Bitcoin tumbles to $18k, trades below previous cycle’s ATH first time in history

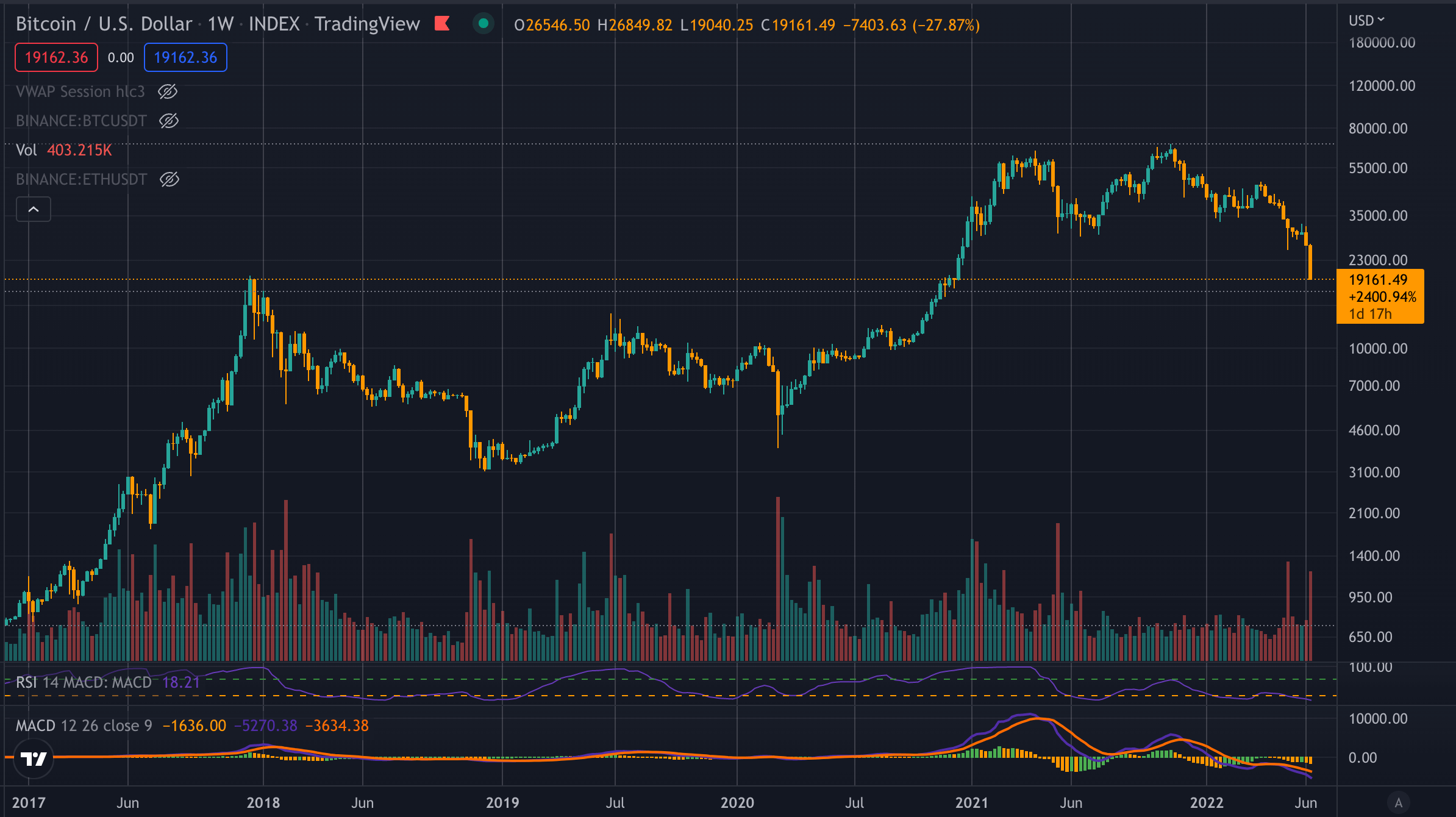

Bitcoin (BTC) fell below its all-time high of $ 19,750 for the first time after reaching $ 18,750 in the early morning of June 18 (GMT).

Despite a slight rise by the afternoon, BTC is trading below the 2017 peak of $ 19,220 at the time of the press.

After every half and the subsequent Bull Run, Bitcoin has always exceeded the highest price in the previous cycle. The nullification of this trend brings us to a whole new world of price discovery for premier cryptocurrencies.

Bitcoin has experienced three and a half events in 2012, 2016 and 2020.

Each time it is halved, the block reward is halved, increasing the shortage and reducing the supply. Prices go up as supply goes down, but demand stays the same or goes up. After 2012 and the first half, Bitcoin never touched $ 32 again. Since 2016, the price has never returned to $ 1,200, but since 2020, the price has returned to $ 19,100.

Macroeconomic factors

Due to the current macroeconomic situation, Bitcoin has been placed in a position never seen in its history. From 2009 to 2022, Bitcoin did not have to survive the global economic crisis outside the web3 ecosystem.

Since its inception, Bitcoin has focused on events directly related to blockchain. But now we need to deal with fallout from pandemics, wars in Ukraine, inflation surges, and the threat of a recession.

Meanwhile, the collapse of Terra and the potential bankruptcy of Celsius and 3AC have rocked the crypto market in recent weeks. Given this landscape, it’s not surprising that Bitcoin is moving into unexplored territory.

Bitcoin could continue to trade at unprecedented lows, with inflation continuing to rise and interest rates rising slightly.

Interestingly, Bitcoin prices plummeted from $ 20,400 to $ 19,100 within an hour on Saturday morning. Since then, it has continued to fall to $ 18,750 while traditional financial markets are closed.

Such a short-term sharp decline suggests some kind of long squeeze or other clearing event. Many funds, wallets, and lending platforms have needed to allocate more money to ensure that loans are properly secured over the past few weeks.

Clearing some important positions secured against Bitcoin can cause Bitcoin prices to fall. According to the company, there have been $ 250 million in liquidations in the last 24 hours. CoinGlass. Continued downward pressure can exacerbate the situation with the domino effect on liquidation.