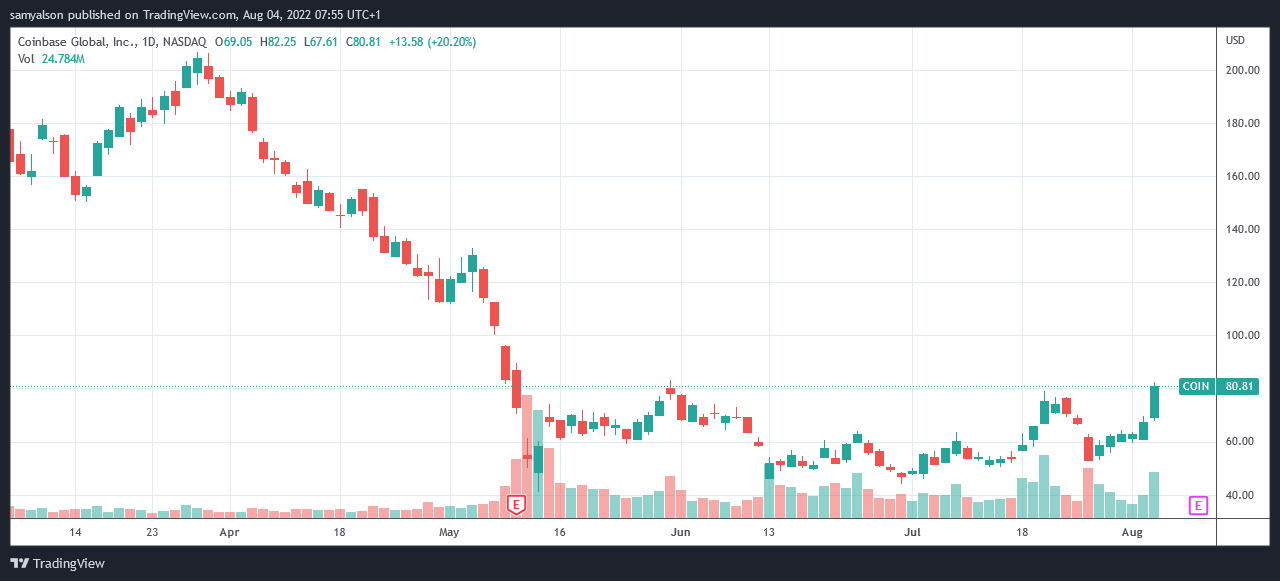

Coinbase stock posts 9 week high on rumors of better than expected earnings

Shares of Coinbase Global Inc (COIN) surged 18% on Aug. 3 to close at $80.81, a level not seen since May 31.

In after-hours trading, COIN traded relatively flat, giving up less than 1% of its previous gains.

The company has recently faced several controversies, including an SEC investigation into its securities listing, criminal insider trading charges against a former executive and his brother, and rumors of liquidity problems amid cryptocurrency prices plummeting. .

COIN is down 68% year-to-date and has lost 76% in value since its debut on the Nasdaq on April 14, 2021. But recent stock performance has brought welcome relief to long-suffering investors.

Investors Are Ready For Coinbase’s Earnings Report

The company plans to announce the second quarter earnings report August 9.

according to Zack Equity Research (ZER) said the company’s actual performance may be better than expected, despite Wall Street forecasts that earnings will fall year-on-year due to falling earnings, ZER analysts say. .

Coinbase is set to report a quarterly loss of $3.04 per share, down 147% on an annualized basis. Meanwhile, revenue is expected to decline 61% year over year to $877.3 million.

However, ZER said the company’s consensus earnings per share (EPS) estimate was revised slightly higher to 0.73%.

Estimated Consensus Earnings Average or median forecasts from analysts covering stocks. While “far from perfect,” it still plays an important role in evaluating stock valuations. Analysts at ZER said Coinbase is “most likely to beat consensus EPS estimates.”

Looking at historical data, Coinbase has beaten consensus forecasts for EPS twice in the last four quarters. Combined with their analysis, Coinbase becomes a “compelling profit-beating candidate.”

COIN’s recent performance suggests the market agrees.

Kathy Wood Offloads COIN In Response To SEC Investigation

Kathy Wood’s Three Arc Investment Management LLC Fund offloaded approximately 1.41 million shares of COIN on July 26, following the news of the SEC’s investigation into Coinbase’s listed securities.

Coinbase Chief Legal Officer Paul Grewal said he believes the exchange is securities compliant and looks forward to working with the SEC on this matter.

according to bloomberg newsThree Arc Investment is the company’s third largest shareholder, holding approximately 8.95 million shares at the end of June. So Ark has sold an estimated 16% of its holdings.

Wood was hit hard by @deaftrader1, who pointed out that COIN is up 50% since Ark sold its shares.

50% coin up after surrendering Cathy pic.twitter.com/xF0fELeB2g

— Deaf Trader (@deaftrader1) August 3, 2022