BTC is now cheaper than the all-in-sustaining cost of mining BTC

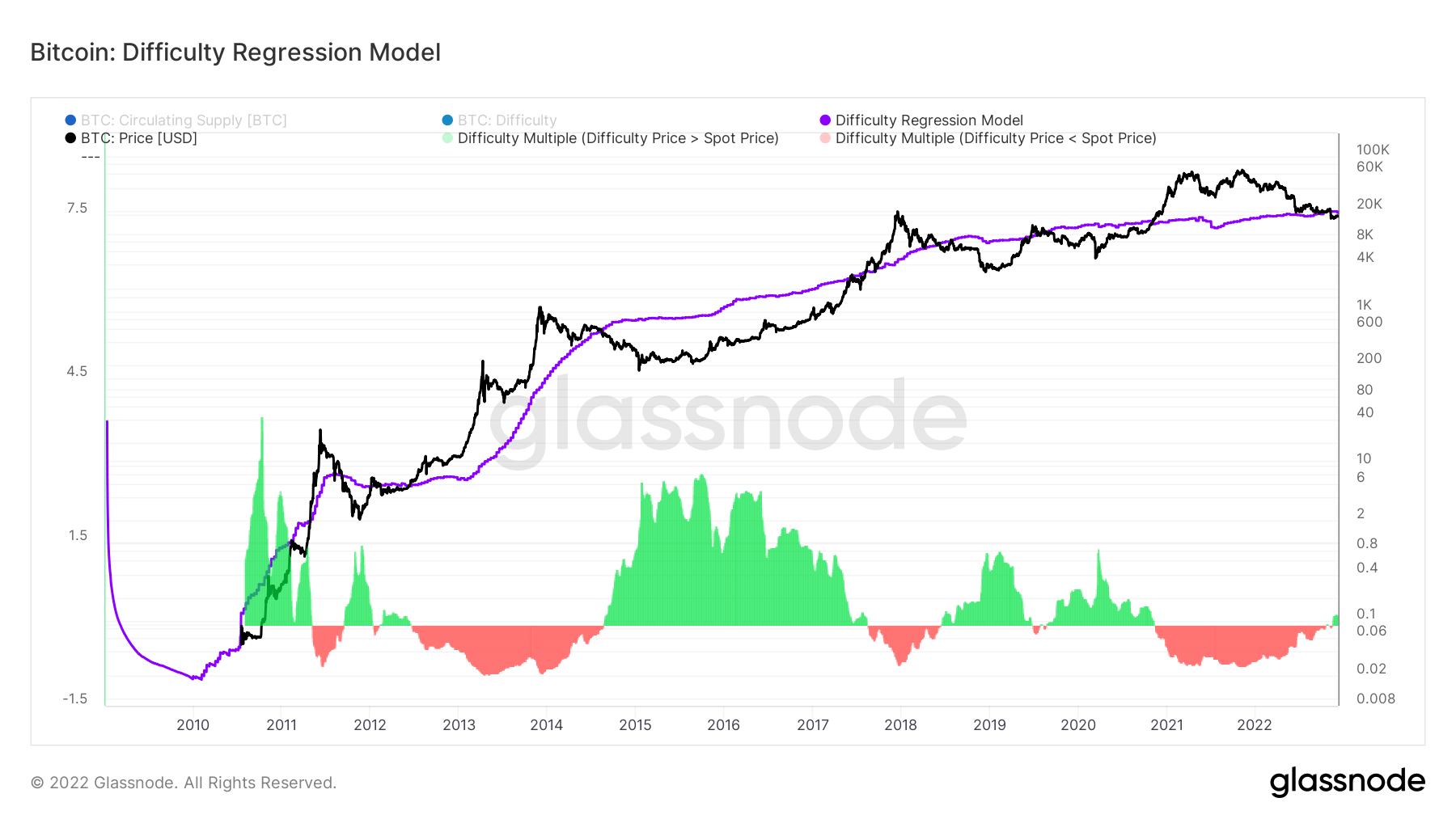

According to the difficulty regression model, the cost of Bitcoin (BTC) is now cheaper than the cost of mining 1 Bitcoin.

