Bitcoin outperforms commodities as market gears up for high volatility

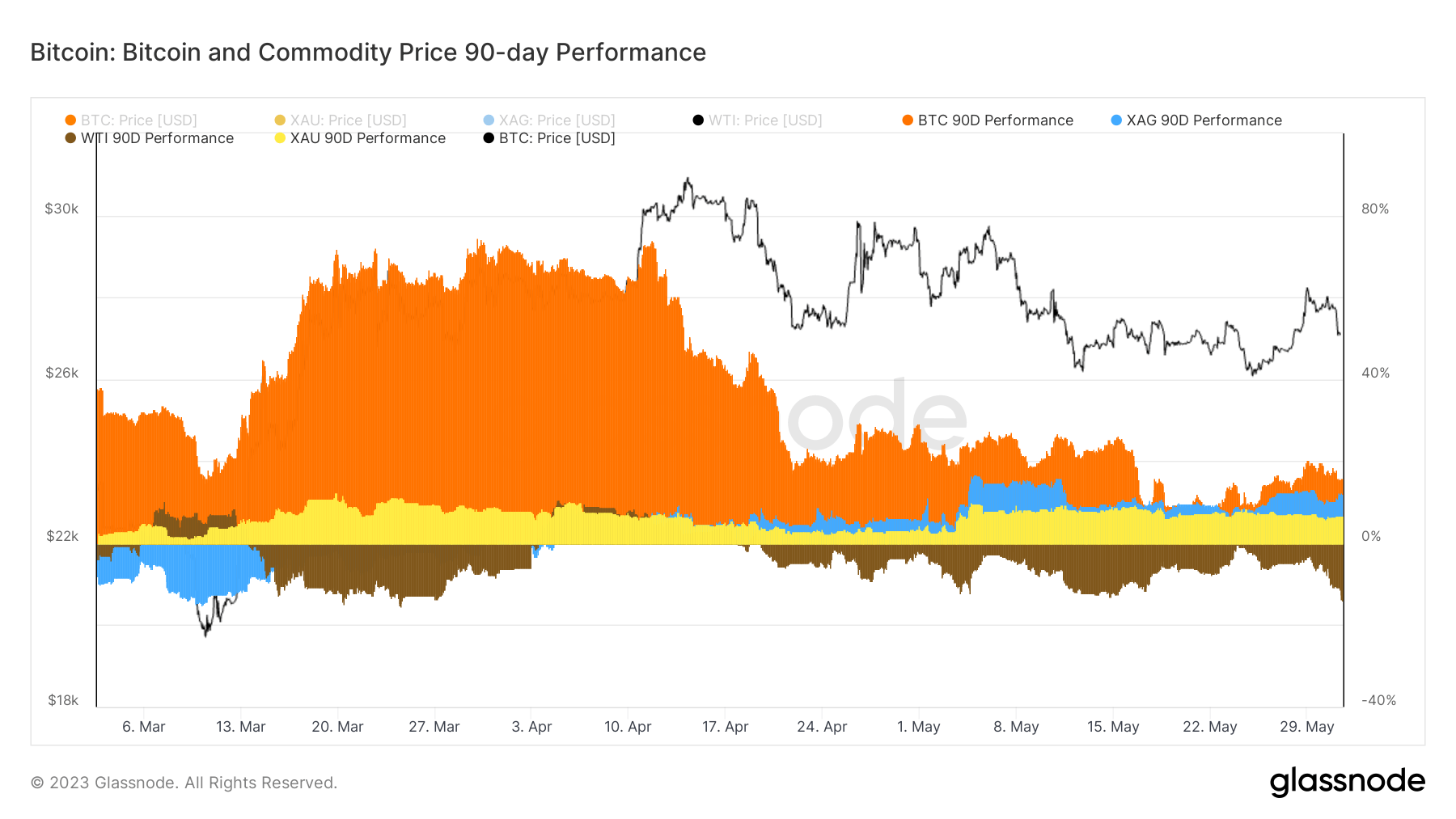

Bitcoin and commodities, especially gold and silver, have shown remarkable performance so far in 2023, despite the widespread market crisis caused by the US debt ceiling.

Over the past 90 days, Bitcoin recorded a 15.85% gain, beating silver’s 12.41% gain and gold’s 6.82% gain.

