Why the Ethereum/Bitcoin ratio will continue to fall

Much has been said about Ethereum flipping Bitcoin in the past. Especially during the 2017 bull market when the ETH/BTC ratio peaked at his 0.157.

But fast forward to the present, fueled by the ongoing banking crisis story, and Glassnode’s data was analyzed. crypto slate It suggests a period of Ethereum’s underperformance is ahead, paying the price for the idea of ’flipping’.

Bitcoin – Ethereum Achieves Cap Dominance

Market capitalization is the most popular way to value and compare cryptocurrencies. It is calculated by multiplying the current price by the circulating supply.

A variation of the market capitalization method is the realized cap. This replaces the current price in the calculation above with the price the coin last moved. Proponents argue that this minimizes the impact of irretrievably lost coins, thus resulting in a more accurate valuation.

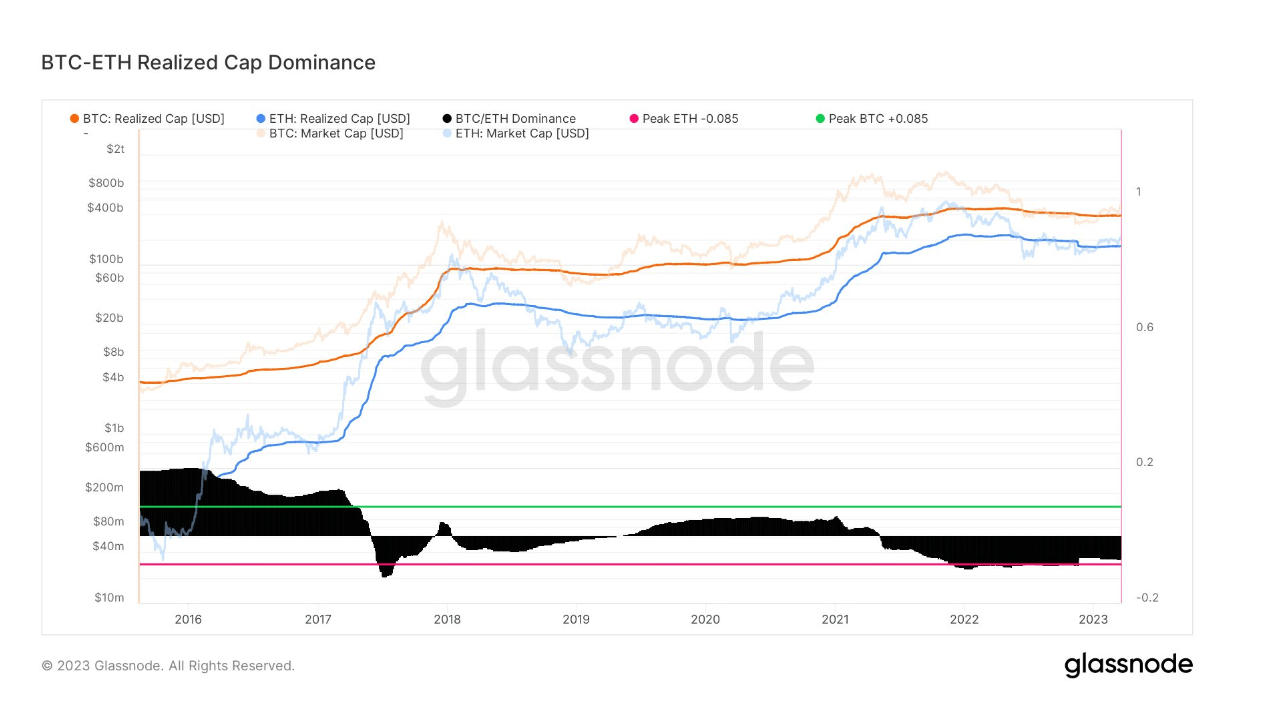

The chart below shows the Bitcoin and Ethereum markets and realized caps since 2016. Looking specifically at the realized cap line, June 2017 saw a tightening between BTC and ETH.

Around April 2019, the two began to diverge. By May 2021, however, the two bands had narrowed further. However, Ethereum’s realization cap has started to fall in recent weeks, and Bitcoin holdings have remained relatively stable.

This chart shows the market cap of BTC as [(BTC market cap + ETH market cap) – 0.765]The number 0.765 visualizes the oscillator around its long-term average. This indicates that the market is starting to leave the two-year period of ETH dominance.

Based on the current situation, the market is preparing for higher interest rates and banks continue to tighten credit. This is generally a scenario that favors risk-off assets.

