Bitcoin retakes $20,000 fueling speculation of bull market return

After breaking the $19,300 resistance in the fourth question, Bitcoin rose early on Tuesday (UTC) and peaked at $20,400.

The $20,170 levels provide near-term support as the bulls run out. However, the strong rally over the past 24 hours has prompted some to call for an end to the bear market.

Trader and host of the Wolf of all Streets Podcast. Scott MelkerBitcoin’s price action today is quite an anomaly given that the stock is going in the opposite direction.

Bitcoin rises big on days when the Stonks are down.

In 2022, it will be like watching a unicorn ride a three-legged elephant through the halls of Valhalla from the window of a billion-dollar luxury penthouse on Uranus.

— All Street Wolves (@scottmelker) September 27, 2022

Even more perplexing is that this comes at a time when major currencies such as the EUR and GBP are losing significant ground to the USD.

The rise has brought some optimism to the market, but what are the on-chain indicators showing?

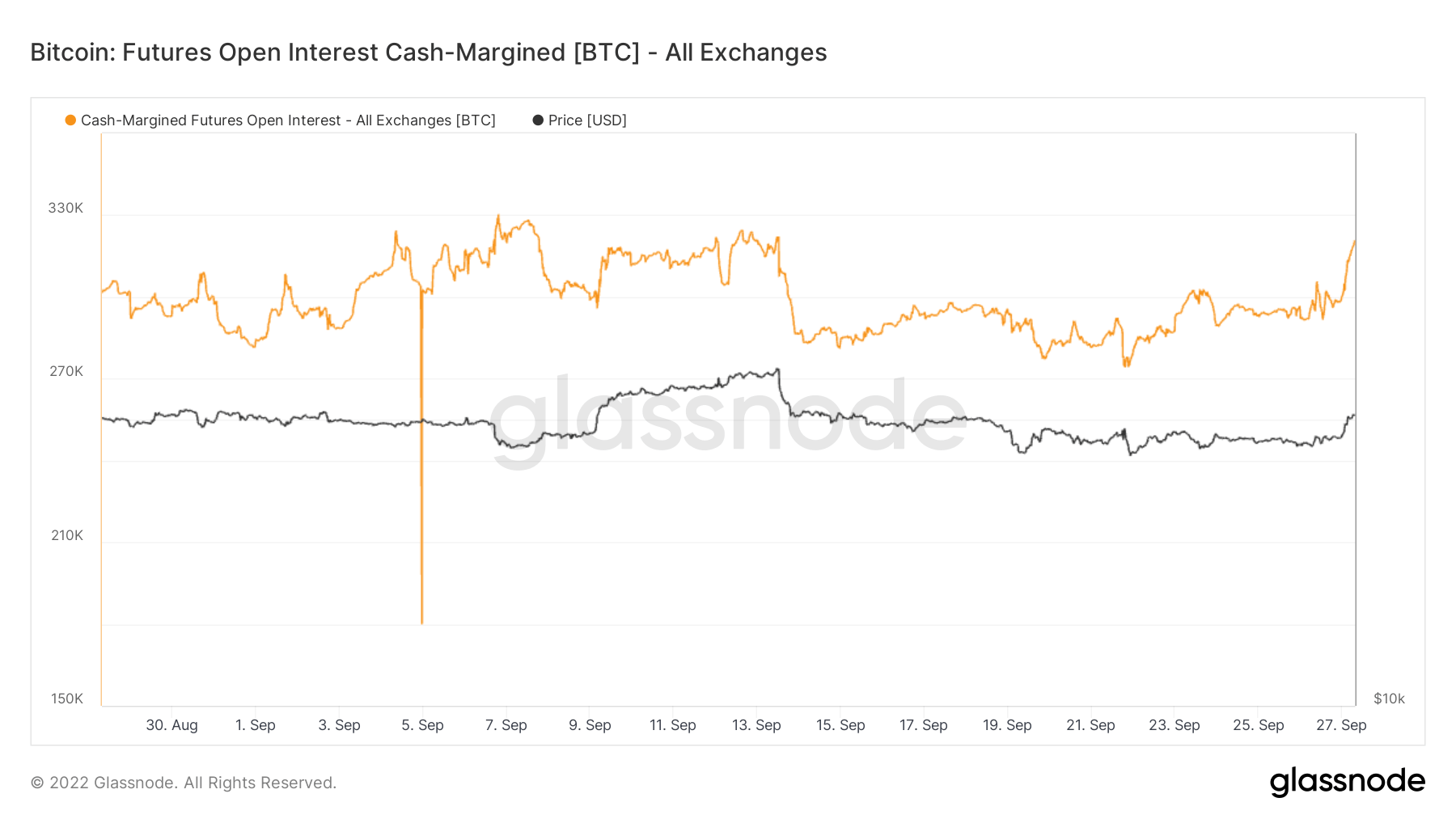

futures open interest

Open interest refers to the number of futures contracts in a particular time period. The contract is concluded when both the seller and the buyer agree. In general, an increase in open interest and an increase in price indicate an upward trend.

The Glassnode chart below shows futures open interest skyrocketing as the Bitcoin price surged overnight. However, at this time, it is unclear whether this pattern will persist based on daily data points.

