An indecisive options market keeps Bitcoin flat

Bitcoin (BTC) is stuck in a tight trading range, fluctuating between $30,000 and $31,000. Some on-chain indicators point to this ongoing sideways movement being observed prior to Bitcoin’s last bull run, but nothing indicates a major shift could be imminent. Almost never.

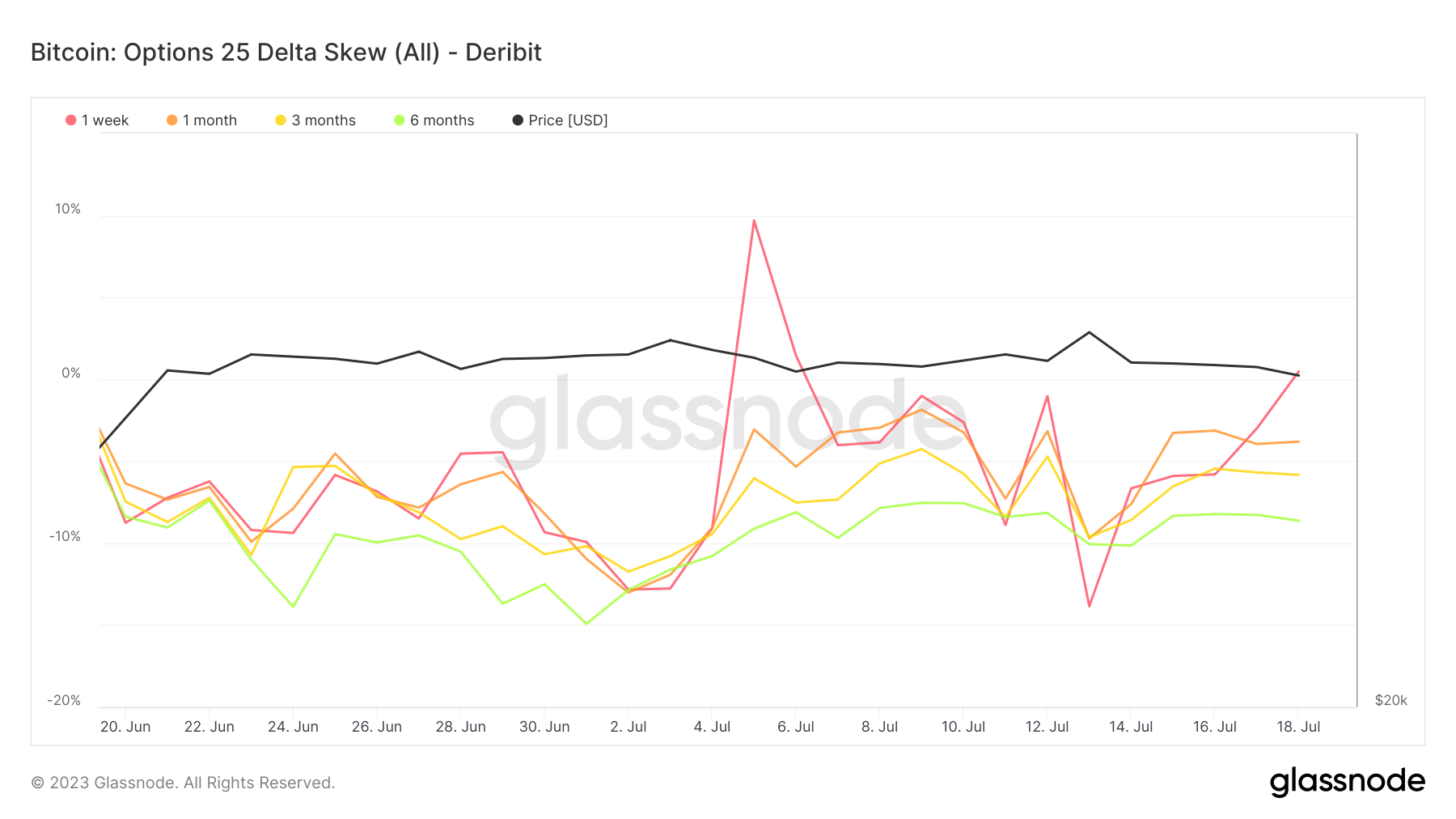

Derivatives markets, and options markets in particular, have revealed that they are divided over the performance of Bitcoin. This division is evident when analyzing Bitcoin options delta skew. The delta skews for option contracts expiring 1 week, 1 month, 3 months and 6 months from now are 0.48%, -3.8%, -5.83% and -8.62% respectively.

Delta skew, also known as ‘skew’ or ‘risk reversal’, is a measure of market sentiment often used in the options market. It measures the difference in implied volatility between out-of-the-money (OTM) puts and OTM calls.

