Bitcoin miner revenue stabilizes as Inscriptions demand wanes

Since early 2023, a new form of non-fungible tokens (NFTs) known as Bitcoin Ordinals Inscriptions has sparked widespread interest in the crypto space.

Inscriptions’ popularity can be attributed to its novelty and the unique value proposition it offers. They provide a way for users to immortalize messages on the immutable Bitcoin blockchain, adding a new layer of functionality to Bitcoin’s utility as a store of value. This opens up new avenues for creativity and personal expression within the Bitcoin ecosystem, allowing users to create lasting legacies on the blockchain.

Furthermore, the emergence of Inscriptions represents an important milestone for Bitcoin, marking its entry into the NFT space, a territory previously dominated by Ethereum and other smart contract platforms.

However, the surge in popularity of Inscriptions has had a major impact on the Bitcoin network. The increased demand for these new NFTs has led to a significant rise in transaction costs and network congestion, resulting in an unprecedented surge in mining revenue due to increased transaction fees.

But recent data suggests that the enthusiasm around Inscriptions has cooled. Various miner-related indicators show a return to pre-registration levels, indicating a normalization of the market.

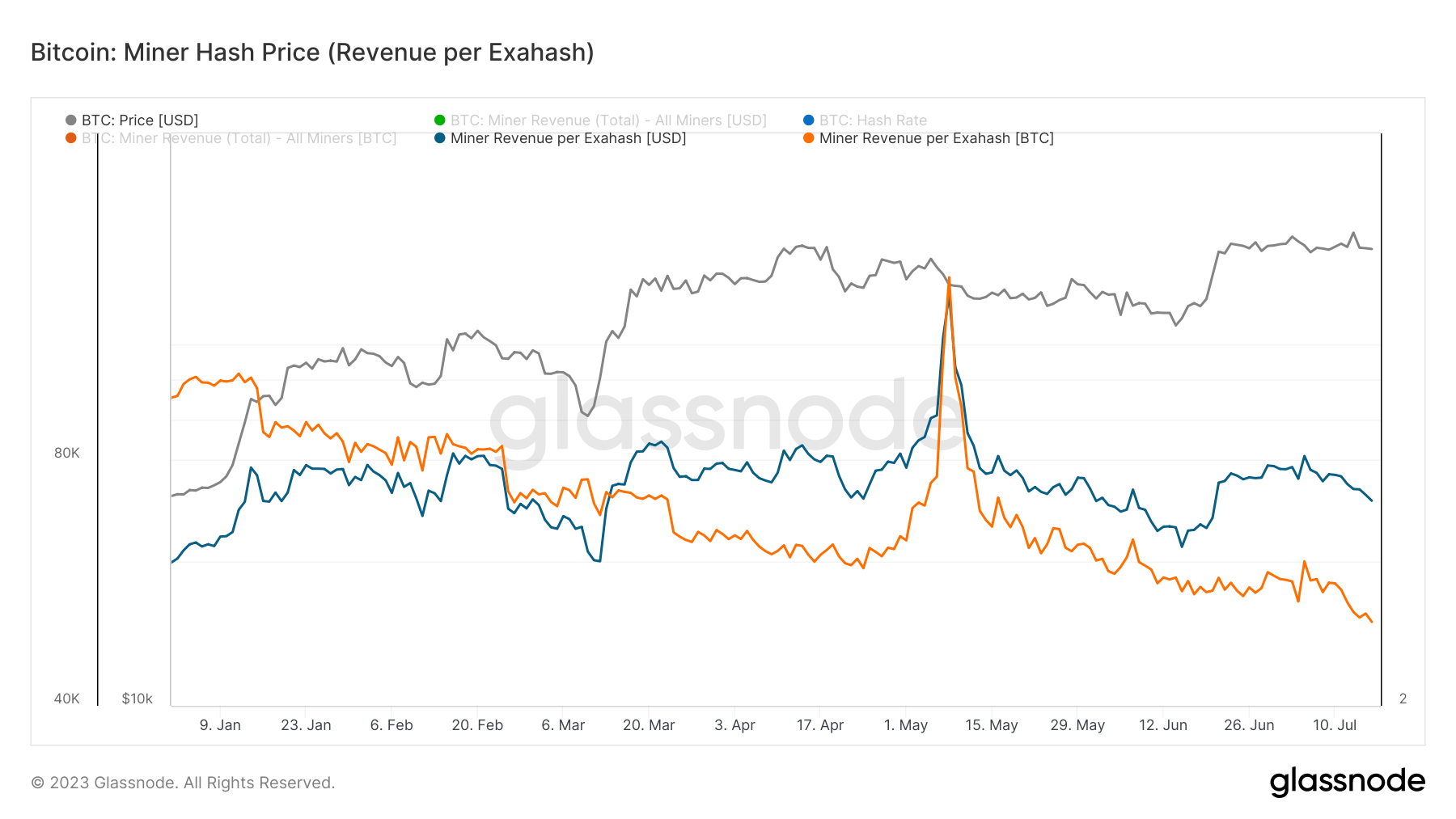

Miner revenue, a measure of revenue earned for each exahash of computing power miners contribute to the network, has declined significantly since its peak on May 8, 2023. USD revenue per exahash dropped by more than 44. % since May 8, following an increase of 110% from January to May.

