Can May’s biggest GameFi crash victims survive the bear market? | May Monthly Report

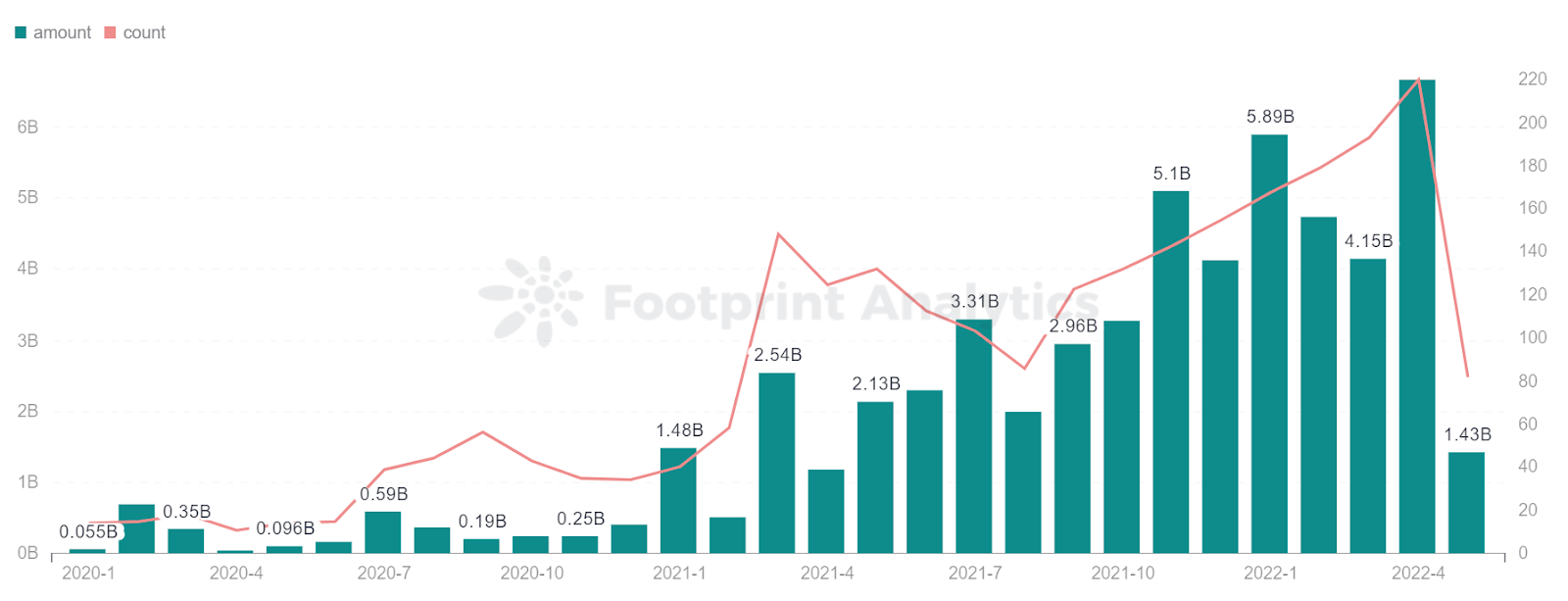

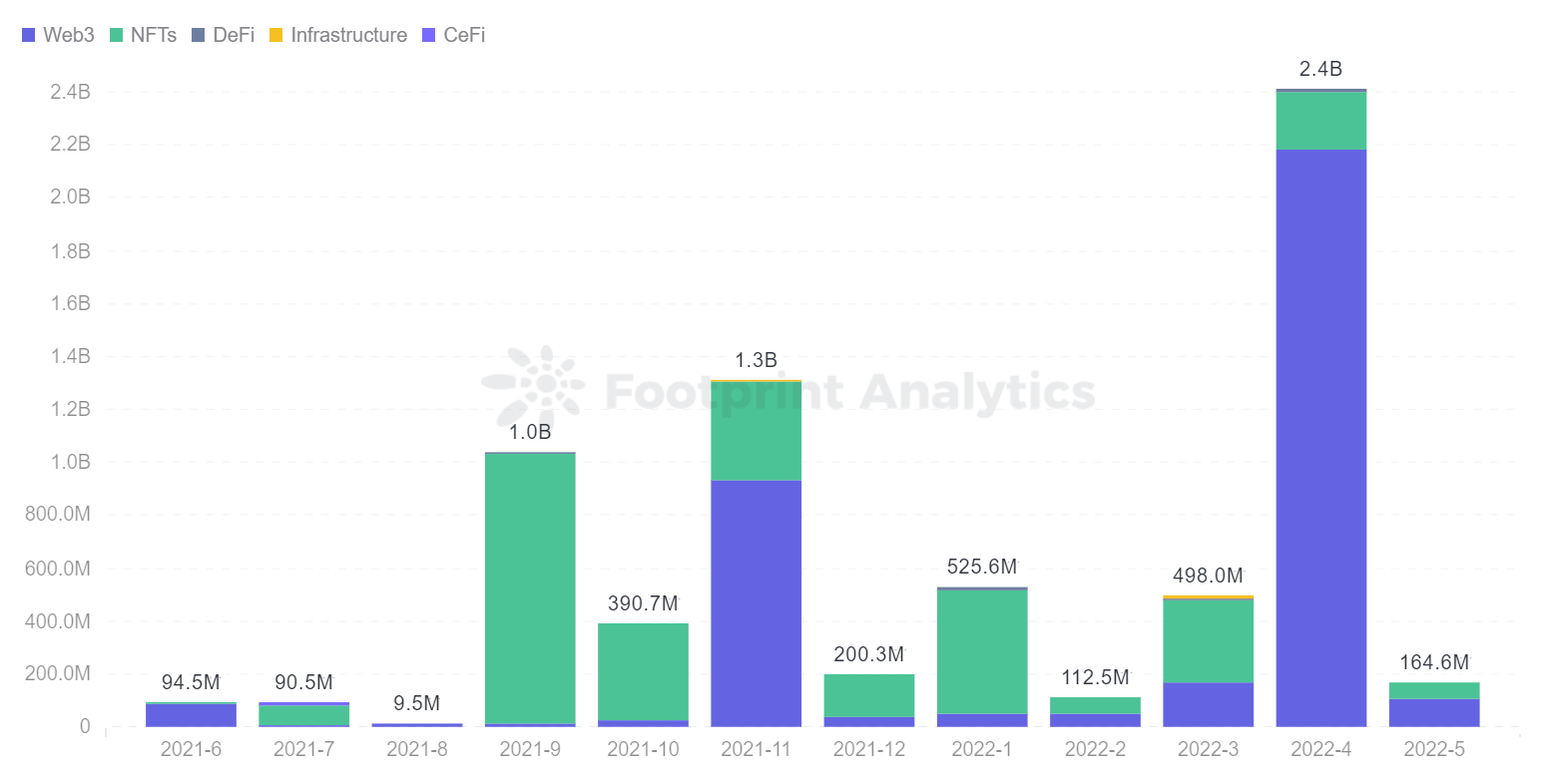

There were many ups and downs May in the GameFi sector And crypto investors.especially GameFi loan funds, It decreased from a peak of $ 2.4 billion to $ 165 million, a decrease of 93.14%. This is the most significant decline since 2021 and is lower than everyone’s expectations of the GameFi market.

