Coinbase plans European expansion as crypto downturn continues

Crypto exchange Coinbase plans to expand its business in Europe and is actively registering in major European countries such as Italy, Spain, France and the Netherlands. Bloomberg News Reported on June 29th.

On June 13, the company announced that it would cut 1,100 American workers, or 18% of its workforce, because of the importance of staying lean during a recession.

Prior to the announcement of the dismissal, staff criticized the company’s poor performance in a subsequently deleted online petition. The petition called on several senior executives, saying Coinbase co-founder Brian Armstrong was “really ridiculous at multiple levels.”

Coinbase expands in Europe

Despite recent bearish pricing behavior in cryptocurrencies, Nana Murugesan, Coinbase’s Vice President of Business Development and International, plans to increase the company’s presence in Europe at both the retail and institutional levels. I said there is.

“In all of these markets, our intention is to offer retail and institutional products.”

Murugesan noted that the company hired its first employee in Switzerland and added that it would consider an acquisition to speed up its expansion plans as the sector’s reputation plummeted during the recession.

Recession continues

Cryptocurrency prices have recently fallen due to several factors, including severe macroeconomic conditions and scandals at Terra and Three Arrows Capital.

Investors continue to flee to the dollar, as evidenced by the 1.2% surge in DXY since June 27.

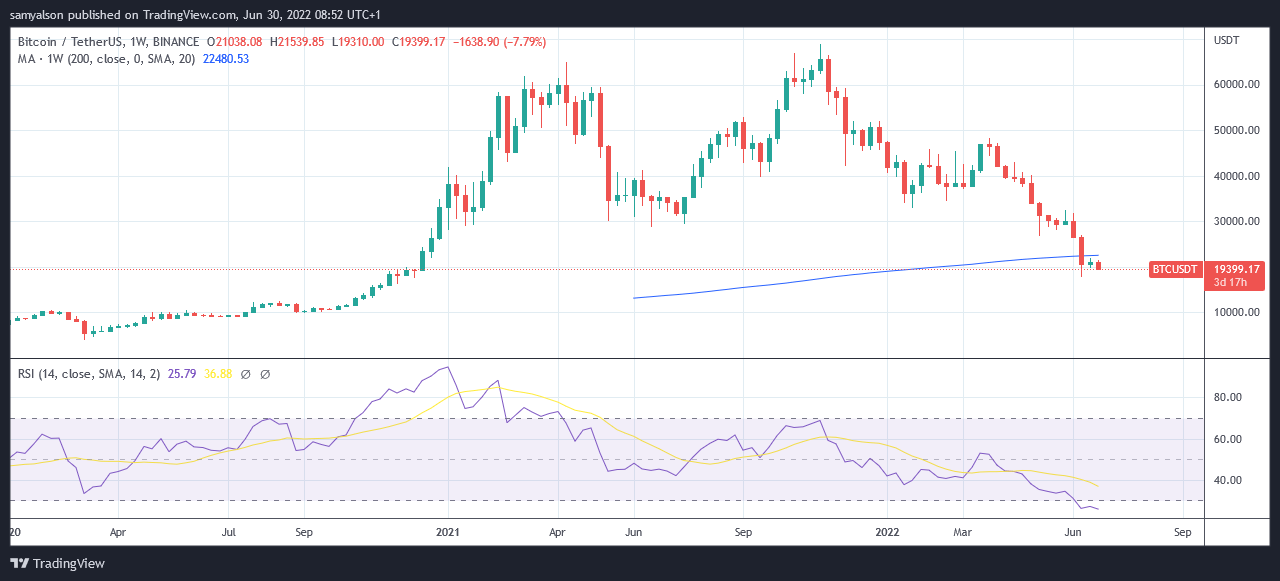

Meanwhile, market leader Bitcoin (BTC) fell below the psychologically significant $ 20,000 level on June 29. Analysis of the 200-day moving average shows that BTC is on track to close three consecutive weekly candles below this level. It happened before.

The 200-day moving average It represents the average price over the last 200 days (or 40 weeks) and is considered an important indicator for calculating long-term trends.

Goldman Sachs says coins are for sale

Coinbase’s share price did not respond to the announcement, closing at $ 49.75, down 1.4% on the June 29 trading day. On the other hand, COIN’s year-to-date loss is -80%.

On June 27, investment banking firm Goldman Sachs downgraded Coinbase’s stock from neutral to sale, adding that outflows of spending remain a concern.

Coinbase Monthly trading users and total trading volume in the second quarter are expected to decline from the previous quarter.The second quarter report is August 9..