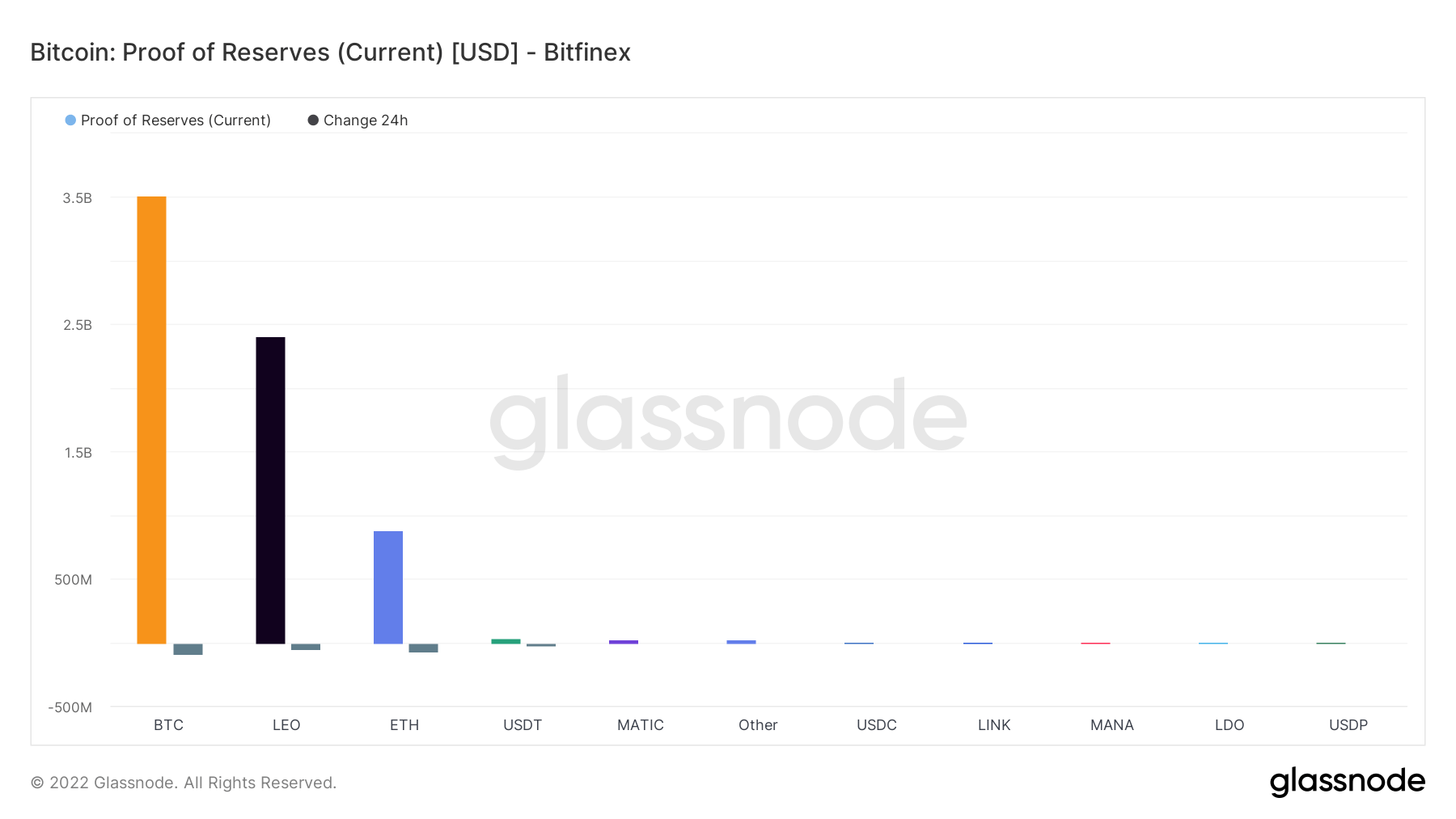

Bitfinex closes week leading Bitcoin reserves according to Glassnode

crypto slate Analysts looked at detailed margins for major cryptocurrency exchanges other than Coinbase and Binance. Bitfinex has revealed that it holds the most significant Bitcoin (BTC) reserve, holding $3.5 billion worth of his BTC.