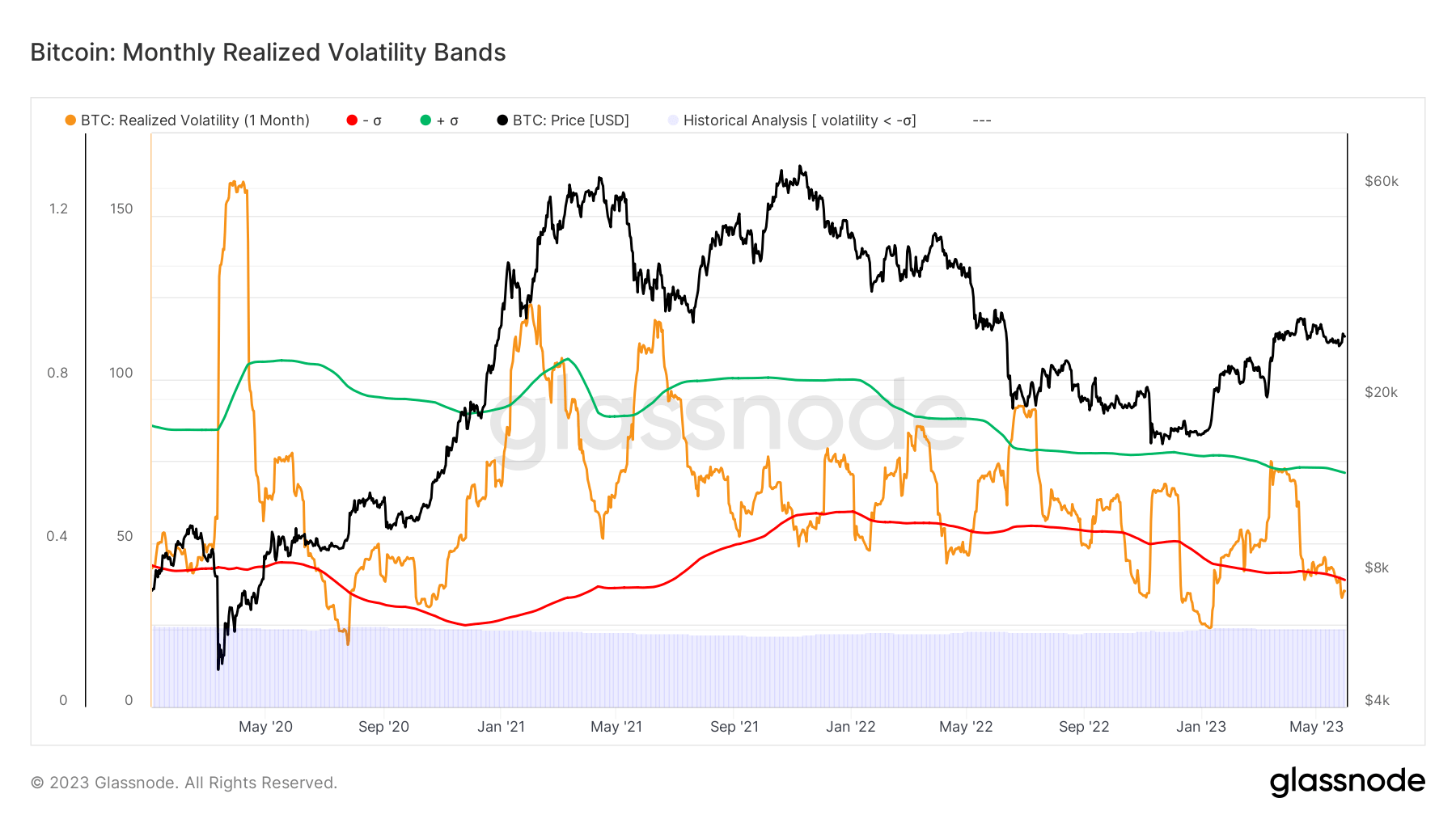

However, Bitcoin’s slow and steady return observed should not be misinterpreted as an indicator of an imminent stable market.

Bitcoin’s realized monthly volatility (a measure of how volatile or diversified an asset’s returns are over a month) has fallen to 34.1%, below the lower end of the Bollinger Bands of one standard deviation.

Bollinger Bands are a technical analysis tool that plots a range set around asset prices, with wider bands indicating higher volatility and vice versa. A drop below the lower band could signal an upcoming correction or reversal.

