Bitcoin outperformed NASDAQ after Fed raised rates by 0.75%

The NASDAQ and gold prices plunged after the Fed’s latest rate hike of 0.75%.

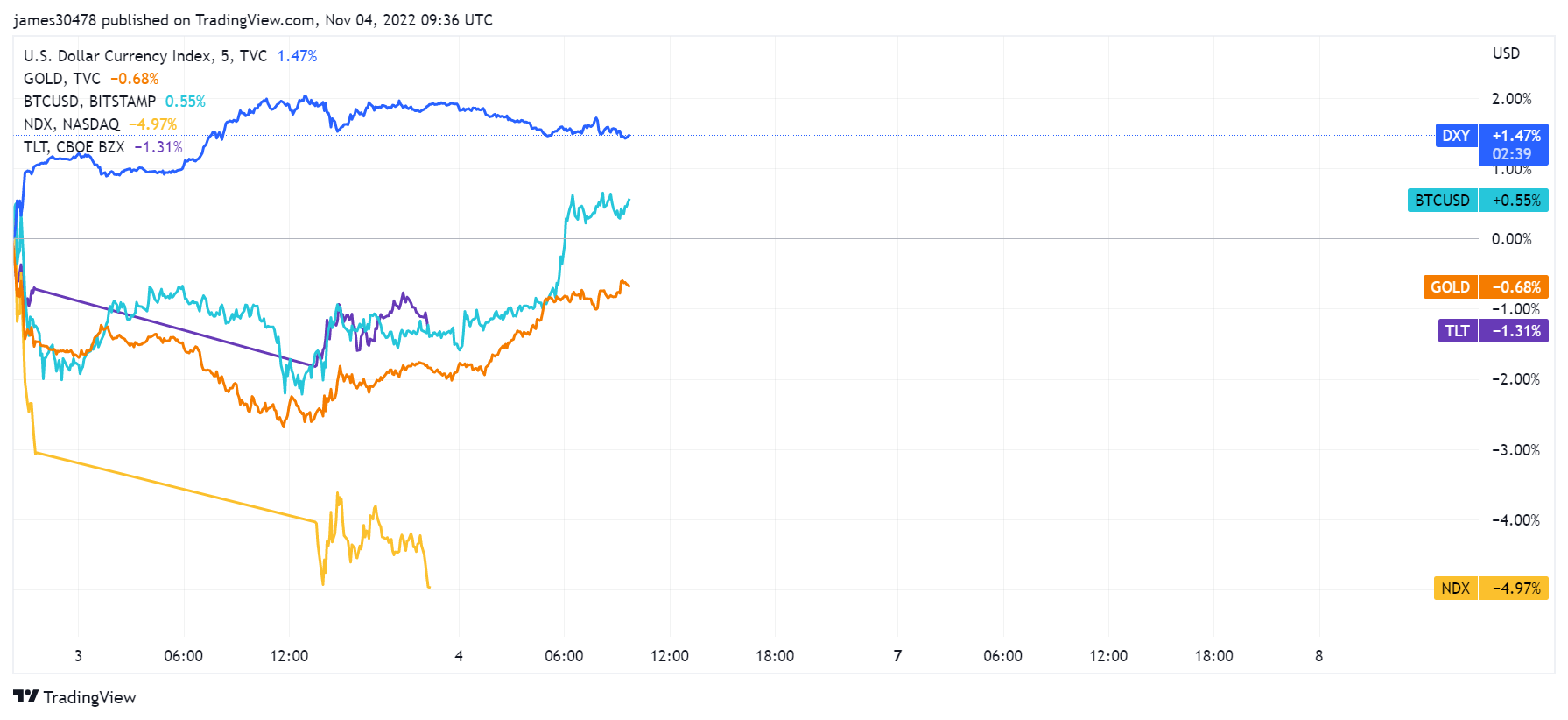

Market data showed NASDAQ down 4.97% and gold down 0.68%, both hitting year-to-date lows in the last 40 hours.

BTC, on the other hand, is up 0.55% over the same period. According to this, BTC is roughly on par with stable assets such as gold, and outperforms “safer” assets such as NASDAQ.

The Fed’s Stance on Recent Rate Hikes

The Federal Reserve has taken a hawkish approach, aggressively fighting inflation and attempting to bring it back to 2%. The Federal Reserve Board press release:

“The Commission aims to achieve maximum employment and inflation of 2% over the long term. We decided to raise it to 4 percent.”

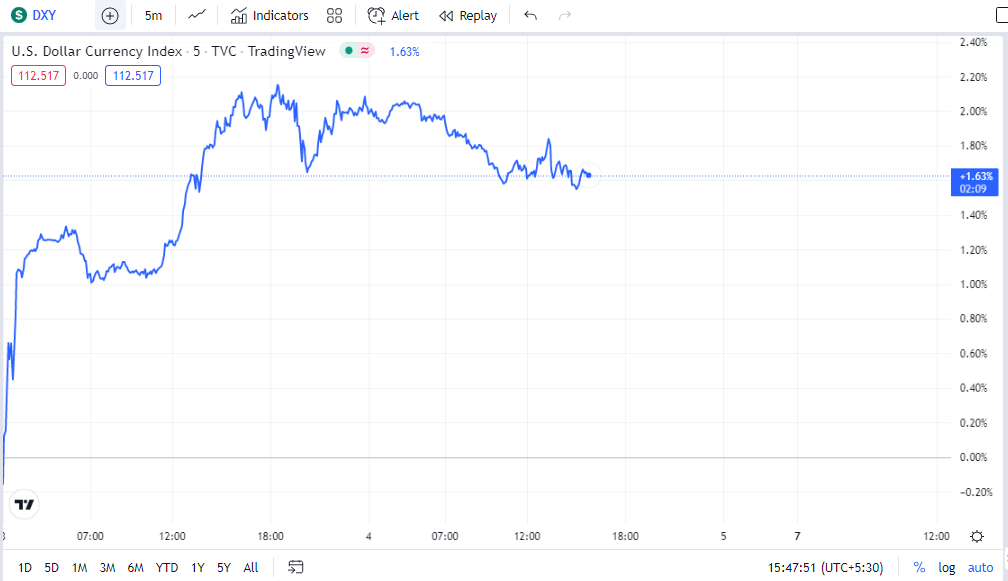

As expected, the US Dollar Index (DXY) surged after gaining 75 basis points.

still a long way to go

Fed Chairman Jay Powell said the Fed still has a long way to go in fighting inflation. He said:

“We still have a way to go, and data since the last meeting suggests the final level of interest rates will be higher than previously expected.”

He argued that it was too early to discuss a pause in rate hikes.

BTC is doing better than other assets

Bitcoin continues to perform as designed, even as inflation disrupts markets around the world. As long as current trends continue, the demand for the world’s most valuable cryptocurrency should continue to grow. Moreover, given the limited supply growth, this price increase should outpace inflation.

MicroStrategy executive chairman Michael Saylor backs up this claim. Speaking on MicroStrategy’s third quarter earnings call, Saylor said: bitcoin is winningand his company has benefited positively from it.

Thaler explained that BTC has risen 72% since August 2020. In the meantime, NASDAQ he rose only 15% and gold he fell 19%. The filing reflects the impressive growth BTC has gained over the years, despite suffering from recent declines due to a general bear market.