BlackRock’s Bitcoin ETF filing fuels U.S. accumulation

BlackRock, the world’s largest asset manager with over $9 trillion in assets under management, has made waves in the cryptocurrency market with its recent filing for a Bitcoin Exchange Traded Fund (ETF). Despite the presence of some of the largest cryptocurrency exchanges in the United States, there are no ETFs tracking the spot price of Bitcoin due to regulatory restrictions.

An ETF is a basket of securities, such as stocks, that track an underlying index. For Bitcoin ETFs, they are designed to track the spot price of Bitcoin. This is a great advantage for investors as they can touch the price of Bitcoin without worrying about the challenges of buying and storing cryptocurrencies themselves. Like other ETFs, Bitcoin ETFs can be bought and sold on traditional stock exchanges.

As evidenced by Glassnode on-chain data, the expectation that industry giants like BlackRock will launch bitcoin ETFs is sparking a new wave of bitcoin hoarding in the US.

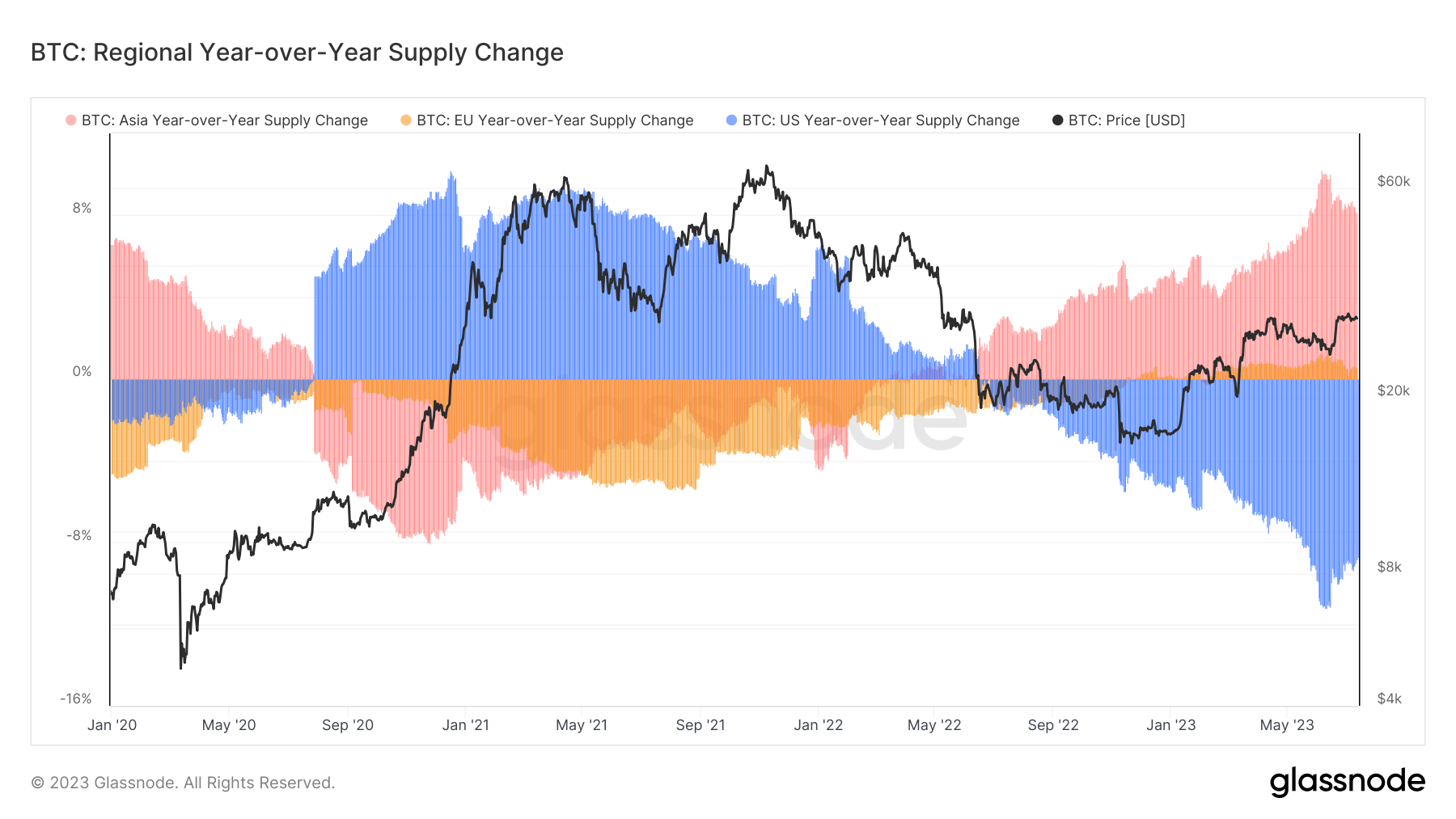

Glassnode data reveals an increase in Bitcoin holdings by U.S. companies since the beginning of the month, despite a year-on-year decline. Notably, the beginning of this surge appears to coincide with the announcement of BlackRock’s Bitcoin ETF filing.