Ethereum is considered to be more risk-on and in higher beta than Bitcoin, suggesting it will underperform against major cryptocurrencies moving to a risk-off environment.

Ethereum basics

An analysis of Ethereum fundamentals also suggests further underperformance.

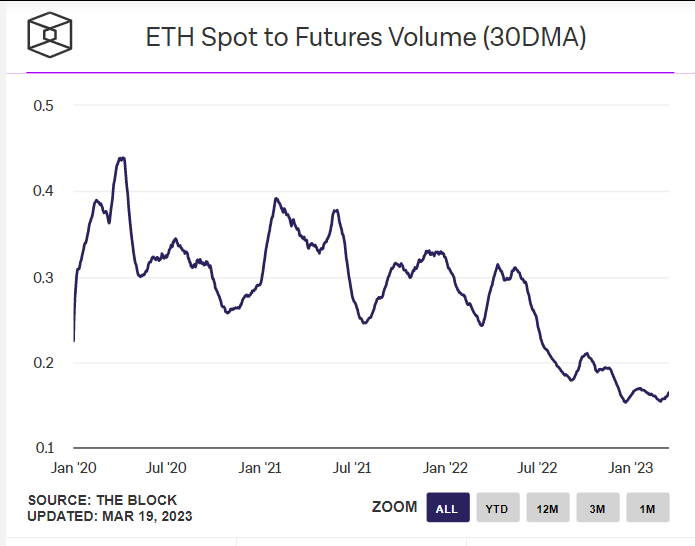

A common indicator of ecosystem health is a high spot-to-futures ratio. This shows that the holders control the traders and their intention is profit rather than belief in the ecosystem.

Data from ETH spot blocks to futures volumes show a macro downtrend since April 2020. The downtrend accelerated around May 2022 (Terra-LUNA implosion) before dropping to an all-time low.

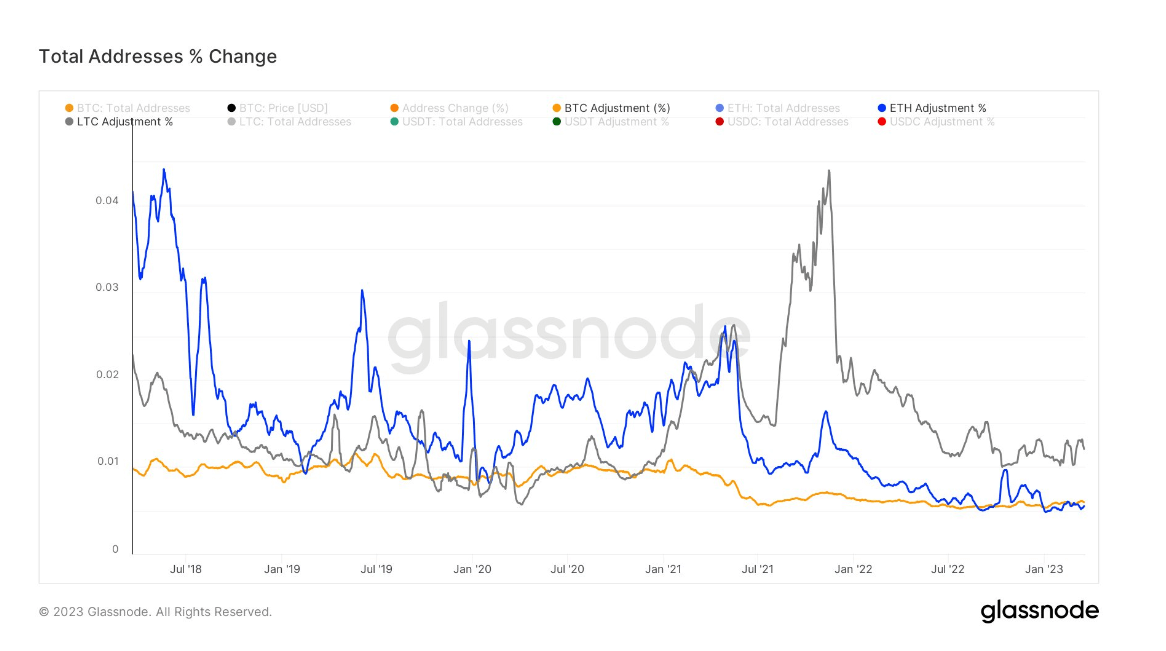

Overall ETH address change rate has been declining over the past five years, falling below BTC last month.

Similarly, the rate of change in total LTC addresses started to pull away from ETH (and BTC) around June 2021 and has remained consistently high ever since, especially moving to the top of the market around November 2021. .

