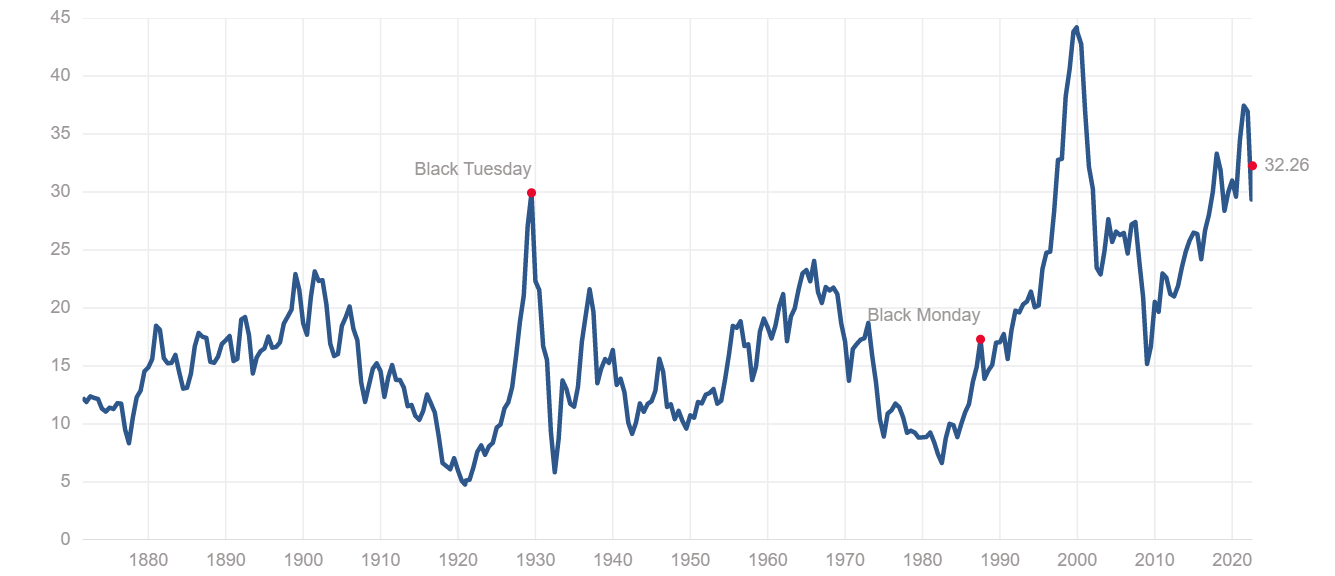

The S&P 500 index also falls into the same category. Shiller’s price-to-earnings ratio (P/E) puts the S&P index in the highly overvalued category. This ratio shows the inflation-adjusted return of the S&P index over the past decade and is used to measure the overall stock market performance. The current Shiller P/E ratio of 32.26 is well above the levels recorded before the 2008 financial crisis and on par with the Great Depression of the late 1920s.

The real estate market is also struggling. In 2020, the value of the global property market reached a record high of $326.5 trillion, an increase of 5% from its 2019 value.

The figure was expected to be even higher this year due to a growing population that is contributing to the housing shortage. In the United States, interest rates have been pegged at near zero since the 2008 financial crisis, making mortgages cheaper and boosting home sales nationwide.

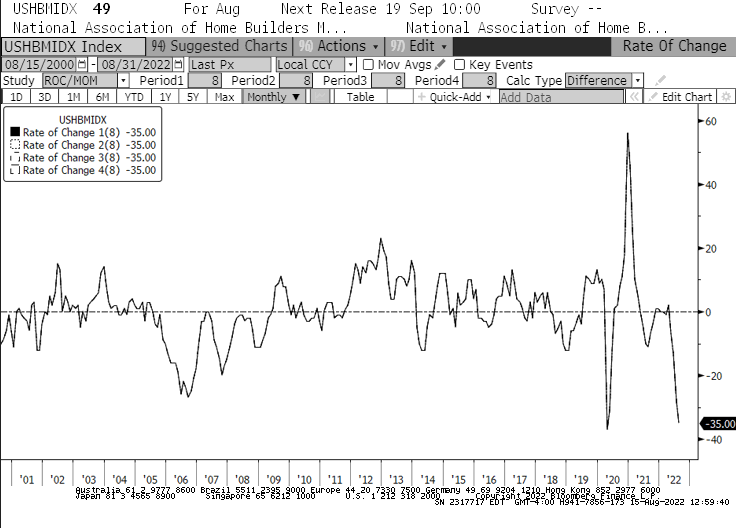

The rise in interest rates seen since the beginning of the year is set to change this. Since January, the National Association of Home Builders (NAHB) housing market index has posted its fastest ever -35 decline. The decline recorded by the index was faster than in 2008, when the housing bubble suddenly burst. This is also the longest monthly decline for the NAHB Index, as it marked eight straight months of decline in his August for the first time since 2007.

We found a significant number of institutional investors and asset managers reconsidering their portfolios as nearly every segment of the market fell. Overvalued real estate, overbought stocks, and bonds with negative real yields are all headed for a period of stagflation that could last for years.

Large financial institutions, asset managers and hedge funds can all face difficult choices. Stay in the market, ride out the storm and risk short and long term losses or rebalance your portfolio with a diversified set of assets with better chances. of growth in the market of stagflation.

Even if some institutional investors choose the latter route, it could lead to increased inflows into Bitcoin (BTC). The cryptocurrency industry is experiencing unprecedented growth in institutional adoption as assets other than Bitcoin become an integral part of many large investment portfolios.

But Bitcoin, the largest and most liquid cryptocurrency, could be the target of most of these investments.