AMD Posts First Loss in Years as Consumer Chip Sales Plummet by 65%

AMD posted its first quarterly loss in years on Tuesday due to weak sales of processors for client PCs. Overall, AMD’s chip sales fell by 64%. AMD’s data center and gaming hardware shipments continued to be strong and flat year-over-year. AMD management expects the CPU market to start recovering in the second half of the year However, the company’s outlook for the second quarter is less optimistic.

mix bag

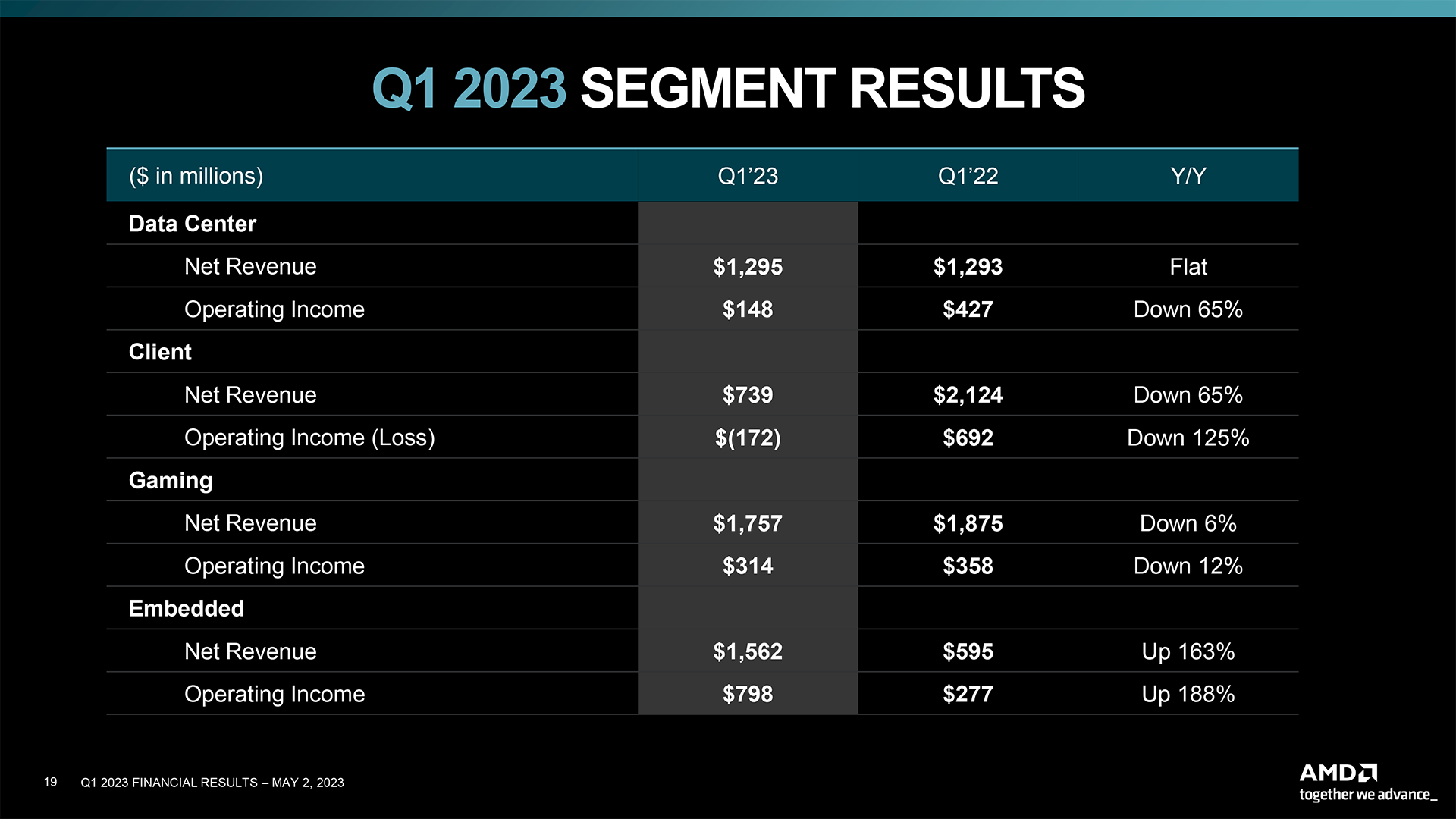

AMD’s revenue for the first quarter of fiscal 2023 was $5,353 million, down 9% year-over-year and down slightly quarter-over-quarter. Unfortunately, the company was in the red with a net loss of $139 million, compared to his $786 million net income in the first quarter of fiscal 2022. Additionally, AMD’s gross margin declined from his 48% in Q1 FY2022 to his 44% in Q1 FY2023.

Dr. Lisa Su, Chairman and CEO of AMD, said:

In fact, AMD’s results were mixed, with all business units, except the Client Computing business, remaining broadly flat compared to Q1 2022 and even remaining profitable. In fact, AMD’s data center division was even able to increase revenue slightly, but profitability declined.

“Our strategically important data center and embedded segments contributed more than 50 percent of our revenue in the first quarter,” said Jean Hu, EVP, CFO and Treasurer at AMD. increase.

