Bitcoin long-term holders capitulate at levels seen during FTX collapse

quick take

- Bitcoin long-term holders (LTH) are defined as investors who have held Bitcoin for more than 6 months and are considered smart money in the ecosystem. Typically, they buy bitcoin when prices are subdued and distribute in bull markets.

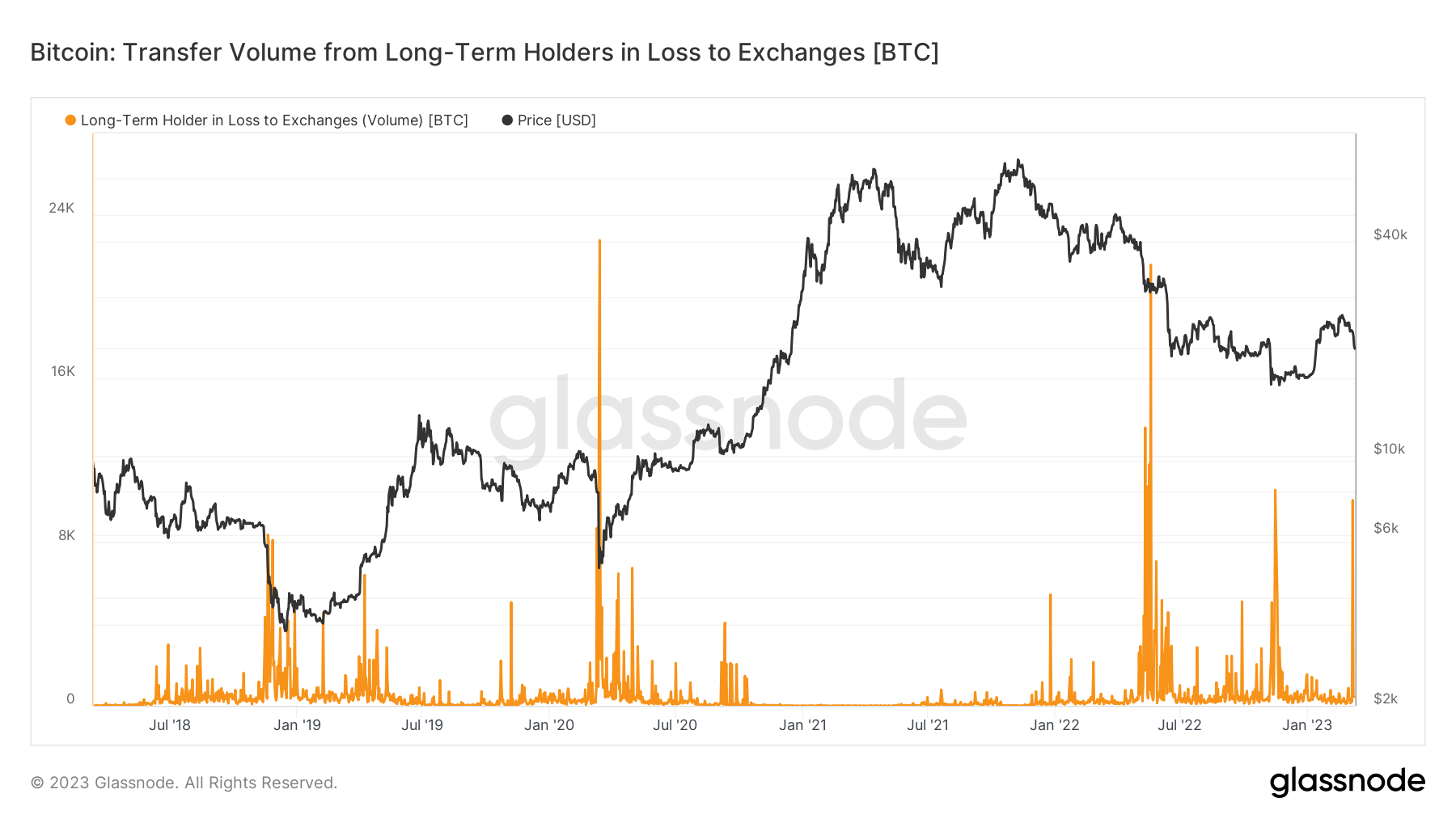

- However, in the event of panic or fear in the market, LTH will surrender and sell Bitcoin. You can see this in the on-chain metrics below.

- These indicators show that when LTH sells bitcoin to exchanges, there are substantial spikes in moments of fear and surrender. These events include the demise of LUNA and FTX, the May 2021 ban in China, and the now significant surrender of Silvergate and later Silicon Valley Bank influence.

- Long-term holders surrendered to levels similar to the collapse of FTX. About 10,000 bitcoins were sent to exchanges, all sold at a loss.

- A surrender, especially of long-term holders, could mark the bottom of the Bitcoin cycle. However, the impact and contagion from the banking and financial sectors is still unknown and will be short-term bearish for Bitcoin price action.

A post about long-term Bitcoin holders surrendering at levels seen during the collapse of FTX first appeared on CryptoSlate.