Bitcoin miners cash in on June price surge, selling thousands of BTC

Bitcoin (BTC) miners sold a substantial amount of the bitcoins they mined in June to fund their operations, according to Glassnode data analyzed by . crypto slate.

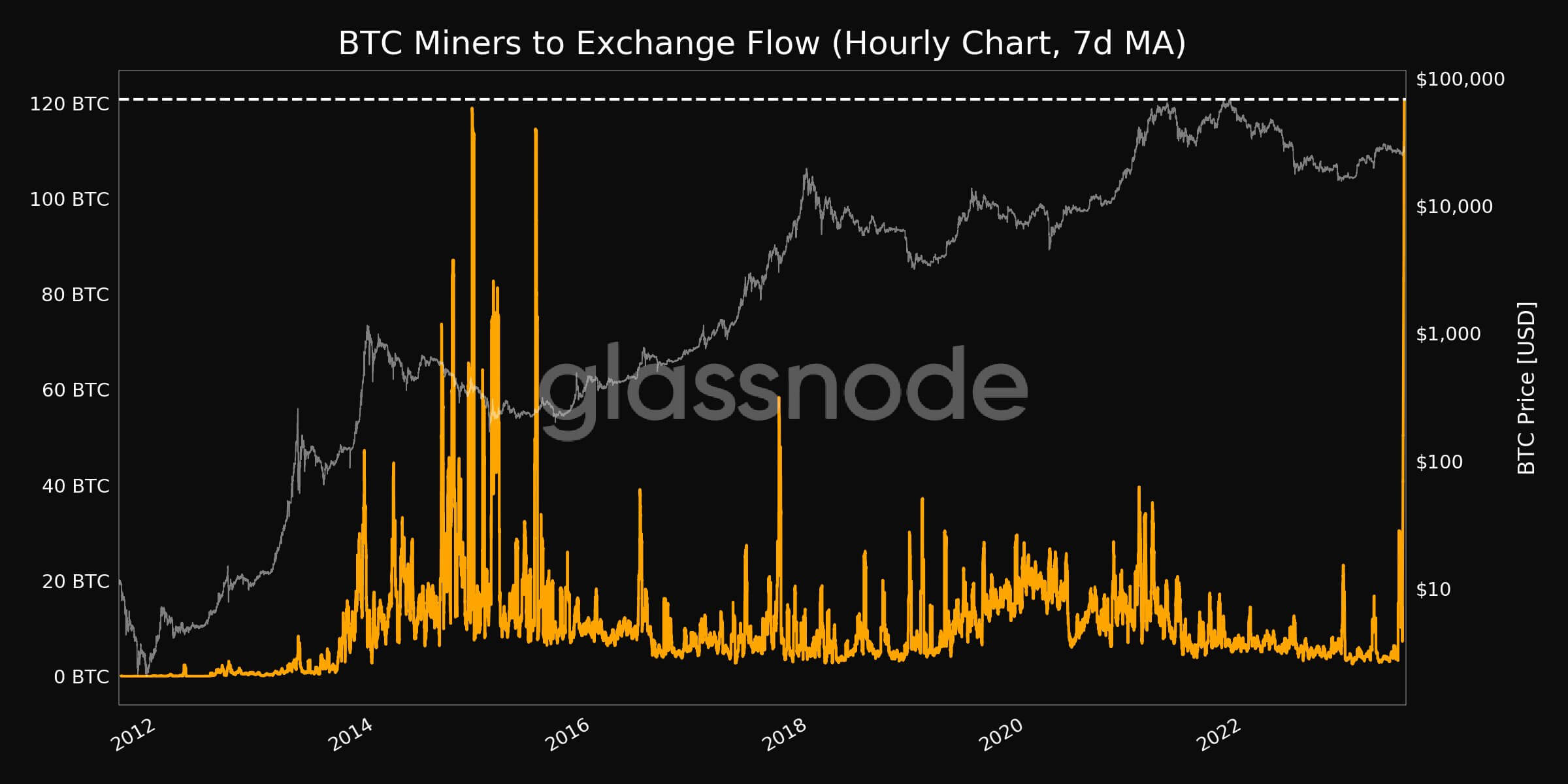

According to the graph below, miner exchange flows peaked at 4,710 BTC on June 20, the highest rate in five years. Other days of the month also saw significant spikes, with trading volumes to exchanges averaging over 2000 BTC.

glass node said 7-day moving average hourly flow from m toinner To eexchange reached 120.77 BTC, one of the highest levels since 2015.

