Coinbase reports $1.10B loss in Q2 as assets on exchange slump

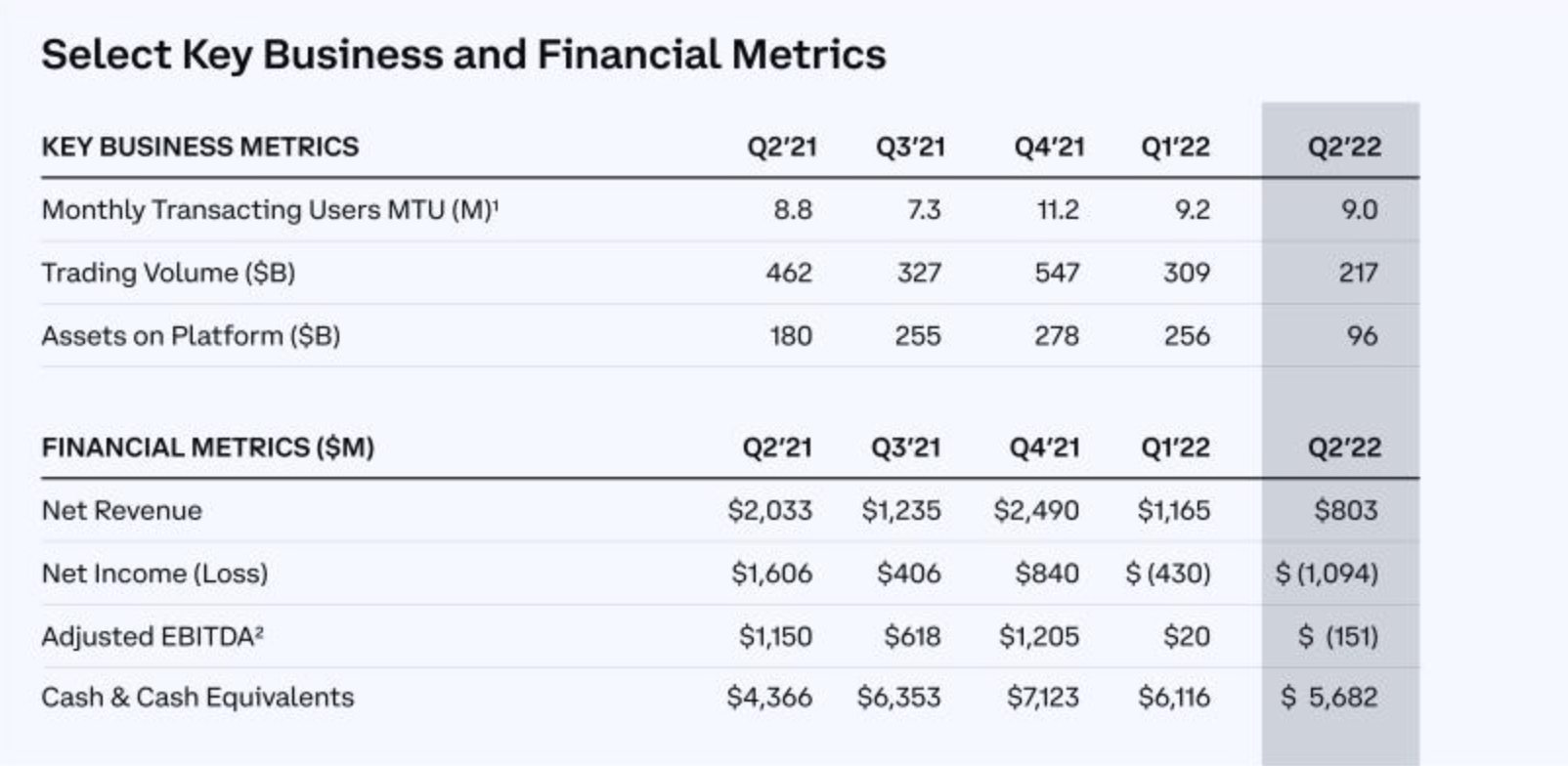

Coinbase Global Q2 result It shows that the crypto exchange posted a net loss of $1.1 billion during the period. That compares with his $430 million loss in the first quarter of 2021 and net profit of $1.61 billion in the second quarter of 2021.

Net revenue for the second quarter was $803 million, down from $1.17 billion in the first quarter and $2.03 billion in the second quarter of 2021, according to a shareholder letter dated Aug. 9.

The value of crypto assets on exchanges fell from $256 billion in Q1 to just $96 billion in Q2. One year ago in Q2 2021, exchange assets totaled $180 billion.

