Bitcoin miners are forced to sell to cover operating costs

Bitcoin miners are pitching revenue to keep up with rising operating costs. Miners can no longer afford HODL as electricity prices continue to rise and Bitcoin follows its downward trend.

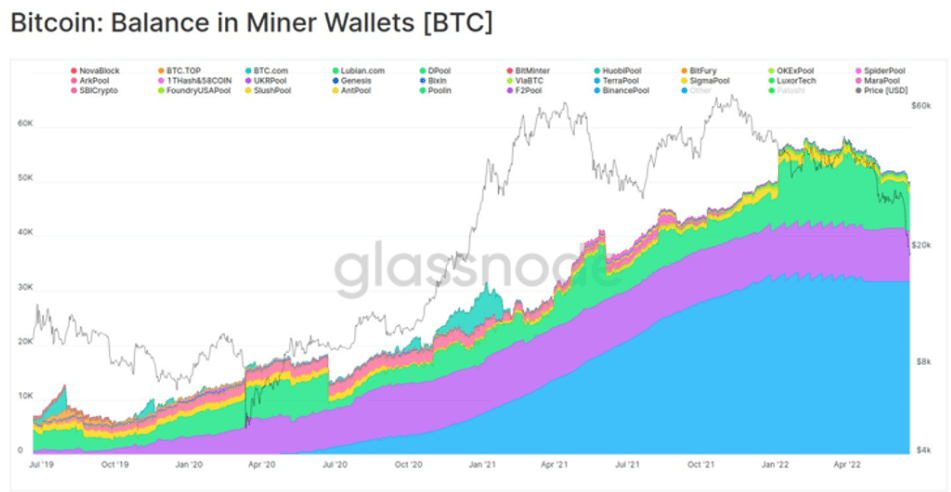

As the chart above shows, the sold-out trend began in early 2022. At the time, experts commented that the miners sold their earnings because they expected Bitcoin to continue to fall.

They were right. Mining equipment manufactured before 2019 lost profitability when Bitcoin hit its 18-month low on June 14. At the time of writing, Bitcoin is trading for about $ 20,170. This is almost the lowest profitable price of the 2021 model Antminer S19j.

I can’t HODL

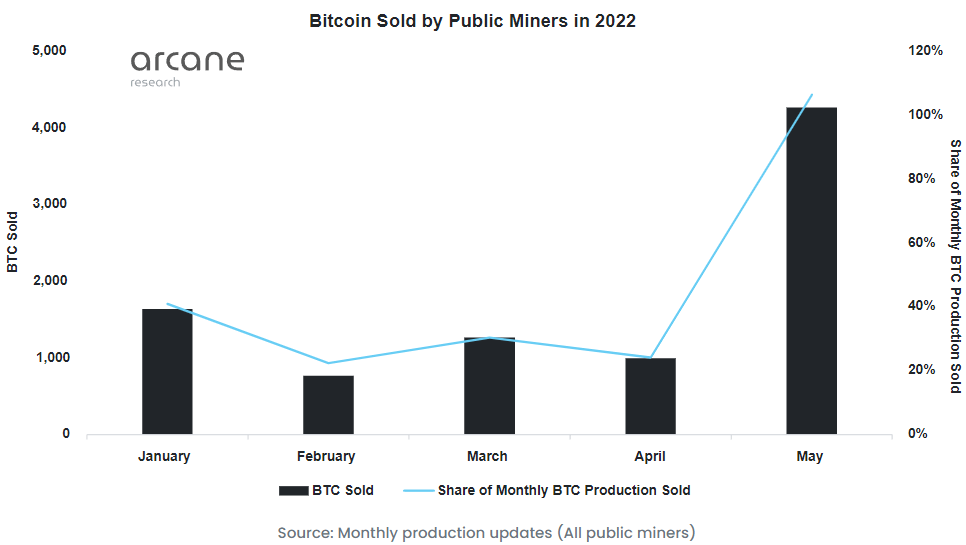

Arcane Research data It shows that public Bitcoin miners receive about 900 Bitcoins daily. They hold as much as possible and tend to be part of the largest whale on the market.

However, rising energy costs and lower Bitcoin prices have put public miners in a difficult situation.

According to figures, public mining companies sold 30% of Bitcoin production in the first four months of 2022.

Marcus Sotiriou, a Global Block analyst at digital asset brokers, commented on the sell-out trend. Said The main reasons for the sale are:

“As electricity prices rise, profitability declines, forcing Bitcoin to liquidate some of it to cover its operating costs.”

Another Glassnode analyst pointed out that other miners are also sellers. He said:

“The balance of miners stagnated from the cumulative uptrend in 2019-21 and turned down. Miners spent about 9k $ BTC from the treasury last week and fell from about 60k $ BTC.”

Expected to sell

Despite the importance of data pointing to selling trends, experts point out that this is usually the behavior of miners in the bear market.

Miners tend to accumulate in bull markets and sell during bears to cover interest payments or pay higher costs. For example, in the last bear market in November 2018, miners sold a significant amount of coins while Bitcoin was falling.