Bitcoin investors look to 2023 after disappointment of Santa rally that never was

The run-up to Christmas was filled with hope for Santa’s rally to end the year on a high note.

Unfortunately, the price stagnated for the three days before Christmas, with Bitcoin trading in a narrow range between $16,585 and $16,940 during this period. Similarly, on Dec. 25, the daily candlestick fell 0.8% ($136) to him, and he closed above the one-day low of $16,830.

Since then, major cryptocurrencies have fallen further, with $16,480 offering local support on December 28th.

So the failed Santa rally is quickly devolved into an increasingly improbable year-end high. But what about 2023?

Will Bitcoin Recover in 2023?

For Bitcoin and cryptocurrency investors, 2022 has been a humbling experience for many reasons.

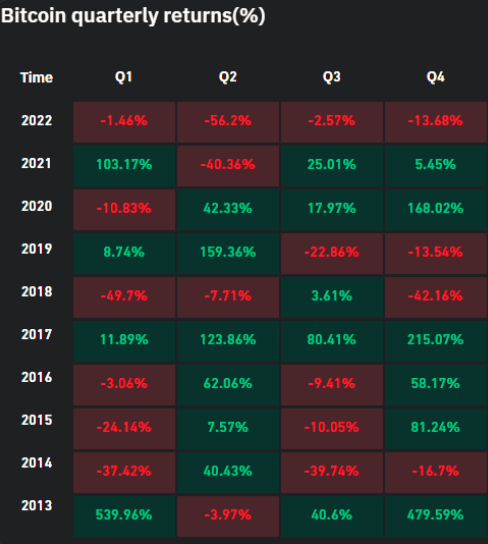

Documents Bitcoin’s quarterly price performance, @esatoshiclub 2022 was the worst year since 2018.

Looking at the data, we can see that all four quarters of 2022 have posted losses. This is unprecedented. Similarly, Q2 2022 had the largest loss rate on record.

“#bitcoin Prices look set to drop nearly 70% in 2022, the worst year since the cryptocurrency crash of 2018. “

Summing up the year, the typical reaction of believers is that the market has hit rock bottom and things are only getting better. For example, when commenting on the current situation, @rovercrc Said, “2023 can’t get any worse…”

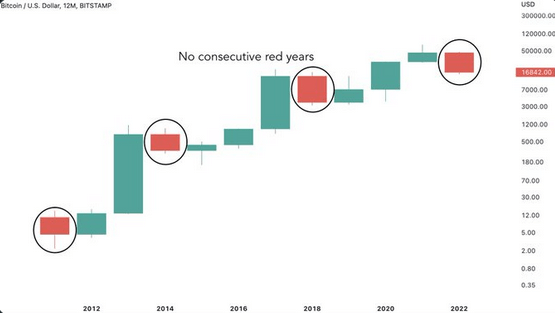

to inspire, @Game of Trades_ pointed outBitcoin has never had a consecutive year of losses. So, based on historical data, 2023 could end at around $17,000 and above.

However, remember that historical data is no guarantee of future performance, given that 2022 is the first year in which all four quarters are in the red. Especially as the macro picture remains uncertain heading into the new year.