Bitcoin’s exchange balance drops to 5-year low as price hits $30K

Since June 22nd, Bitcoin has been trading above the psychologically important level of $30,000. This price surge is a result of increased demand for digital assets, which is exacerbated by the low availability of Bitcoin on exchanges.

One of the key indicators highlighting this trend is the percentage of Bitcoin supply held on exchanges. Data from Glassnode measures the total amount of coins held at an exchange address and calculates the percentage of supply on the exchange.

When a large amount of Bitcoin is held on an exchange, it often indicates that investors are ready to sell their holdings, suggesting bearish sentiment. Conversely, a decline in the amount of Bitcoin on exchanges could suggest that investors are moving assets into private wallets for long-term holding, signaling bullish sentiment.

Furthermore, the amount of Bitcoins on exchanges directly affects market liquidity. High liquidity means a large number of market participants, and buyers quickly absorb a large number of sell orders. However, if the amount of bitcoin on the exchange drops significantly, it could lead to a drop in liquidity. This means that a large number of sell orders can have a large impact on market prices and lead to increased volatility.

Therefore, tracking the amount of Bitcoin held on an exchange can provide valuable insight into potential market movements and investor sentiment.

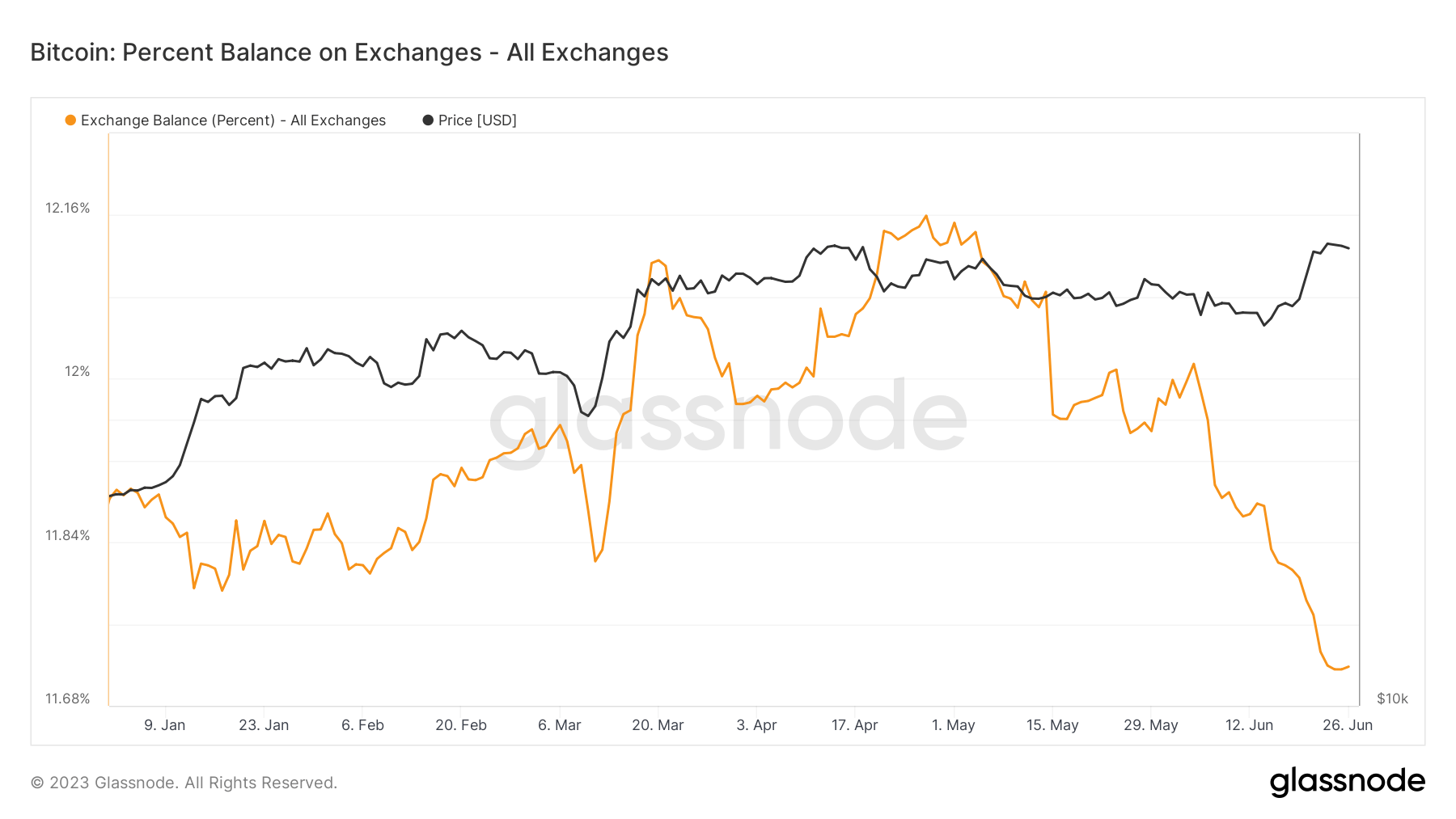

The share of bitcoin supply held on exchanges has been trending downward since the end of April, when it hit a year-to-date high of 12.16%.