To determine the geographic location of Bitcoin entities, Glassnode compares transaction timestamps with uptime in different geographic regions. Through this method, we can identify the most likely location of an entity and gain a broader understanding of the dynamics of local Bitcoin supply.

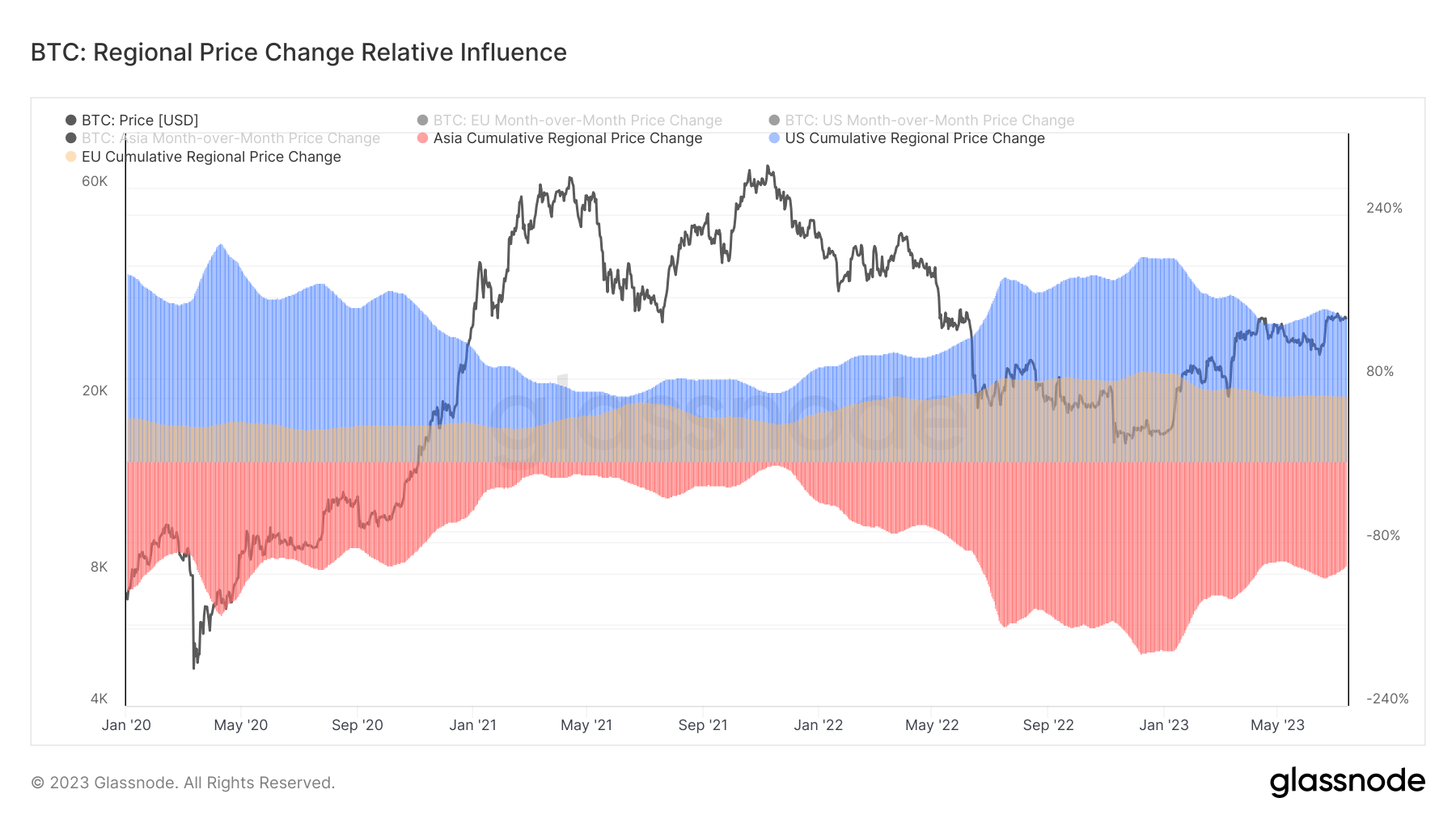

Given the widespread influence of the US market on bitcoin prices, the resurgence of bitcoin accumulation in the US could mark a pivotal change for the cryptocurrency market. Glassnode uses two models to calculate this effect. One looks at the cumulative price performance during trading hours in the EU, US and Asia. The other compares the cumulative performance by region to the grand total. According to these models, the United States has 139.2% of the regional market’s influence, a disproportionately high figure that highlights the prominent role of the United States in global Bitcoin trading.

The significance of BlackRock’s Bitcoin ETF filing goes beyond just price movements. Bitcoin ETFs, especially those launched by financial giants like BlackRock, could usher in a new era of institutional and individual investment in Bitcoin, creating greater market liquidity. However, it is also important to consider the potential regulatory challenges and risks associated with broader cryptocurrencies. passed.

An article about BlackRock’s Bitcoin ETF filing to accelerate US accumulation first appeared on CryptoSlate.