Bitcoin miners capitulation passes, but spiking hash rate keeps pressure on

On October 3rd, Bitcoin’s hash rate soared to an all-time high of 244.25 EH/s. Regarding this, Binance CEO commented as follows: Zhao Changpeng “Miners know things we don’t know,” he said.

Two days later, the hash rate surged again, breaking previous records and reaching an all-time high. 314.58 EH/sfurther demonstrating miner confidence despite heightened price uncertainty amid crypto winter.

On the other hand, since the November 2021 market high, mining difficulty has also increased, but not to the same extent as the hash rate. All of this squeezes miner profits.

The situation is further exacerbated by the fact that Bitcoin continues to trade at relatively low prices.

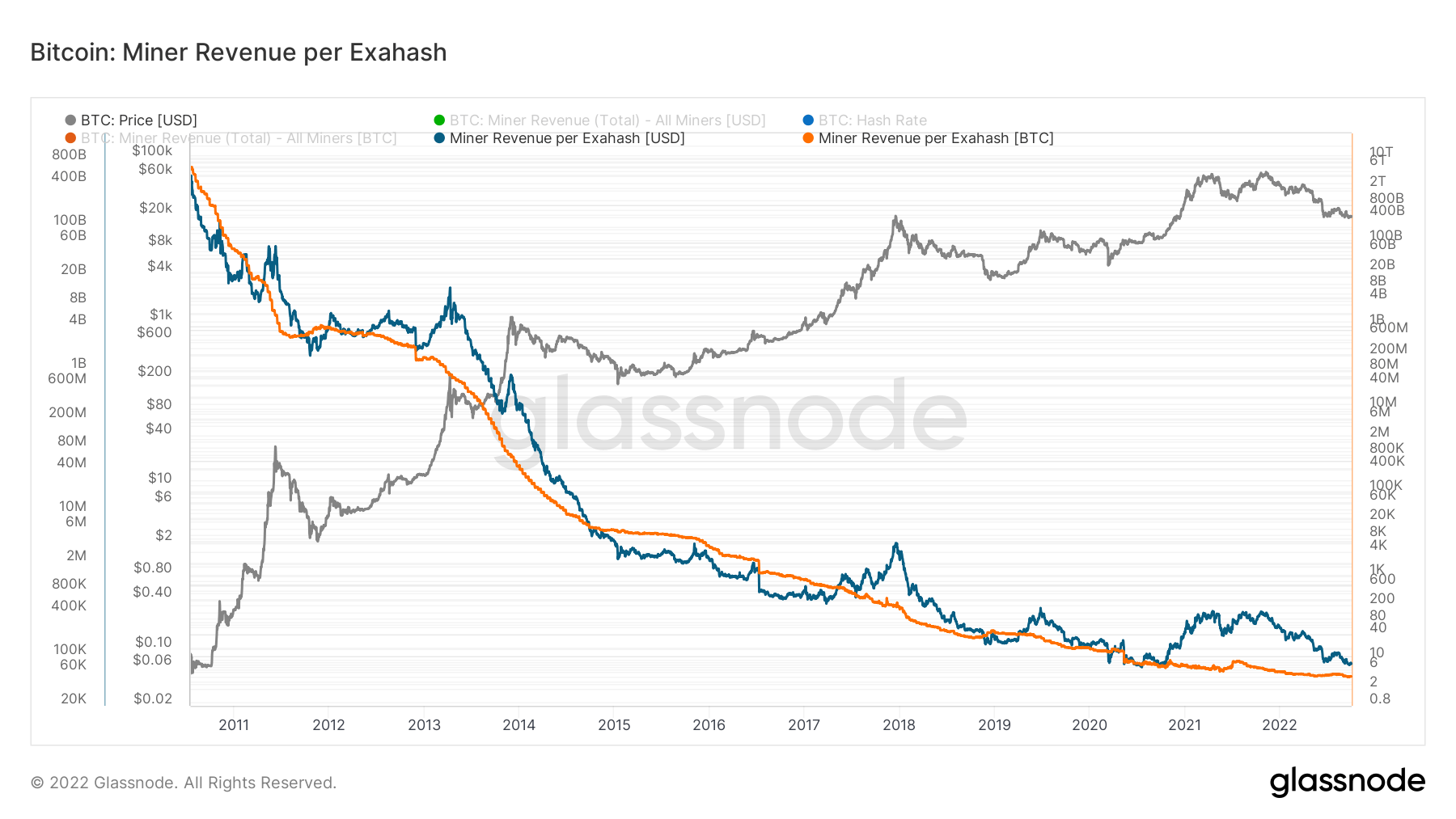

Bitcoin mining revenues sluggish

The Miner Earnings per Exahash chart below shows a long-term steady downward trend in earnings in both USD and BTC.

