Bitcoin miners’ changing strategies: from hoarding to selling

quick take

according to Accountant and Bitcoin Mining Analyst at Compass Mining, Anthony Power tThroughout 2021, Bitcoin miners tended to hold the majority of Bitcoin production as the price of the cryptocurrency rose significantly.

But then, in 2022, the price of Bitcoin fell, forcing many heavily indebted miners to liquidate their holdings. According to Power, Marathon Digital and Hut8 were particularly committed to preserving bitcoin assets as long as possible.

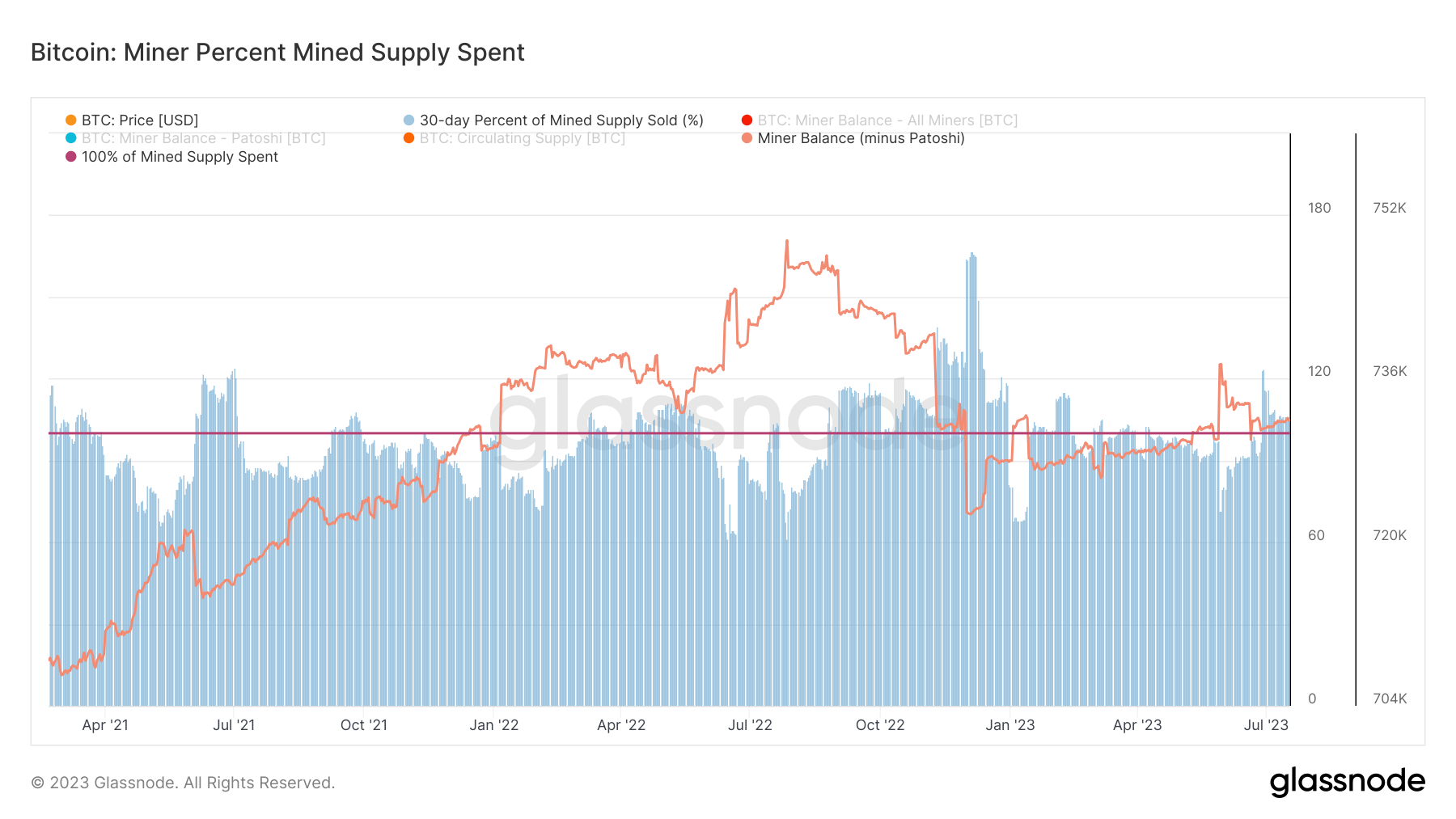

Data from Glassnode confirms this. As we will see throughout 2021, miner total balances continued to grow, but as 2022 continued, miners were offloading funds to cover their liabilities and debts due to the falling Bitcoin price.

According to Anthony Power, it is noteworthy that earlier this year all miners have begun to liquidate some, if not all, of their Bitcoin production following a rebound in the Bitcoin price.

The chart below highlights the strategy adopted by 58% of miners. According to Anthony Power, they are not only liquidating part of their bitcoin production, but are also increasing their cryptocurrency reserves in preparation for next year’s halving event.

The Changing Strategy of Post-Bitcoin Miners: From Hoarding to Selling first appeared on CryptoSlate.