Consumer CPU Sales Plunge, Data Center Hardware Remains Strong

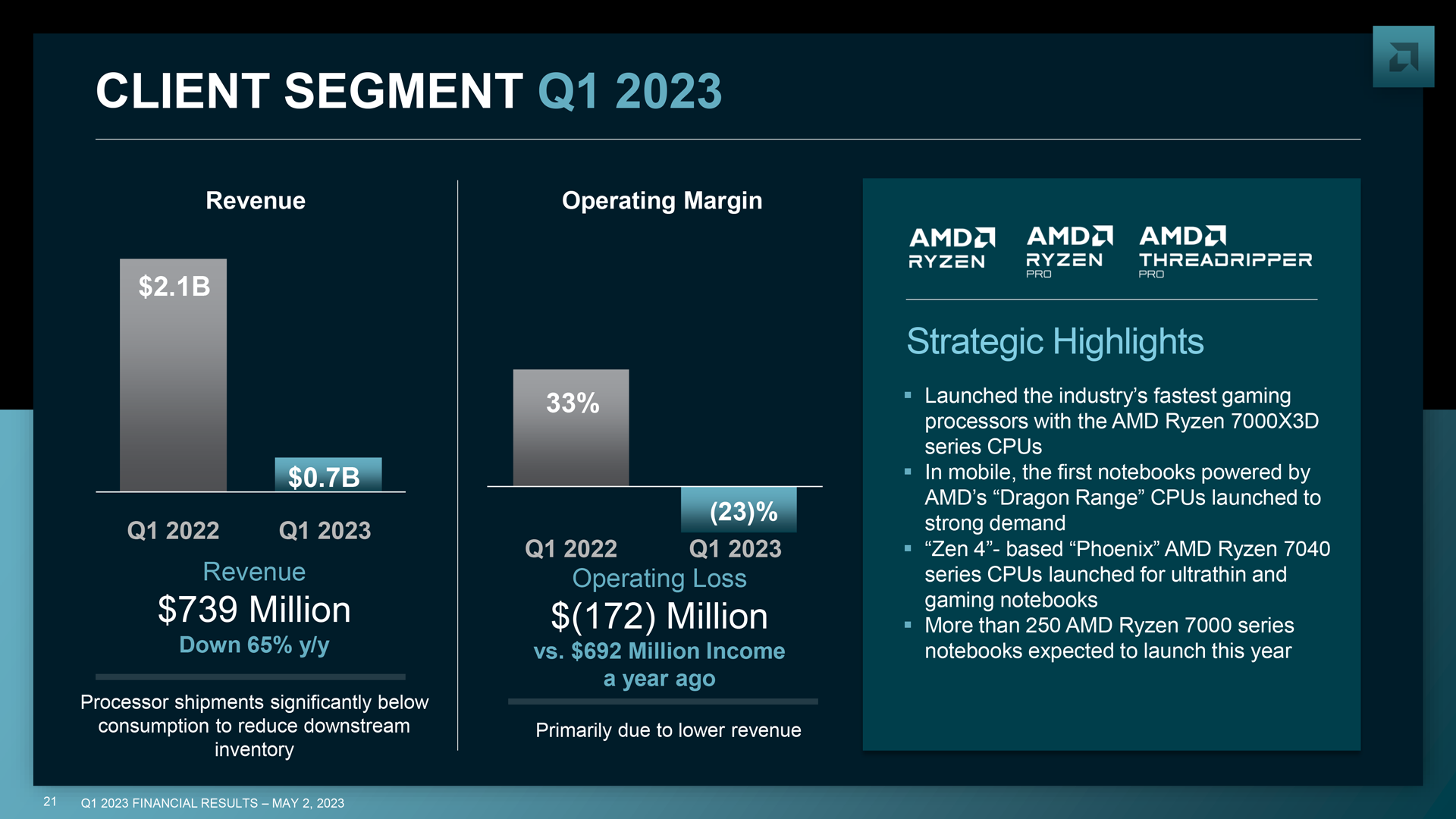

AMD’s client computing The business unit reported revenue of $739 million in the first quarter of 2023, down 65% from the same period last year. The division saw him lose $172 million. This contrasts with his $625 million profit in the same period last year. For years, AMD’s main source of revenue has been the sale of CPUs and chipsets for client PCs, but the division has suffered two consecutive quarters of declining earnings and lost money. Ultimately, AMD’s client PC business was hit harder by the soft PC market than Intel’s client computing group, whose first quarter sales were down 36% year-over-year.

“As we said in our last earnings call, we believe the first quarter was the bottom of the client processor business,” Su said.

