Bitcoin sinks in reaction to US Consumer Price Index hitting 40-year high at 8.6%

Bitcoin (BTC) prices have fallen following the latest release of the US Consumer Price Index (CPI). This indicates that the index was a hit. 8.6% — Highest level in 40 years.

Economists expected CPI numbers to remain flat at 8.3%, the same as in April. However, the Ministry of Labor’s June 10 announcement overturned the idea that inflation was under control.

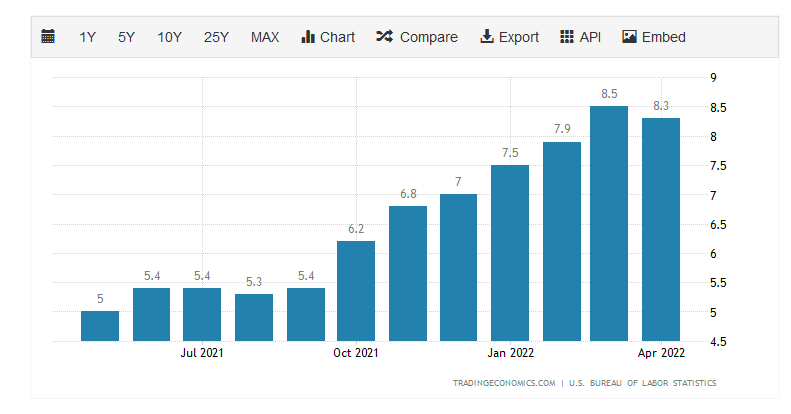

United States … Consumer Price Index

Consumer prices in the United States have skyrocketed since October 2021, according to data from the US Bureau of Labor Statistics. Following the 8.5% peak in March 2022, there was a 0.2% decline the following month, which some analysts call the top of inflation.

Talk to Forbes In May, Ally Financial’s chief market and money strategist Lindsey Bell said the “green shoot” in the data could indicate that inflation was outpaced.

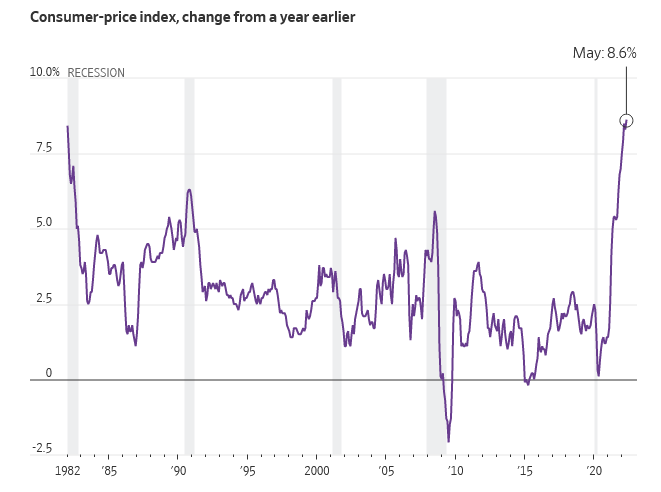

However, according to data released by the US Department of Labor on June 10, the consumer price index in May was 8.6%, exceeding the previous peak in March. It marks the highest level in 40 years and upsets the story of inflation surpassing.