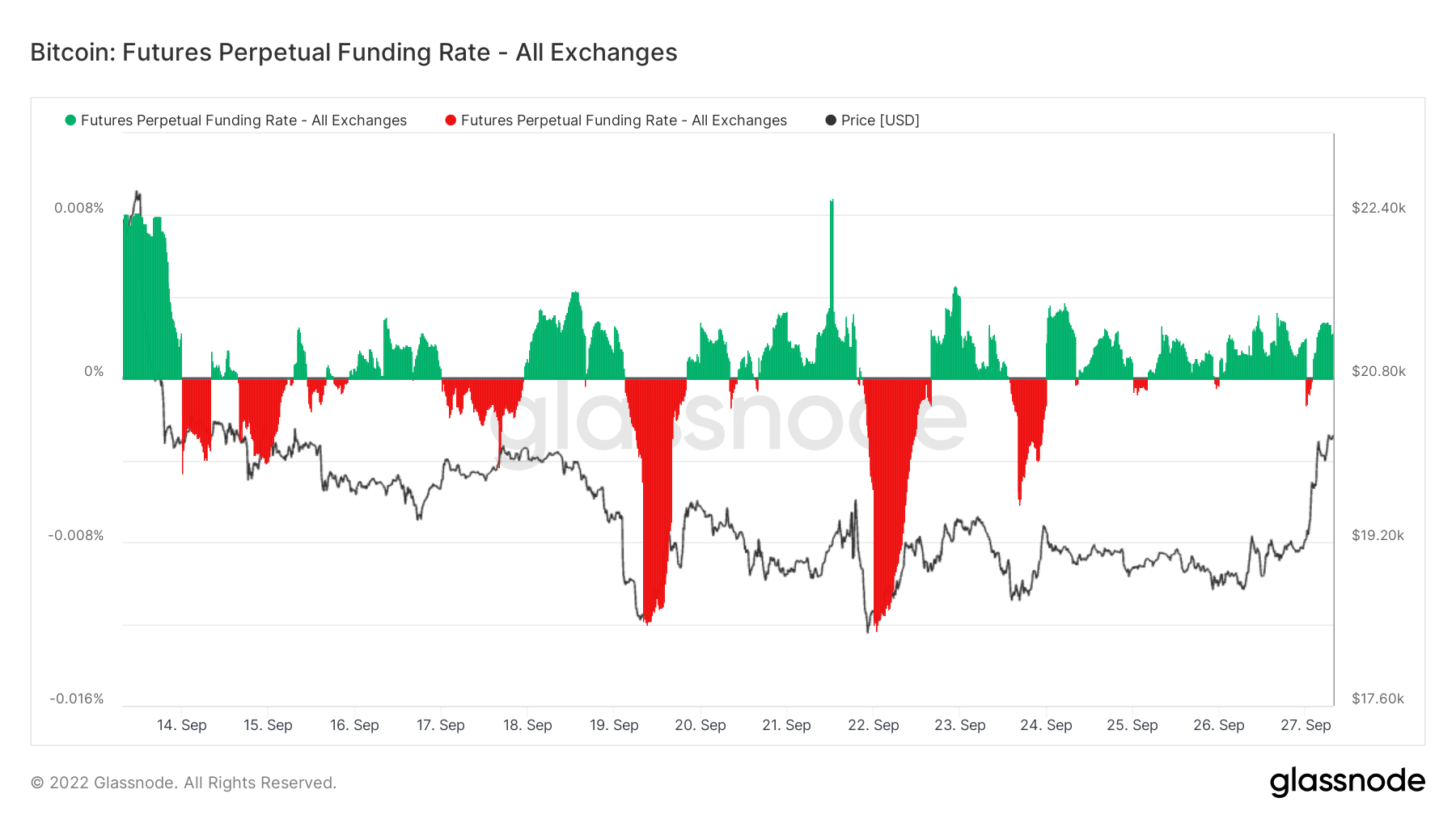

Futures Perpetual Funding Rate

Since perpetual contracts can be held indefinitely, the futures perpetual funding rate refers to the mechanism that ties the perpetual contract market to the spot market price.

The perpetual contract price is higher than the mark price during periods when the funding rate is positive. Therefore, long traders pay for short positions. In contrast, a negative funding rate indicates that the price of the perpetual contract is lower than the marked price, short his trader pays for the long.

The chart below shows the surge in futures traders willing to pay a premium to go long. As with futures open interest, the