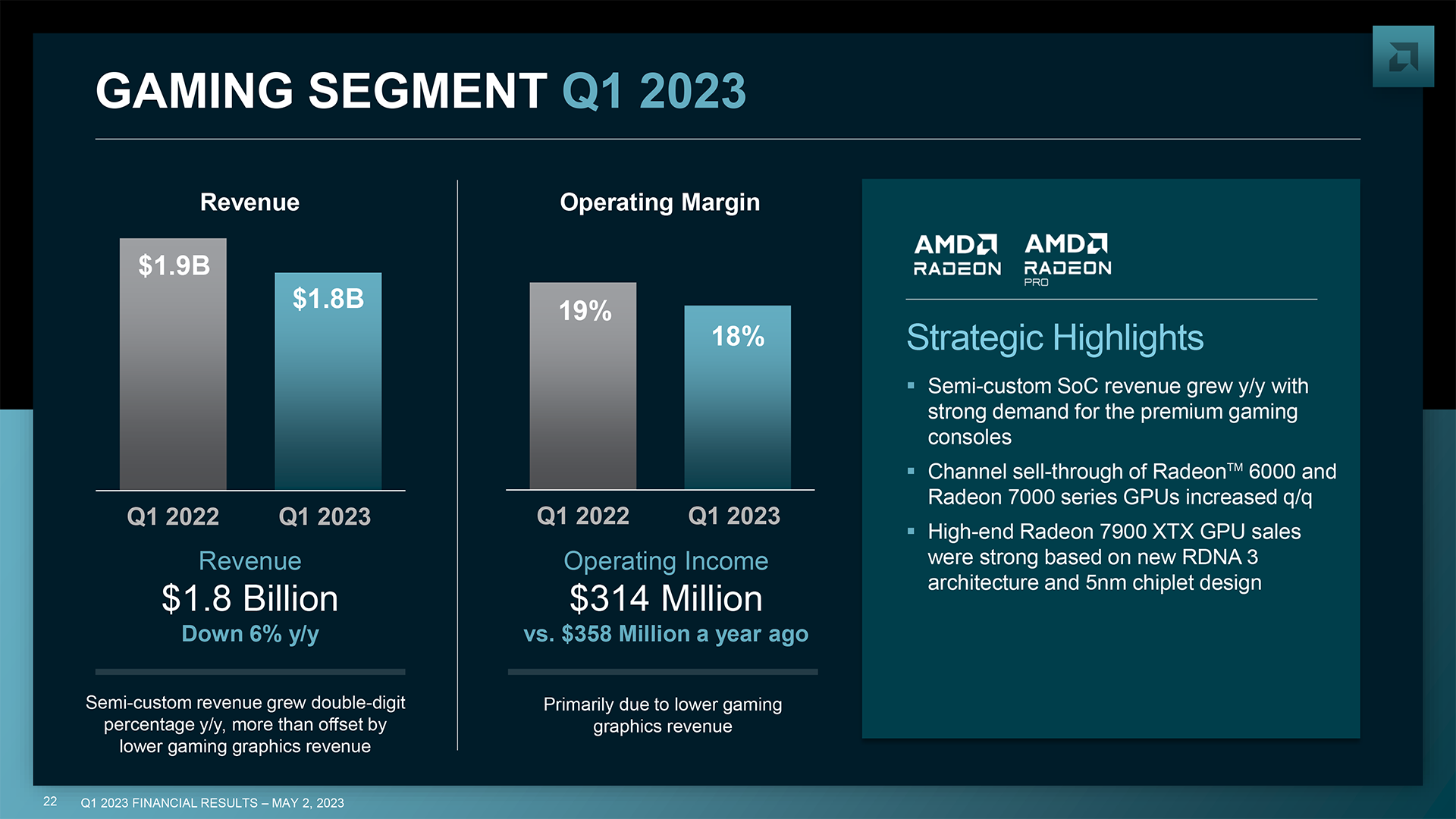

In contrast, AMD’s Game business Unit first quarter revenues reached $1,757 million, down 6% year-over-year. This looks like a powerful result given the ongoing disruption. System-on-chips for game consoles from Microsoft and Sony accounted for the largest share of AMD’s gaming business, growing year-over-year. Meanwhile, sales of discrete Radeon graphics processors declined year-over-year. Still, it grew quarter after quarter as the company increased shipments of its Radeon RX 7900 series graphics products and offered competitive pricing for its previous generation Radeon RX 6000 series products. The company continued to be profitable, with net income of $314 million, down 12% year over year.

“Semi-custom SoC revenues increased year over year as demand for premium consoles remained strong after the holiday cycle,” said Su. “In the gaming graphics channel, sales of Radeon RX 6000 and Radeon RX 7000 series GPUs increased sequentially. Sales of high-end Radeon RX 7900 XTX GPUs were strong in the first quarter, and we are on track to expand RDNA 3 GPUs. We’re well on our way, and we’re strengthening our portfolio with the launch of our new mainstream Radeon RX 7000 series GPUs this quarter.”

In Q1 2023, AMD’s Data center business generated $1.295 billion. This is broadly flat compared to the same quarter last year ($12930). Meanwhile, unit profitability declined 65% year-over-year to total $148 million. This is not surprising as large cloud service providers are reconsidering server purchases these days. Keep the volume high.

It’s worth noting that AMD’s server business was flat compared to Intel’s Data Center and AI Group, so it performed slightly better. In contrast, the blue company experienced a 39% decline in data center component revenue.