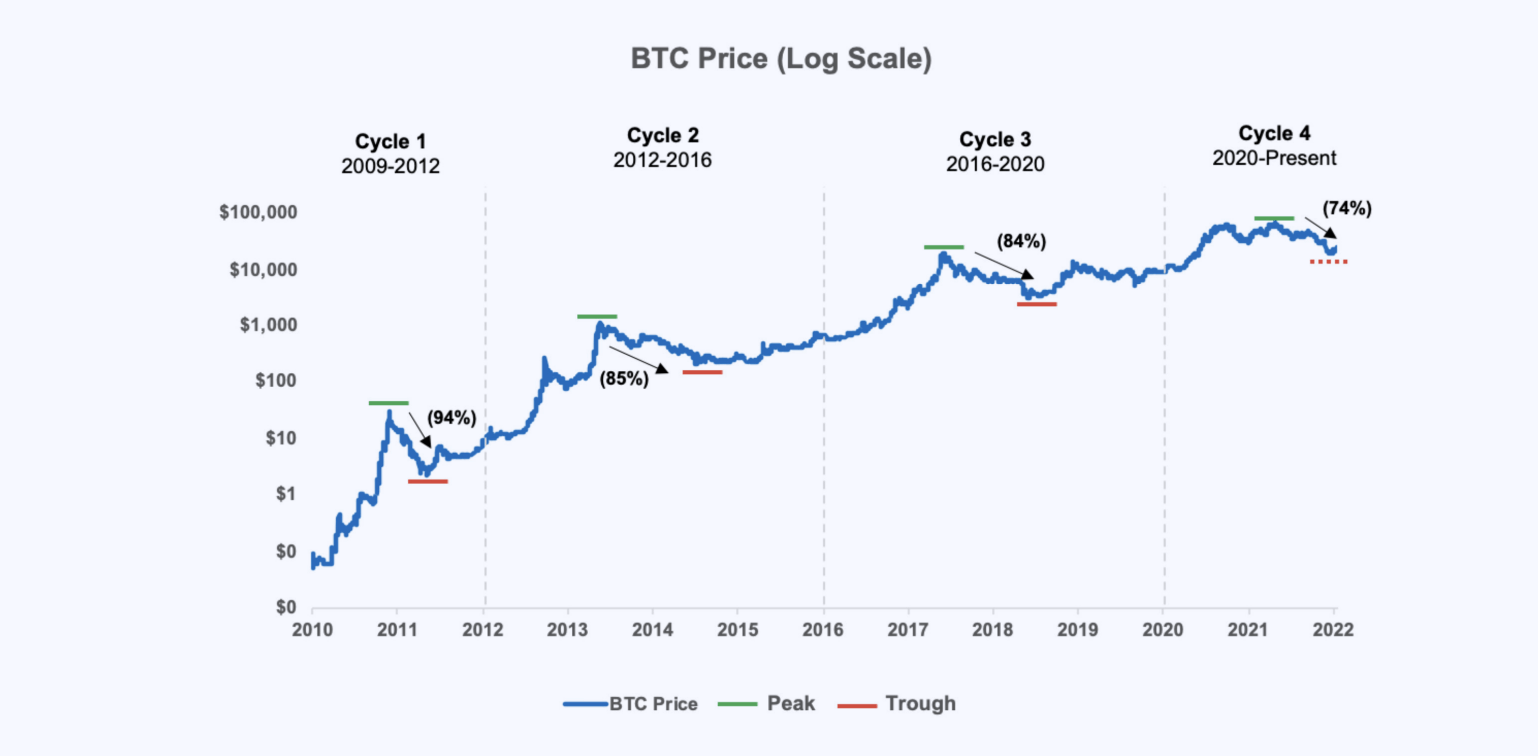

Coinbase also points to four major crypto asset price cycles that have been seen in space since 2010, and in the chart below, Bitcoin’s rate of change from its most recent peak in November 2021 to its low in June 2022. It points to a 74% decline in market capitalization.

The company said:

Each previous cycle lasted 2 to 4 years and the crypto market capitalization increased significantly compared to the previous cycle. Each previous cycle has brought new market participants, developers, and products that further evolve the crypto economy. These cycles are evident by displaying the Bitcoin price on a logarithmic scale. The previous peak-to-trough declines were historically 84%, 85% and 94%, but these previous declines were not consistent with the broader macro recession.

In a letter to shareholders, the company compared recent data to 2020, stating, “The best way to value Coinbase through this nascent industry early is through the same lens we use to value cryptocurrencies. It’s about evaluating it over the cycle.”

From 2020 to 2022, authenticated users tripled, monthly volume tripled, and assets on the platform quadrupled.

Coinbase says, “The bear market is not as bad as it looks.” “It can be terrifying and could have a significant short-term financial impact,” he continued, but “it will be stronger than ever.”

While the numbers may seem bearish for US-based exchanges, many in the crypto industry would agree with Coinbase that “the crypto market is cyclical.” Several exchanges filed for bankruptcy this quarter, but Coinbase remains bullish about its future prospects.

The company’s monthly transaction users (MTU) were down only 2% over the first quarter.

“Despite continued market softness, we are pleased to have delivered 9 million MTUs in Q2, a decrease of 200,000 or 2% compared to Q1.”

Coinbase noted that both Bitcoin trading volume and trading revenue increased 7% and 6% respectively in Q2 versus Q1. Total retail deals fell from $74 billion in the first quarter to $46 billion. Institutional trading volume also fell from $235 in the first quarter to $171 billion in the second quarter.

Additionally, regarding institutional involvement, Coinbase said:

“On the institutional side, it is easy to lose sight of the continued use of our platform as both new and existing clients embrace crypto as a new asset class with all of the market volatility.”

Coinbase says three themes underpin the decline in trading volume.

- Key U.S. retail customers were inactive, but not leaving the platform

- “Massive trading volume” has occurred on offshore exchanges where Coinbase can list cryptocurrency derivatives without “commodity equivalence.”

- Coinbase had no “significant volume exposure related to the $LUNA liquidation event.”

Coinbase claimed that it had no material exposure to $LUNA and was an “unsupported asset,” but listed a wrapped version of the token, wLUNA. Omitted from shareholder letters.

The exchange also noted that it has no counterparty exposure to Three Arrows Capital, Celsius and Voyager.

Adapting to market conditions

Coinbase also said it was taking steps to reduce costs in the face of “challenging crypto market conditions.”

Those steps include limiting backfilling and hiring for certain positions and cutting paid media and incentives.

The company also optimizes infrastructure and professional services spending and invests in teams in low-cost regions.

The company added:

“On the expense side, we have and will continue to tightly control our expense levels. It allows me to concentrate on “