What’s troubling Ethereum ahead of the Merge?

With less than two days left before Ethereum transitions to a proof-of-stake system and all eyes are on the merge, many are still worried whether the merge will change the crypto market for the better. .

According to the latest report from analytics firm Nansen, the problems facing PoS Ethereum cannot be ignored. However, the company believes most concerns are largely unwarranted as Ethereum weathers the storm and emerges as a stronger and more resilient chain.

Integrate into a more centralized system?

One of the most heated conversations about Merge is about the degree of centralization it brings to Ethereum.

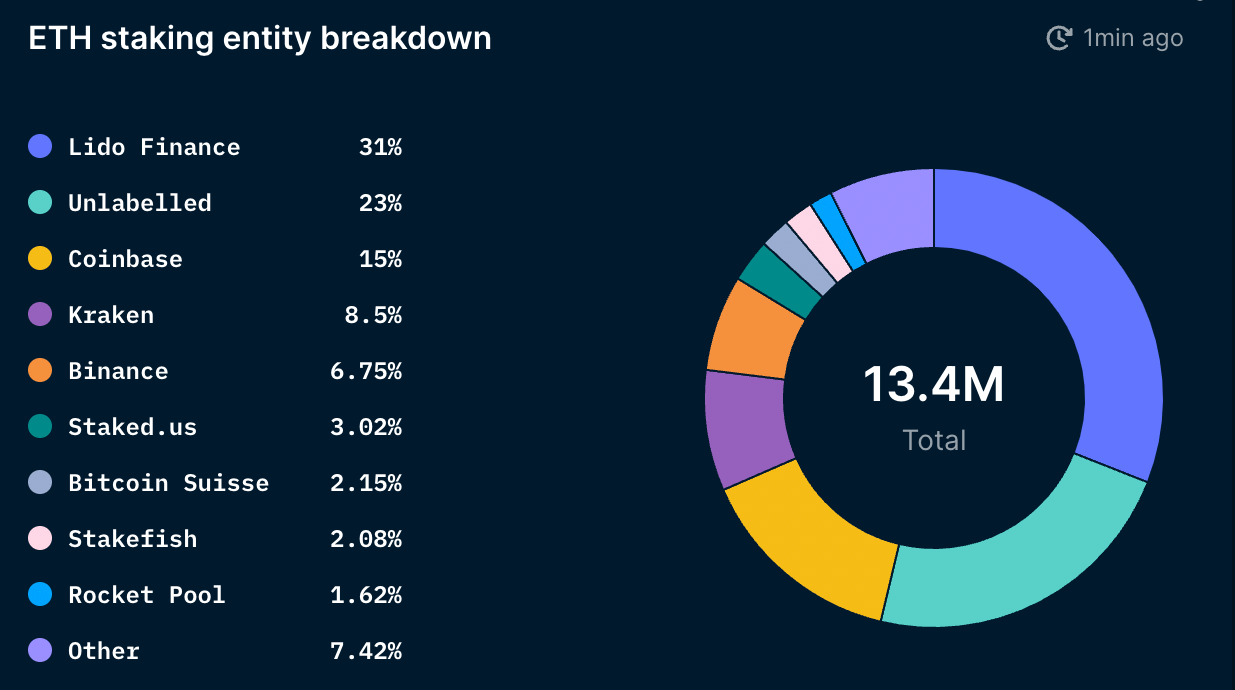

Nansen reports that around 80,000 unique addresses have been set up to participate in Ethereum staking. While that number may seem high, looking at the landscape of intermediary staking providers shows that there is a great deal of centralization going on.

In total, 11.3% of the ETH supply is staked, or 13.5 million ETH. Lido, a decentralized liquid staking protocol, accounts for 31% of total ETH staked. Coinbase, Kraken, and Binance hold about 30% of staked ETH.

Exchanges such as Coinbase, Kraken and Binance must comply with the regulations of the jurisdictions in which they operate. This is why the bulk of the market is focused on centralization issues rather than the centralization issues that can arise from them. It can come from decentralized services like Lido.

As the liquid staking solution market expands, Lido’s share will grow even higher. According to Nansen, Lido accounts for 47% of Liquid Stake ETH, while Coinbase, Kraken and Binance together account for 45%. Zooming in on liquid staking providers, excluding centralized exchanges, shows Lido’s dominance. Lido holds 91% of the liquid staking market.

Lido is a service provider managed by the Lido DAO and configured to allow multiple validator sets. The structure of the DAO makes it difficult for regulators to target him, but many believe that his Lido weakness lies in its tokens. Nansen noted in the report that centralizing ownership of LDO tokens could leave Lido vulnerable and subject to centralization risks. The top nine wallets holding LDO tokens hold 46% of the governance power, which in theory could have a significant impact on Ethereum validators.

“If Lido’s market share continues to rise, it is possible that the Lido DAO will hold the majority of the Ethereum validator set. It can censor specific transactions (via governance) by enforcing orchestration and, in the worst-case scenario, coercing or rewarding validators to behave according to Lido’s wishes. can cause problems,” Nansen said in the report.

It’s important to note that Lido is actively working to mitigate these centralization risks. The platform is considering introducing a dual governance model with LDO and stETH. However, rather than making stETH a governance token, it will only be used to vote against Lido proposals that could negatively impact stETH holders.

No risk of post-merger sale or destabilization

Another major concern about the merger was its potential to trigger a large sale. Nansen said in the report that a staker cannot dump his ETH on the market. All his staked ETH will be locked until the Shanghai upgrade, which is scheduled between 6-12 months after the merge.

Staking rewards will also be harder to sell. According to reports, there is an exit queue of about 6 validators per epoch. If the epoch lasts about 6.4 minutes, it will take about 300 days for his staked 13 million ETH to be withdrawn.

Nansen believes that the illiquid investors are most likely to sell when they are finally able to exit. The report also points out that most selling is done for profit. If the market remains neutral or slightly bullish, most of his unstaked ETH is likely to remain away from the market. Even if most of the illiquid stakers decided to sell, they would likely not have the power to move the market significantly, as they accounted for only his 18% of the total ETH staked.

Another good sign of future stability, according to the report, is the accumulation seen in smart money wallets and wallets belonging to ETH millionaires and billionaires. Overall, ETH millionaires and millionaires have been consistently piling up Ethereum since the beginning of the year. Smart money wallets, which have historically focused more on transactions than direct accumulation, appear to have increased holdings since hitting an annual low in June. This suggests that we expect positive price action after the merger.

Nansen concludes that most of what currently plagues Ethereum will not adversely affect the post-merger network. It states that the network is set up to get out of the merge without major issues.

“The liquid staking market appears to be heading towards a ‘winner takes all’ scenario. does not undermine Ethereum’s core value proposition.”