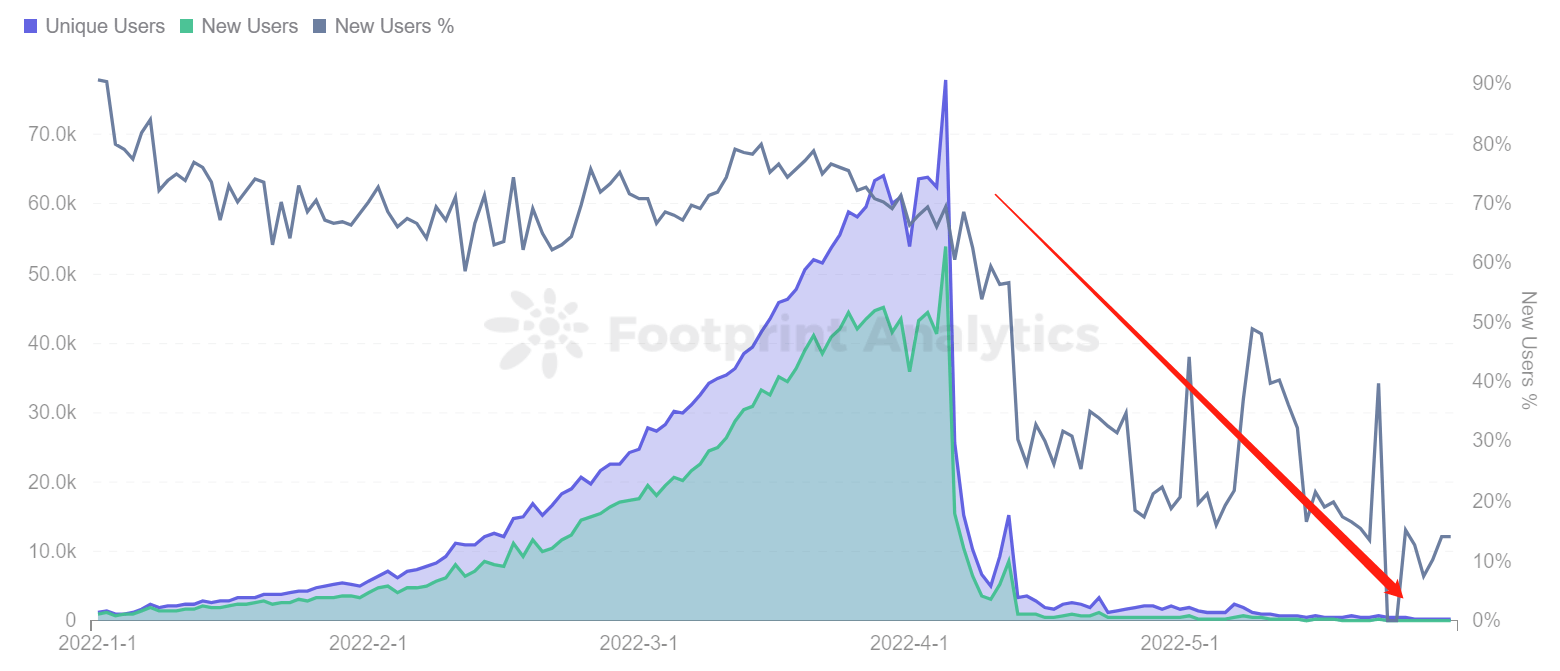

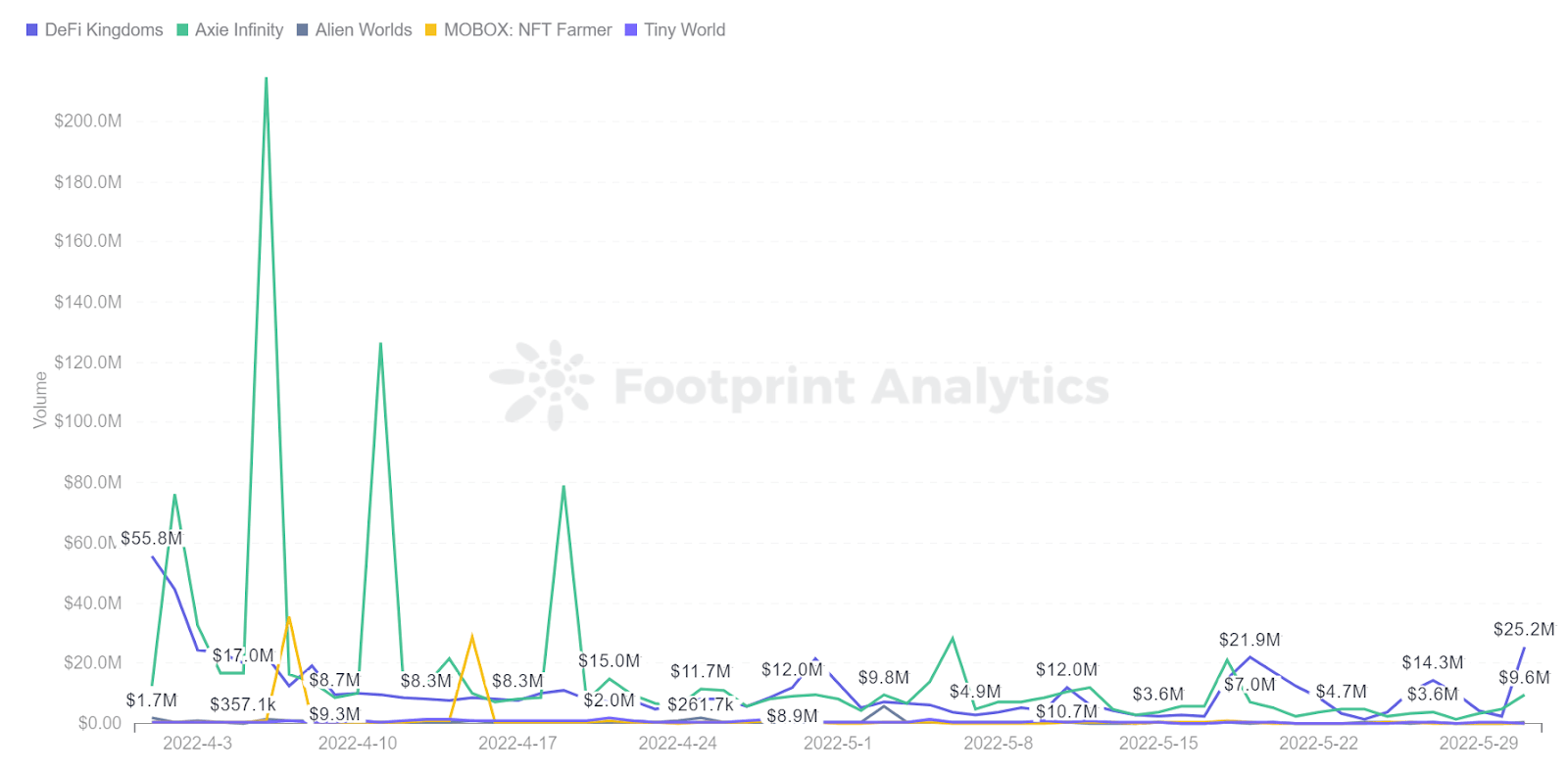

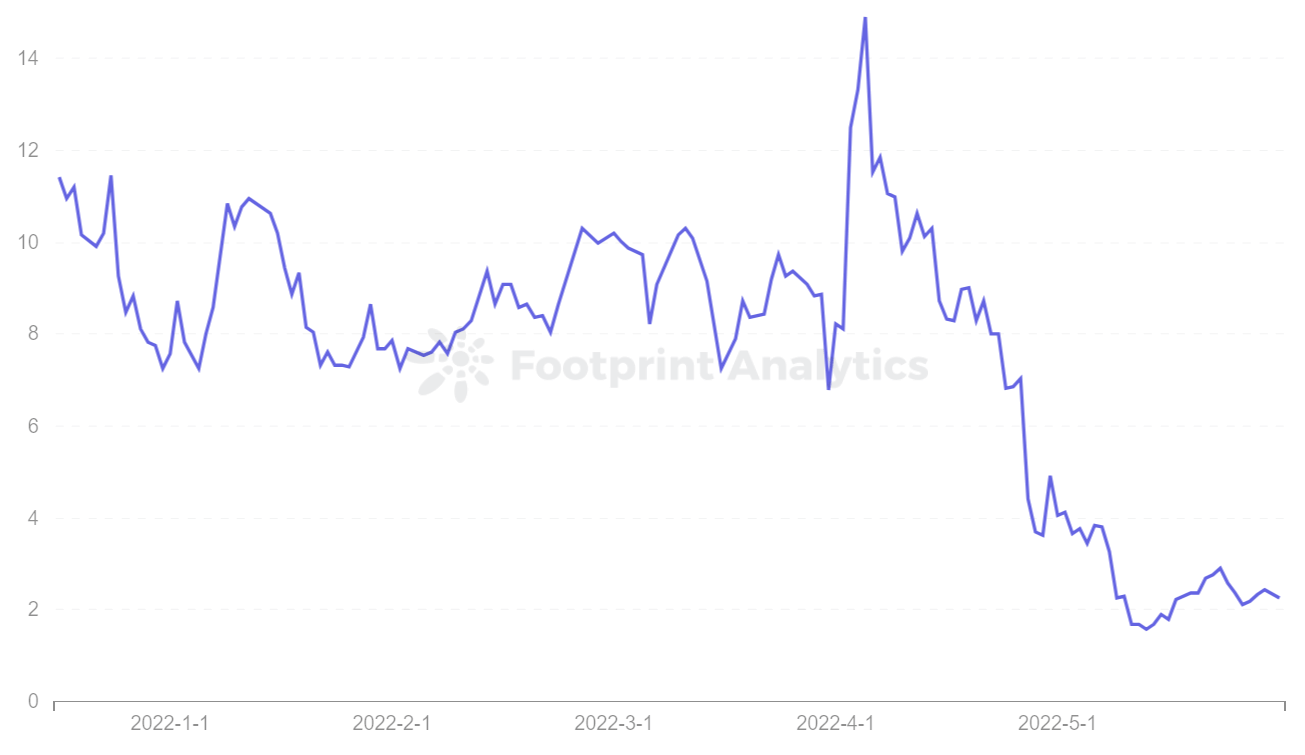

Former leader Axie Infinity was also hit hard. The number of players has been reduced from over 100,000 to less than 10,000. Is there a risk of collapse? And StepN, which occurred in the bear market in May, crashed as well. Can it see a reversal and continue to lead M2E in the GameFi sector?

