Alameda’s capital portfolio reveals highest token investments in Polygon, Hole, and Port Finance

The capital portfolio of bankrupt cryptocurrency trading firm Alameda Capital recently release Some interesting investments have been revealed by the Financial Times.

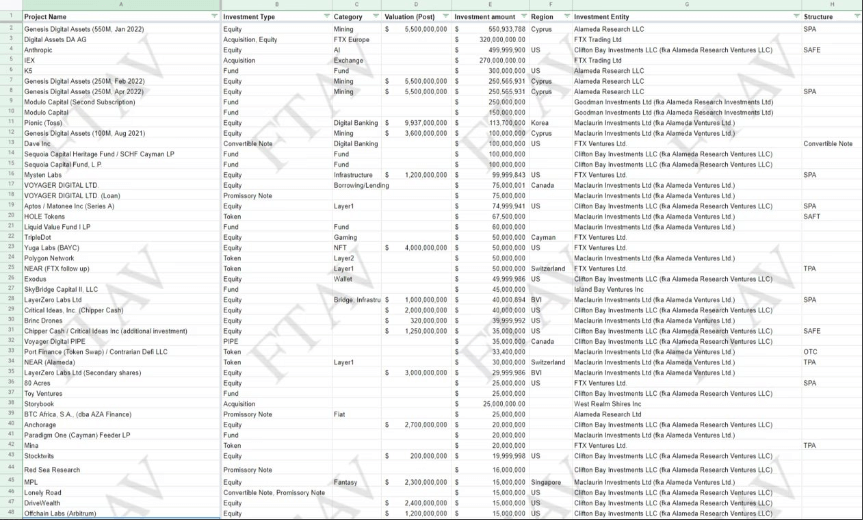

The $5.4 billion FTX/Alameda portfolio has nearly 500 illiquid investments across 10 holding companies, according to the spreadsheet.

Two of the most significant investments are cryptocurrency mining firm Genesis Digital’s $1.15 billion investment and Open AI’s founding of Anthropic’s $500 million investment. Crypto influencer Wu Blockchain said the investment was “silly.”

The two largest investments, a $1.15 billion investment in cryptocurrency mining company Genesis Digital and a $500 million investment in Anthropic, founded by OpenAI employees, are ridiculous.

— Wu Blockchain (@WuBlockchain) December 6, 2022

Investing in Sequoias and Skybridges

A $200 million investment in Sequoia, the venture capital firm that previously cut FTX’s stake to zero, is also included in the bankrupt trading firm’s holdings.

In addition, Alameda documents list Anthony Scaramucci’s $45 million investment in Skybridge Capital. FTX transferred his 30% stake in SkyBridge to Alameda to protect investors’ assets, according to the spreadsheet. Founder Anthony Scaramucci has since revealed that Skybridge has suffered a loss on his holdings of FTT tokens on FTX.

Additionally, the portfolio reveals the largest token investments in the form of HOLE – $67.5M, Polygon – $50M, NEAR (FTX) – $50M, Port Finance – $33.5M, NEAR (Alameda) – $30M I made it

Last month, FTX announced a Chapter 11 bankruptcy filing along with sister company Alameda Research and about 130 FTX-affiliated companies.

However, an analysis by Arkham Intelligence on November 25 revealed that Alameda Research withdrew more than $200 million from FTX.US before declaring bankruptcy. In addition, Arkham is twitter thread FTX’s sister company, Alameda Research, had raised $204 million from FTX US in the last few days before the collapse of various crypto assets.