According to data obtained from Glassnode, the current cost to mine one Bitcoin is $18.8K, while the cost per Bitcoin is $16,5771.8.

The difficulty regression model is considered the ultimate abstraction of the mining “price” because it represents all mining variables with a single number. It represents the average cost of production for the Bitcoin mining industry without requiring a detailed breakdown of mining equipment, power costs, and logistical concerns. .

A few days after FTX filed for bankruptcy, the price of Bitcoin fell below the difficulty regression model and has remained there ever since.

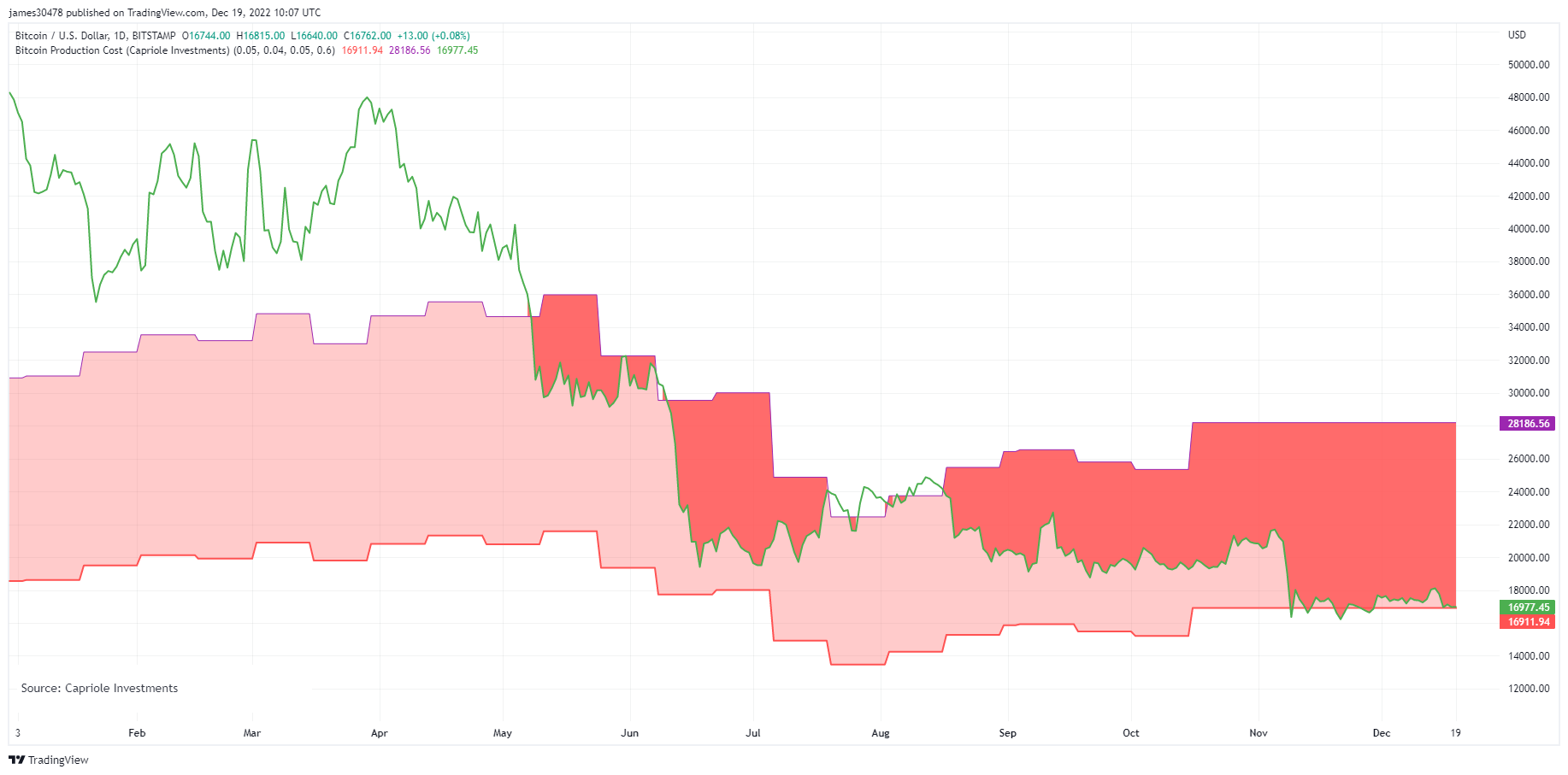

Additionally, Tradingview data shows that the price of Bitcoin is currently lower than the price of electricity. Bitcoin’s price is currently trading at about a 60% discount to Bitcoin’s energy value based on the wattage of energy used by the network. This is the biggest discount since the price hit $4,000 on March 13, 2020 and $160 on January 14, 2015.

The market price was below the average mining cost only three times: 2016-2017, late 2018-May 2019, and early 2020. The market price was several times the mining cost.

If history were to repeat itself, the smaller the gap between Bitcoin’s market value and mining costs, the more attractive Bitcoin would be as an investment. Nevertheless, investors and traders should be cautious about investing in Bitcoin and Altcoins due to the current bearish market conditions and macro environment.

