Bitcoin OTC desks see highest holdings in a year as inflows rise

Bitcoin over-the-counter (OTC) holdings, often overlooked in cryptocurrency trading, have surged to a one-year high, with inflows consistently outstripping outflows since May 2023, according to Glassnode data.

Over-the-counter (OTC) trading refers to the direct exchange of assets such as Bitcoin between two parties, bypassing traditional exchanges. This off-exchange transaction takes place through a decentralized network of dealers and often involves large amounts of bitcoin.

This is done through a decentralized dealer network. In the context of Bitcoin, OTC trading is often used by whales who want to buy and sell Bitcoin without having too much impact on the market price. This is important as large-scale trading on public exchanges can cause significant price fluctuations.

OTC Holdings refers to the amount of Bitcoin held by these OTC desks. These holdings may provide insight into the behavior of large investors. For example, an increase in OTC holdings suggests that more whales are buying bitcoin through his OTC trades, potentially signaling bullish market sentiment. Conversely, a decrease in OTC holdings could mean the opposite.

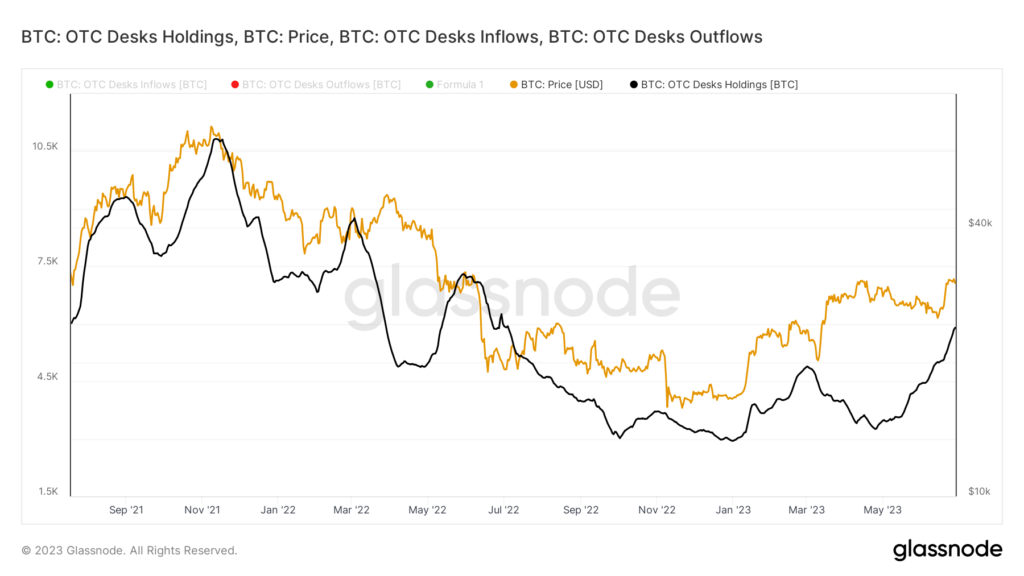

Bitcoin OTC holdings

After starting the year with a local low of around 2,969 BTC, OTC holdings recovered and reached 6,285 BTC on June 28, 2023, the highest level since May 2022.

Despite this recent surge, Bitcoin OTC holdings have yet to surpass the all-time high of 11,928 BTC set on August 17, 2020. The record was set amid Bitcoin’s all-time high of $68,692 on November 10, 2021.

Interestingly, there seems to be a loose correlation between Bitcoin price and OTC holdings, with OTC holdings slightly lagging BTC price. For example, as Bitcoin has been trading relatively flat since June 21, OTC holdings have increased by 12.45%, rising from 5,244 BTC to 5,899 BTC using the 30-day EMA. This rise occurred while the price of Bitcoin remained near $30,000.