Below is an overview The entire GameFi market Summary of changes in each project by data analysis in May.

GameFi Market Overview

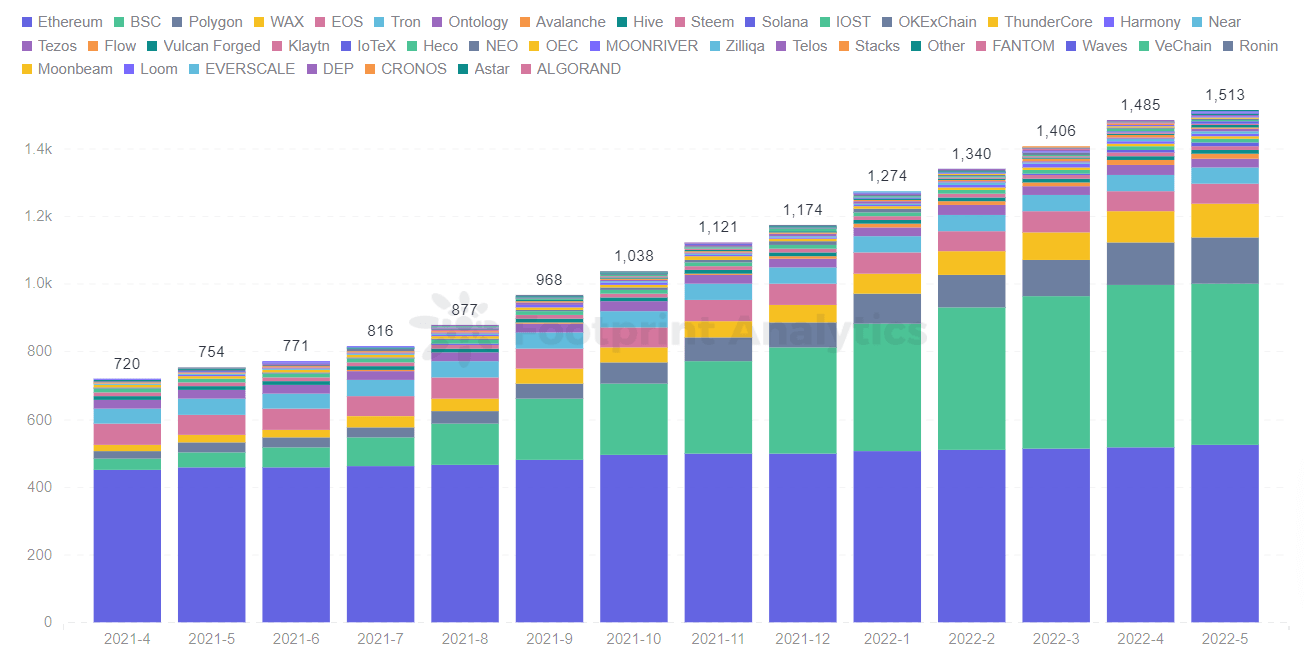

GameFi project counts up 1.9% MoM, showing slowdown

rear BTC, ETH, LUNAWhen StepN Tanked Aquarium seems to have a consensus that the bear market is really here.

The number of GameFi projects increased by only 1.9% in May, primarily due to the growth of Polygon chain projects. Growth in two mainchain projects, Ethereum and BSC, is slowly slowing.

The problems of Ethereum’s high gas charges and network congestion continue, which is the main reason why the number of projects could not be increased rapidly.After a notable game project like StarSharks Cryptomines couldn’t retain users and BSC had some problems.

Polygon, on the other hand, is the blockchain with the highest number of projects this month.

