A huge stablecoin supply is waiting on the sidelines to trigger a bull run

Bitcoin is usually considered the backbone of the cryptocurrency industry, but the role that stablecoins play in the market should never be underestimated.

Stablecoins are essentially the fiat currency of the crypto ecosystem and serve as the primary provider of liquidity to the market.

When we look at the cryptocurrency market as a closed system containing only stablecoins and cryptocurrencies, the supply of stablecoins and how they work becomes increasingly important. This is especially useful when analyzing Bitcoin performance. This is because the ratio of the two may indicate a potential price increase.

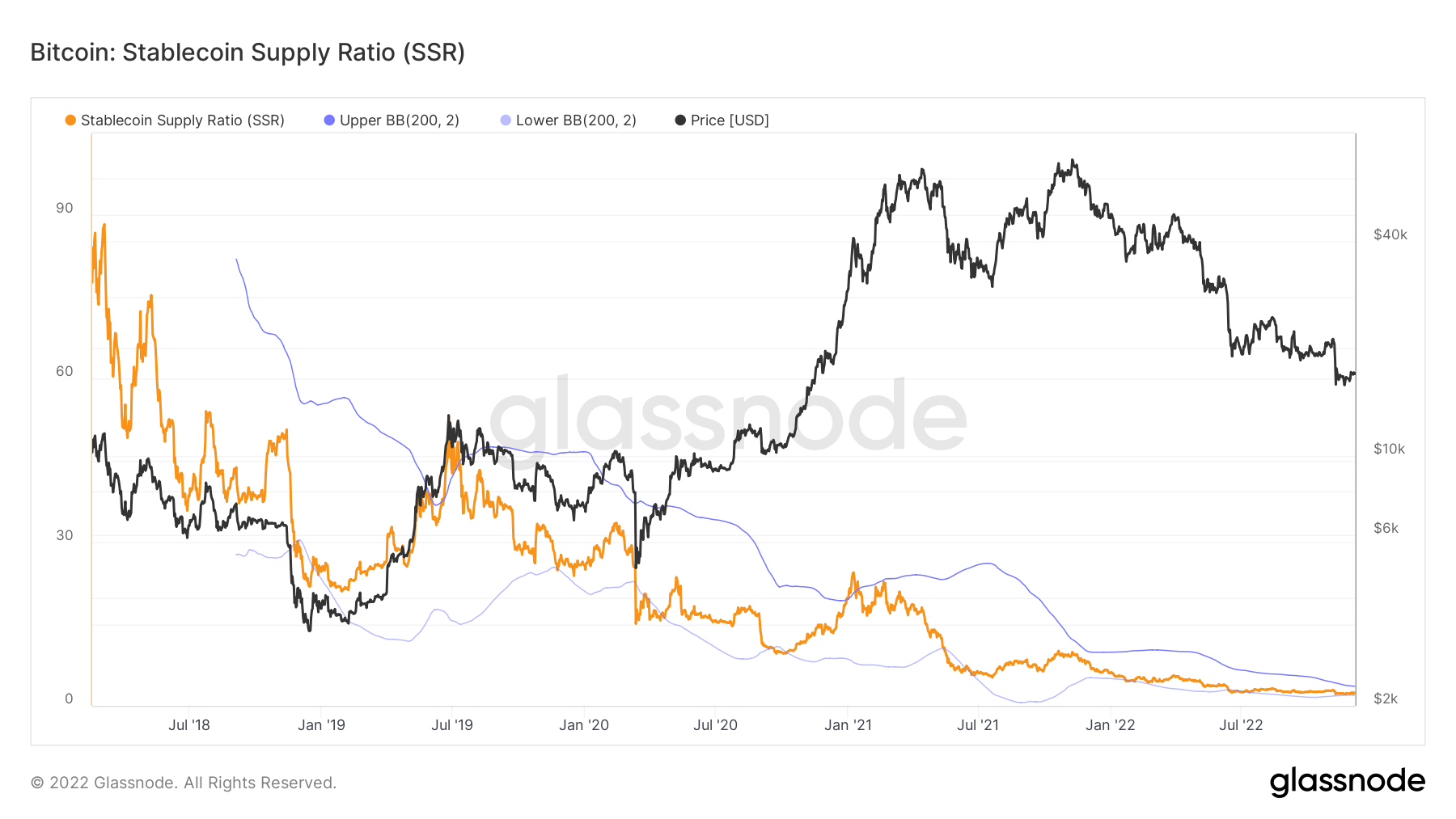

Stablecoin Supply Ratio (SSR) indicates the ratio of the circulating supply of Bitcoin to the supply of stablecoins.