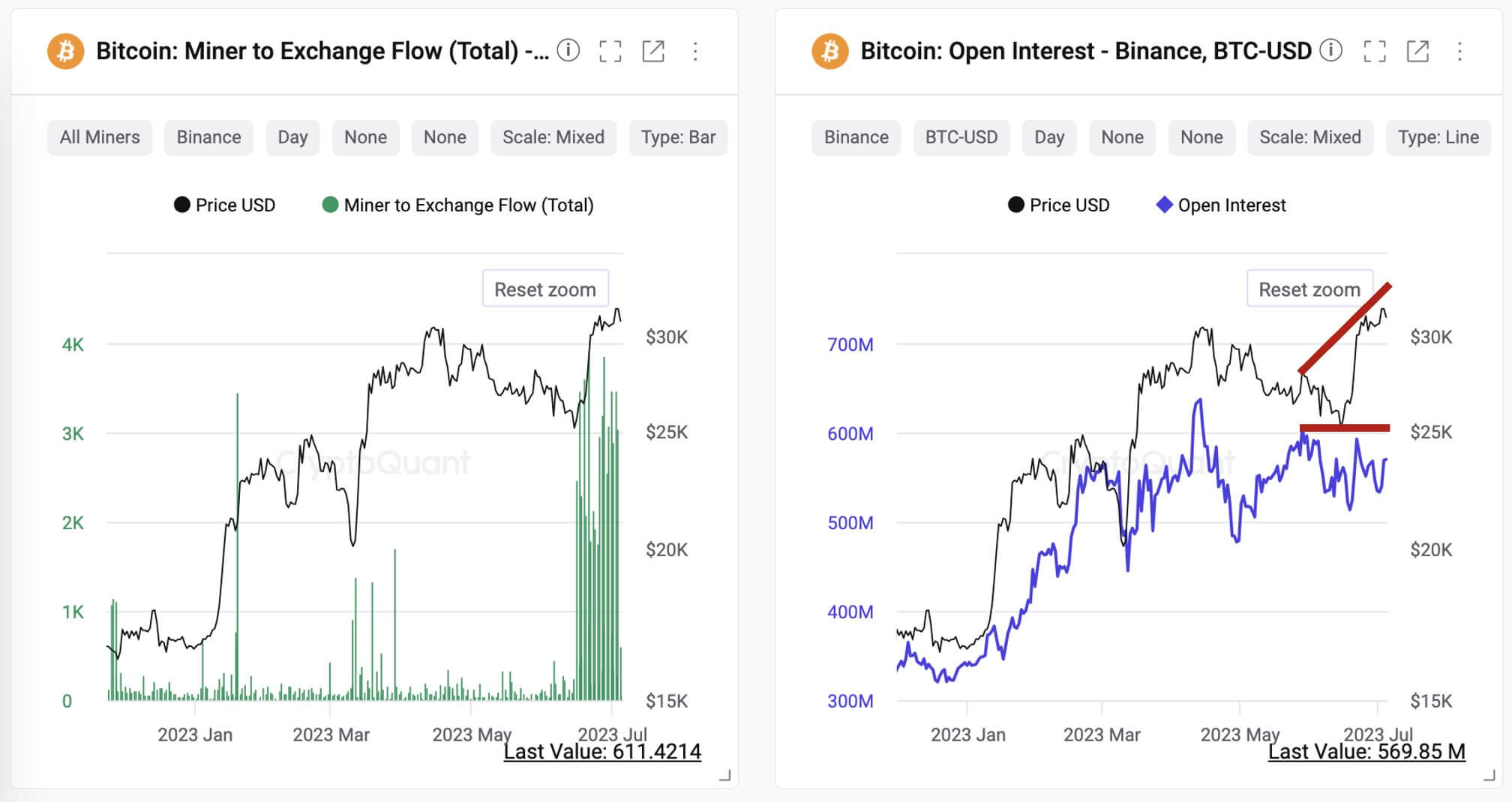

July 4, CryptoQuant CEO Ki Young Ju Said Over the past three weeks, miners have transferred over 54,000 BTC to Binance. “BTC-USD open interest has not changed significantly, suggesting it is unlikely to fill up collateral to punt new long positions,” said Ju.

Mr Ju added:

“There seems to be a high possibility of spot selling.”

In a recently released operational update, bitcoin miners Marathon Digital, Cleanspark and Hut8 confirmed these transactions.

Reported on July 6th statement, Marathon Digital announced that it sold 700 BTC, equivalent to 71.5% of the 979 BTC mined in June, for an undisclosed amount. Its rival, Hut 8, sold 217 BTC (100% of Bitcoins produced in May, 70 Bitcoins produced in June) was $7.9 million.

Cleanse Park, on the other hand, sold According to a July 3 statement, it acquired 84% of the 491 BTC it mined in June for $11.2 million.

These trading activities suggest that miners wanted to capitalize on BTC’s recent price surge to secure their profits. In June, BTC traded mostly above $25,000 and peaked at $31,268 after several traditional financial institutions, including BlackRock, filed for Bitcoin ETFs.

Post-Bitcoin miners profited from the June price surge, selling thousands of BTC and first appearing on CryptoSlate.