Bitcoin shorts liquidated total $9 million as BTC moves back above $20,000

At 14:00 UTC on August 29, Bitcoin bulls stepped in to stop the price drop, sending BTC surge to $20,300 in the process. The move was accompanied by considerable volume on the hourly chart.

The local downtrend, which bottomed out at $19,500 early Monday, was sparked by a speech by Jerome Powell in Jackson Hole, Wyoming, on Friday. I said I have to bear it.

Markets have taken Powell’s words to mean that the Fed can do little to curb runaway inflation, which is stuck at a 40-year high.

The next FOMC meeting will take place on September 20-21 and the odds will be three in a row. 75 basis points Up to 2-3 increases per Eurozone financial market.

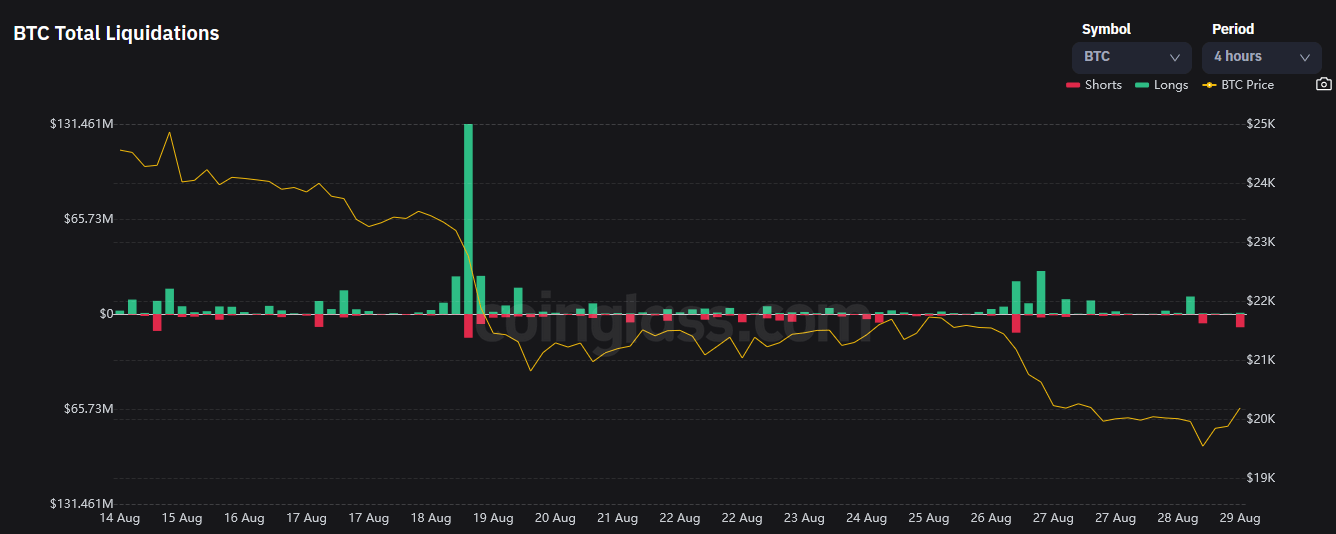

bitcoin short liquidated

Despite the impact of Powell’s speech, crypto bulls fought back, pushing Bitcoin back above $20,000.

Since Terra’s collapse, there have been five distinct occasions where BTC has lost $20,000, but only the bulls have recovered this key psychological level.

Coinglass shows $9 million Bitcoin short liquidated as BTC rises. The asset is currently trading +4% above its $19,500 local bottom.

Nevertheless, sentiment remains a concern as macro factors, including record news, weigh on all markets. energy prices the entire eurozone.

Stocks in a pinch

US stocks fell as investors adjusted their expectations for Chairman Powell’s Jackson Hole speech last Friday.

of Nasdaq Stocks fell as much as 1% on expectations that higher yields and higher interest rates would hurt the tech sector. The S&P 500 rose slightly as he fell 0.5% at the US open.

Gold, on the other hand, performed as expected in a difficult trading environment. It is now up +0.2% to $1,753 an ounce.