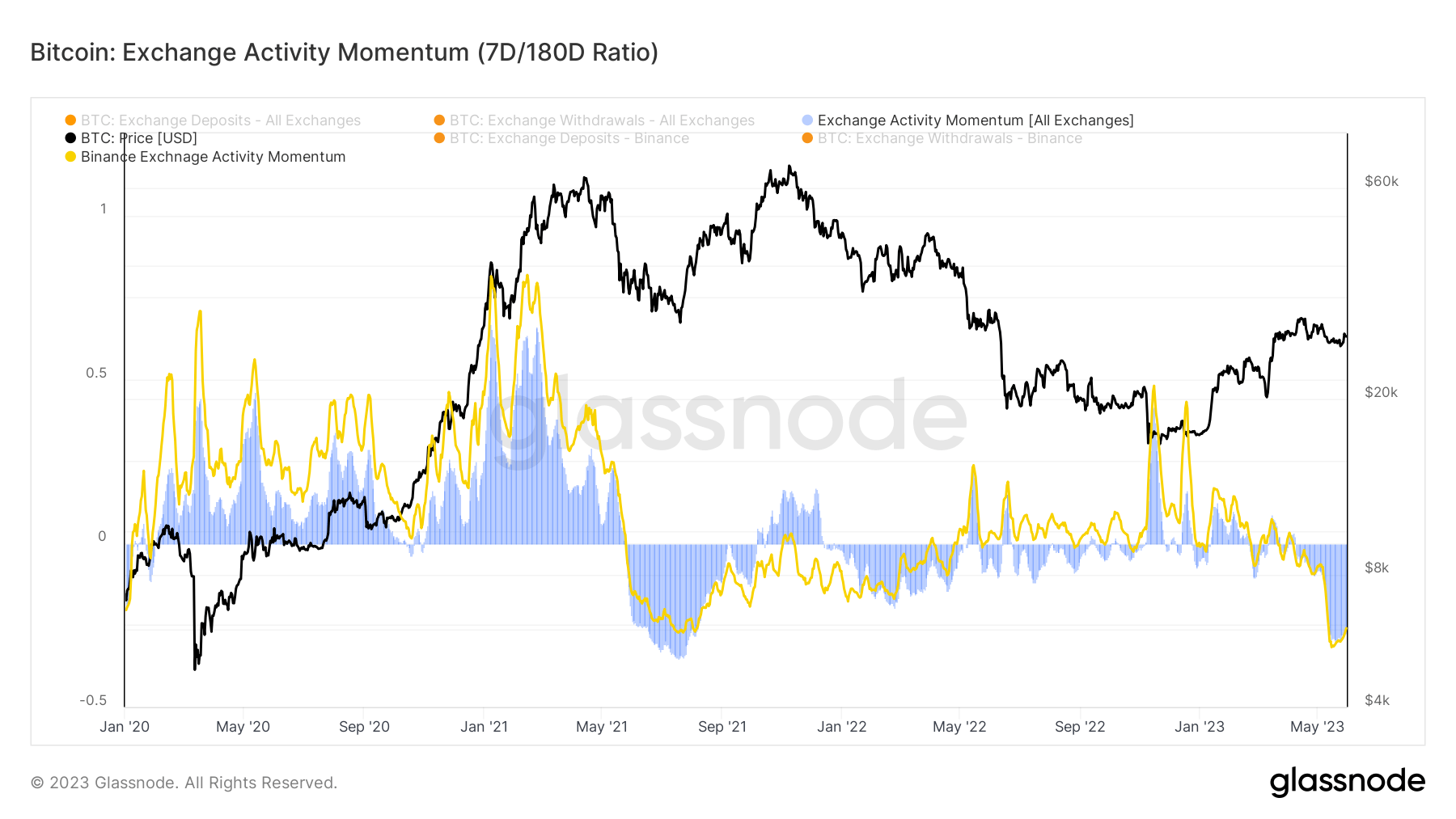

The slowdown in Bitcoin market activity is further supported by the momentum seen in currency activity. Glassnode calculates this metric by comparing the average number of foreign exchange deposit and withdrawal transactions for the current week to the median number of such transactions over the past six months to create an activity rate.

The recent 27.3% drop in this ratio compared to the last six months confirms the downward trend in market participants.

These two factors – lower investor activity and lower realized monthly volatility – paint a dormant, flat market. However, according to glass nodesuch periods of low volatility accounted for only 19.3% of the Bitcoin market history, suggesting a likely volatility spike going forward.

Bitcoin outperforming commodities first appeared on CryptoSlate as markets geared up for high volatility.