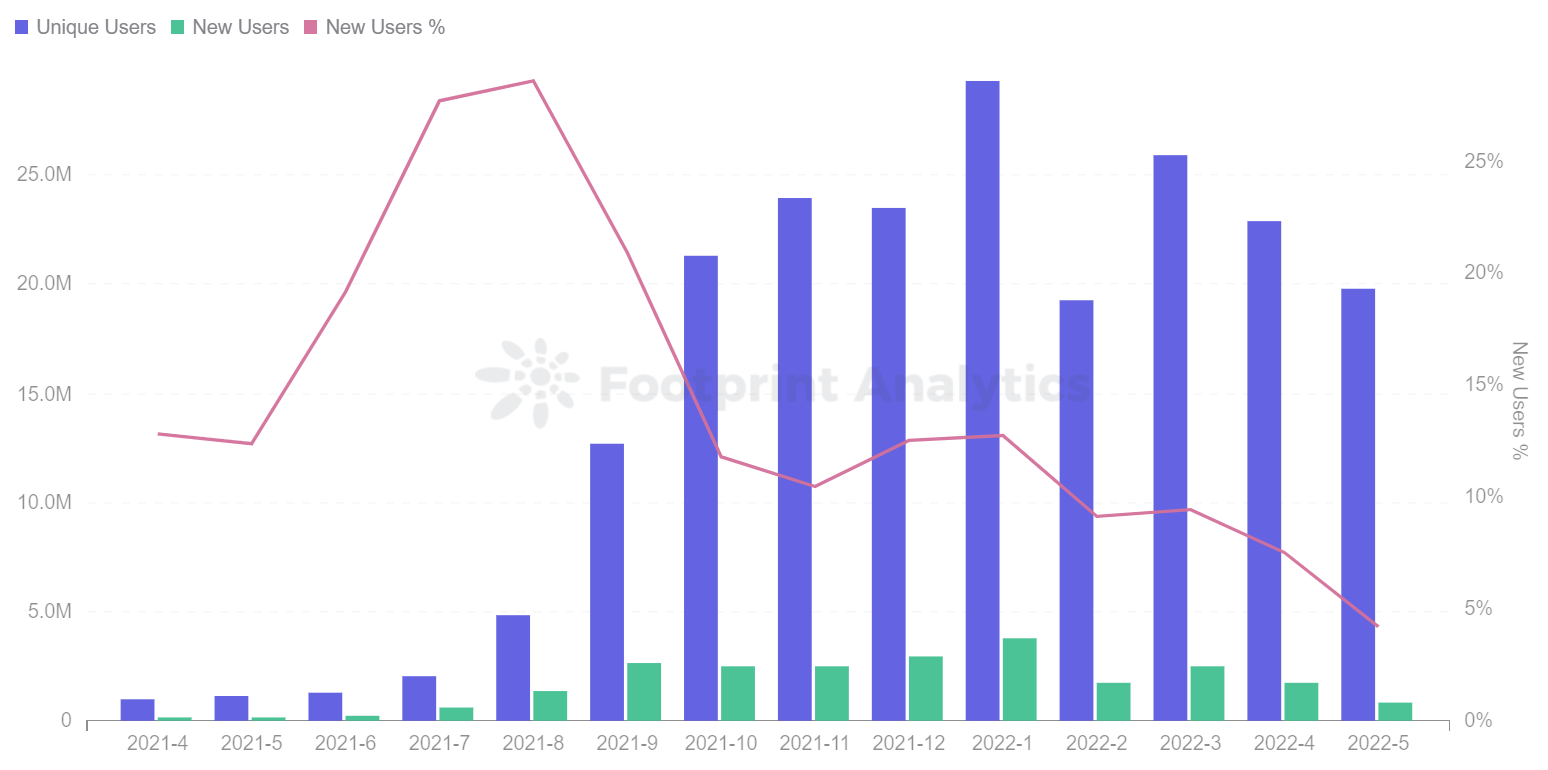

The total number of active GameFi users and transaction volume continue to decline

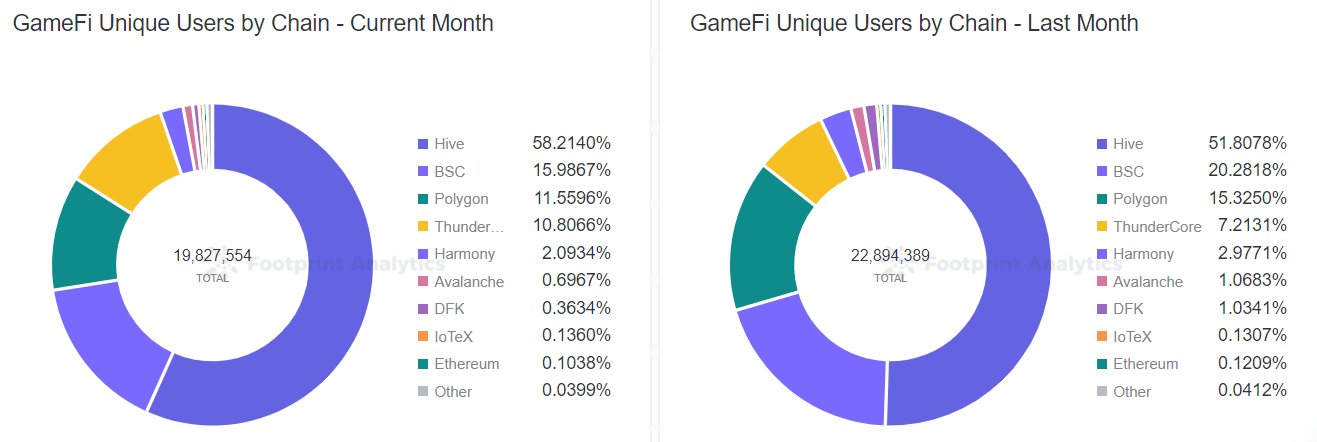

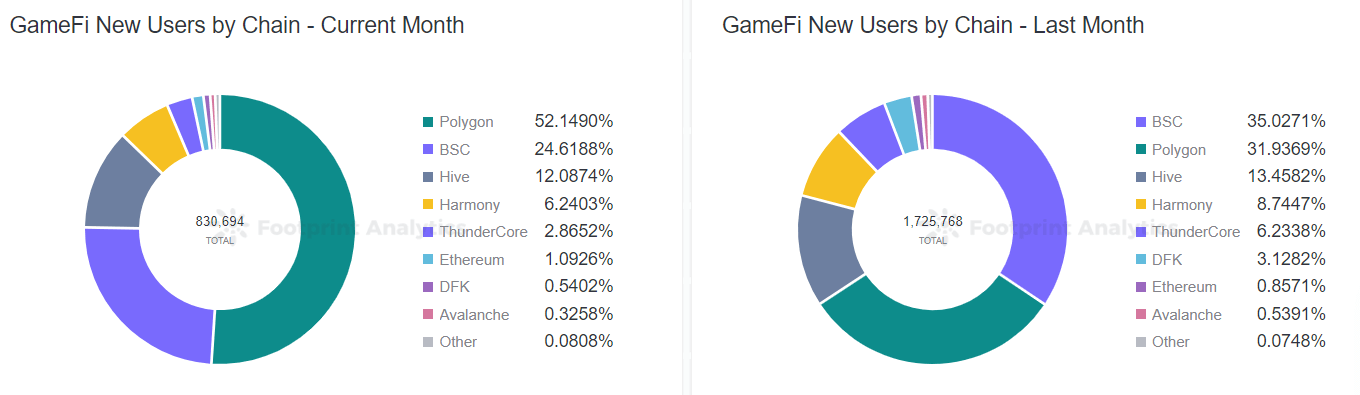

As of May 31, the total number of active users is 19.83 million, of which 830,000 are new users and 19 million are old users. The total number of active users decreased by 13.4% compared to April.