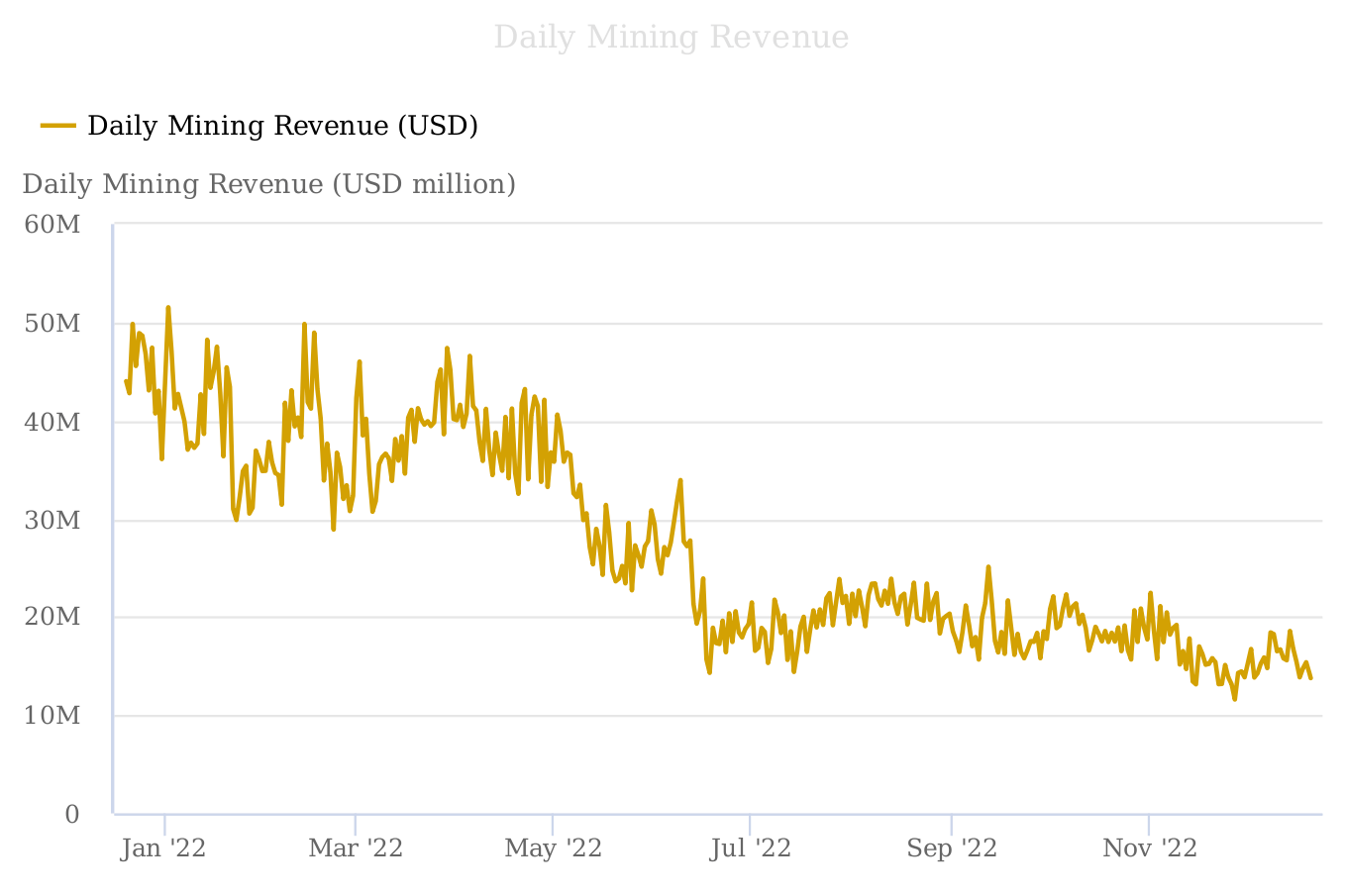

The current market puts pressure on miners

If the mining cost is lower than the market value of Bitcoin, the mining operation remains profitable and more miners participate. However, in the current market, miners are under pressure due to rising mining costs.

According to data obtained from Braiins.com, miner revenue has decreased by 72.34% in the last 12 months.

moreover, Previous Reports of CryptoSlate The hash price, representing earnings per Exahash per day, has hit an all-time low of $583,000.