The moves seen in SSR provide insight into whether Bitcoin or stablecoins are more important in the market. This ratio essentially compares two power statuses.

A high SSR indicates a small supply of stablecoins relative to Bitcoin’s market capitalization. This indicates that there is little buying pressure in the market as there are few stablecoins (liquidity) in circulation. Low buying pressure could indicate a possible drop in Bitcoin price and is seen as a bearish sign.

A low SSR means a high supply of stablecoins compared to the market cap of Bitcoin. It is seen as a bullish sign as it shows excess liquidity waiting to be deployed to Bitcoin.

Looking at an increase in SSR indicates declining purchasing power, while a downward trend indicates rising purchasing power for stablecoins.

According to data analyzed by CryptoSlate, SSR has been steadily declining since the beginning of the year. The ratio has dropped almost vertically twice this year.

The current ratio is 2.34, the lowest since 2018.

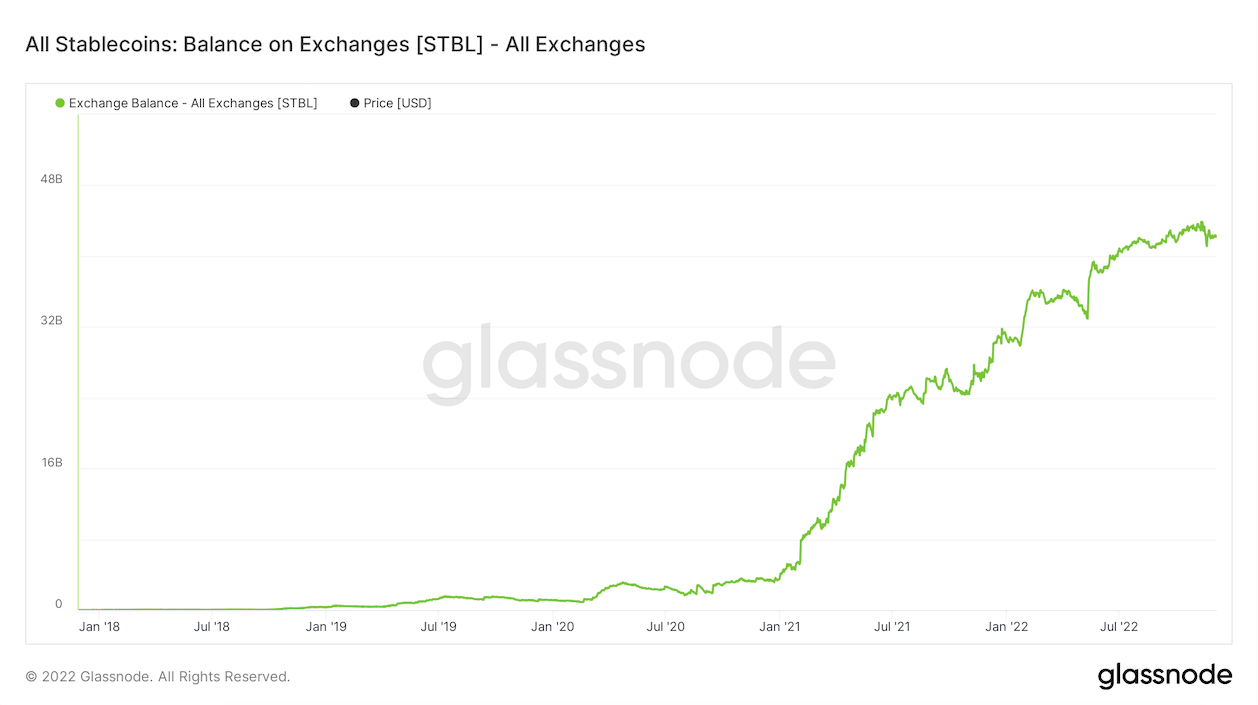

The SSR drop is further supported by a surge in stablecoin balances on exchanges.

Similar to SSR, exchange balances show the amount of “unused” liquidity on the side of a centralized exchange.According to data from glass nodestablecoin balances on exchanges have been growing exponentially since January 2021. While there was a steep decline in the weeks following the Luna collapse and the aftermath of FTX, its upward trend continues throughout the year.

As of December 6th, there are over $42 billion worth of stablecoins on centralized exchanges. This indicates that there is around $42 billion in liquidity on the market’s sidelines, ready to roll out into cryptocurrencies like Bitcoin.