Bitcoin and equities roll over as markets digest another round of rate hikes: MacroSlate Report

A further drop in CPI to 7.1% on December 13 was met by an expected rally in equities and lower US dollar and Treasury yields. On Dec. 14, Chairman Powell raised interest rates by his 50bps, setting his new federal funds rate target at 4.25% to 4.5%.

Rise in the consumer price index

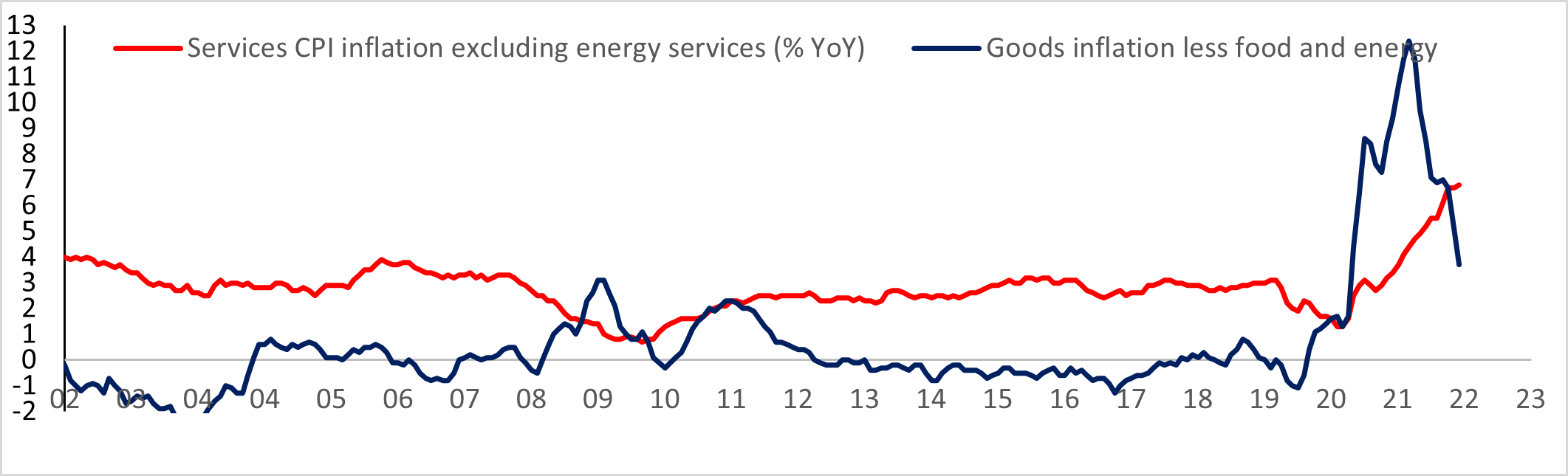

Headline inflation slowed to 7.1% from 7.7%, offset by a 0.5% decline in core commodity prices and a 1.6% decline in energy prices.

Core goods inflation continued to fall from its peak in February to just under 4%, now above 12%. However, services inflation, excluding energy, he rose to 6.8%. Services inflation will continue to rise as the US job market remains resilient. However, that may change in 2023.

Powell remains hawkish

The Fed hiked rates by an expected 50 basis points to set a new federal funds target of 4.25% to 4.5%. Powell’s tone remained unchanged, saying rate hikes were “ongoing” and that he would “keep the course until the job is done.” Powell expects inflation to continue to moderately decline as the labor market remains tight. His 55% of core CPI is still rising rapidly, despite the rapid decline in housing and commodity prices.