This is primarily affected by the number of users of some game projects on the BSC chain. Both old and new users have decreased by 5% to 10%. For example, StarSharks, which was endorsed by many industry players before April, encountered a “death spiral” in just over a month, reducing the number of users from 10,000 to 100.

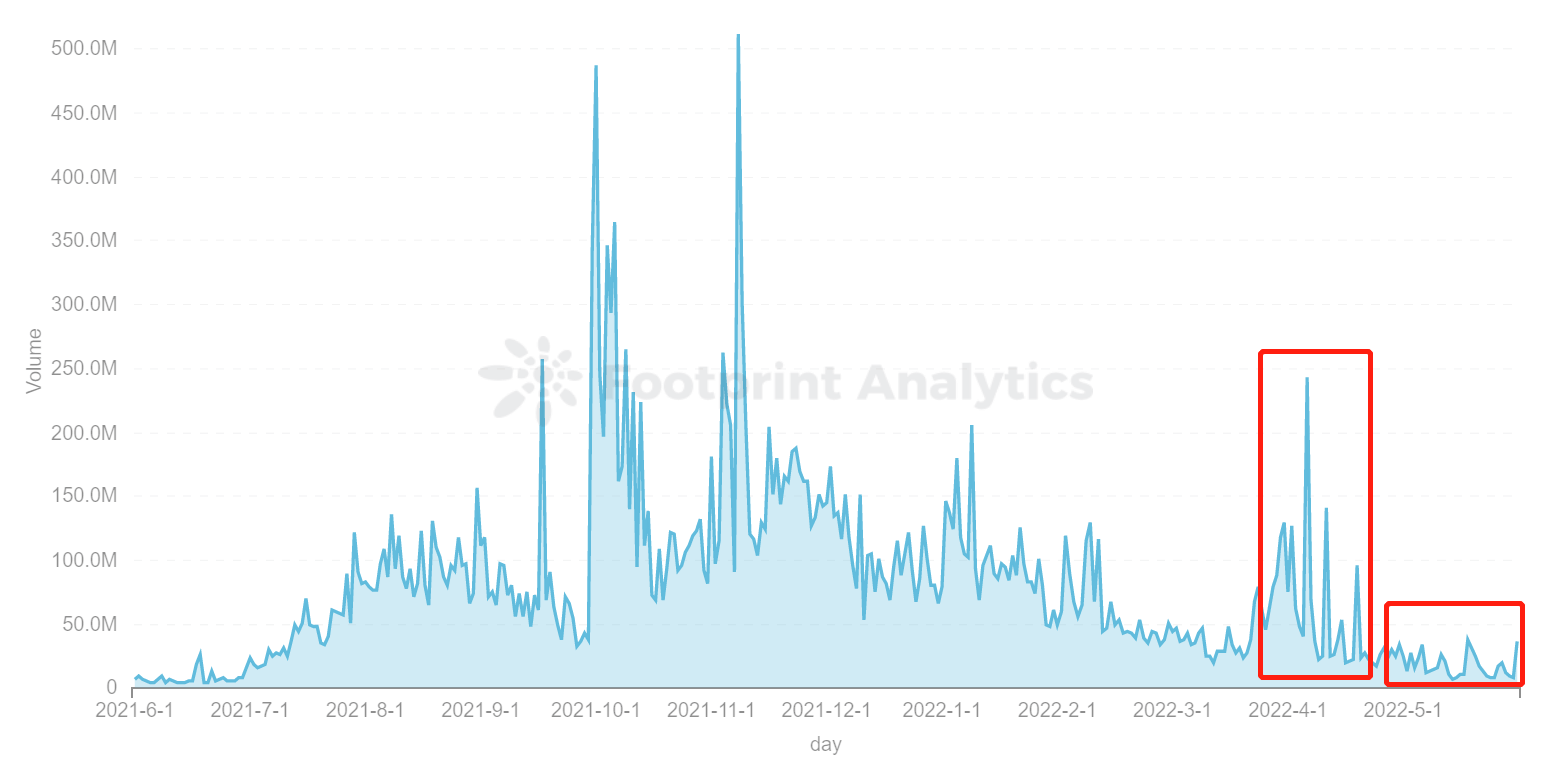

According to Footprint Analytics data, the overall daily trading volume in May was lower than in April. Including top GameFi projects such as Axie Infinity’s average transaction value, it fell from $ 26.85 million in April to $ 7.14 million. The average Splinterlands transaction value fell from $ 4,118 in April to $ 2,724. The transaction volume of CryptoMines has been halved.

GameFi raised nearly $ 165 million, with MoM down 93.14%.

The total investment in the blockchain sector in May was $ 1.43 billion. The GameFi sector accounted for 11.5% of total investment, at $ 165 million. Compared to April, GameFi’s investment has decreased by 93.14%.

Web3’s investment in GameFi has dropped the most, but that doesn’t mean that Web3 has lost its dominant position. According to the news, on May 18, a16z launched a $ 600 million fund dedicated to game startups to increase bets on Web3 technology. As such, Web3 remains an important sector of the organization’s focus and will be one of GameFi’s core technologies.

