Comparing the 2022 bear market to 2018

Comparing the 2018 crypto bear market to the current 2022 bear market, not all bear markets are created equal.

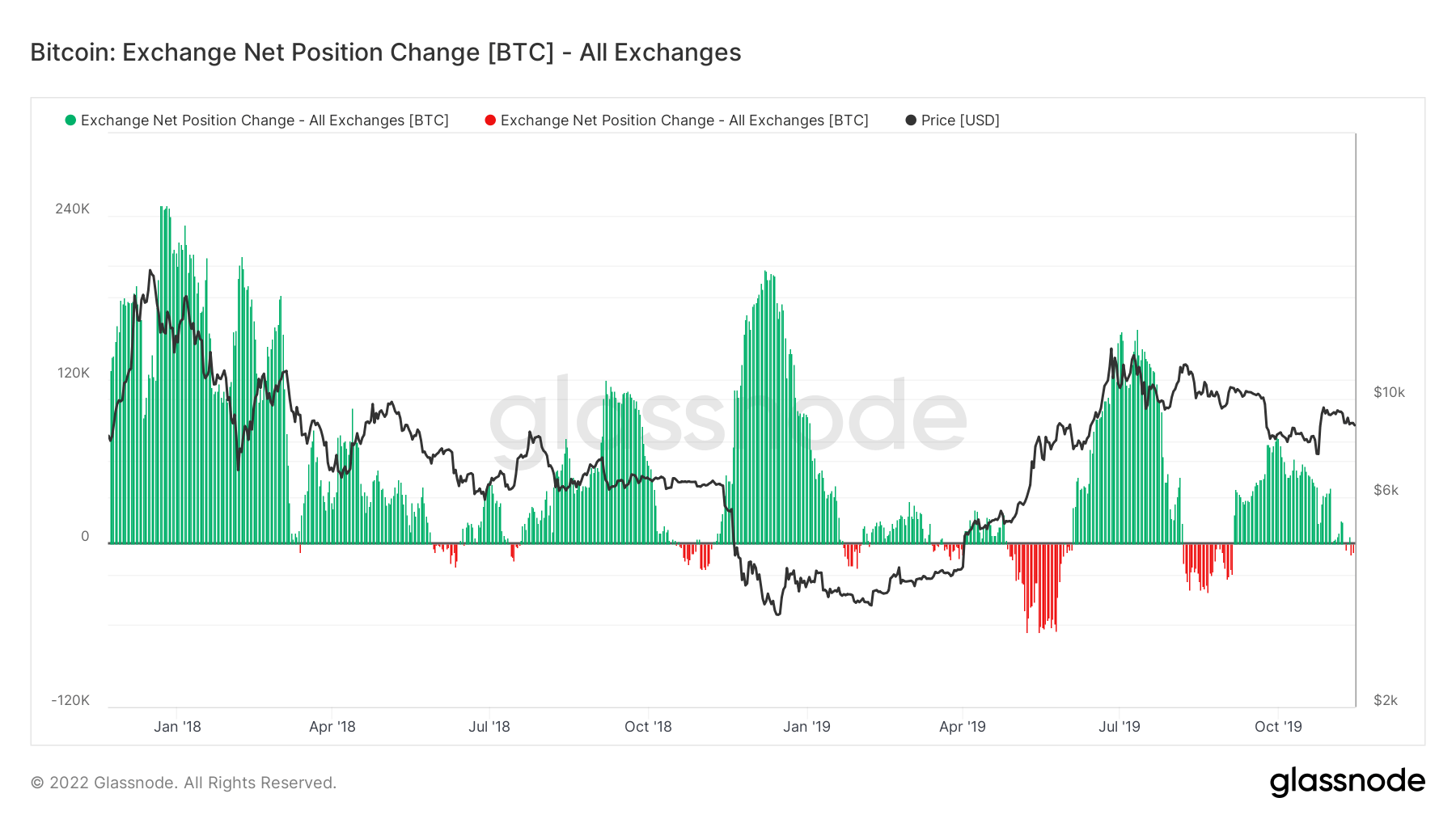

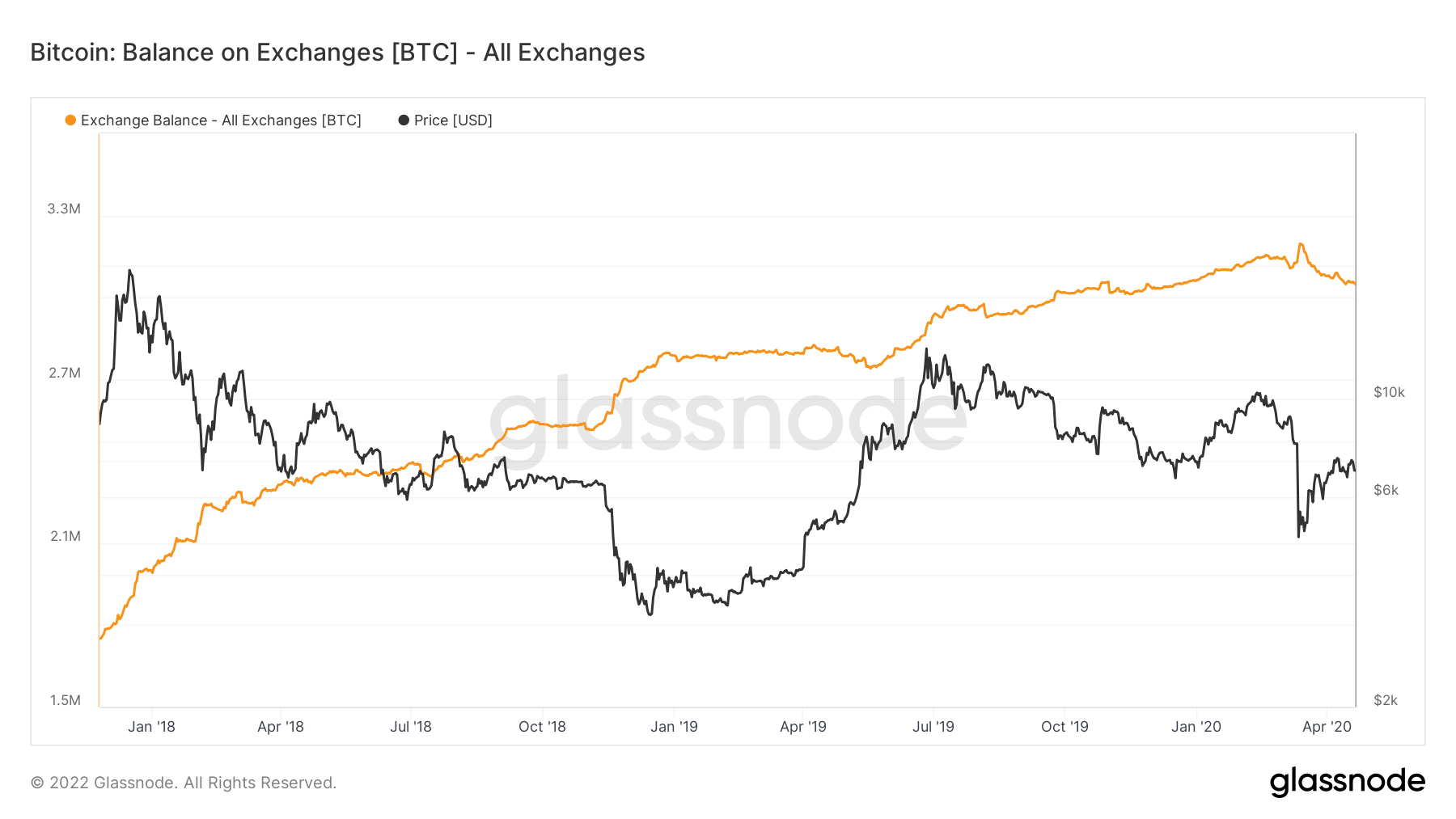

Exchange BTC Balance 2018-2019

Following the peak of the bull market in December 2017, the price of Bitcoin (BTC) dipped below $10,000, leading to a massive influx of BTC on exchanges from January 2018 to Q4 2019.

Starting with around 1.7 million BTC on the exchange in January 2018, by the end of 2019, the exchange held an estimated 3 million BTC.