Currently, the BTC denominated reward is only 4 BTC per day. This equates to approximately $80,000 in earnings per day for him per exahash. This is on par with earnings seen in late 2020 when Bitcoin was around $10,000.

Meanwhile, mining difficulty has increased along with hash rate, meaning that profitably mining BTC has never been more demanding and competitive.

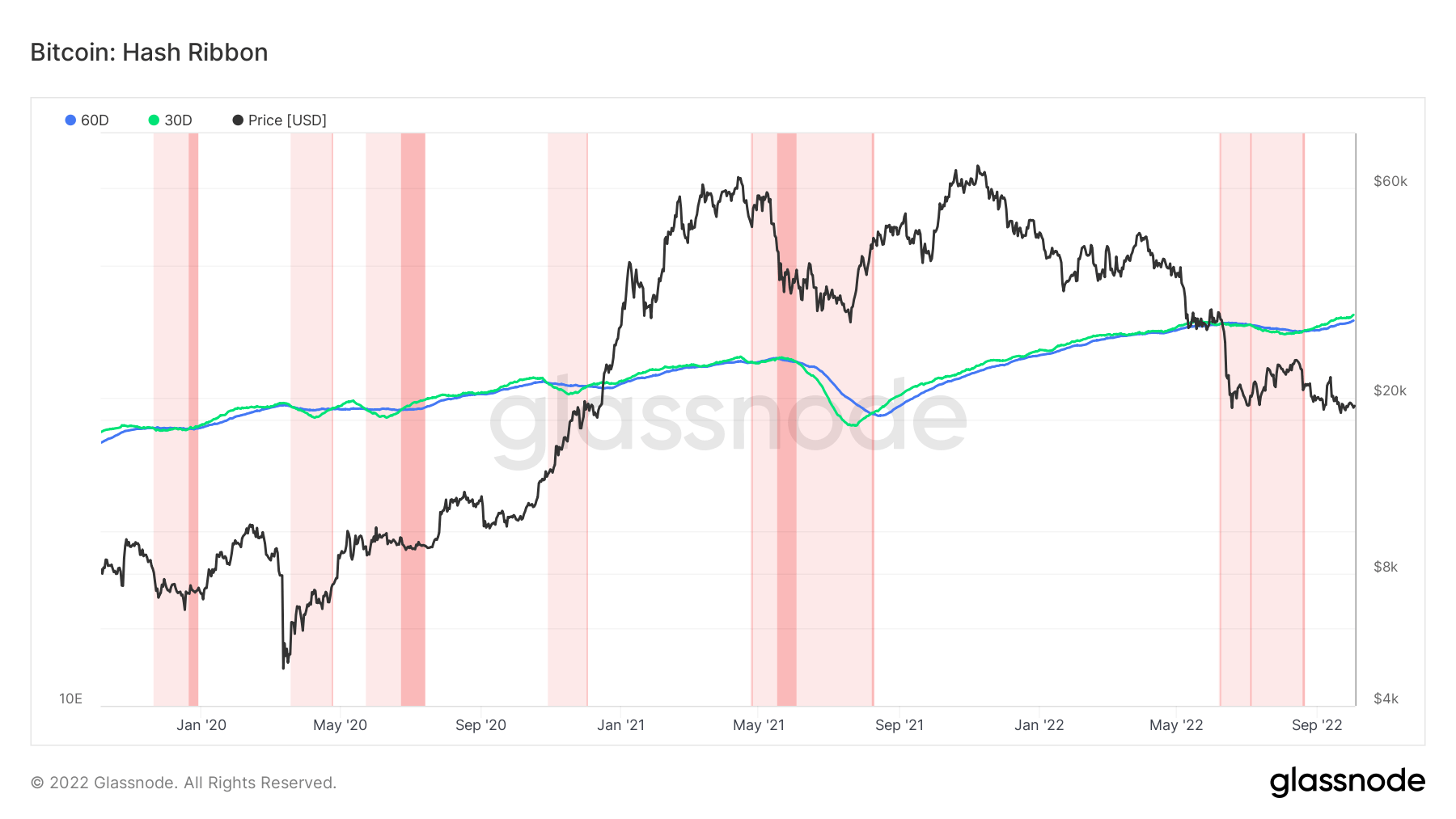

hash ribbon

Hash Ribbons are calculated from the 30-day and 60-day Simple Moving Averages (SMA) of the Bitcoin hash rate. Analysts use this metric to determine the duration of miner distress, and thus can be used to predict surrender.

The chart below shows that the market has passed a two-month long capitulation period that ended around September. The capitulation period may be a factor in Bitcoin’s continued decline and then he bounced back to the $20,000 level multiple times in recent weeks.