Consider changing to GameFi in May

Today, the crypto market is experiencing a serious downturn, with stablecoin prices for most cryptocurrencies and algorithms dropping to the lowest levels ever.

Is Axie Infinity at stake?

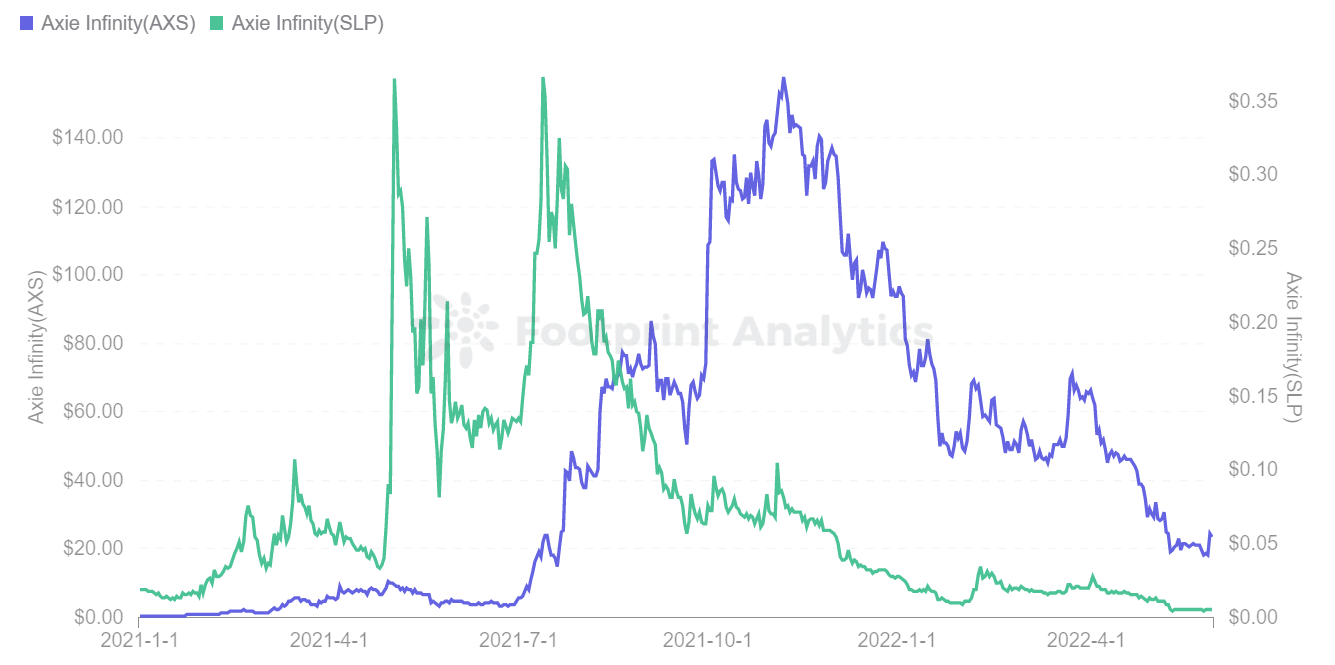

rear Axie Infinity Attacked and continued to show a downward trend, the sharp decline in SLP and AXS was serious.

According to Footprint Analytics data, Axie Infinity’s token SLP fell to $ 0.0057 as of May 31, down 98.5% from its all-time high of $ 0.37. Governance token AXS also fell to $ 23.79, down 84.9% from a record high of $ 157.80.

Axie Infinity’s economic activity relies heavily on combat and breeding capabilities, earning SLP and AXS in pet combat and consuming SLP and AXS in pet breeding. Therefore, these two tokens are important to the game. When they reach zero, Axies become worthless.

To avoid falling into a death spiral due to falling token prices, the team has removed SLP mining from single-player adventure mode, released the Origin Android version on May 12, and allowed it to be used for purchase. Announced Axie Infinity Market Axie and other assets and more. Use any cryptocurrency. However, these measures could not stop the price decline.

It’s too early to say if Axie Infinity will collapse.

Another soaring game, Star Sharks, also faced a fall in coin prices. SSS fell from a peak of $ 14.91 to $ 2.26.

In summary, in many P2E GameFi projects, it’s important not only to enable players to profit in the early stages, but also to maintain a long-term increase in their value. To reduce the chances of a project going into recession, we need to continuously introduce new players to invest new money in the game, optimize tokenomics and provide higher security.