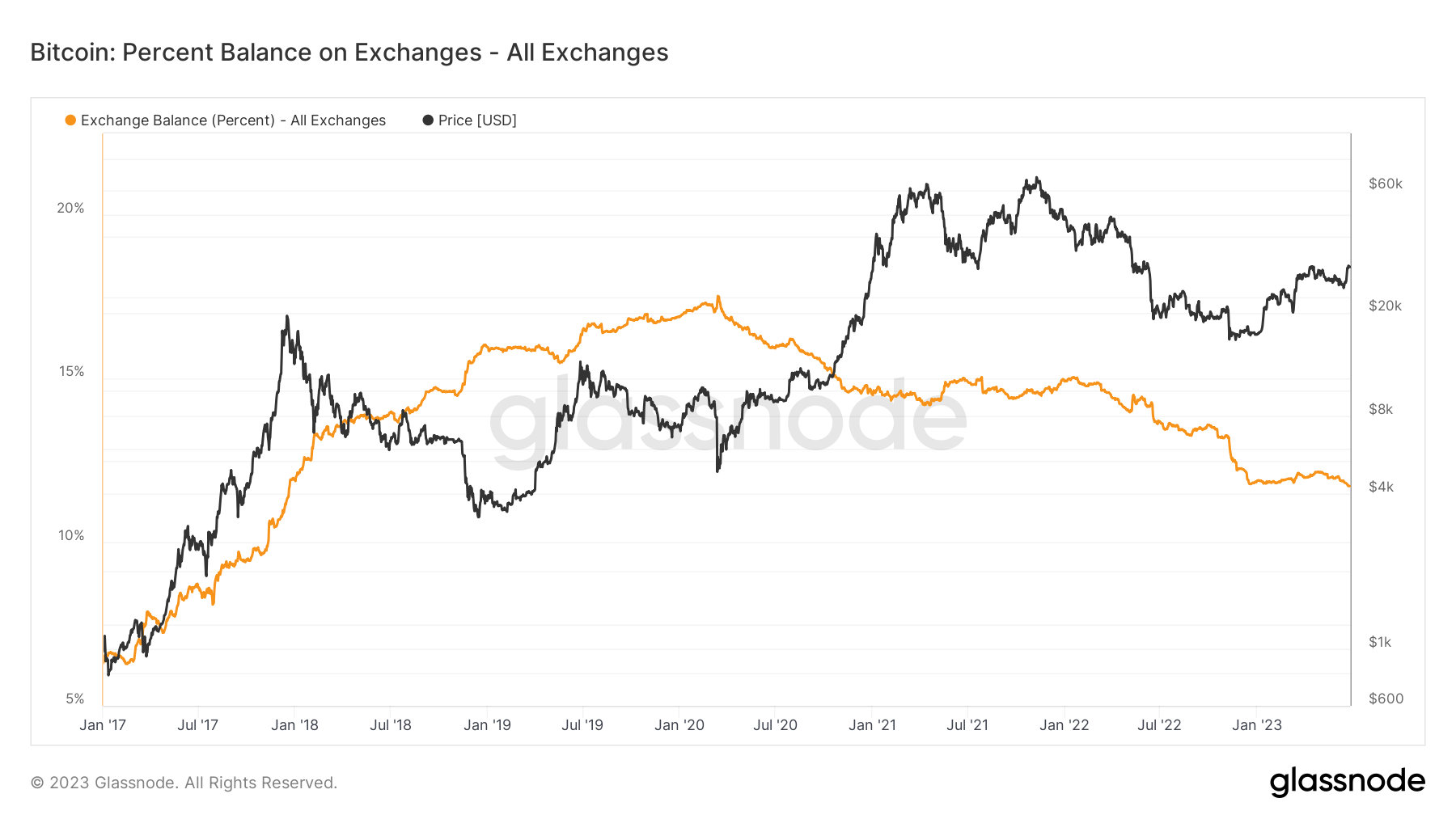

A broader perspective, however, shows that Bitcoin holdings on exchanges have been declining since March 2020, when they reached a record high of 17.51%.

The share of bitcoin supply held on exchanges has now fallen to a five-and-a-half-year low of 11.71%, reaching a level last recorded in December 2017. This trend indicates a shift in investor behavior with more holders choosing to custody. Bitcoin was probably removed from exchanges in anticipation of future price increases.

The article first appeared on CryptoSlate after the price hit $30,000 and bitcoin trading balances fell to five-year lows.