Bitcoin accumulation trend score shows shrimps buying, whales selling

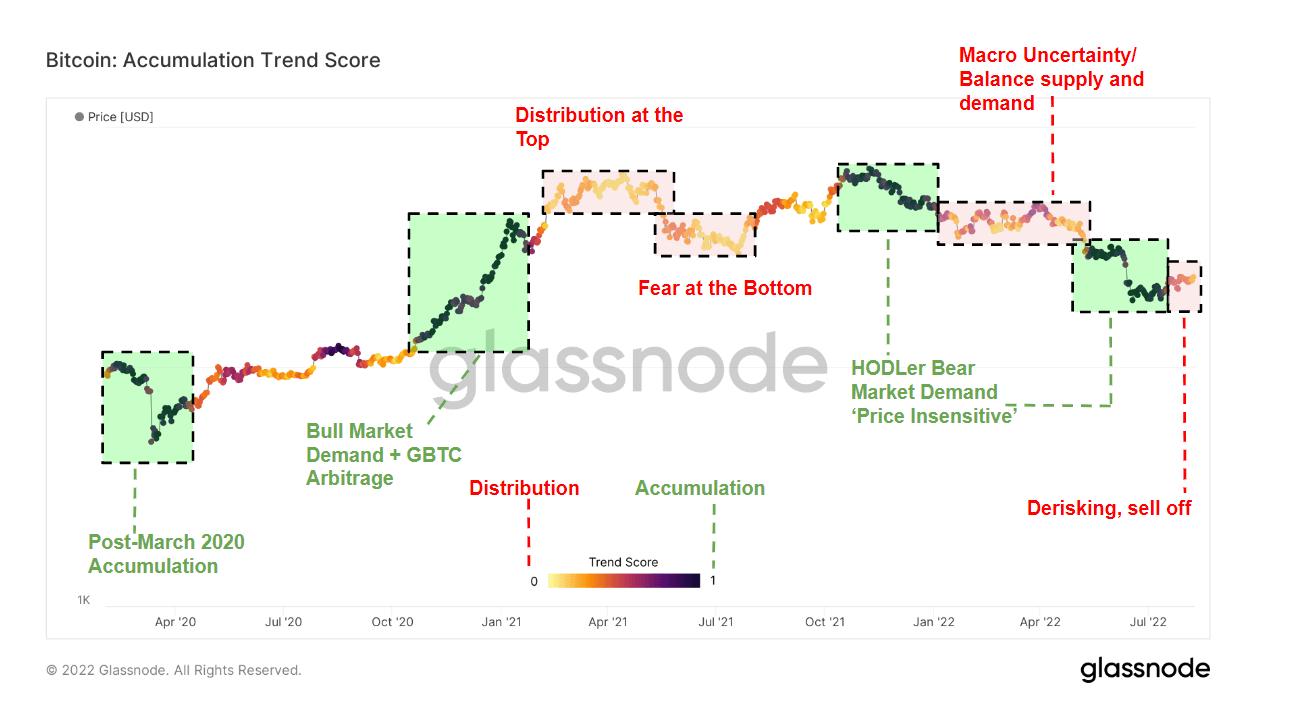

The Accumulation Propensity Score is an on-chain metric used to determine if an entity is actively accumulating coins. This is a much better indicator of overall market sentiment to buy or sell as it can be applied to any cohort to determine the behavior of a particular group.

This metric is made up of two metrics: entity participation score and balance change score. An entity’s participation score represents its overall coin balance, while its balance change score represents the number of new coins bought and sold during the month.

Accumulated trend scores close to 1 indicate that the network is mostly accumulating, while scores close to 0 indicate that the network is primarily distributing coins.

Applied to Bitcoin, the Cumulative Propensity Score provides excellent insight into the balance size and behavior of market participants over the course of a month. Exchanges and miners are excluded from the index, data a better representation of market conditions,

Bitcoin Accumulation Propensity Score from April 2020 to August 2022 shows four different accumulation periods. The periods of accumulation highlighted in green in the chart above occurred in March 2020, early 2021, early 2022, and late May 2022. The most notable accumulation rate was seen in his March 2020, when the outbreak of the COVID-19 pandemic crushed global markets. The big sell-off seen in the wake of the Terra (LUNA) crash that occurred in late May and early July triggered massive accumulation.

The coin distribution period highlighted in red and yellow follows all accumulation periods. The highest coin distribution rates were seen when miners left China in the summer of 2021 and when Russia launched its invasion of Ukraine in February 2022. Also this summer, many addresses sold his BTC as macro uncertainty pushed more investors. Reduce portfolio risk.