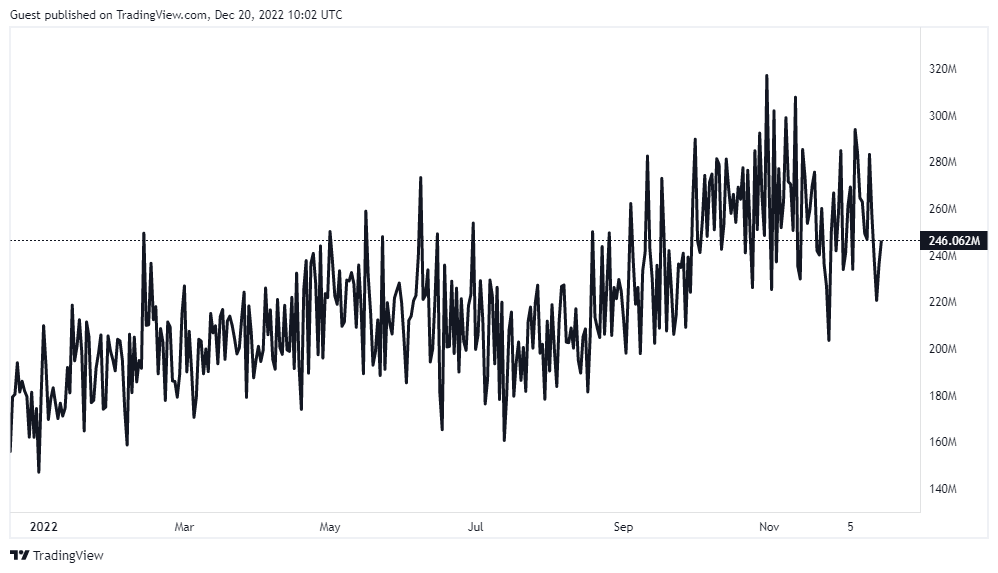

Additionally, Bitcoin’s hashrate also suggests that the cost of producing Bitcoin has skyrocketed and is being sold at discounted prices.

Bitcoin hashrate measures the amount of processing and computational power that miners give to the Bitcoin network. According to Trading View, Bitcoin’s hashrate is currently at 246.062 EH/s.

Many bitcoin mining businesses could be forced out of business if the price of bitcoin does not rise or fall.