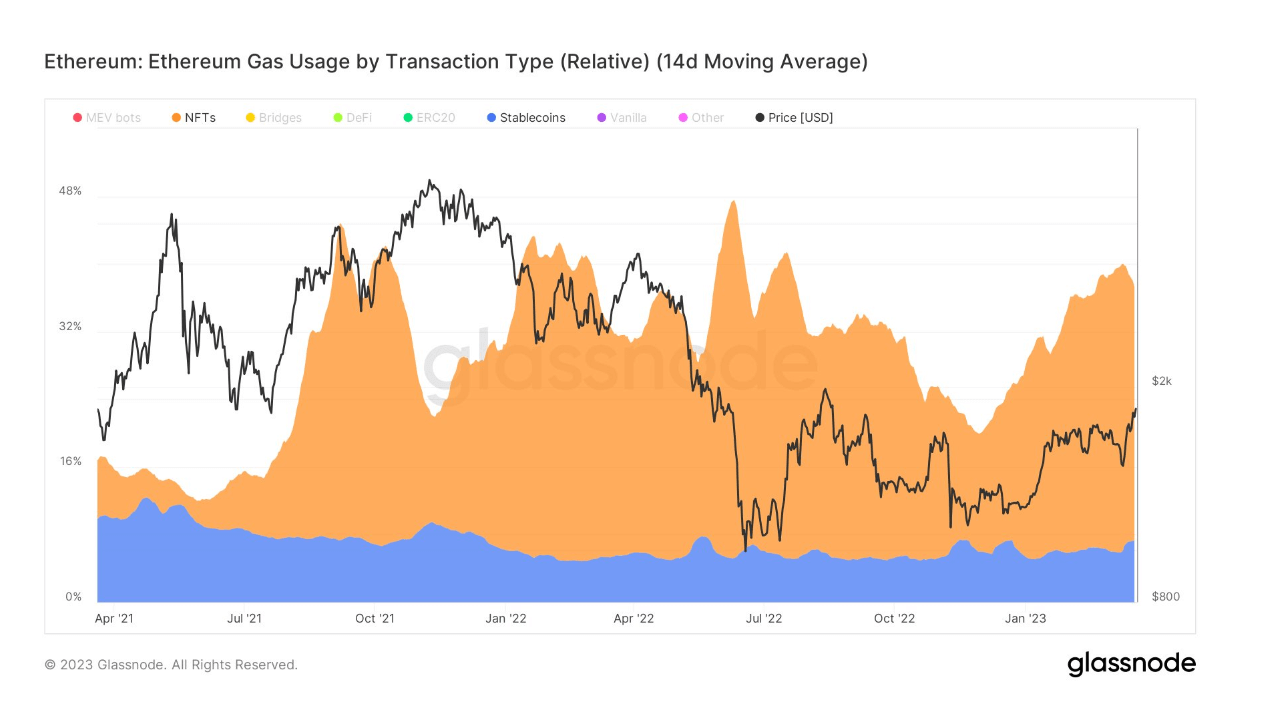

On-chain data shows that stablecoins and NFT transactions constitute the most significant gas usage on ETH, with the former spiked around December 2022.

In June 2022, stablecoin and NFT transactions accounted for almost half of ETH gas usage. Currently, the percentage is around 35%, indicating a general decline of these applications on the ETH chain.