In late August, the 30-day SMA surpassed the 60-day SMA and the hashrate rose. When this phenomenon occurs, the price usually tends to move upwards, as we will see when BTC rises to his $69,000 level in November 2021.

However, apart from the rally between September 7th and 11th, the BTC price did not sustain its upward trend this time around.

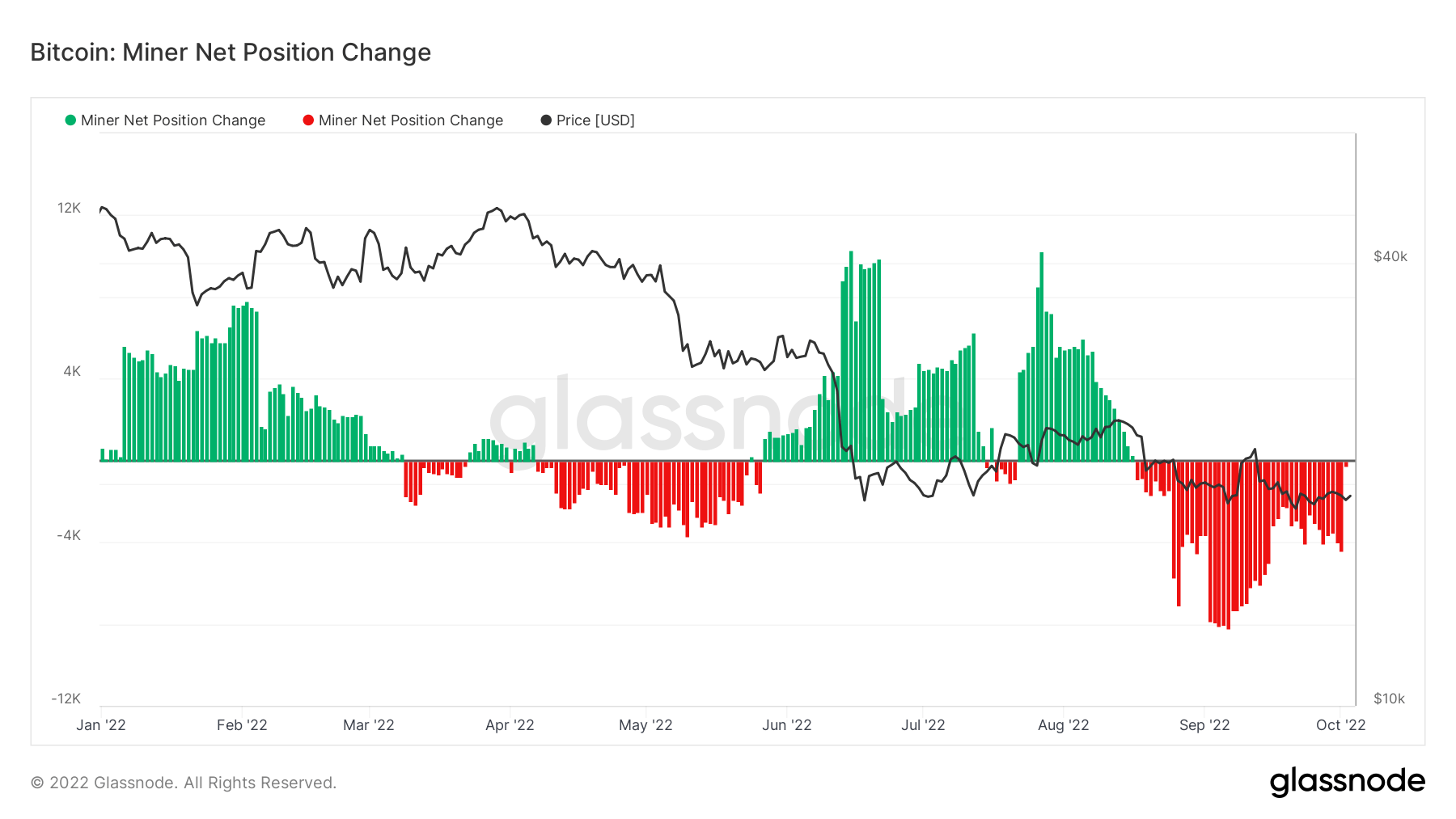

Minor net position change

A miner’s net position change is the 30-day percentage change in a Bitcoin miner’s unspent supply. A net positive reading is equivalent if the miner holds the token, while a net negative reading is if the miner sells it to the market.

The chart below shows the net negative distribution of tokens since mid-August. At its peak in September, sales reached -9,000.

Since then, the current net position change is -4,500, a noticeable drop in the distribution.