Bitcoin and S&P 500 decouple from net liquidity

Bitcoin and the S&P 500 have historically shown a near-perfect correlation with net liquidity, a key market metric often overlooked in market analysis.

However, as of June 2023, this correlation appears to be fading, which could indicate a major shift in market dynamics.

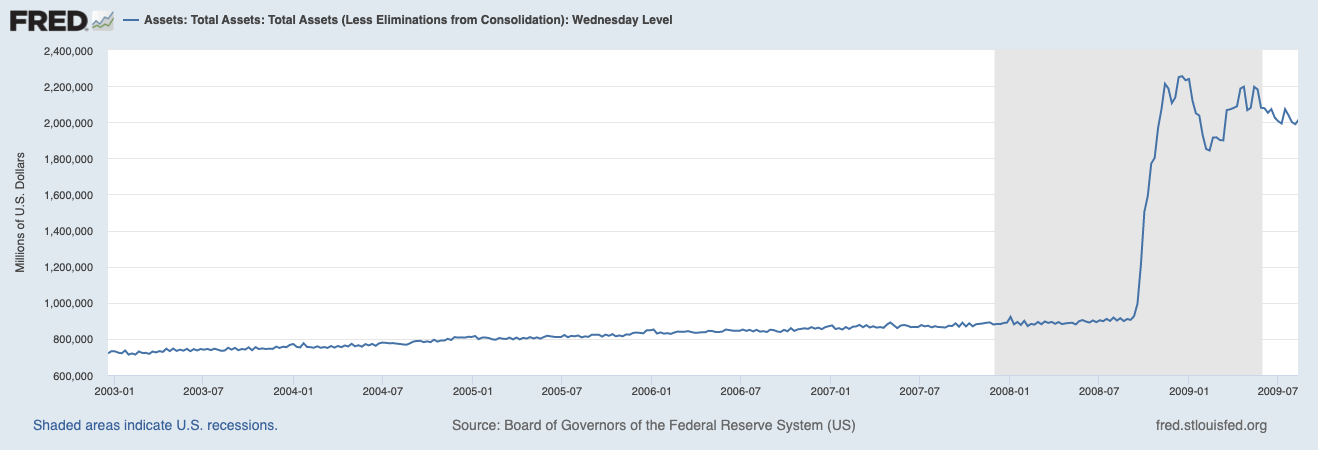

Net liquidity is calculated by subtracting “current liabilities” from “current assets”. In the context of the Federal Reserve, this includes deducting Treasury General Account amounts and overnight reverse repo amounts from the Fed’s balance sheet. This indicator provides a snapshot of the size of the Federal Reserve’s market interventions and has been a key driver of the market, especially since the 2008 financial crisis.

The size of the Fed’s balance sheet was a relatively unimportant metric until the 2008 financial crisis. To combat the fallout of the crisis, the Fed embarked on a historically unprecedented quantitative easing campaign, significantly expanding its balance sheet. This rapid increase in debt provided valuable insight into the scale of the Federal Reserve’s market interventions.

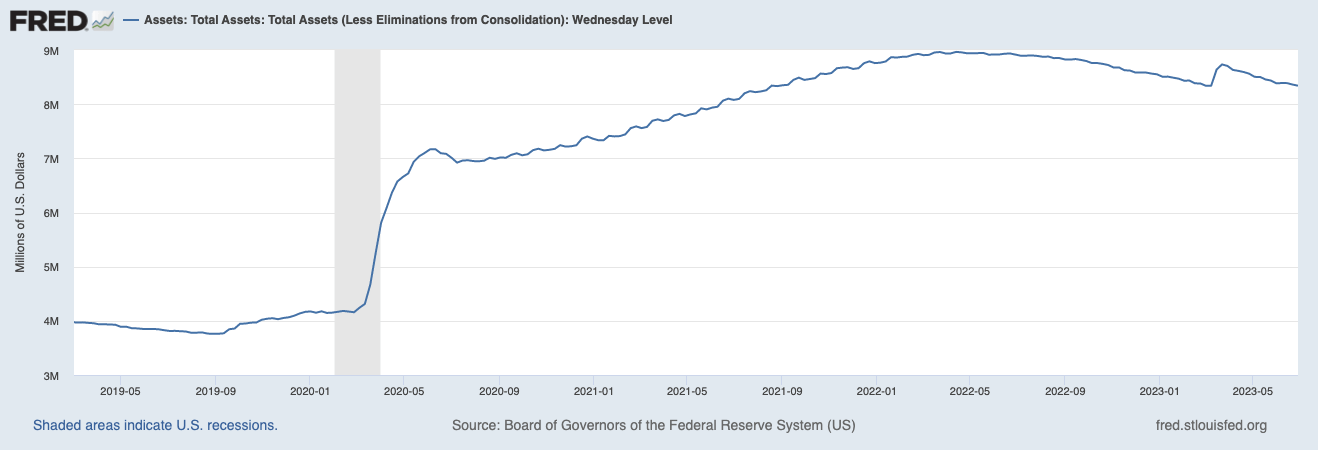

However, the correlation between net liquidity and asset prices changed in 2020. U.S. financial markets are heading for historic 2020 despite the Federal Reserve nearly doubling the size of its balance sheet, adding $3.4 trillion between August 2019 and June 2020. Recovered quickly from the crash. In March 2020, it continued to update all-time highs. This has led many analysts to hypothesize that the Fed has lost its position as a major market driver in the United States and has instead circulated excess liquidity in the economy.