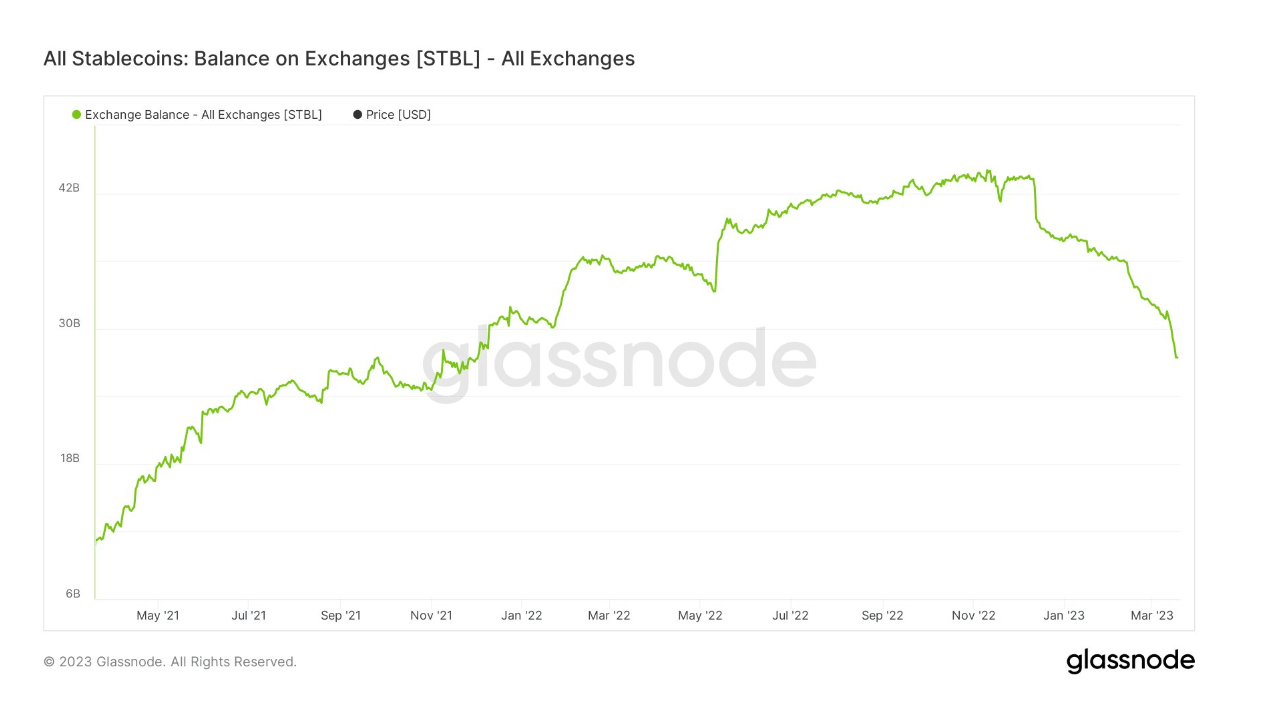

This can be explained by the growing popularity of Ordinal on BTC. This slightly reduced the demand for ETH NFTs. Similarly, exchange stablecoins have slumped to his 17-month low. This suggests a general decline in the importance of stablecoins to cryptocurrencies.

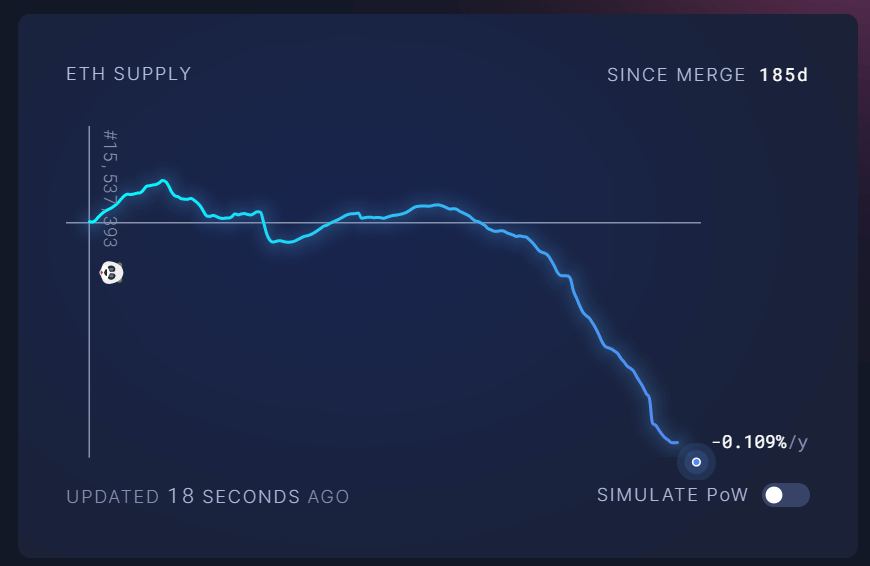

The merging narrative has led to bullish price drivers in the switch to proof-of-stake and deflationary tokenomics. However, after more than six months, ETH continues to lose against Bitcoin. There are several possible reasons for this.

