BUSD balance on exchanges down $6B over 30 days

About $6 billion worth of Binance US Dollars (BUSD) have been withdrawn from exchanges in the past 30 days, according to Binance.com. of crypto slate Analysis of Glassnode data.

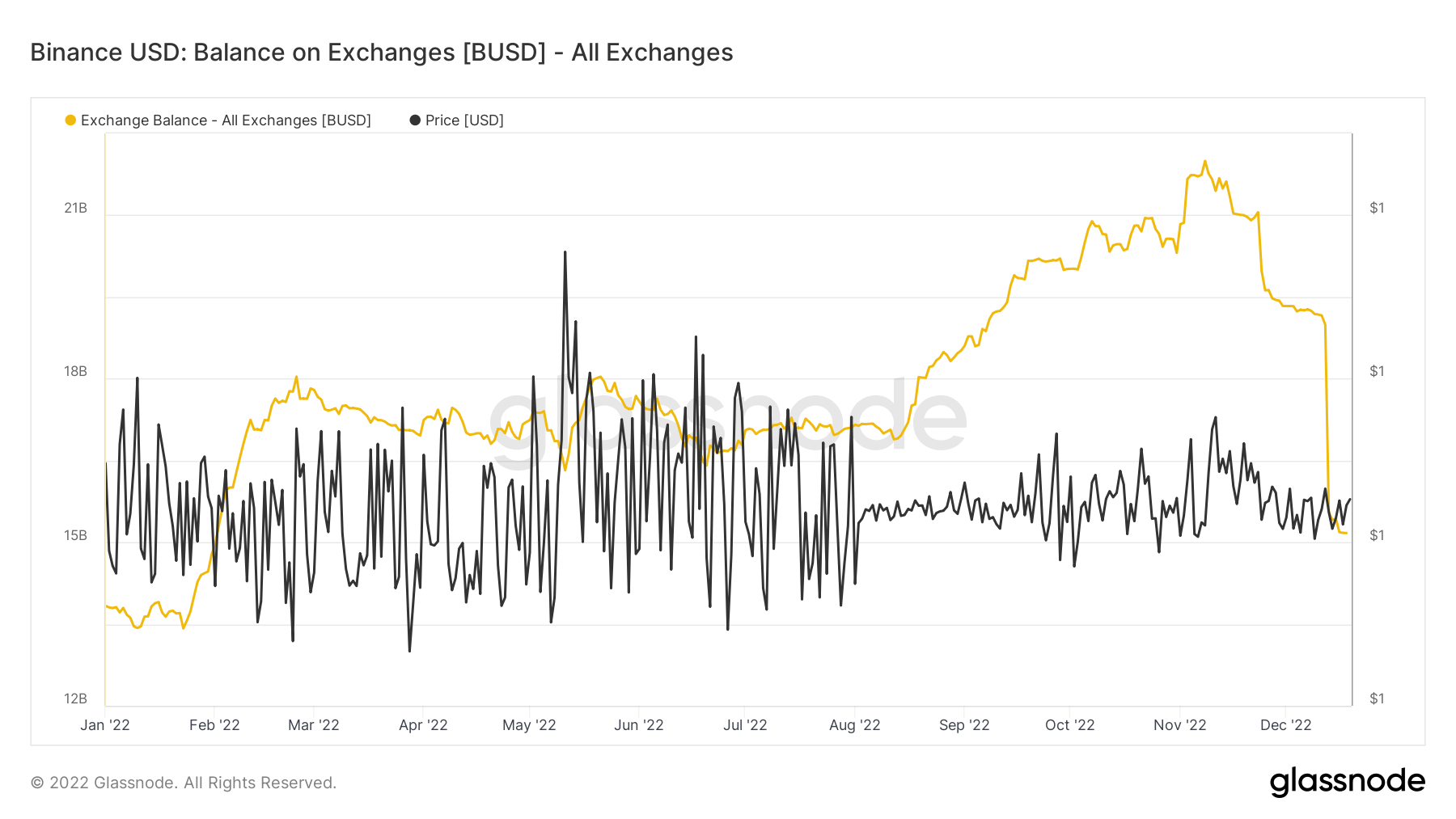

BUSD exchange balance

The orange line in the graph below represents the BUSD balance of all crypto exchanges included in Glassnode. The chart starts at the beginning of the year and shows his two periods when his BUSD reserves on the exchange increased.

The first followed in February, when BUSD balances registered 33% growth, rising from around $13.5 billion to $18 billion. After that, BUSD reserves he reduced to about $16.5 billion in late August. This is the second growing season.

From late August to mid-November, the amount of BUSD held on exchanges increased another 33%, from $16.5 billion to around $22 billion.

However, the exchange failed to sustain this level. As the graph also shows, the exchange lost about $6 billion worth of his BUSD in the last 30 days, and his BUSD balance on the exchange has retreated to his just over $15 billion.