When denominated in BTC, miner revenues followed a similar trend, down 48% since May 8th.

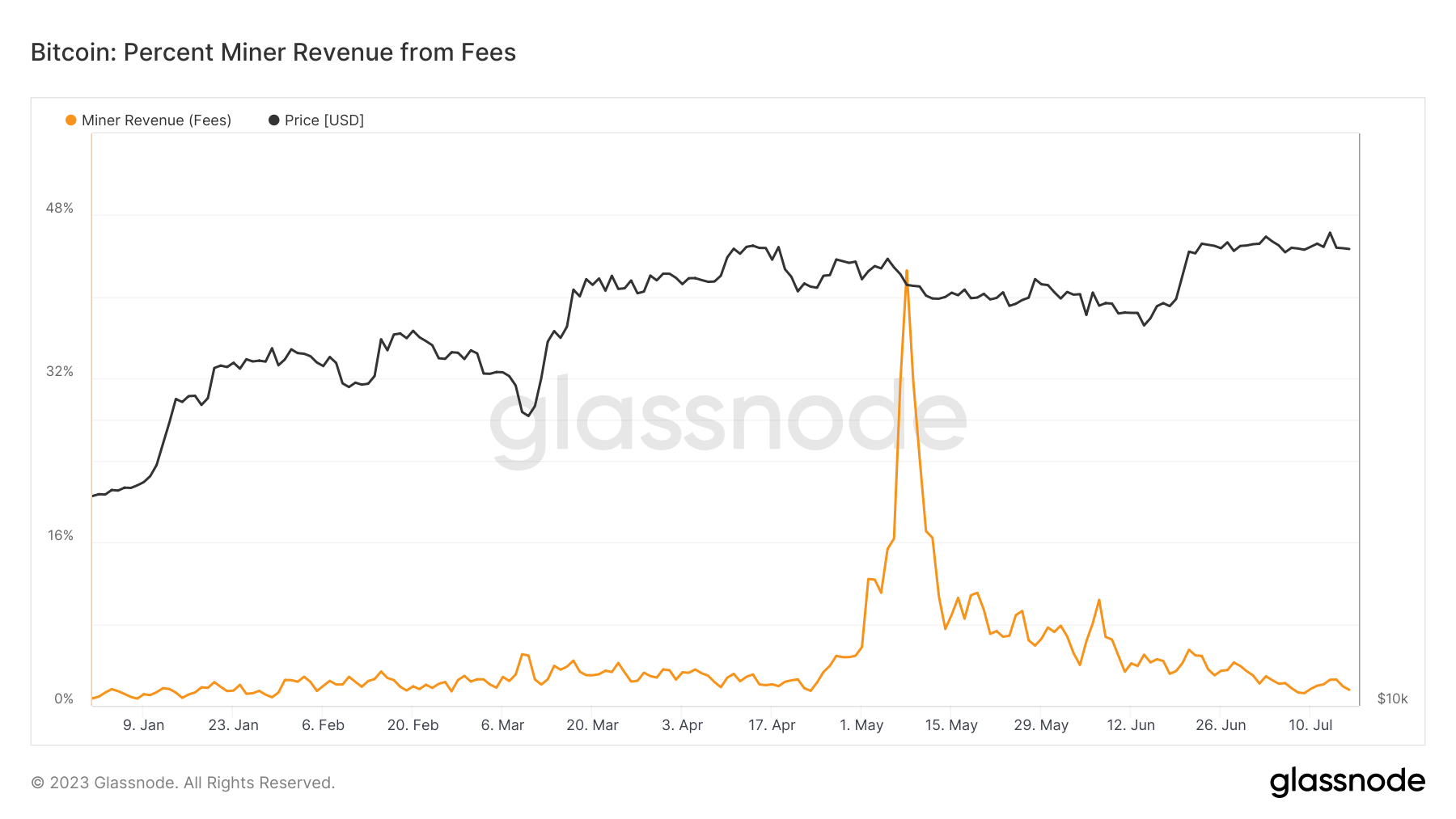

The Inscriptions craze has had a significant impact on miner revenue mix. On May 8, transaction fees hit their second-highest level ever, accounting for his 42.59% of overall miner revenue. The all-time high was recorded on December 22, 2017, when Bitcoin climbed to $20,000, when transaction fees accounted for 43.57% of total revenue.

To put this into perspective, transaction fees accounted for only 0.73% of miner revenue as of January 1, 2023. As of June 16, 2023, transaction fees accounted for approximately 1.56% of miner revenue, indicating that most of the revenue comes from block rewards.

The normalization of miner earnings and the decline in transaction fees suggest that the market has adapted to the inscription phenomenon. The Inscriptions trend provided a temporary economic boon for bitcoin miners, but the bitcoin network appears to be returning to normal operations.

This return to normalcy is a positive sign for the Bitcoin network, demonstrating its resilience and ability to adapt to new developments and trends.