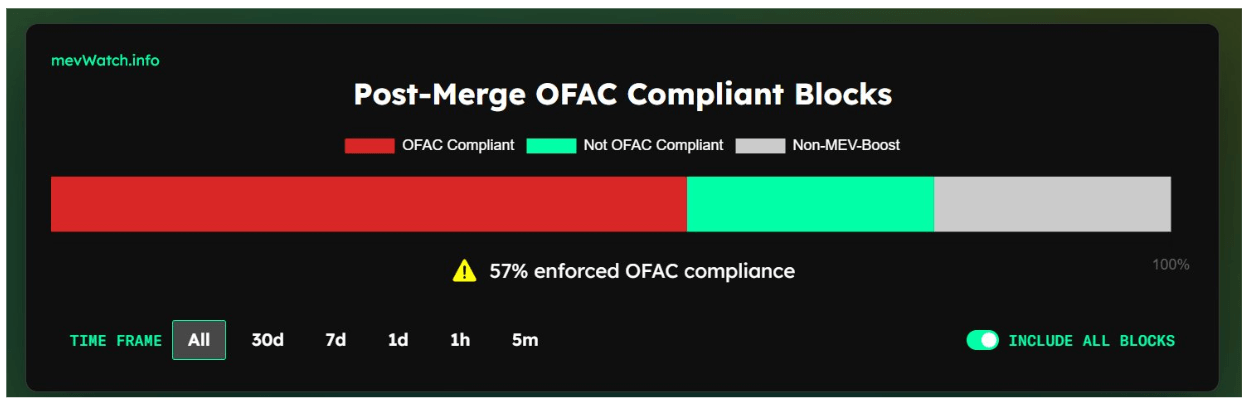

Ethereum’s reputation as an uncensorable decentralized chain has taken a huge hit since the Tornado Cash sanctions. More than half of the blocks are still Office of Foreign Assets Control (OFAC) compliant. That means more than half of the networks will filter out transactions on orders from US authorities.

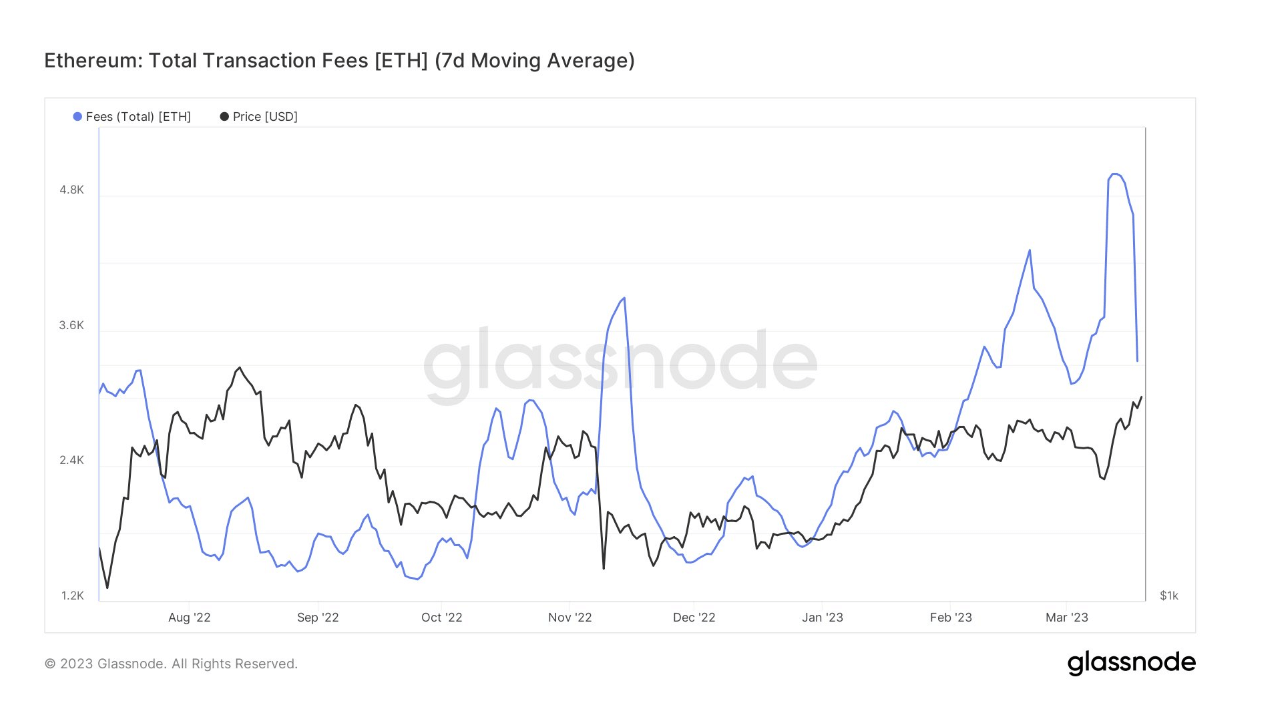

And while the developers have clarified that the merger will not directly reduce fees, there remains an ongoing and unresolved issue regarding costly transactions. The chart below shows that transaction fees recently jumped to around 5,000 ETH.

The ETH/BTC ratio is currently at 0.0635, less than half of its 2017 peak. Since the banking crisis, this ratio has dropped significantly, suggesting that the market is overwhelmingly in favor of Bitcoin during this uncertain time.