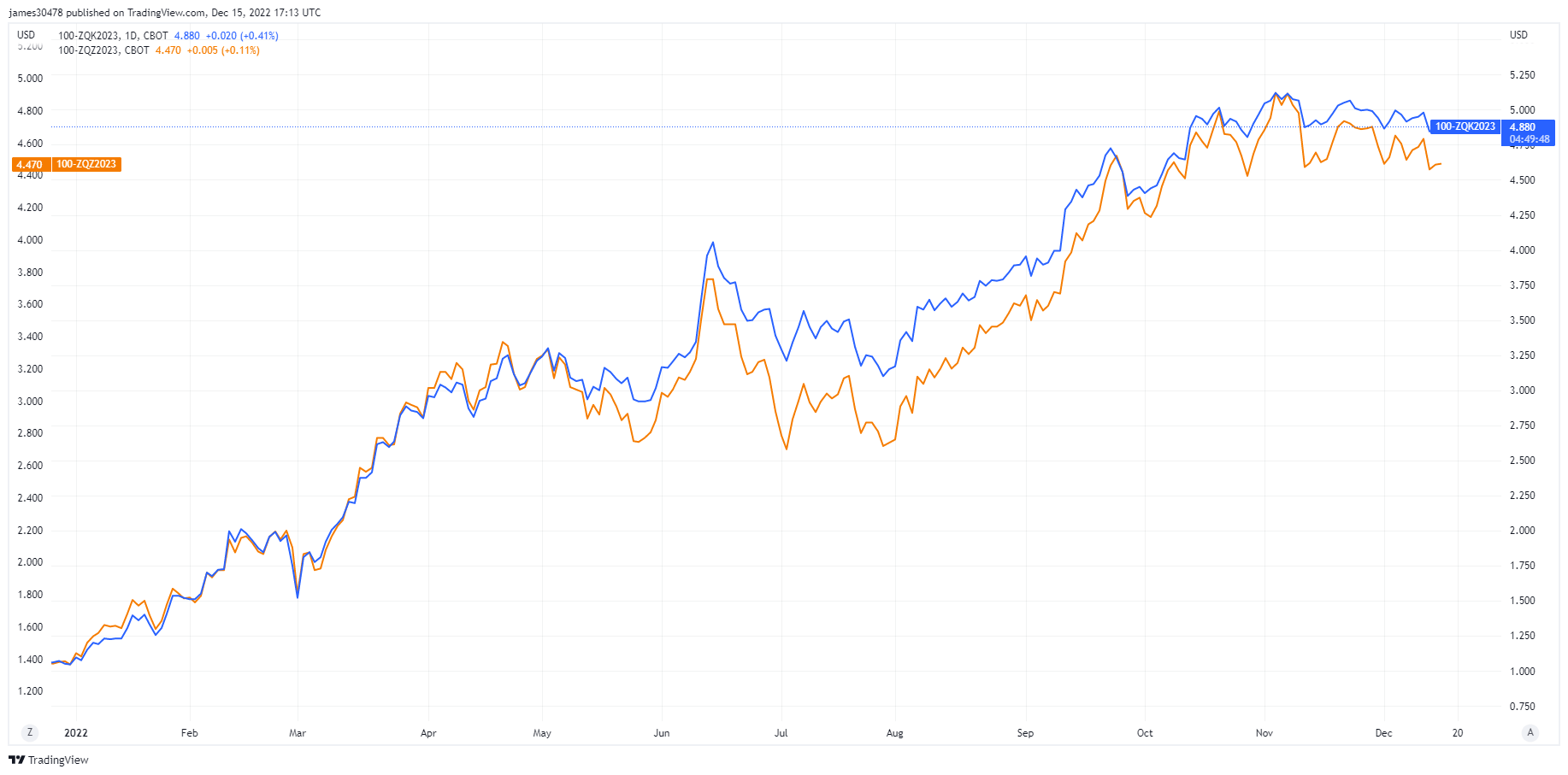

The market continues to battle the Fed and disagrees on futures Fed funding rates. The market predicts that in May 2023 he will see the federal funds rate peak at 4.8% and by December 2023 he will drop to 4.5%.