Data was obtained from OKX, KuCoin, Crypto.com, ByBit, Binance, BitMEX, and Bitfinex on December 16th. OKX is the second largest BTC pool with over $1.5 billion in BTC after Bitfinex, while Binance is the third with just over $5 billion in BTC. BitMEX is #4 with BTC just over $1 billion. Crypto.com, ByBit and KuCoin were fifth, sixth and seventh with $700 million, $370 million and $300 million respectively.

billions of reserves

Bitfinex, OKX, Binance, and BitMEX calculate reserves in billions. Of all the exchanges included in this analysis, Bitfinex emerged as holding significantly more BTC than his six other exchanges that have publicly disclosed their reserves.

bitfinex

According to the numbers, Bitfinex entered the weekend with $3.5 billion in BTC and around $2.37 billion in UNUS SED LEO (LEO). The exchange also holds just under $1 billion of Ethereum (ETH).

In addition to BTC, LEO and ETH, the chart shows Bitfinex holding 8 multi-million assets each.

According to the November 21st data, 91% of Bitfinex’s reserves consisted of BTC and ETH, meaning that Bitfinex held the most BTC. Even though the ETH reserve has shrunk, the exchange still holds the largest amount of his BTC.

According to another study at the end of November 2022, Bitfinex holds over $11 billion worth of Tether (USDT), representing 60% of the total USDT supply. However, current data show that this amount was reduced to millions within two weeks of him.

