CleanSpark mined 3,750 BTC in FY’22, BTC reserves down 40% since January

CleanSpark’s hash rate reached 6 EH/s on Dec 21, 2021 compared to 2 EH/s on Dec 31, 2021, representing a 3x increase on an annual basis.

The company says it has achieved its year-end target for hash rate and expects to reach 16 EH/s by the end of 2023.

2022 financial highlights

CleanSpark has mined a total of 3,750 Bitcoin (BTC) during the 2022 fiscal year ending September 30th. The annual financial report shows a 320% increase on an annual basis.

Meanwhile, annual revenue increased 235% to $131.5 million from $39.3 million in 2021.

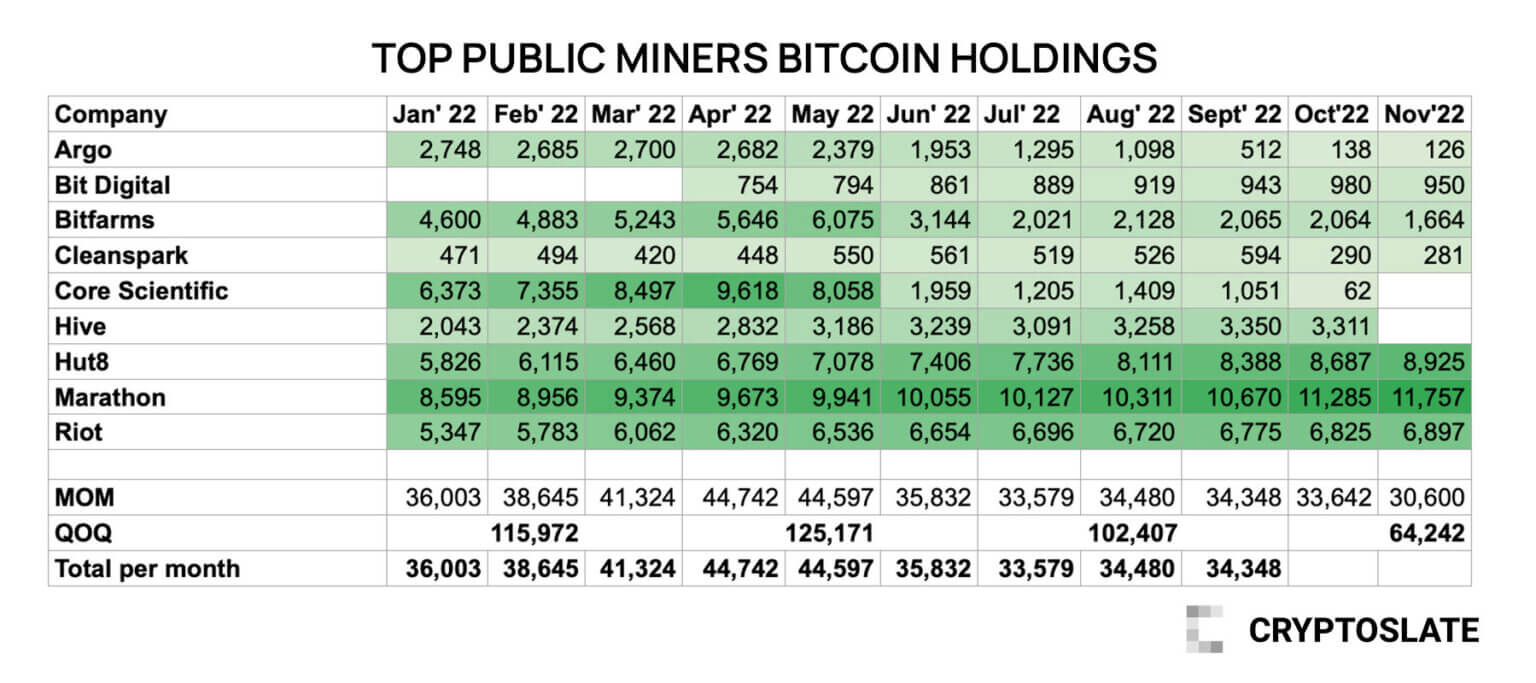

However, despite the 2x and 3x increase in revenue and mined BTC, the company’s BTC reserves fell by 40.3% to 281 BTC as of November 30, down to 471 BTC as of January 31. compared to crypto slate data.

According to the report, as of the end of September 2022, CleanSpark holds $20.5 million in cash and $11.1 million in BTC. Combined with mining assets, CleanSpark’s total assets will be worth $452.6 million in 2022.

BTC reserves drop 40.3%

According to CryptoSlate data, CleanSpark sold 304 BTC in October and another 9 BTC in November.

As of November 30, the company held 281 BTC in reserves, compared to 594 at the end of September and 471 at the end of January.

According to the numbers, CleanSpark started the year with 471 BTC and was able to increase this amount to 594 BTC in September, the end of CleanSpark’s fiscal year.

On September 30th, BTC was trading around $19,422. At this price, 594 BTC equates to approximately $11.1 million, which is also listed in CleanSpark’s 2022 fiscal year report for its assets.

However, the data also show a sharp 51% drop from 594 BTC in September to 290 BTC in October. This figure he dropped to 281 BTC in November, down 40.3% from 471 BTC in January.