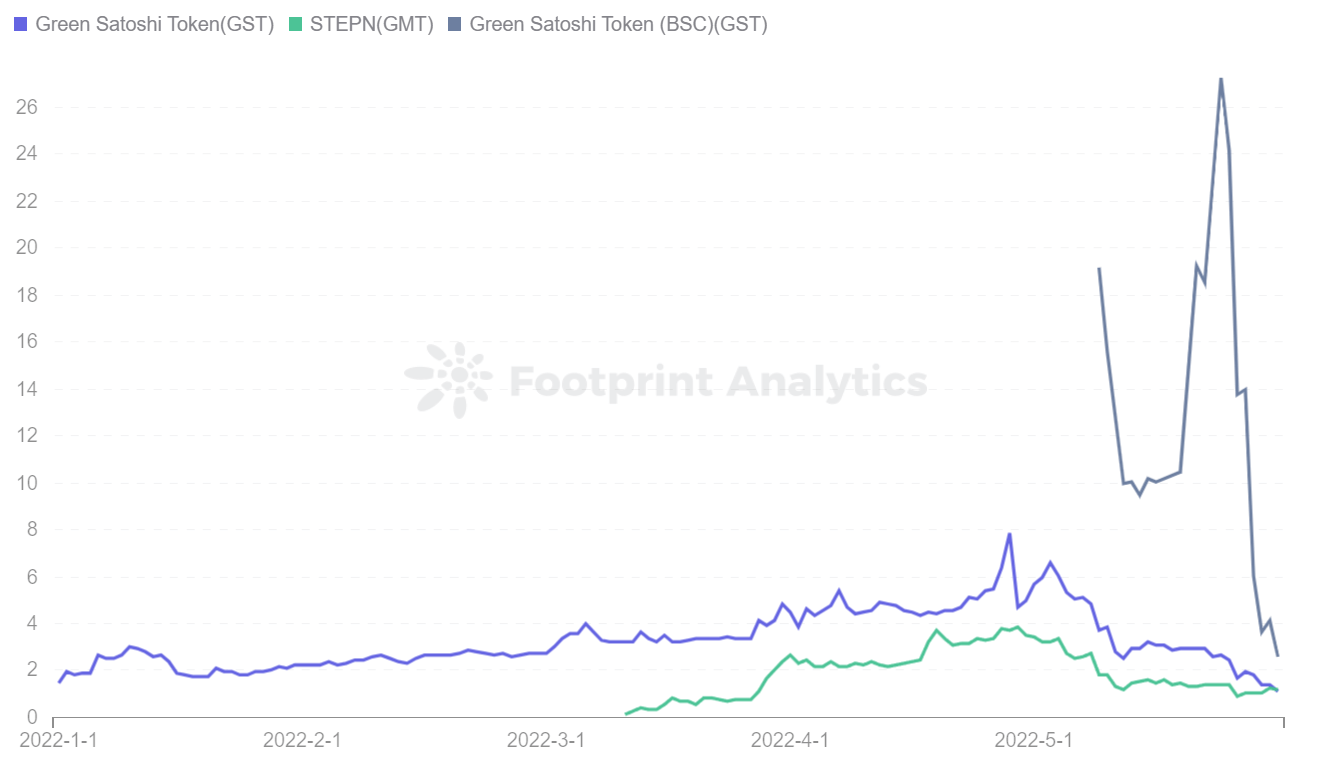

Can StepN stabilize the currency and avoid falling to zero?

StepN Responsible for the rapid growth of Move-to-Earn, launched by Solana and BSC. This is one of the first successful mobile blockchain games.

On May 25th, StepN’s GMT and GST coin prices continued to fall. The GST coin price of the BSC chain fell from $ 27.26 to $ 2.58, down 90.53% in just seven days due to sales pressure from SOL, GST and GMT and the official announcement of the block of users in mainland China. The price of the token GMT coin has dropped slightly.

Overview

Despite the slides of many major GameFi projects, new funding rounds continue.

Current events can reveal whether the death spiral means the death of the project or can be considered a stress test, allowing the project to recover even more powerfully.

May event review

NFT & GameFi

- Over 5 million NFTs cast in Cardano

- Google Trends data for NFTs show that global interest has been reduced by 70%

- X2Y2 has released an automatic reinvestment tool. This tool can automatically purchase the WETH revenue earned by the user as X2Y2 tokens for re-pledge.

- Enthusiasm in the NFT market has diminished, and gas prices have fallen to their lowest levels since June.

- STEPN removes GPS in China amid regulatory concerns

Metaverse and Web3

- Web3 gaming platform Village Studio completes € 2.1 million pre-seed loan led by Animoca Brands

- Metaverse real estate sells for a record $ 5 million in the TCG world

- Footprint Analytics Raises $ 4.15 Million in Seed Plus Round

- Brave Browser has been integrated with Solana Blockchain to extend Web3 access

- Metaverse App BUD Completes $ 36.8 Million Series B Loan Led by Sequoia Capital India

DeFi and tokens

- DAI reigns as the leading decentralized stablecoin by market capitalization

- Anchor Protocol Violations Incurred $ 800,000 Loss After Launching Terra Chain

- ETH profitability reaches a 22-month low of 57.31%

- The areas of concentration for lending and clearing in the Ethereum chain are $ 1459 and $ 1193.

- Bitcoin’s dominance has increased to 45%, the highest level since October 2021

Network and infrastructure

- Ethereum L2 has decreased by 40% since early April

- Ethereum has more than 81 million non-zero addresses, a record high

- Terra gets a second life as the new blockchain runs on LUNA 2.0 airdrops

- LUNA founder DoKwon faces allegations of fraud over the mirror protocol

- Avalanche loses $ 60 million in UST crash

institution

- CryptoGiantFTX is ready for billions of dollars for acquisition

- VC Focusing on Singapore Cryptocurrency Raises $ 100 Million For Third Fund

- Google wants new talent to lead the global Web3 team

- Cryptocurrency exchange Gemini will stop trading UST and MIR

- Brazilian Cryptocurrency Exchange NoxBitcoin Compensates UST Users at USDT 1: 1

World wide

- South Korean officials are reportedly investigating the staff behind Terra

- Ukrainian Eurovision Winners Sell NFTs to Assist Ukraine’s Defense

- South Korean financial authorities will develop regulations related to StableCoins and DeFi

- New Zealand authorities investigate crypto Ponzi scheme

- U.S. lawmakers have submitted a record number of over 80 crypto bills this year

This work has been contributed by Footprint analysis community.

The Footprint Community is a place where data and crypto enthusiasts around the world can gain insights and insights into Web3, Metaverse, DeFi, GameFi, or other areas of the new world of blockchain. Here, lively and diverse voices support each other and move the community forward.

Date and author: June 2022, Vincy

Source: Footprint analysis – May 2022 Report Dashboard

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform for visualizing blockchain data and discovering insights. Clean up and integrate on-chain data so users of all experience levels can quickly start exploring tokens, projects, and protocols. With over 1000 dashboard templates and a drag-and-drop interface, anyone can create their own customized charts in minutes. Reveal blockchain data and invest smarter with Footprint.