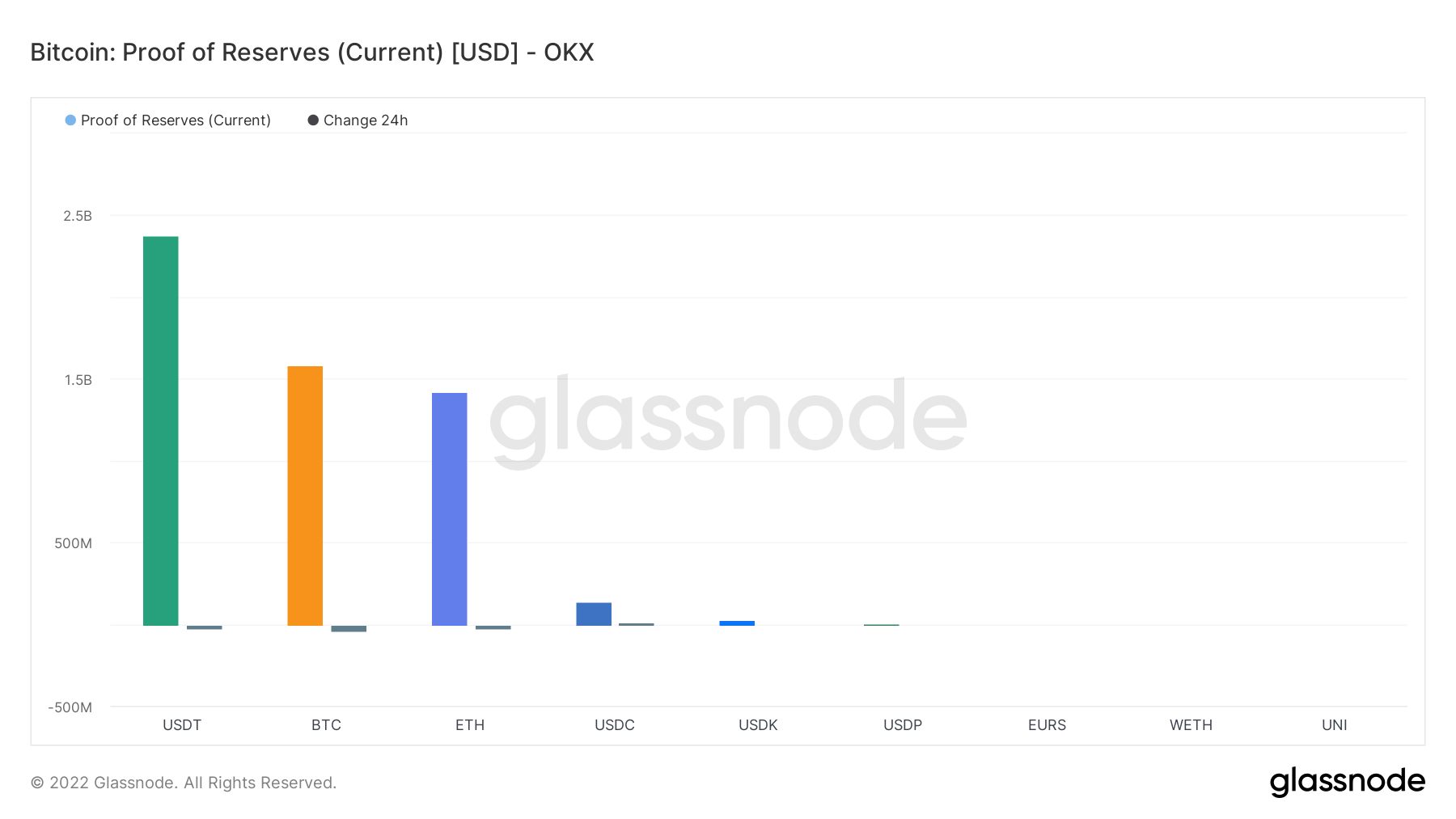

OKX

OKX is the only exchange that measures BTC reserves in billions included in this analysis. The exchange’s BTC reserves are just over $1.5 billion.

In addition to a sizeable amount of BTC, OKX also holds approximately $2.43 billion in USDT. Additionally, he has $1.5 billion worth of ETH on the exchange.

According to OKX AnnouncementWe also back up all user assets 1:1 with real funds.

