BTC bear market is worse than in 2014 but better than in 2018

Recent data shows that the current bear market is doing better than 2018, but worse than 2014 in terms of ROI.

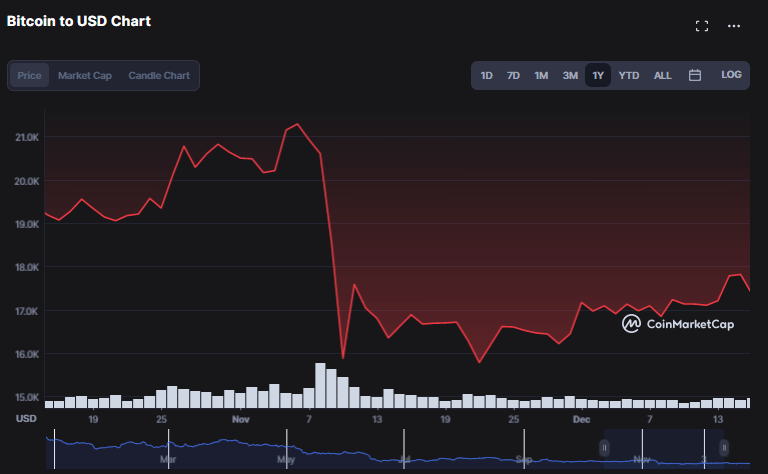

Bitcoin’s price, which started the year at $50,700, has fallen more than 66% to $16,847.51 at the time of writing. coin market capitalization.

It was the war between Russia and Ukraine that triggered the crypto bear market in 2022. Furthermore, the entire cryptocurrency market, including Bitcoin, has deteriorated in the aftermath of Terra Luna’s collapse.

After the FTX crash on November 7, the market hit new lows and Bitcoin traded in a new flat range between $15,000 and $17,000.

Several companies have filed for bankruptcy in the wake of the FTX craze, including BlockFi and Genesis. The Fed’s interest rate hikes to combat inflation did not improve the situation for Bitcoin either.

A moderate rally on December 27 saw Bitcoin just break below the $17,000 range before falling 1.5%.

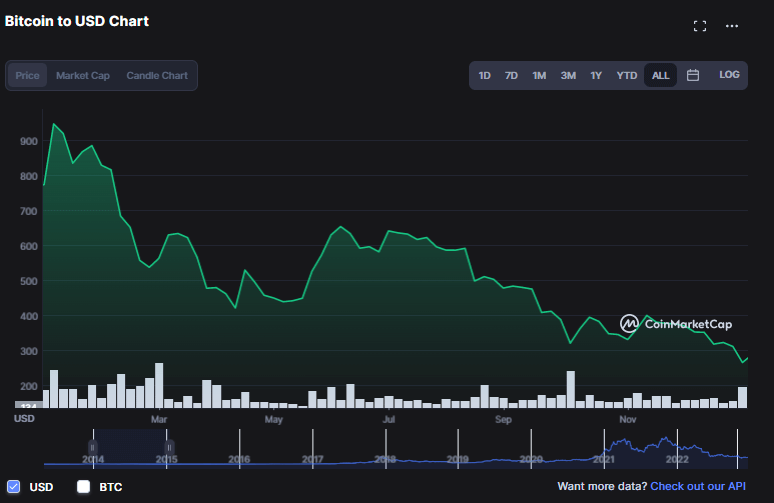

2014-2015 Bearcycle

After reaching $1,000 for the first time in December 2013, Bitcoin’s price plunged to $601.78 within a month, entering a prolonged bear market. Over his next two years, the cryptocurrency continued to fall, hitting a low of $320 in June 2014 before bottoming out at around $170 in January 2015.

The long cryptocurrency winter of 2014 was due to the Mt. Gox hack, which halted Bitcoin withdrawals in early February. Ultimately, the platform stopped all trading and filed for bankruptcy in Japan and the United States.

Several major financial authorities have also expressed concerns about Bitcoin. As a result, general sentiment around Bitcoin remained negative until August 2015, when the trend began to change.

Bitcoin price, which started at $773.44 in 2014, dropped more than 59% to $462.53 by the end of the year.

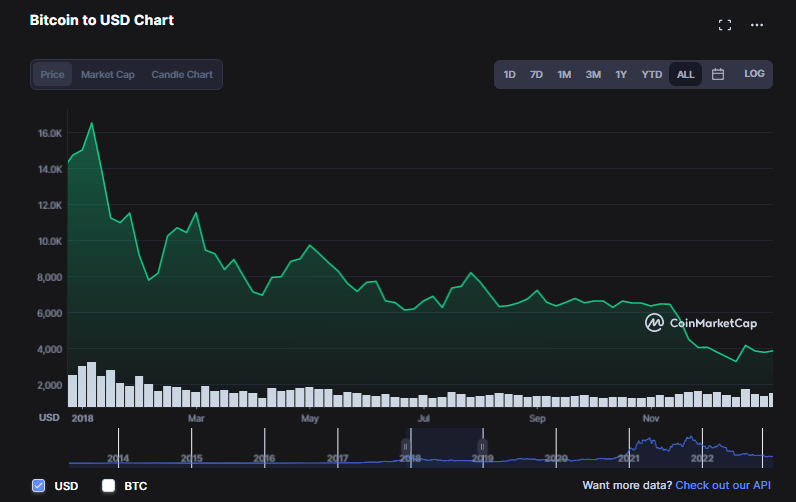

2018 Bear Cycle

After recovering to $1,000 in January 2017, Bitcoin continued to climb to $20,000 by the end of the year. However, his $20,000 peak in Bitcoin was short-lived, losing more than 81% of his value to $3,200 within a year afterwards.

A major hack of Japanese cryptocurrency exchange Coincheck began in the crypto winter of 2018, resulting in the loss of approximately $530 million in NEM (XEM).

Another blow came in March and June when Facebook and Google banned ICO and token sale ads. Contributing to the bear market were regulatory efforts to regulate the crypto market, with the U.S. Securities and Exchange Commission rejecting his BTC exchange-traded fund application.

Bitcoin price, which started at $14,978 in 2018, fell by more than 74% to $3,746.71 at the end of the year.