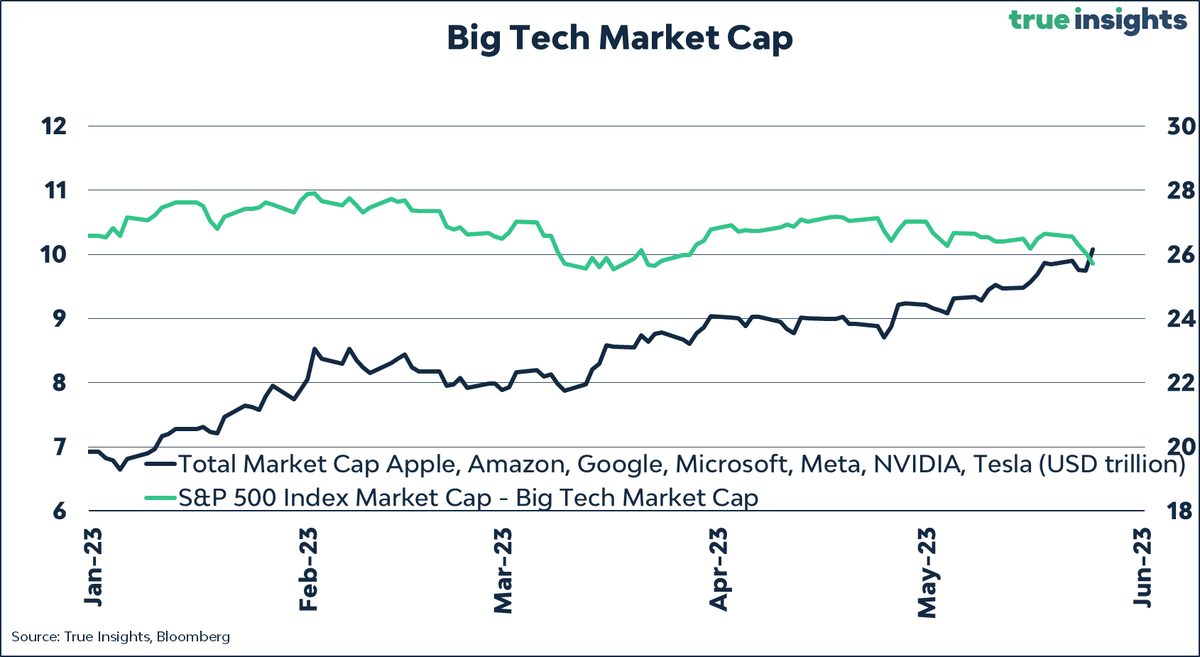

However, unlike past trends, net liquidity has not become a major market driver for the S&P 500 these days. Selected technology and AI stocks were the main drivers of index performance. These stocks are bucking the broader bearish trend, suggesting a shift in market dynamics.

A closer look at the index, however, reveals a different picture.Before crypto slate Our analysis showed relatively stagnant performance when these outliers were removed from the index. This suggests that the index’s strong performance may not be as broad-based as it initially appears, but rather concentrated in a few high-performing sectors.

The decoupling of the S&P 500 from net liquidity is important, as it has historically been the driving force behind important indices.

Decoupling the S&P 500 from net liquidity reduces the impact of broader economic factors that net liquidity represents, such as the Federal Reserve’s monetary policy and the health of the economy as a whole. Rather, index performance is increasingly influenced by trends in specific sectors such as AI and technology.

Decoupling Bitcoin from net liquidity represents a different dynamic. Bitcoin operates in a different market environment than traditional financial assets like the S&P 500.

Bitcoin’s decoupling from net liquidity suggests that price volatility is beginning to be influenced by market dynamics such as supply and demand within the market, rather than broader economic factors.

This could make Bitcoin’s price less susceptible to external economic shocks and increase price stability. However, as cryptocurrencies become more susceptible to market-specific risks, Bitcoin investors may also face increased risks.

As a result of this decoupling, Bitcoin is less susceptible to external economic shocks, which may lead to greater price stability. However, this also comes with potential increased risks for Bitcoin investors as the cryptocurrency becomes more susceptible to market-specific risks.

It first appeared on CryptoSlate after Bitcoin and the S&P 500 were decoupled from net liquidity.