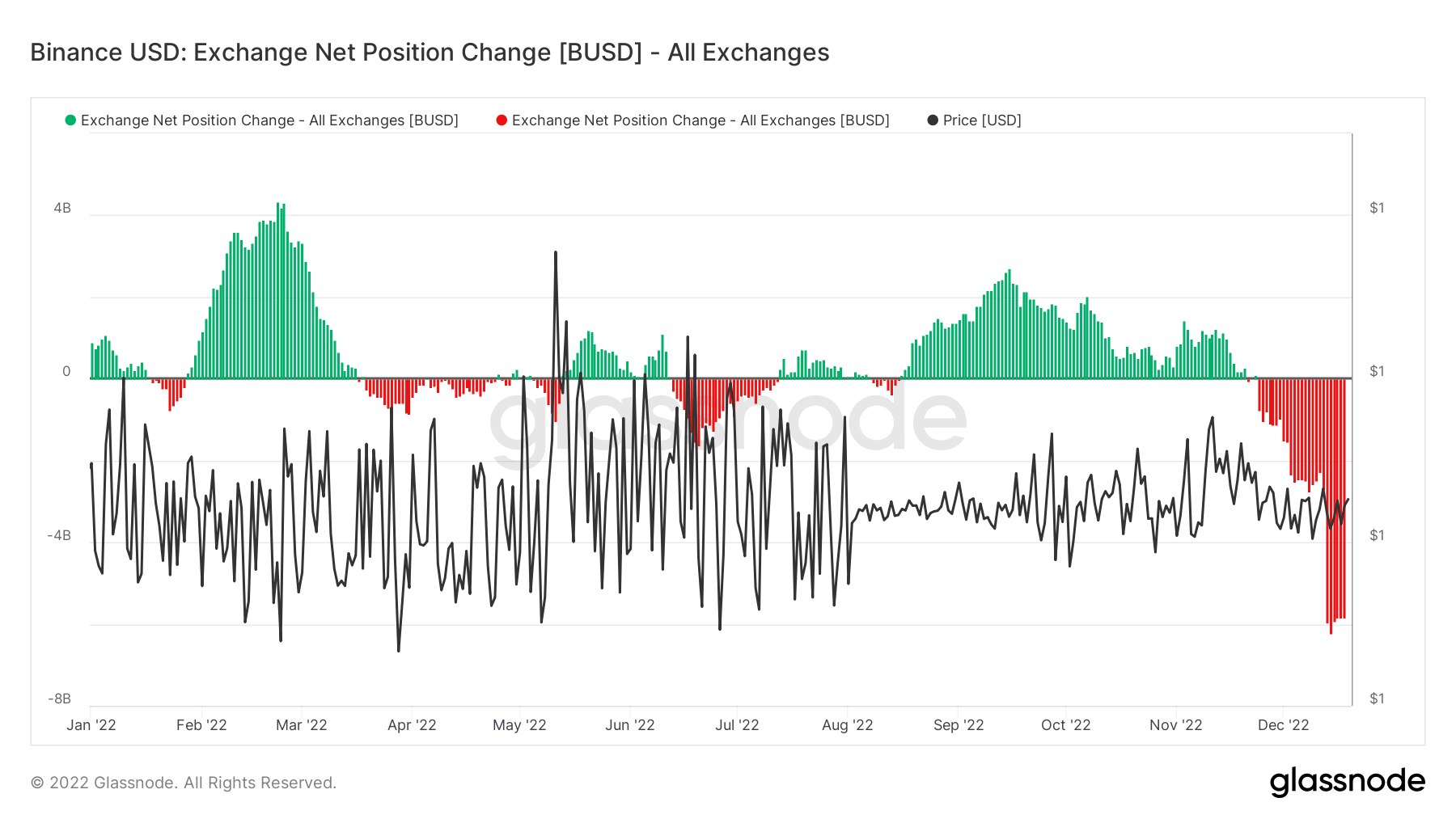

The chart below shows the change in the exchange net position of BUSD held on the exchange. Green areas indicate BUSD inflows and red areas represent outflows.

The inflows and outflows shown in the chart above also coincide with the movement of the BUSD balance shown in the first chart. According to net position data, the BUSD outflow he started in late November and has only increased since then.

in the meantime, crypto slate Data shows that the BUSD price has registered a 0.35% decline over the last 30 days. BUSD is trading around $1.00008 at the time of writing, 14.94% below the all-time high recorded on November 25, 2019.

BUSD dominance

In early November, BUSD was the best performing stablecoin among the top three stablecoins. His other two are Tether (USDT) and USD Coin (USDC). Data from Nov. 4 showed BUSD dominance increased by 6% year-to-date, while USDT supply fell by 4%.

By mid-December, BUSD lost its edge. BUSD supply fell below $20 billion, but he claimed USDC had the upper hand as supply exceeded $45 billion.