When the market is bullish, traders are willing to pay more money for the opportunity to buy an asset, so an OTM call option (an option to buy above the current price) becomes an OTM put option (an option to sell below the current price). ) has higher implied volatility than . Prices are expected to rise in the future. This situation results in positive delta skew.

Conversely, when the market is bearish, the implied volatility of OTM put options is higher than OTM call options, resulting in negative delta skew. In this case, the trader expects the price to fall and is therefore willing to pay more money for the chance to sell the asset at a higher price in the future.

The 0.48% delta skew for Bitcoin options expiring in a week is slightly positive, indicating a moderately bullish to flat sentiment for Bitcoin in the short term. However, options expiring at 1 month, 3 months, and 6 months have negative delta skews (-3.8%, -5.83%, and -8.62%, respectively), suggesting that long-term market sentiment is increasingly suggested to be bearish. Traders expect the price of Bitcoin to fall and are willing to pay more for opportunities to sell Bitcoin at a higher price in the future.

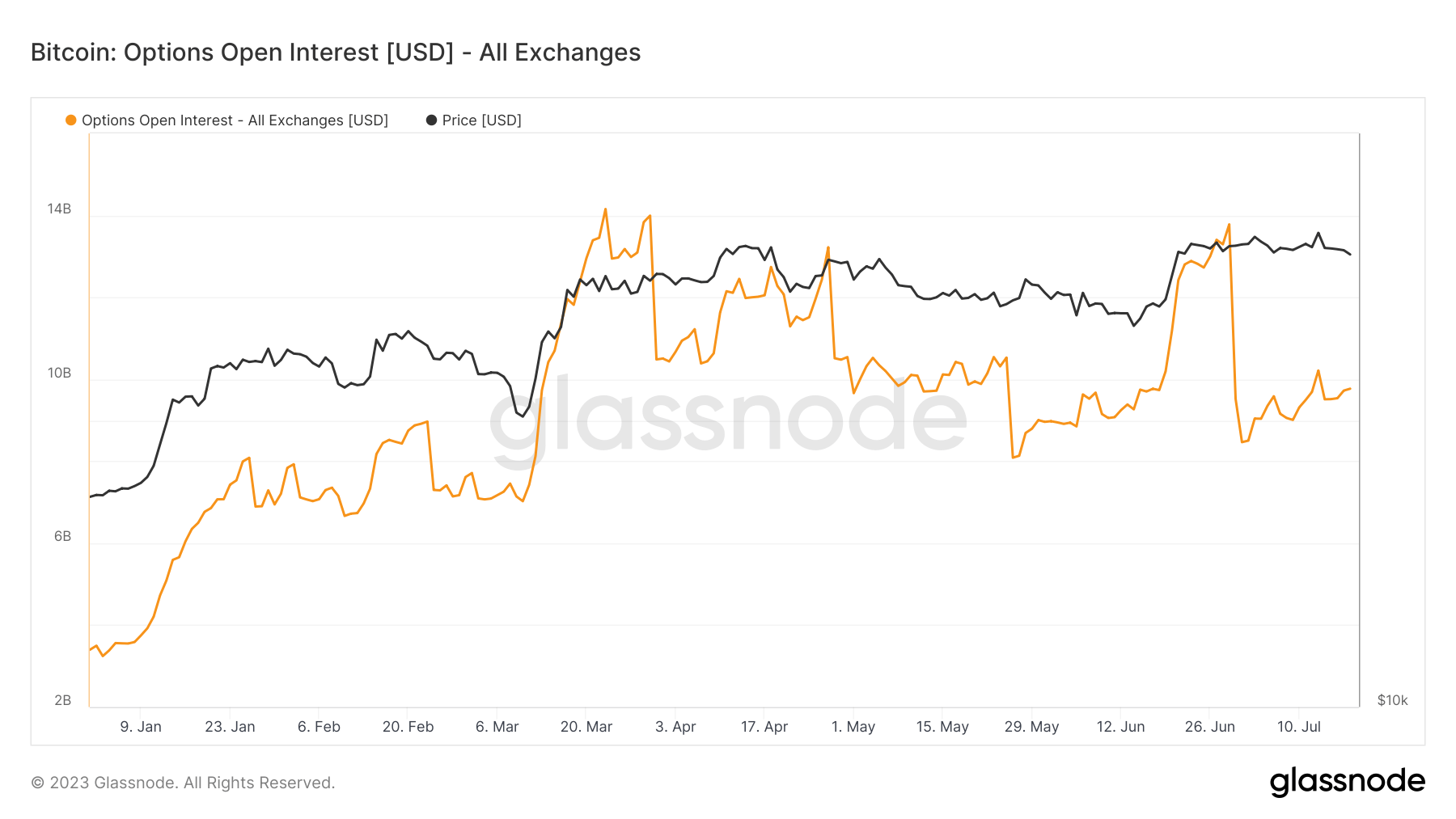

This split in opinion contrasts with the structure of Bitcoin call options open interest, which stands at $9.7 billion. Open Interest refers to the total number of outstanding option contracts that have not been settled. This is an important indicator that reflects the flow of funds into the derivatives market.