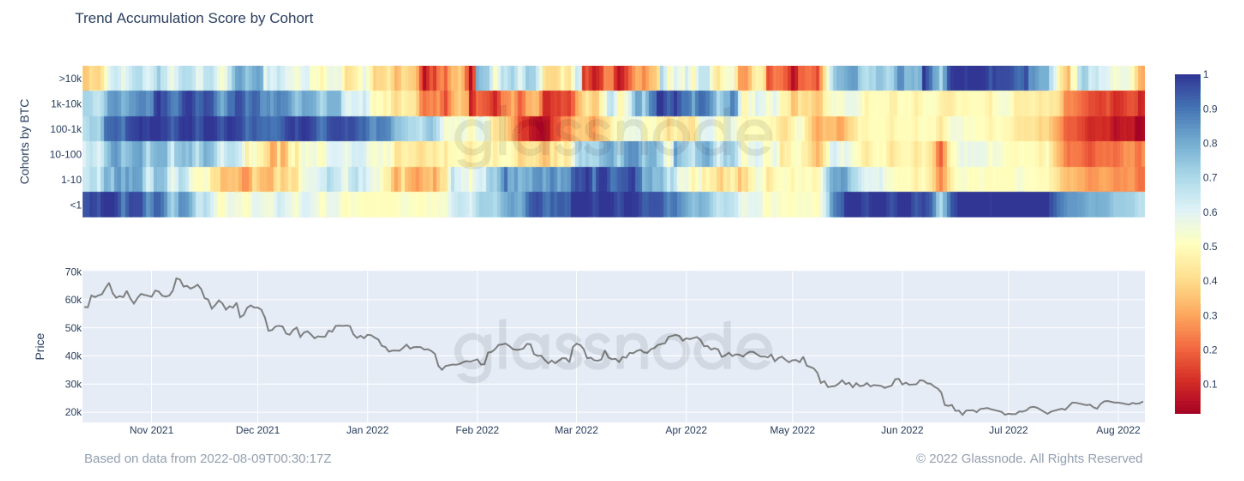

Breaking down the cumulative propensity scores by cohort reveals the behavior of two major groups on the Bitcoin network: whales and shrimp. A whale is defined as an address where he owns more than 1,000 BTC and a shrimp is defined as an address where she owns less than 1 BTC.

Both whales and shrimp actively accumulated BTC throughout the month of July. It has been.

However, as August progresses, whale accumulation rates begin to decline. Overall macro uncertainty has prompted many large holders to reduce their risk and sell their BTC holdings. Many investors are anticipating a harsh winter and are looking to get as much liquidity as possible.

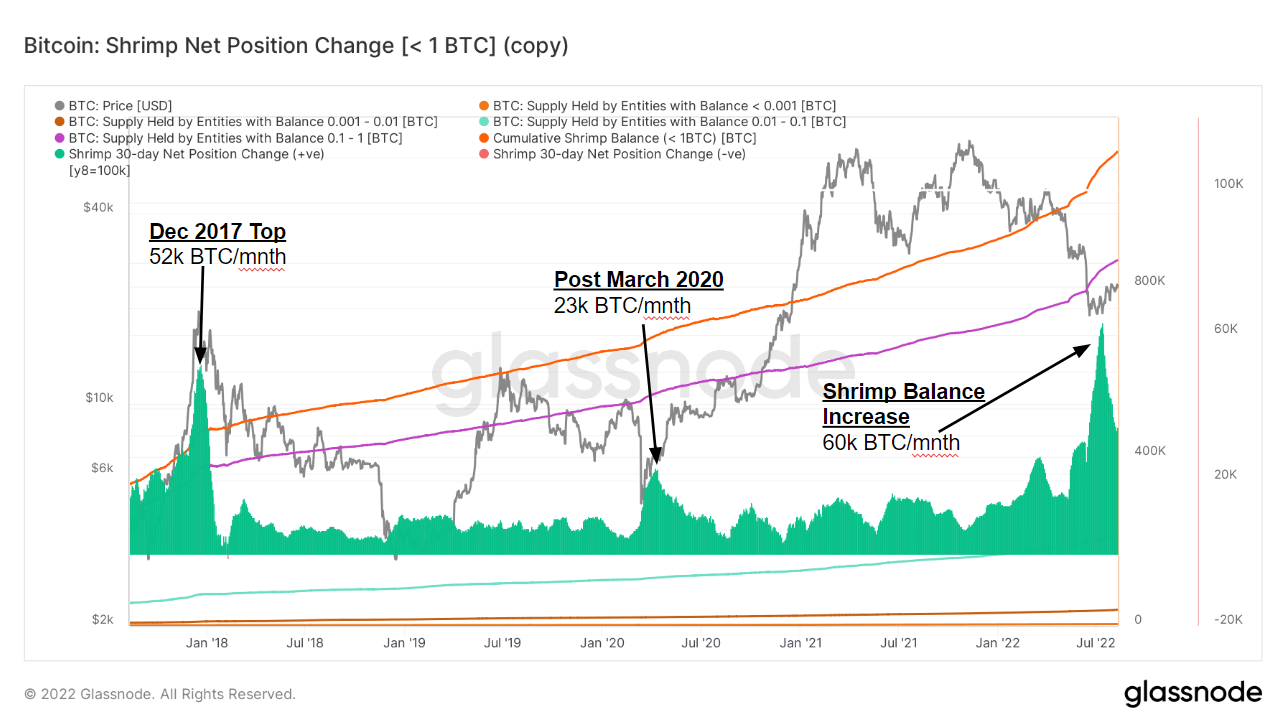

The only entity still piling up BTC is Shrimp, which continues to accumulate even when the majority of holders start selling.July is the most important accumulation month for small holders since 2018 and Shrimp increased its balance by more than 60,000 BTC in one month. The second largest accumulation was in December 2017, when Bitcoin reached an all-time high when Shrimp accumulated 52,000 BTC in his one month.

This is because small holders find the price of Bitcoin around $20,000 very attractive and continue to acquire the coin for long-term investment even if the price stays flat. indicates that