lack of data points and relatively modest magnitude of movement should be used with caution when declaring the end of a bear market.

Will this Bitcoin rally continue?

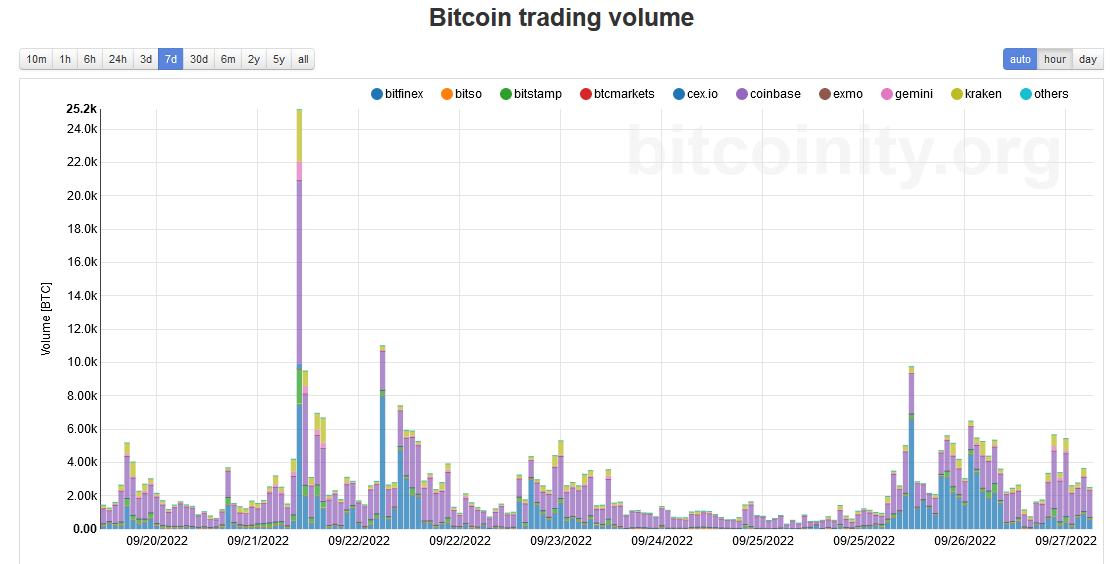

Analysis of spot market volume shows a slight decrease in volume from buyers compared to the previous day.

As of September 27th, peak volume was 6,000 per hour. This is significantly less than on Sept. 21, when he peaked at $19,900 with hourly volume above 25,000.

Based on the above, this latest Bitcoin rally was driven by derivatives traders, not spot buyers.

However, macro factors continue to weigh on all markets. The bear market is unlikely to end as spot buyers are wary.