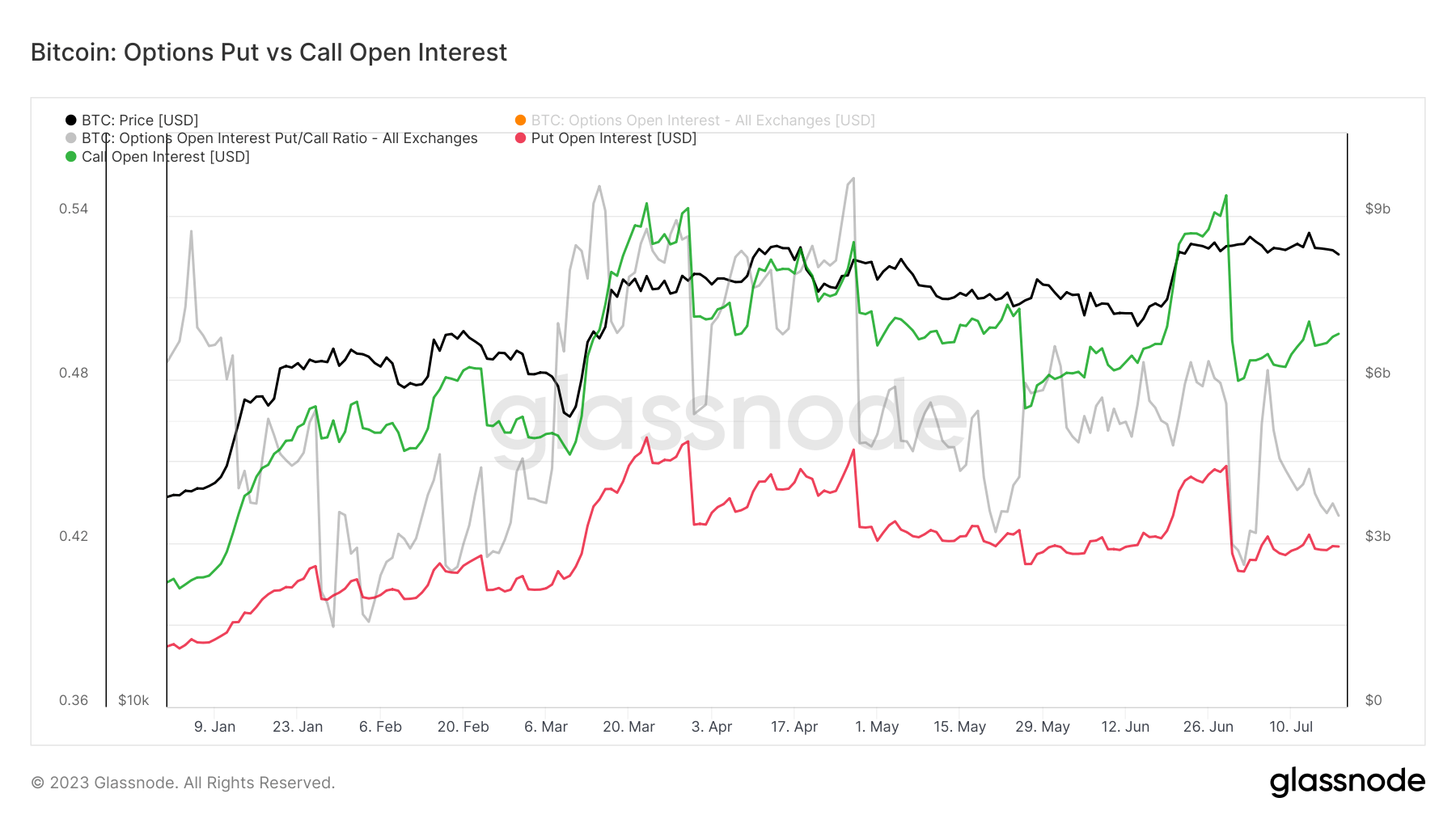

The total open interest in Bitcoin calls is $6.93 billion, significantly higher than the open interest in puts of $2.83 billion. This discrepancy could suggest that traders are generally more bullish on Bitcoin, expecting the price to rise and thus the number of call options.