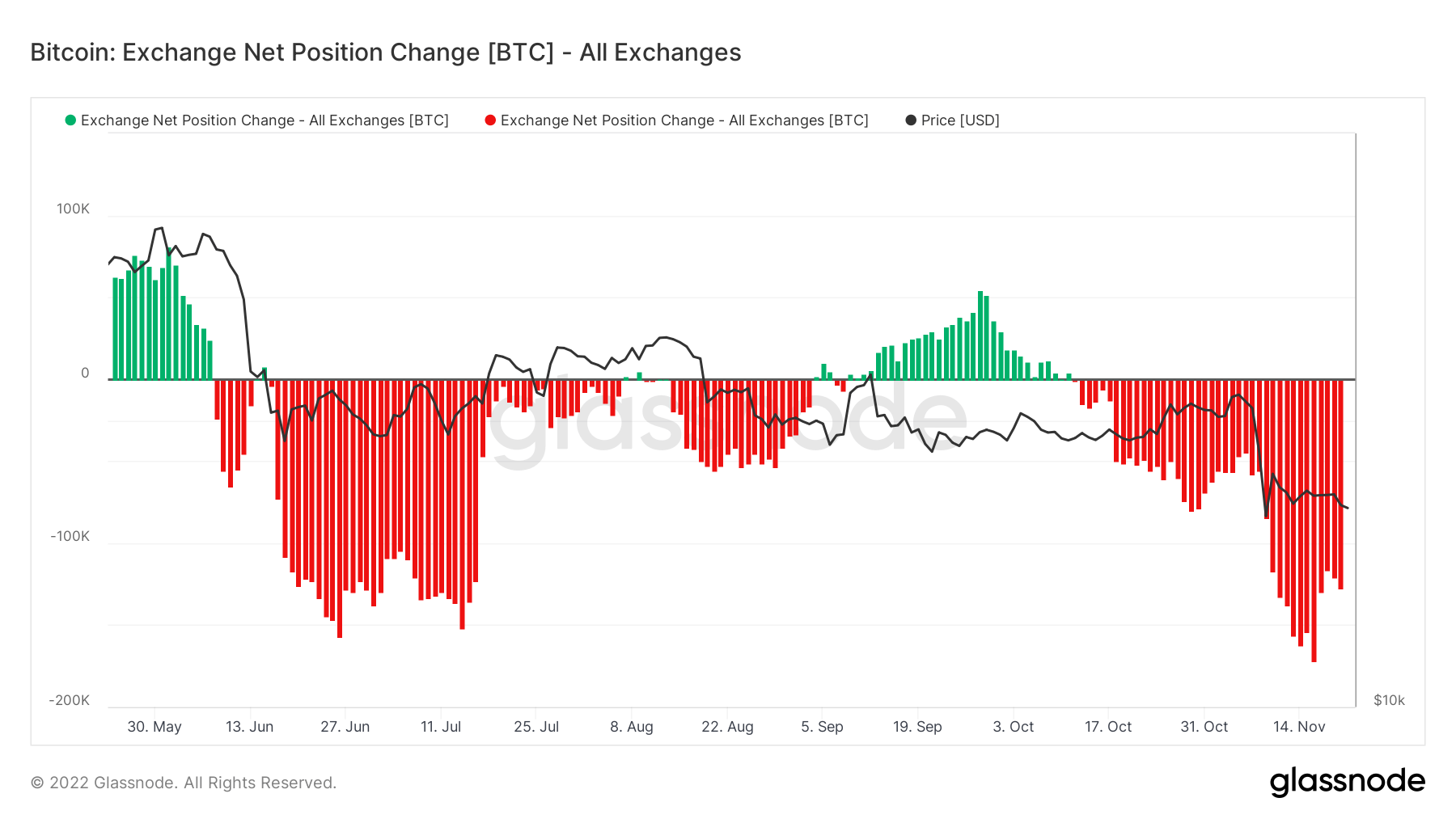

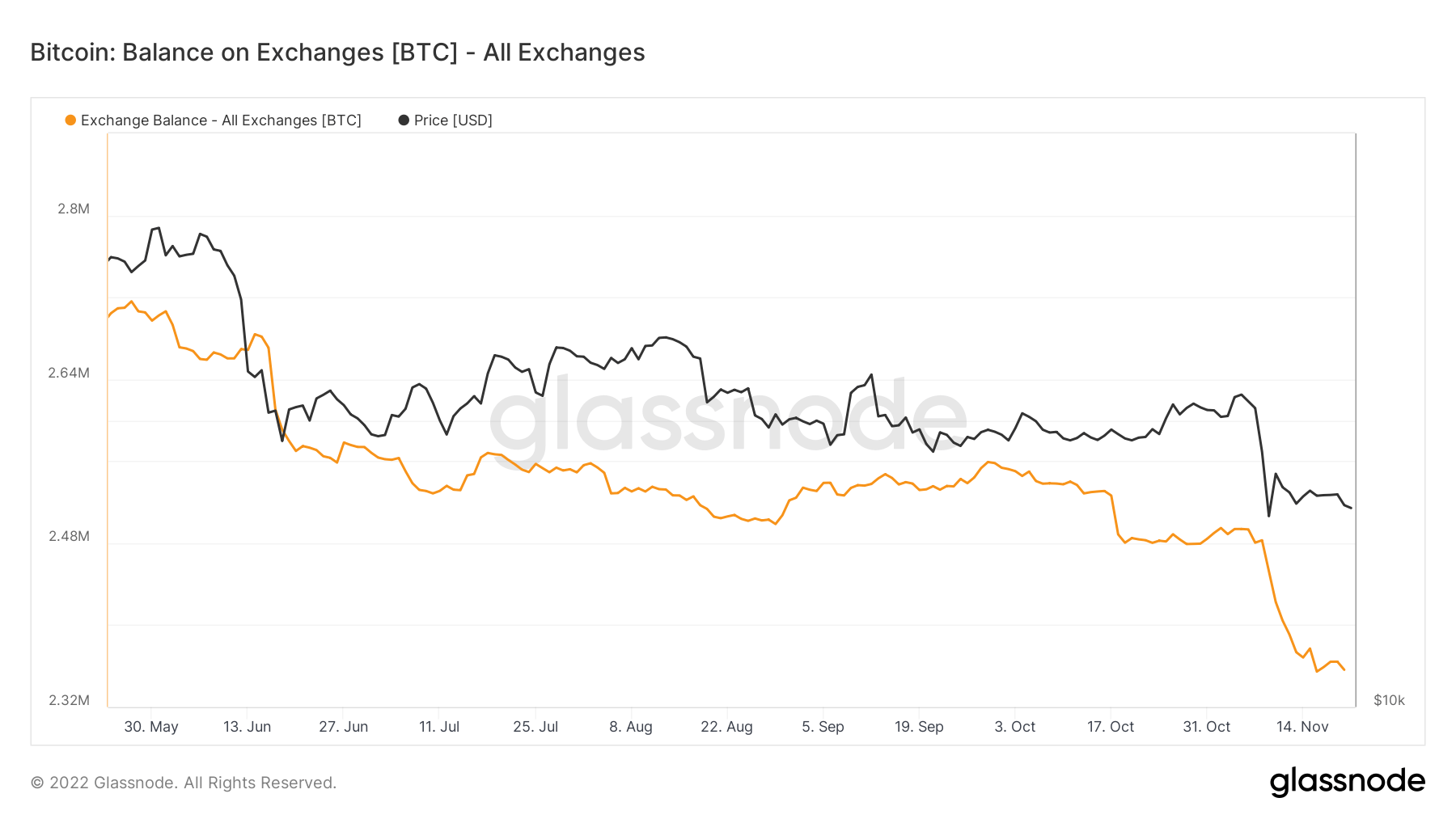

Exchange BTC Balance 2022

Unlike its 2018 predecessor, the 2022 bear market marks a completely different animal. By 2022, unprecedented amounts of BTC have left hundreds of thousands of exchanges at once.

A total of around 300,000 BTC began leaving the exchange from the beginning of June 2022, prior to the aftermath of the FTX collapse. After the collapse, his increasing trend of removing BTC from exchanges only accelerated following the mantra “not your key, not your key”. The coin has settled.