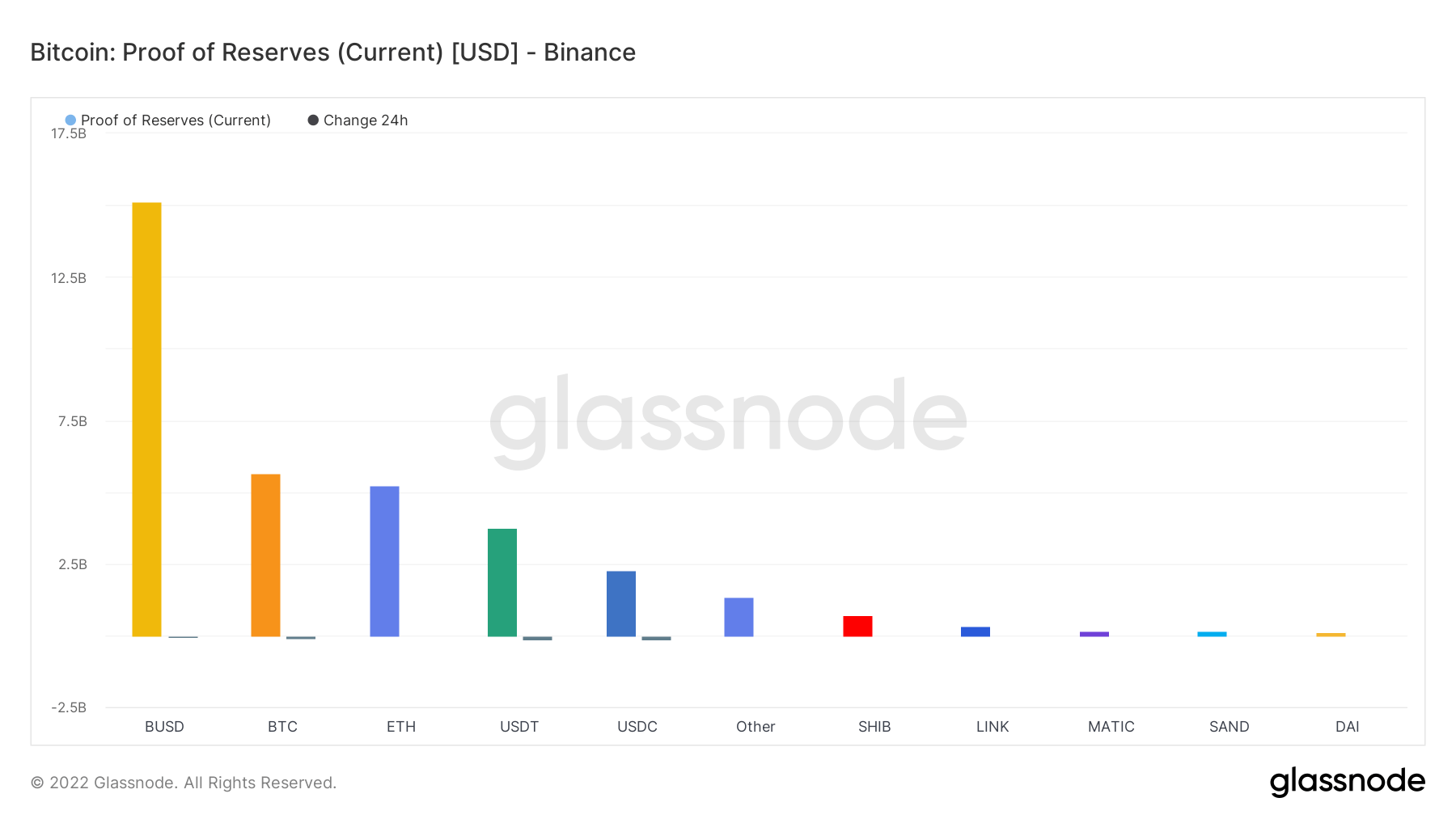

binance

Binance has earned around $5.6 billion in BTC, taking 3rd place in the ranking. Also, this exchange holds his $5 billion in ETH.

Despite the size of the BTC pool, Binance holds $15 billion in Binance USD (BUSD), $6.25 million in USDT and around $2.5 billion in USDC.

On December 15th, Binance experienced a withdrawal crisis that reduced its reserves by $3.5 billion in 24 hours. Nevertheless, this exchange holds the largest total reserves among all other exchanges included in this analysis.