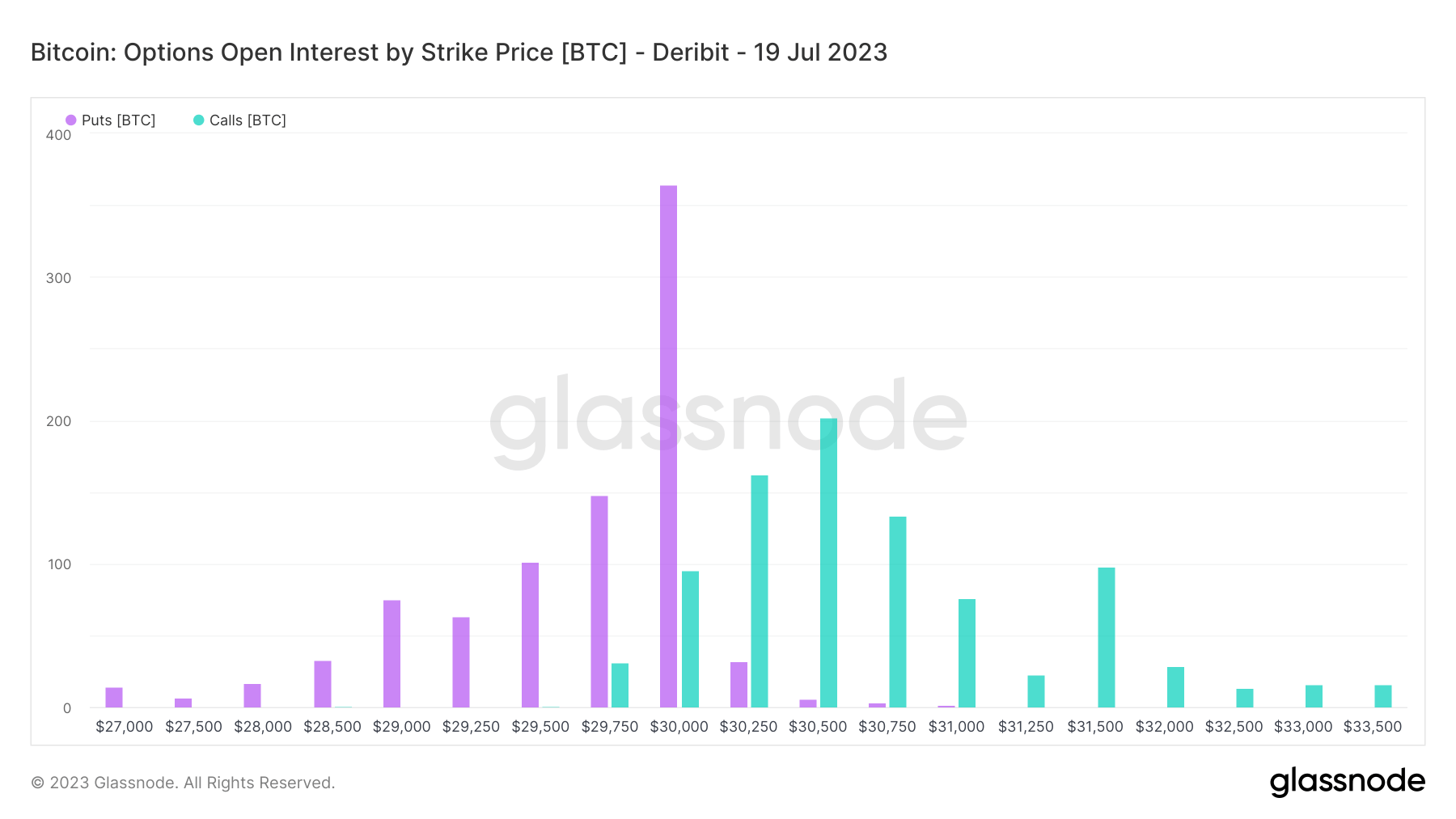

However, open interest in call and put options with strike prices on option contracts expiring on July 19 presents a different picture. The same open interest of 365.4 BTC is betting that BTC will fall below $30,000 and above $30,250-30,500. This interest balance reflects the current price level of Bitcoin and indicates that the market is stagnating.

In conclusion, the indecisive derivatives market is keeping Bitcoin flat. Some traders are bullish, expecting the price to rise, while an equal number are bearish, betting on a price drop. The sector supports Bitcoin in a narrow trading range and there are few signs of major changes in the coming days.

In contrast to the bearish sentiment reflected in the options market, long-term forecasts by some experts have suggested a more bullish view, with traders betting on future price gains in the current sideways market. seems ready to survive.

The post Indecisive options market keeps Bitcoin sideways appeared first on CryptoSlate.