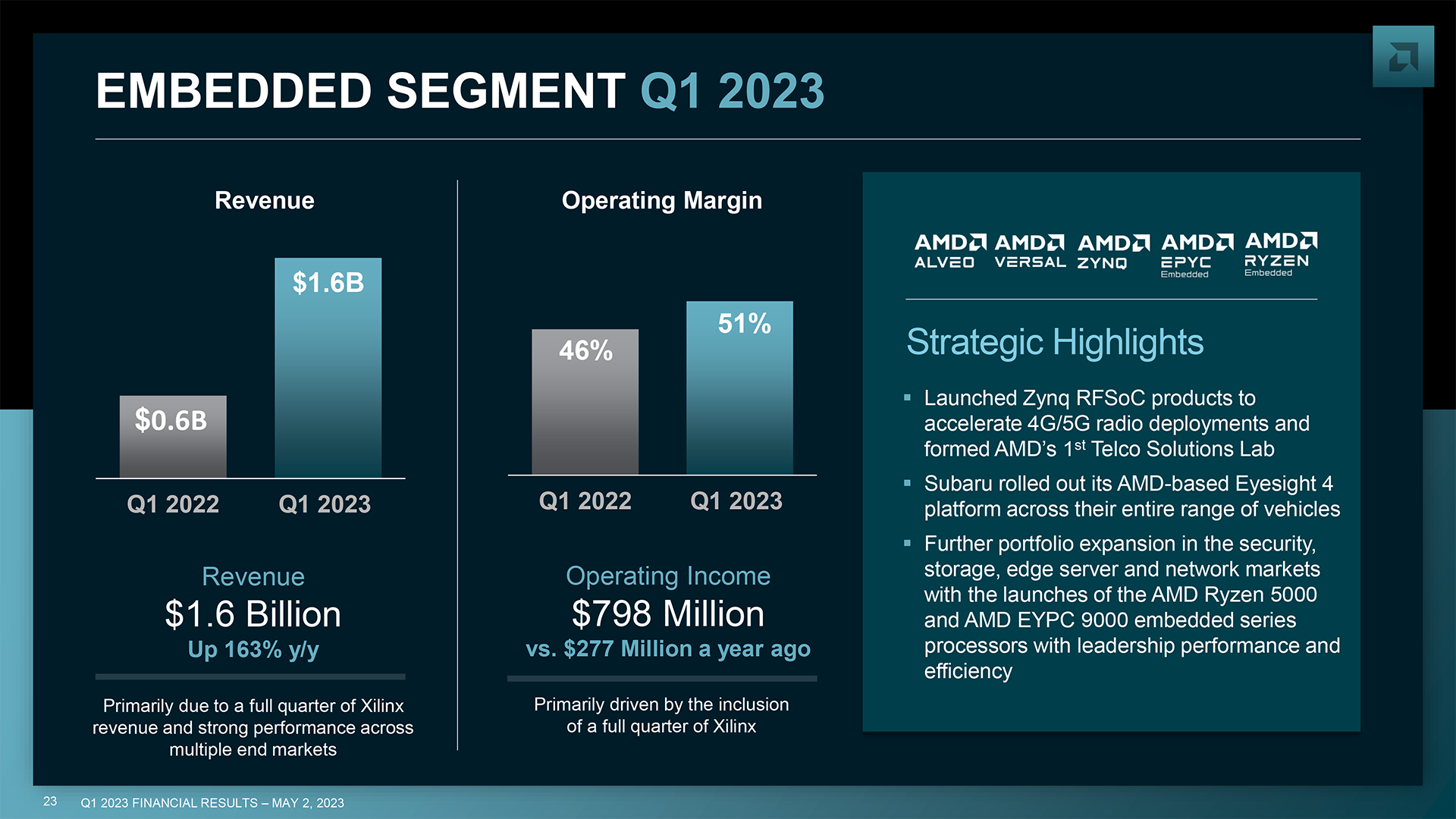

AMD’s embedded businessIt mainly sells products developed by Xilinx and some CPUs designed by AMD.