Bitcoin sinks in response to rising CPI

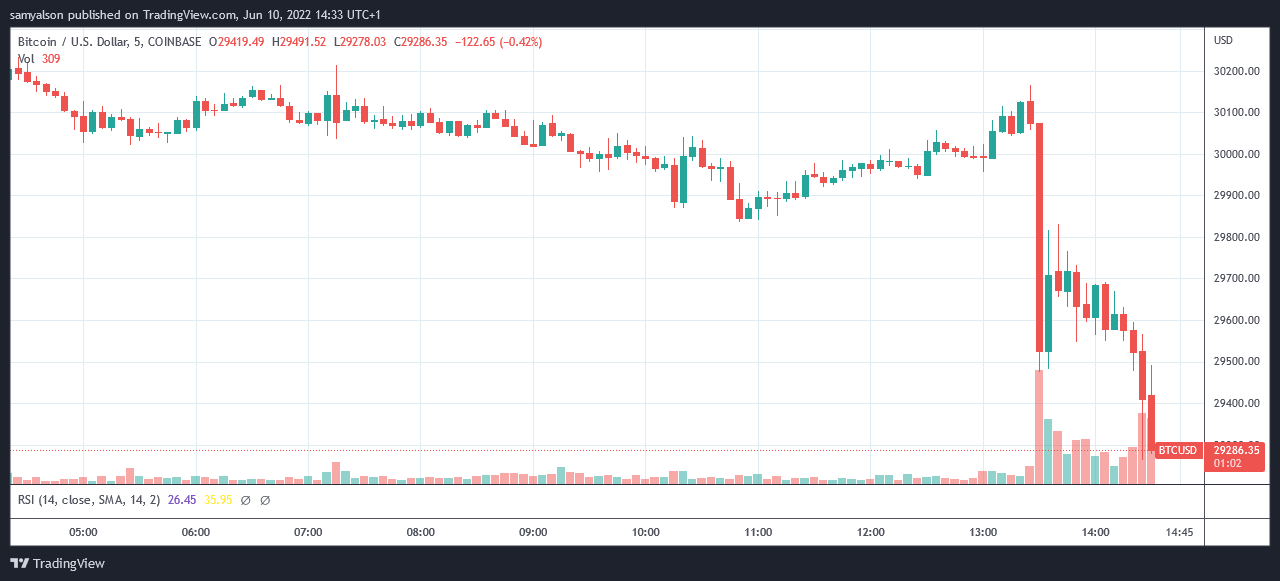

BTC prices responded to the news, turning down 2% in a five-minute candle at 13:30 GMT and bottoming out at $ 29,470. Subsequent counterattacks from the bulls peaked at $ 29,835 before the bear took control and triggered a majority low-priced cascade.

The 14:25 GMT candle then sank below the first local bottom and closed at $ 29,400. The next line of critical support is $ 29,200.

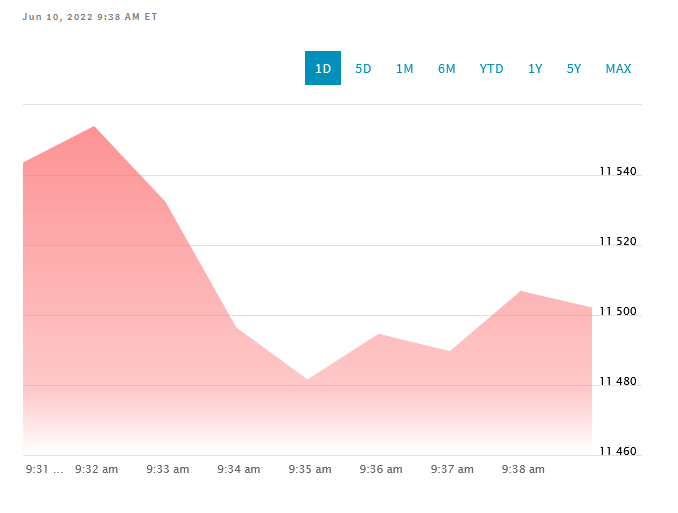

On the other hand, Nasdaq — which currently has the highest correlation with Bitcoin — is much better. It started trading at 11,544 and rose 10 points to the peak of 11,554. Since then, a decline of less than 1% has reached a local bottom of 11,482 before moving into an uptrend.

According to the Financial Times report, US Treasury Secretary Janet Yellen said the fight against inflation will continue to be the White House’s top priority. Undoubtedly, higher-than-expected CPI data will put more pressure on the Fed’s near-future increase in activity rates.

The outlook for Bitcoin as a result of this is bleak.