Bitcoin could be the refuge as bond market faces negative returns

quick take

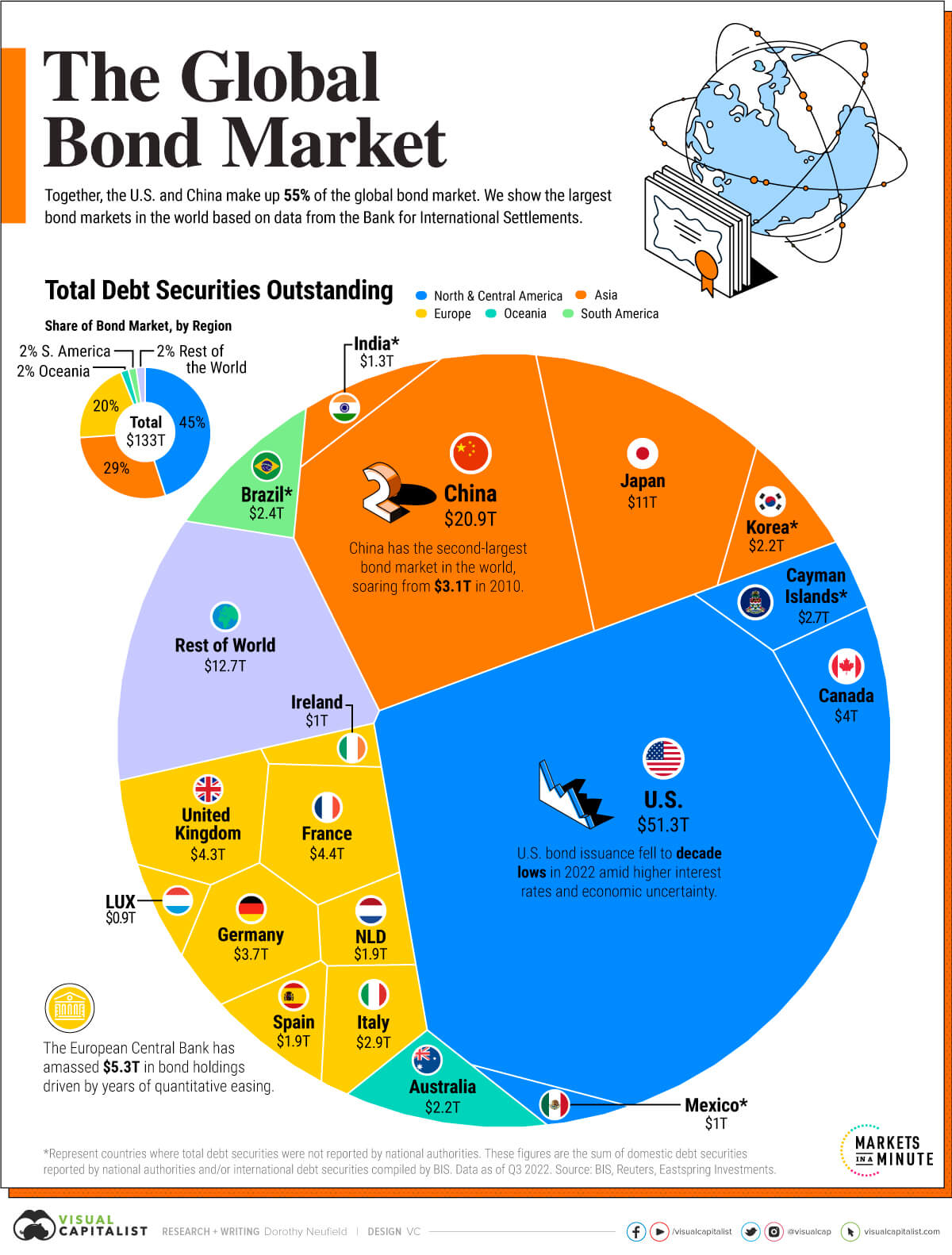

One of the strongest markets globally is the bond market. visual capitalist, estimated to be worth $133 trillion in 2022. This huge market has grown consistently over the last 40 years, largely due to rising government debt as interest rates were cut during recessions and the implementation of quantitative easing measures.

The United States leads the global bond market, holding a commanding 39% market share worth more than $51 trillion. But China is catching up, and she now holds her No. 2 spot in this growing market with a 16% share, according to Visual Capitalist.

Japan presents an interesting example in this context. Japan’s central bank owns about half of the country’s total debt, according to Visual Capitalist data. This significant holding has led to a detailed analysis by the CryptoSlate research team.

A pertinent question that arises in this scenario concerns the buyers of this bond, especially given that it yields mostly negative returns. The answer lies largely in the banking sector, as shown in the chart below.

However, according to Visual Capitalist, the disproportionate size of the banking sector relative to GDP has become a new concern in some countries, such as the United Kingdom, where the size of the banking sector is about six times larger. It’s becoming

It is important to remember that there is an inverse relationship between bonds and yields. As the yield increases, the bond’s value decreases. Careful consideration is therefore essential for any potential investor navigating this complex market.

The idea is that investors will grow weary of negative real interest rates on bonds and move to assets such as bitcoin that comfortably outperform inflation in the long run.

The potential post-Bitcoin haven as the bond market faces negative returns first appeared on CryptoSlate.