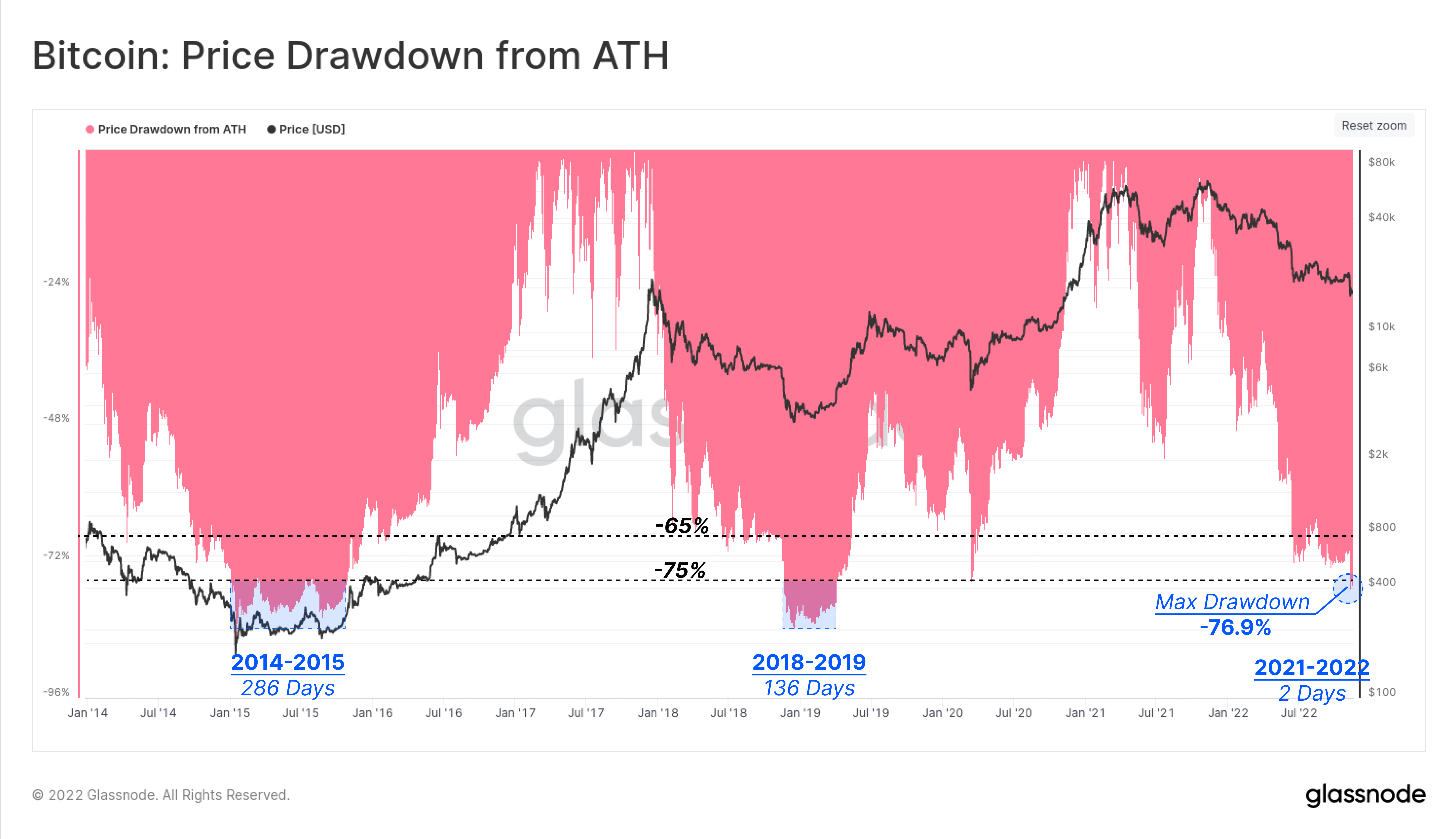

The peak of the bear market in 2018 lasted about 136 days and saw BTC price drop more than 80% from its all-time high (ATH). Compared to his current BTC price (down about 76% from all-time highs (ATH) over the past few days), chart patterns suggest that the 2022 bear market peak may be here.

