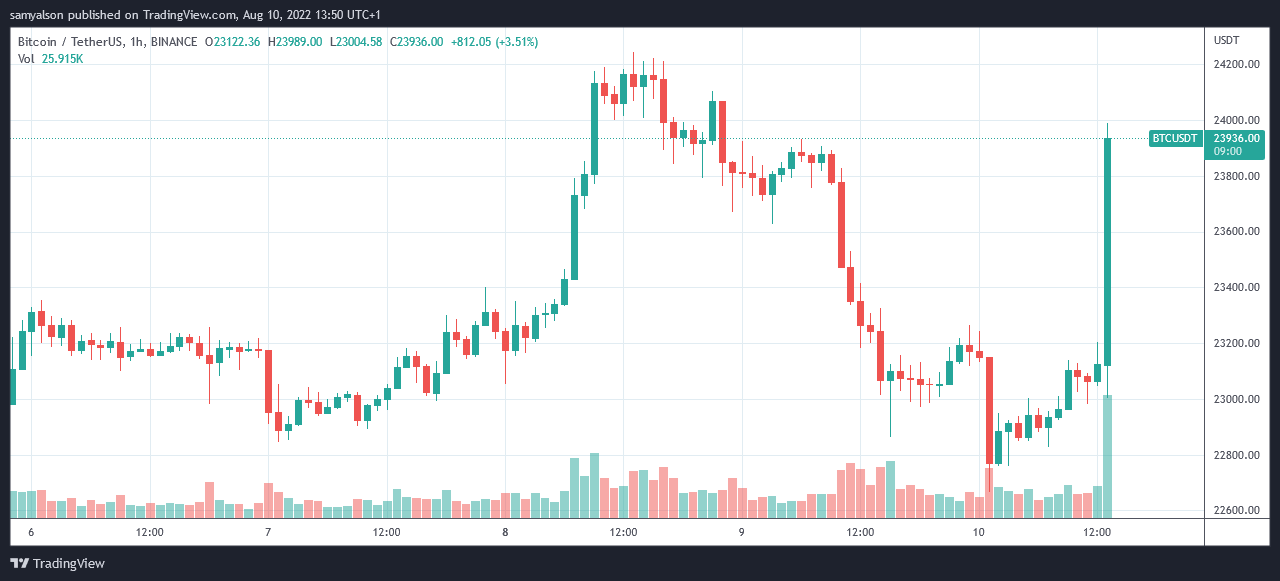

Bitcoin spikes to $24,000 as CPI inflation remains unchanged at 8.5%

After the release of consumer price index (CPI) data by the U.S. Bureau of Labor Statistics (BLS), the price of Bitcoin rose and saw no change in July.

In anticipation of the data, Bitcoin rose from a local bottom of $22,600 on Aug. 10 as investors waited for an inflation report. Once the information was published, BTC’s initial reaction skyrocketed to his $24,000.

Cryptocurrency markets and stocks fell slightly the day before as investors showed caution ahead of the BLS announcement.

CPI vs PCEPI?

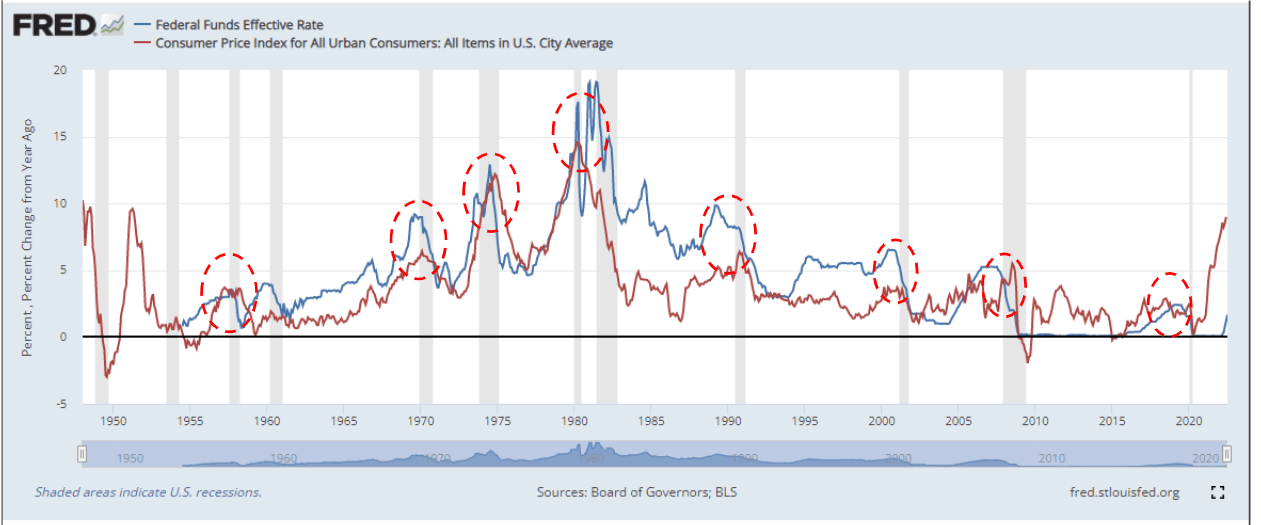

Fed officials have announced a second consecutive 75 basis point rate hike following the last FOMC meeting on July 27th. From 2.25% he ranges from 2.5%.

The next FOMC meeting will be held on the following day September 20-21speculation is growing that the Federal Reserve will be forced to impose another big rate hike to counter a red-hot labor market and soaring average hourly earnings.

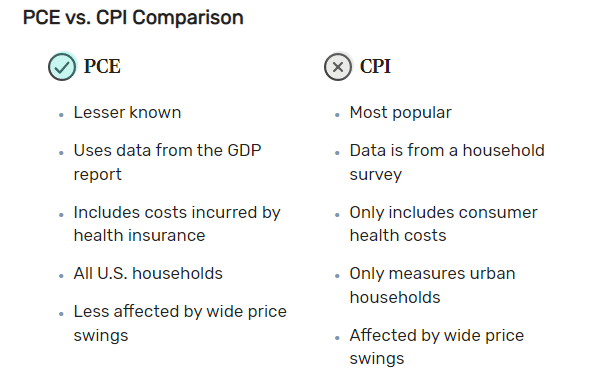

In the United States, there are two official measures of inflation.

- Rise in the consumer price index – Measures monthly changes in prices paid by US consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services that represent total US consumer spending.

- The Personal Consumption Expenditure Price Index (PCEPI) measures changes in prices of household goods and services. An increase in this index warns of inflation, a decrease indicates deflation.

Federal and state governments and businesses use the CPI. In contrast, PCEPI informs the FOMC of inflationary policy.

Focus on September FOMC

Analysts expect core inflation (PCEPI) to rise to 6.1% from 5.9%, putting pressure on the Fed to raise rates significantly in September. But consumer price index data suggests that recent rate hikes are working to cool the economy.

Nonetheless, spurred by strong employment data and better-than-expected wage gains, Economist at Citigroup Another 75 basis points rate hike is likely. But if core inflation beats expectations, it could rise by 100 basis points.

Investor Stanley Druckenmiller pointed outInflation has never dropped from above 5%. CPI,‘ is currently running at 9%.

With that in mind, if the Fed is serious about keeping inflation under control, it needs a 9% funding rate.