Cathie Wood’s ARK Investment isn’t doing so great

ARK Investment, a venture capital firm founded by Cathie Wood, is gearing up for the coldest winter it’s seen in a long time.

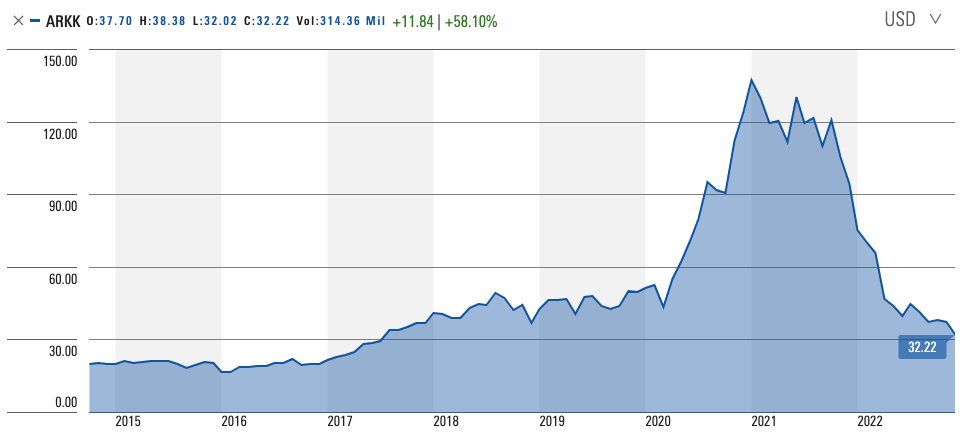

The pandemic-era success story that brought Wood to global fame, the ARK fund saw all of its holdings fall to all-time lows. The fund’s own share price is down nearly 63% this year, returning to late-2017 levels.

The loss seen in ARKK shares, the fund’s innovation ETF, was the biggest drop among more than 230 actively traded diversified ETFs, according to Morningstar Direct. In contrast, the S&P 500 is down just over 14% this year, including dividends.

Fall of ARK

ARK’s downfall was attributed to several factors, with GBTC and COIN’s exposure to cryptocurrencies being the biggest.

The $7.1 billion fund holds about 30 stock positions, with Zoom, Tesla, and Coinbase making up the largest percentage of its portfolio. ARK experienced exponential growth at the beginning of the 2020 pandemic. Wood jumped headfirst into growth-oriented technology companies and increased the fund’s exposure to cryptocurrencies.

Wood’s strategy is to have a fund that invests heavily in technology that she believes has the potential to “change the world.” This strategy paid off within months of investing in an unprofitable early-stage startup. Zoom became a household name during the pandemic and Tesla had its best year ever.

ARK exposure to crypto

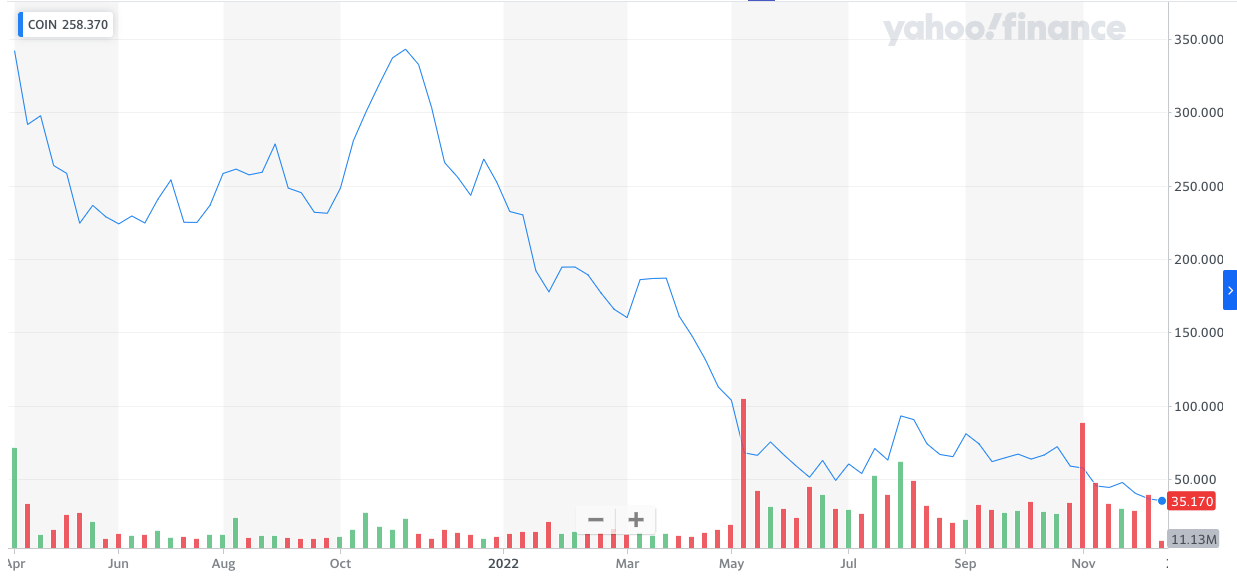

Coinbase also saw its stock price hit an all-time high during the height of the pandemic, making ARK one of the most profitable funds in the space.

ARK also holds a large stake in the Grayscale Bitcoin Trust (GBTC), holding over 6.15 million shares. Although this position represents less than 0.50% of ARK’s portfolio, the loss suffered by GBTC has hit the fund hard.

Bitcoin’s drop from its all-time high of $69,000 rocked GBTC, causing the stock to drop more than 76% over the year. GBTC is currently trading at a discount of over 50% to NAV, meaning it is performing worse than Bitcoin. Coinbase lost more than 80% of its value this year, putting even more pressure on the already struggling fund.

Analysts may disagree about which part of Wood’s portfolio has been hit hardest, but they all agree that ARK is in trouble. John Burkett – St. Laurent, Senior Portfolio Manager at Exencial Wealth Advisors, said ARK lacks a risk management strategy. The fund was built on stimulus-era free money, and its existence now relies heavily on its existence, he says. Said Wall Street Journal.

industry perspective

Todd Rosenbluth, Head of Research at VettaFi, said: Said According to Investors.com, Wood’s focused thematic ETFs appear too concentrated for many shareholders. That crypto exposure doesn’t help either.

But Kathy Wood continues to brush off concerns about the health of the fund. Not only is Wood backing his investments, he’s doubling down on the riskiest positions in his portfolio.

In November, ARK added $43 million in Coinbase stock. Wood’s other fund, his ARK Next Generation Internet ETF, bought $6 million worth of his GBTC in October, significantly increasing its exposure to Bitcoin.

Investors who still support Wood seem to share her beliefs.

Since the beginning of the year, the number of accounts holding funds has dropped by about 8%. In mid-November, the total number of accounts with ARKK reached its annual low.

However, customers actually added cash to ARKK on a net basis in 2022, according to Webbull Financial LLC data. Over $1.4 billion was put into his ARK Innovation ETF this year.

optimism for the future

This shows investors are confident that the disruptive technology Wood is eyeing has yet to reach its prime. The steep losses experienced by all stocks in ARK’s portfolio have not shaken investor confidence, with most appearing willing to bear short-term losses.

These short-term losses could get even worse in the coming weeks. Webbull CEO Anthony Denier said investors may be subjecting their holdings to tax loss harvesting. This is the practice of selling a loss position before the end of the year to realize the loss and write it off as a tax loss. Denier told The Wall Street Journal that the fund’s share price could plunge further if some ARKK holders decide to liquidate.