Introduction of derivatives

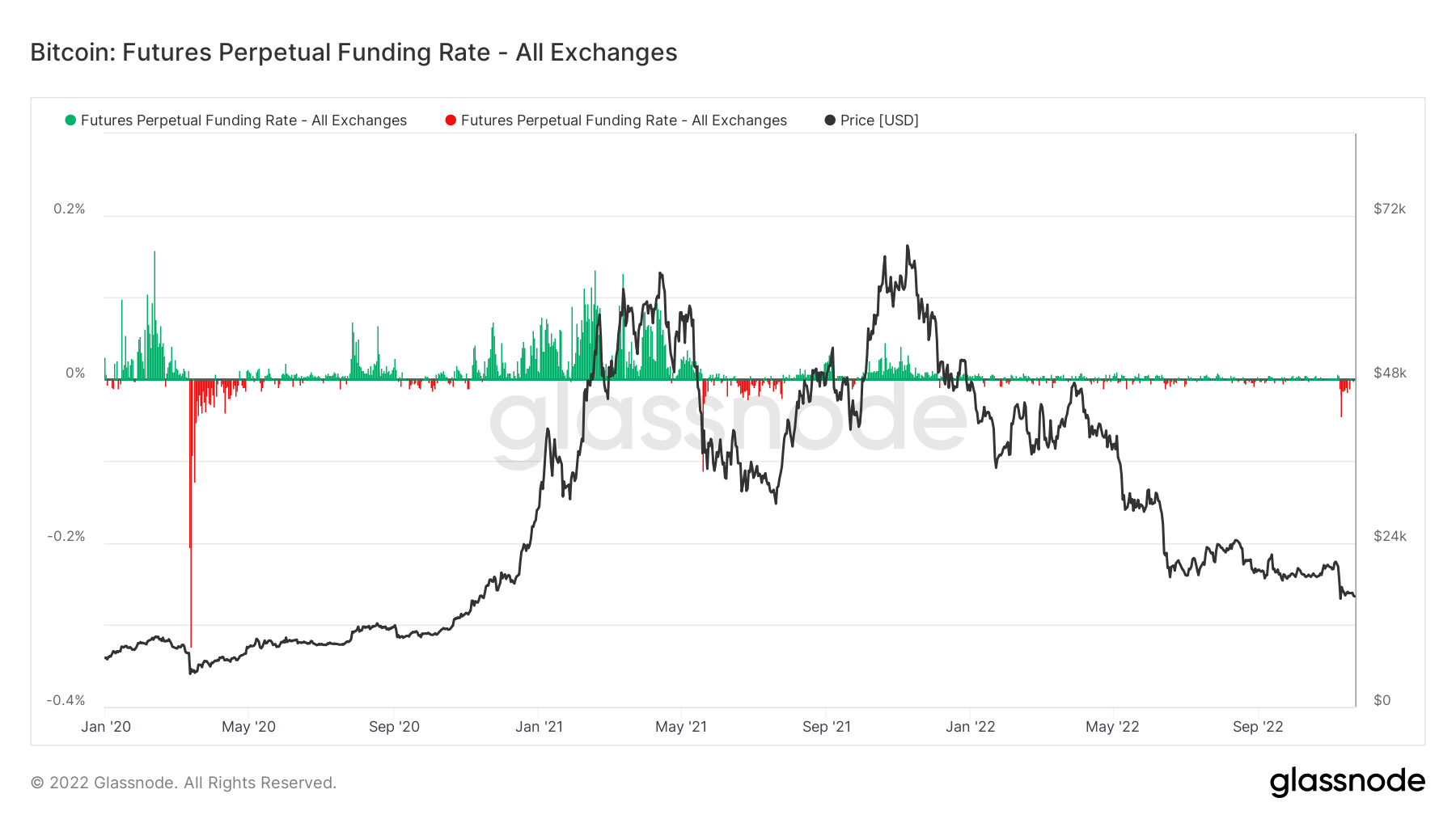

The big difference between the 2018 bear market and 2022 is the introduction of derivatives into the cryptocurrency market.

Derivatives have been a fundamental aspect of the crypto market since the introduction of futures and options in 2021, making up a huge amount of the crypto ecosystem.$2.5 trillion built on derivatives The global banking system is a testament to the sheer scale derivatives have to play in the cryptocurrency ecosystem and the potential and impact they bring.

When analyzing previous bear markets, Cryptoslate found that there is a bottom when shorts become very aggressive and BTC price does not fall further. This has been seen in previous bear market troughs, the impact of the Covid-19 pandemic, the summer 2021 Chinese crypto ban, the Luna crash, and the current collapse of FTX.