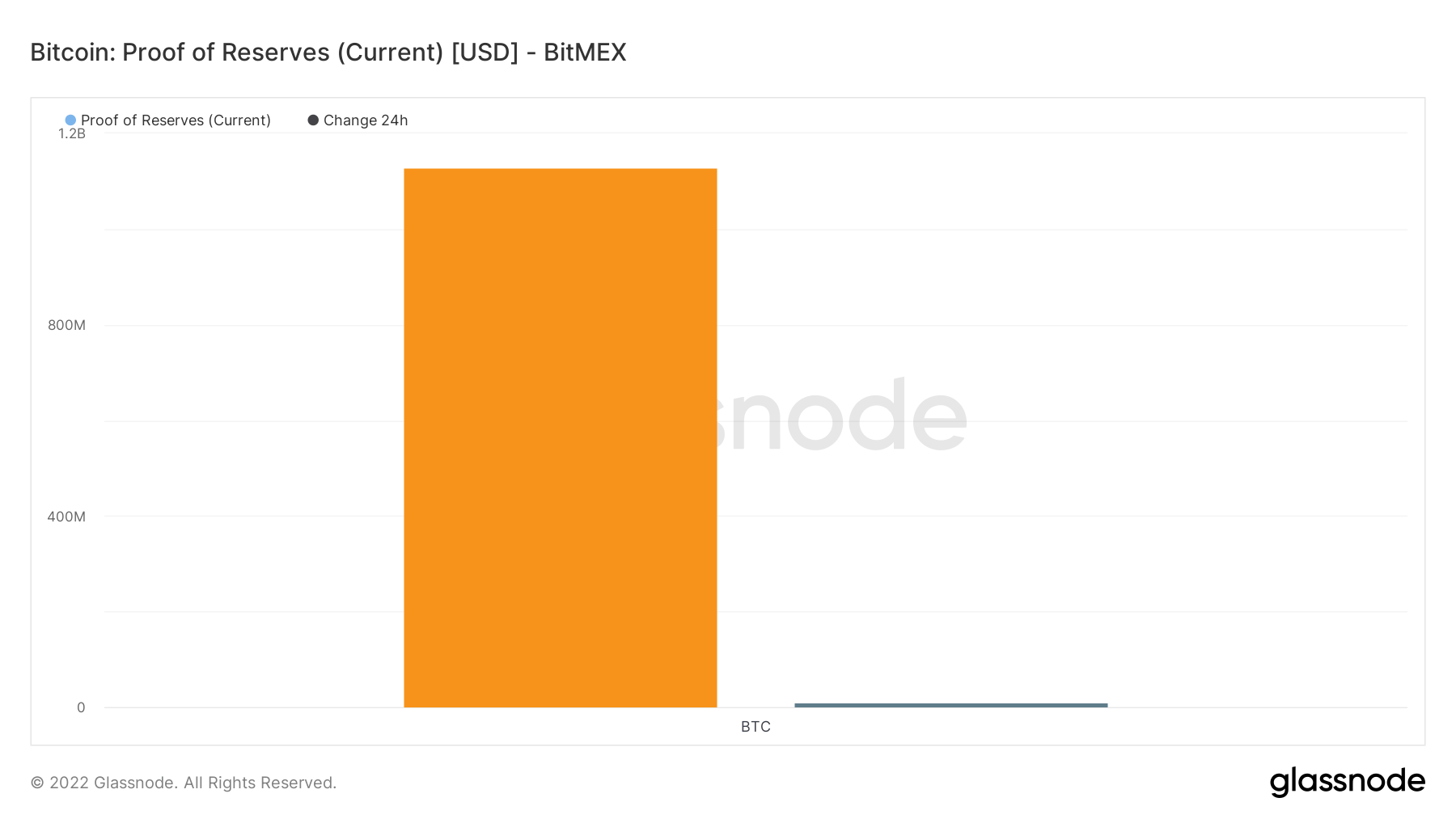

BitMEX

BitMEX holds the 4th largest BTC reserve, around $1.1 billion. The data does not disclose other asset types under BitMEX reserves.

The exchange also announced plans to lay off about 30% of its staff in early November.

millions of reserves

Other exchanges included in this analysis measure reserves in the millions. Of his four remaining, Crypto.com holds the most BTC.