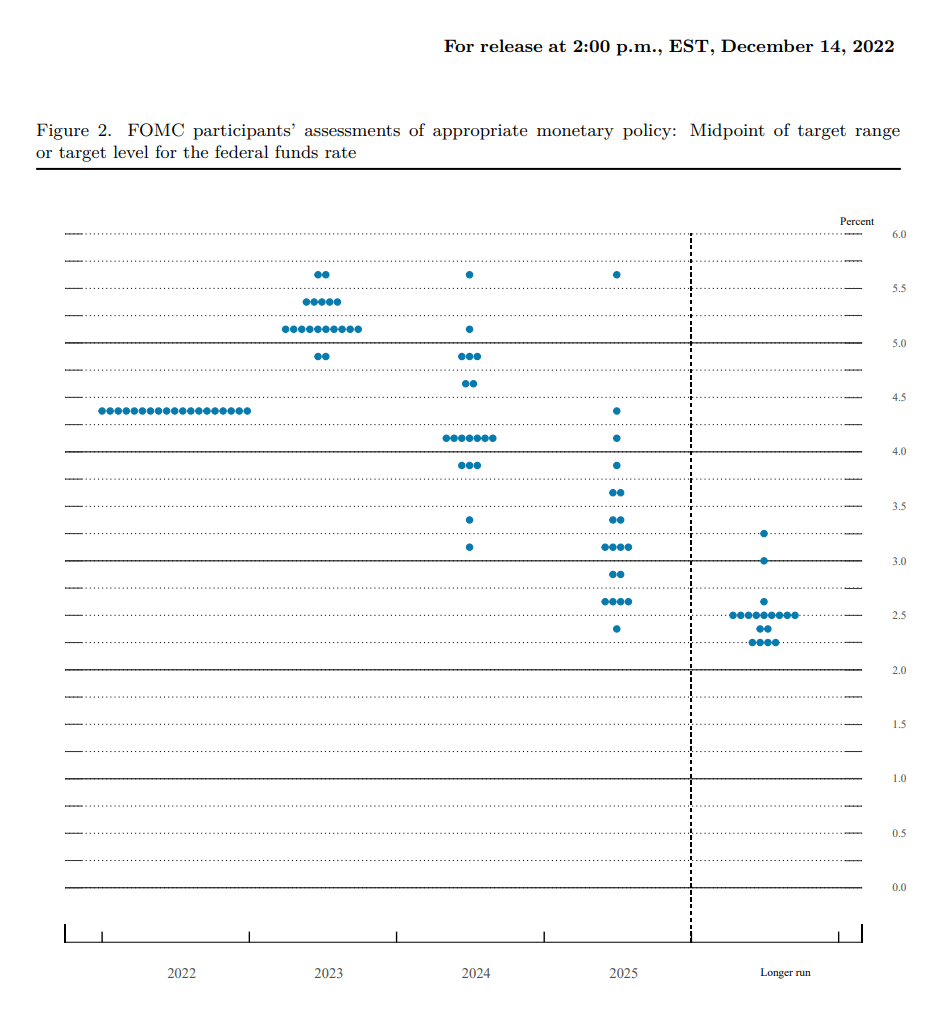

According to the DOT plot showing the forecast of the federal funds rate, each dot represents the opinion of a Fed policymaker. The Federal Reserve has a higher expected funding rate than the market at the end of 2023, revised from 4.6% to 5.1%. Seven of his Fed officials expect him to exceed 5.1%, and 10 expect him to exceed 5%.

Other Notable Rate Hikes

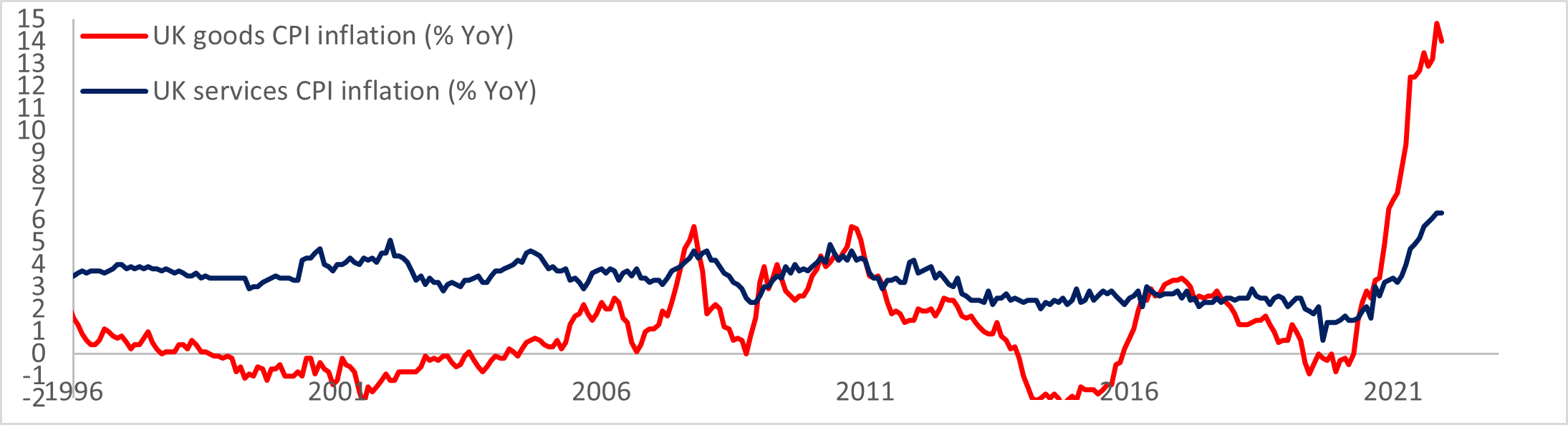

The Bank of England raised interest rates by 50bps on December 15th, raising bank interest rates to 3.5%. This was his ninth consecutive rate hike by the BOE. In addition, inflation expectations fell above market expectations as inflation fell from 11.1% to 10.7% and core interest rates fell from 6.5% to 6.3%, which may have pushed inflation to a peak in the UK.