cautious outlook

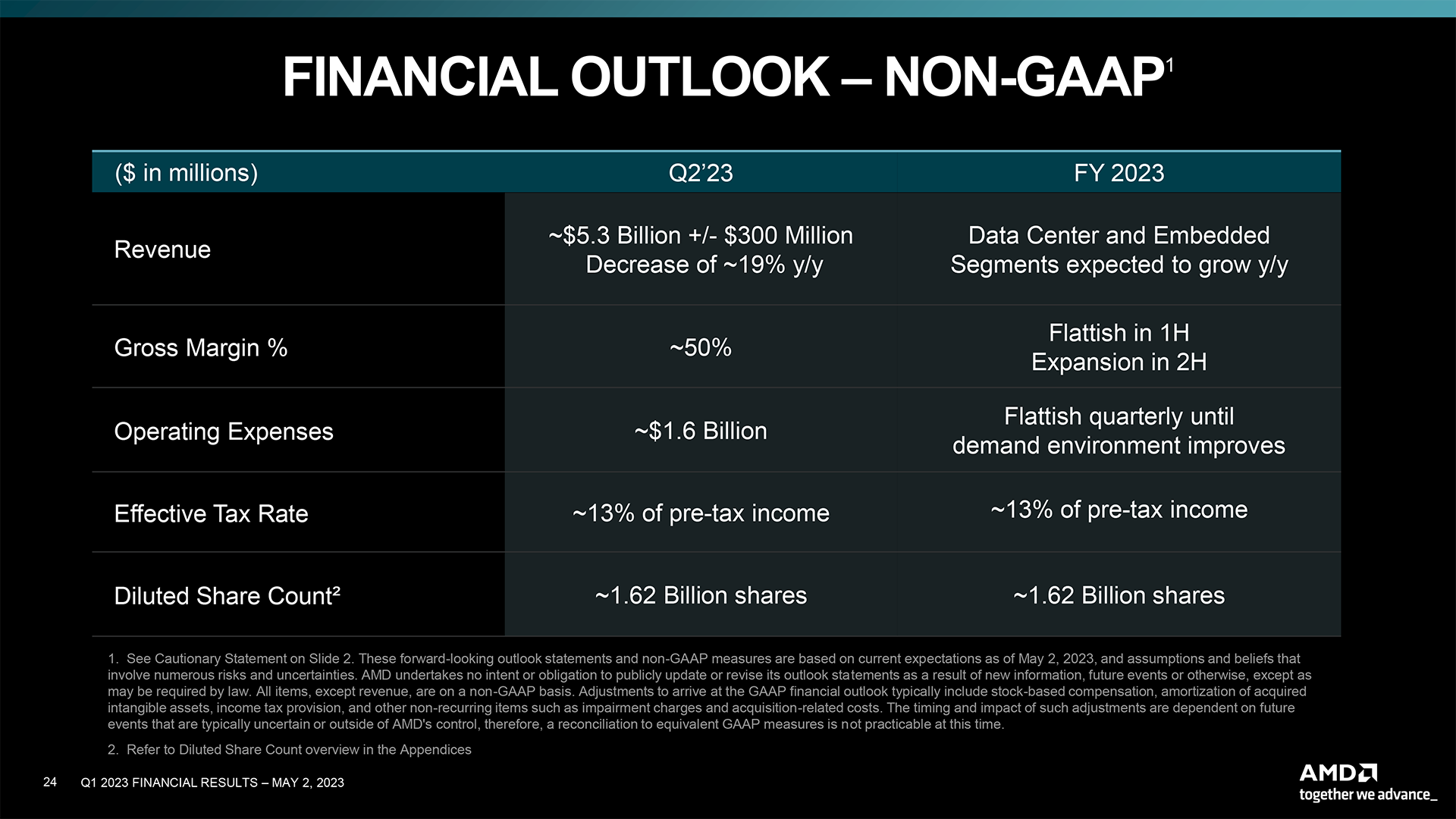

AMD expects second-quarter revenue to be broadly in line with the first quarter, totaling approximately $5.3 billion plus or minus $300 million.

With AMD ramping up production and sales of its Ryzen 7000 series processors for laptops, Phoenix chips already being supplied to OEMs, and these units tending to sell at a premium, such cautious The outlook is a little surprising. The company expects client PC revenue to increase each quarter. Additionally, the company plans to release new Radeon 7000 series graphics processors in the second quarter, which is also expected to boost sales of the company’s gaming hardware, offset by weak console SoC sales. may occur.

Additionally, AMD will officially introduce EPYC ‘Bergamo’ CPUs for cloud data centers and EPYC ‘Genoa-X’ for high-performance technical computing applications. Server CPU growth tends to be slow, but these parts allow AMD to slightly increase sales of data center hardware.

AMD’s Chief Financial Officer (CFO) said: “We remain confident of growth in the second half of the year as the PC and server markets strengthen and our new products increase.”

AMD, on the other hand, is optimistic about strong demand for its products in the second half and beyond. For example, the company expects data center sales this year to surpass his 2022.

“Over the long term, we see significant growth opportunities based on successfully delivering our roadmap and executing on our strategic data centers and embedded assets, making it a priority to accelerate the adoption of our AI products. is determined,” Su said.