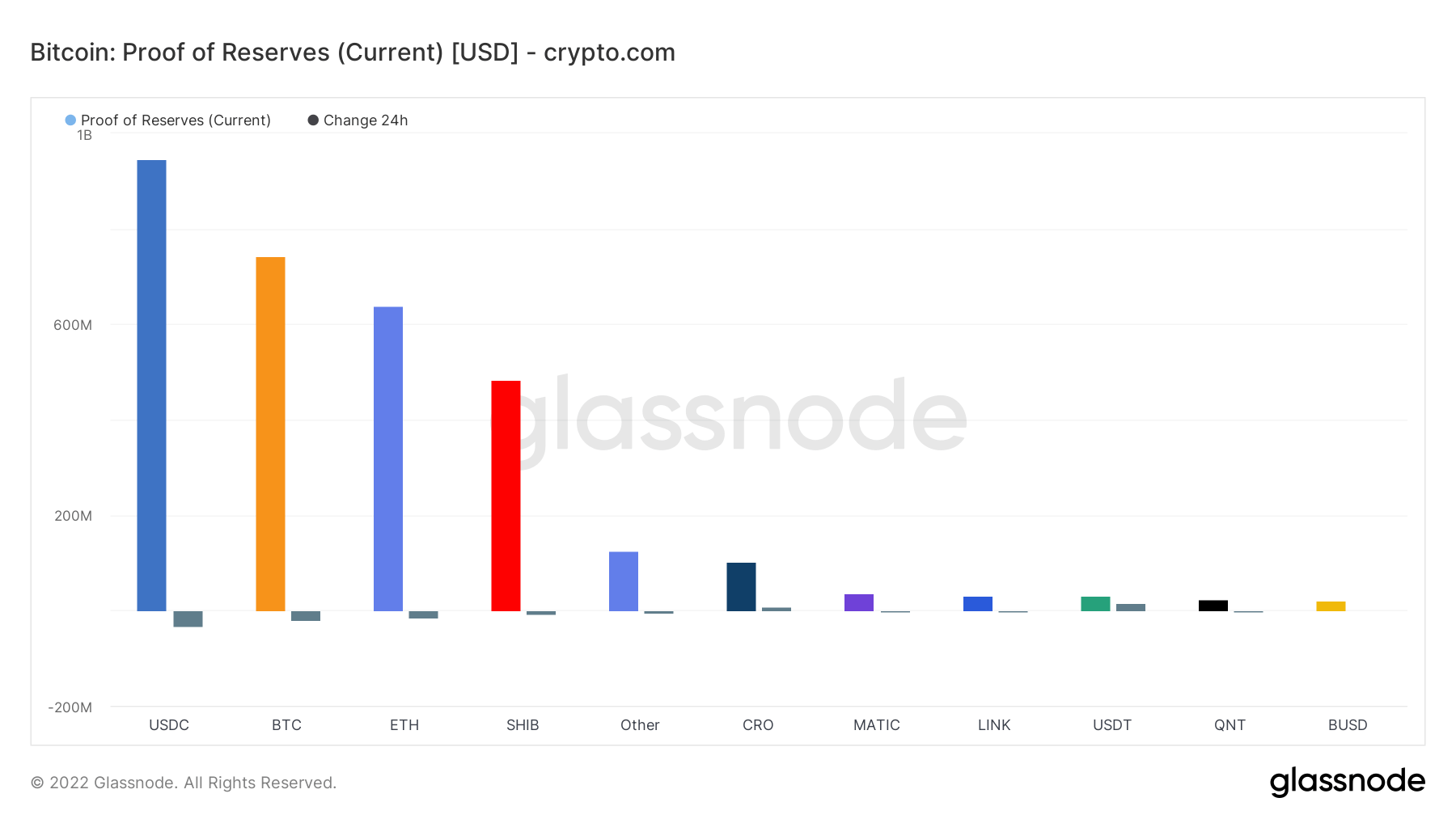

crypto dot com

Crypto.com grabbed $700 million worth of BTC and just over $600 million of ETH over the weekend.

Since November 21st, 52% of Crypto.com’s reserves consist of BTC and ETH, which equates to 53,024 BTC and 391,564 ETH. Current data suggests that exchanges have reduced their BTC reserves while increasing their ETH holdings.

Crypto.com also holds USD Coin (USDC) worth $900 million and SHIBA INU (SHIB) worth about $500 million.

The exchange announced its proof of reserves on December 6, indicating that all assets are fully backed 1:1 on the exchange, with excess reserves to spare. However, audit firm Mothers Group audited evidence of the reserves, revealing that they were preparing to remove the client on December 16.