In addition, the ECB announced plans to raise interest rates from 1.5% to 2% and shrink its balance sheet.

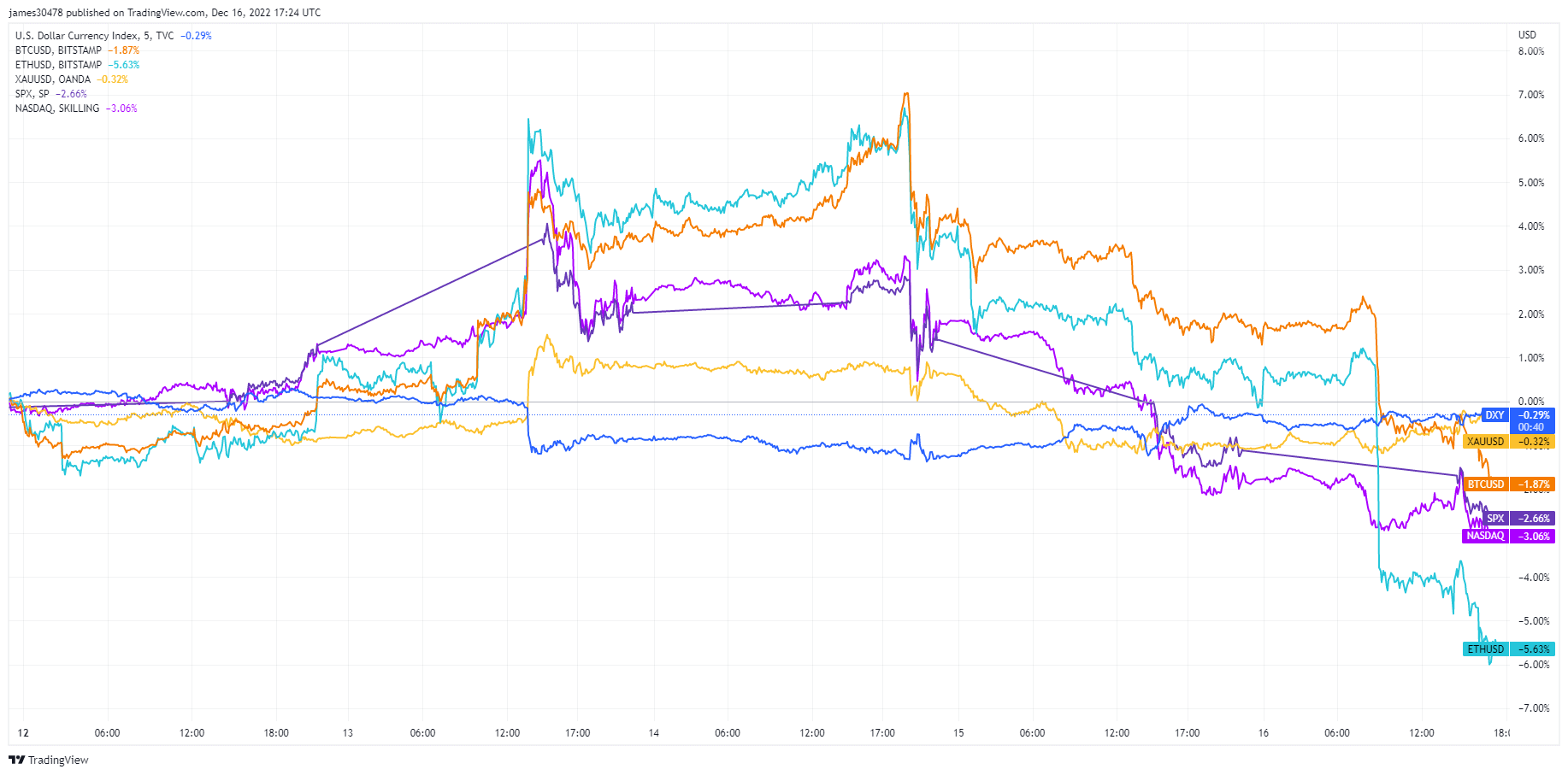

Asset Review: Week starting December 12th

From December 12th to December 15th, BTC was the best performing asset compared to its peers, but on December 16th, BTC and ETH hit new lows for the week.

- Bitcoin: -1.85%

- Ethereum: -5.60%

- Gold: -0.33%

- DXY: -0.39%

- SPX: -2.0%

- Nasdaq: -2.76%