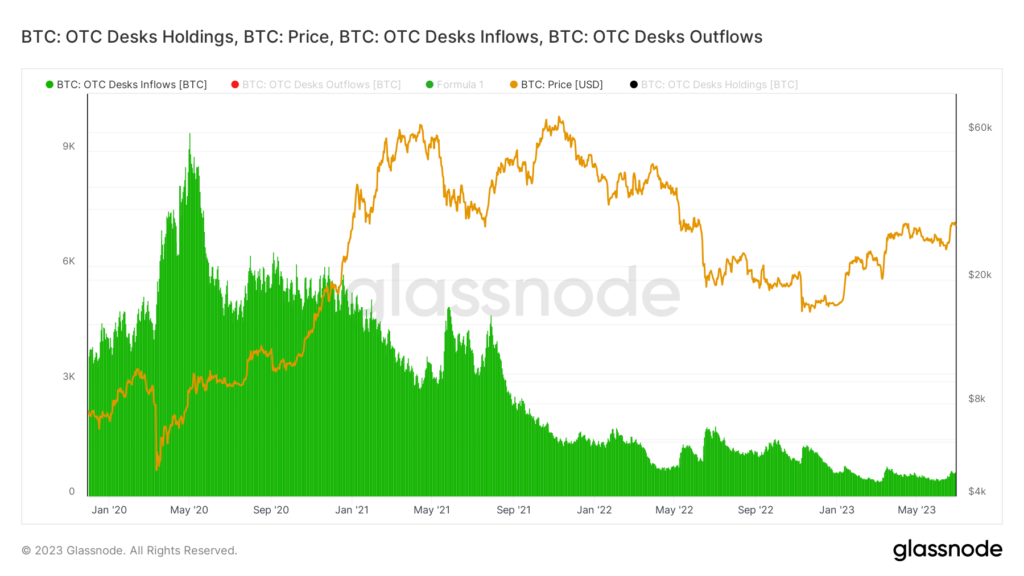

Bitcoin OTC inflow

At the same time, Bitcoin OTC inflows have continued to decline since their peak around the Bitcoin halving in May 2020. At that time, the OTC desk saw him regularly see inflows of well over 6,000 BTC. However, as evidenced by the drop in holdings, 2023 is not looking very favorable, with inflows slumping to the 30-day EMA low of 394 BTC.

However, the trend appeared to reverse in June, with inflows rising to around 645 BTC, a significant drop from pre-pandemic levels.

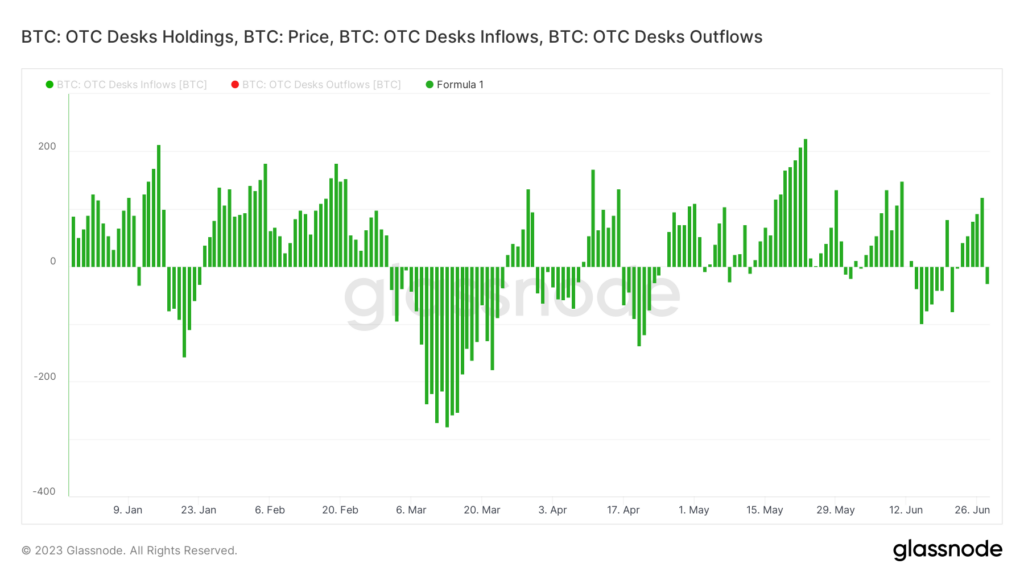

Comparing OTC inflows and outflows, Glassnode data shows a consistent overflow since May 2023. This is particularly noteworthy as the last runoff period was observed in his March 2023.

Recent trends in OTC holdings and inflows suggest that market confidence in Bitcoin is growing again, but overall decline in inflows since 2020 and OTC holdings remain The fact that it is well below its all-time high indicates that the market has a lot of room for growth.

These trends and indicators are worthy of attention by investors and enthusiasts as key indicators of whale sentiment and potential investment opportunities. Additionally, given the myriad of bankruptcies, lawsuits and other regulatory issues that have plagued the crypto industry over the past 12 months, we expect OTC desk trading activity to continue as reserves are restructured and creditors are repaid. will be