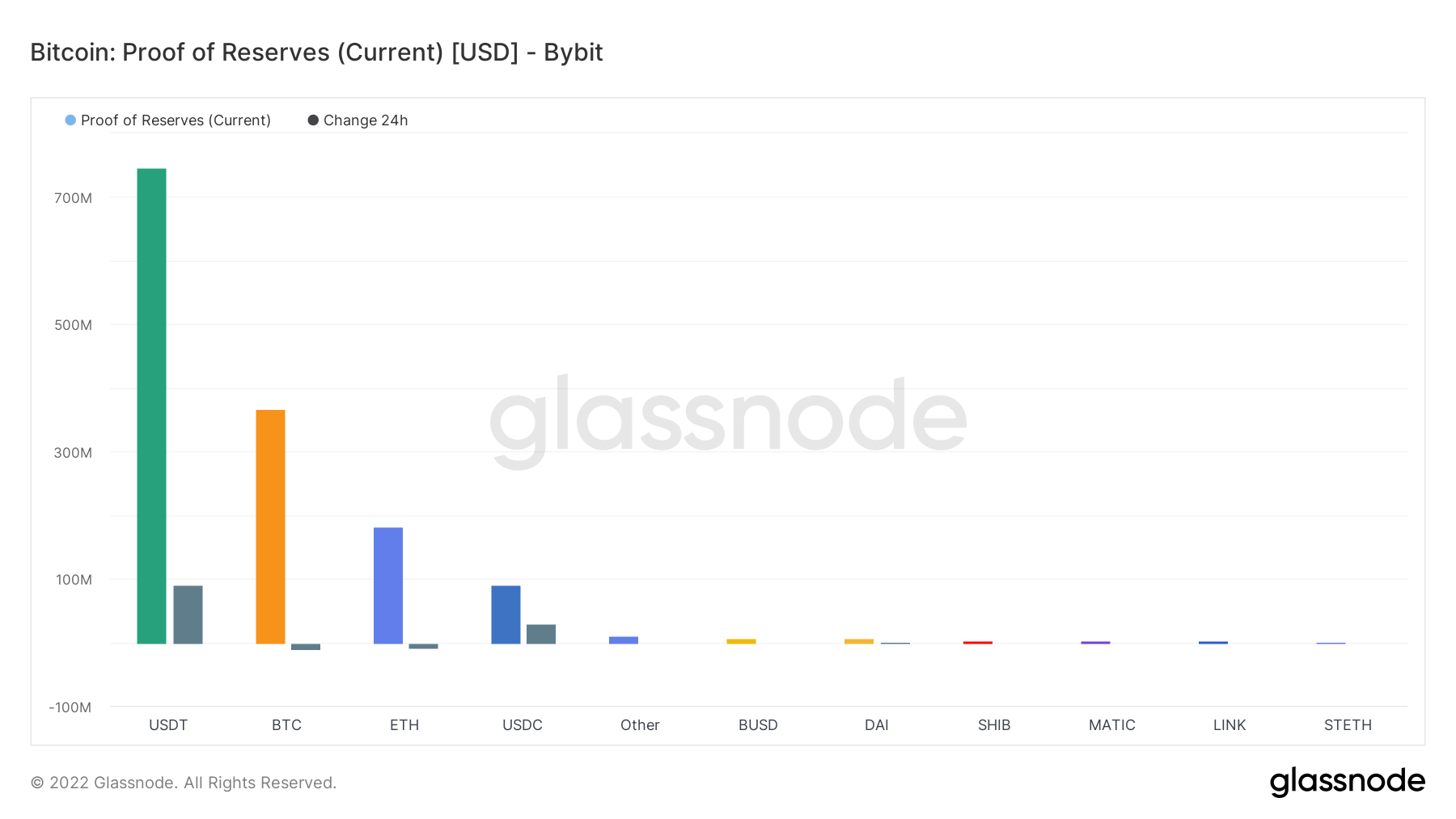

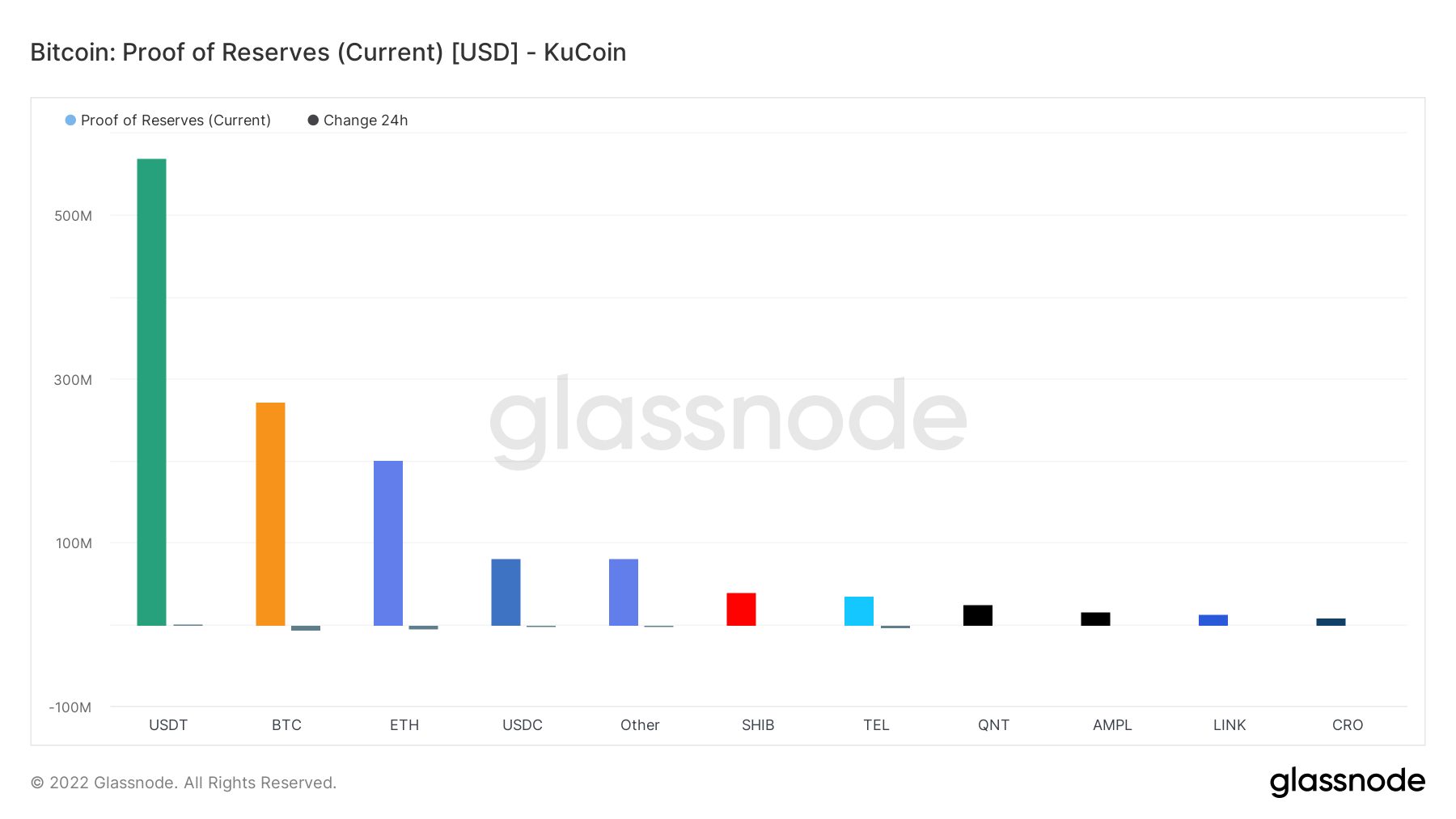

ByBit and Kucoin

Based on the BTC reserve ranking, ByBit and KuCoin come in 4th and 5th place respectively, with a small difference in reserves.

The numbers show that ByBit holds about $370 million in BTC and $200 million in ETH. In addition, the exchange also has over $700 million in his USDT and nearly $100 million in his USDC stablecoin.

ByBit recently announced plans to update withdrawal limits based on verification levels and lay off about 30% of its staff due to difficult market conditions.

KuCoin, on the other hand, holds just under $300 million in BTC and $200 million in ETH. The exchange holds over $600 million in USDT and USDC stablecoins combined.

Influenced by FTX, KuCoin is one of the first exchanges to disclose its holdings. On November 11th, his CEO of KuCoin, Johnny Lyu, announced the exchange’s holdings through his Twitter account. Additionally, the exchange released a proof of its reserves on December 5, which was audited by Mazars Group.