Crypto entrepreneur Jeff Huang allegedly stole 22,000 ETH, ran over 10 failed projects

Jeffrey Fan, a technology entrepreneur and former musician and one of the largest owners of the Bored Ape Yacht Club NFT, is alleged to have seized 22,000 Ethereum (ETH) from financial management services firm Formosa Financial in 2018. increase. Recent exposition According to TwittersleuthZachXBT.

A Taiwanese-American businessman known for the online monica “Machi Big Brother” is said to have spent the next four years running “more than 10 failed pumps and dump tokens and NFT projects.” This article also sheds light on his history in crypto space, the projects and people he is involved with, and evidence that proves dubious transactions.

22,000 ETH embezzled and over 10 projects failed: The story of Machi Big Brother (Jeff Huang)https://t.co/eAzV9vkoRb

— ZachXBT (@zachxbt) June 16, 2022

Huang initially gained fame in the 90’s as a founding member of a pop / rap band named LA Boyz. After that, he established the hip-hop group “Machi” and the record label “Machi Entertainment” in 2003.

According to the article, Huang got off to a start in the music industry, but moved into the tech field when he founded 17 Media (M17), one of Asia’s most popular livestreaming apps, in 2015. did.

Mithril-Project # 1

Huang announced in 2017 Mithril (MITH), His first in a long list of failed crypto projects. Mithril was a decentralized social media site that rewards users with native MITH tokens.

The project raised 60kETH ($ 51.6 million) in February 2018, with 30% of the supply sold for private sale. These tokens are either locked or for some time 70% until the token generation event (TGE) and the rest unlocked in the next 3 months.

MITH is listed Bithumb In April 2018 and just one month later, Private Sale Tokens were fully vested and investors were able to cash out. These tokens accounted for 89% of the circulating supply and caused great selling pressure.

Formosa-Project # 2

Formosa Financial (FMF) Is a financial management platform for blockchain companies. An angel investment round raised 22,000 ETH, followed by a private round with an additional 22,000 ETH. Investors included Binance, Block One, Mithril / Jeffrey Huang and others. The selling point for investors was the “fast track” listed on top-tier centralized exchanges.

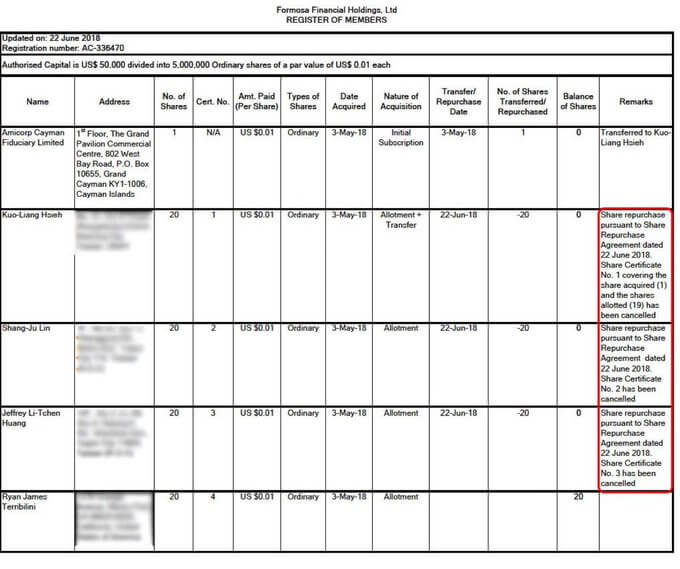

Trading started on IDEX in 2018 and the price has dropped. Then, on June 22, 2018, two withdrawals of 11,000 ETH were made from Formosa Financial’s financial wallet (22,000 ETH total), involving co-founder George Hsieh. Huang and co-founders abandoned their role, George Hsieh moved 10.5k ETH to Binance, and Huang later made gradual deposits in various Binance accounts and wallets. Multiple transfers and withdrawals were made with Jeff involved via on-chain data.

ZachXBT told CryptoSlate that June 22, 2018, was the same day that Huang and Hsieh sold their shares in the company.

This article also includes a SoundCloud audio clip from Formosa Financial co-founder Ryan Terribilini giving his version of what happened to the fund on June 22, 2018.

In the voice, Teribirini can be heard at 0:37 saying, “I didn’t receive the money. George and Jeffrey did.” Teribirini became CEO of Formosa Financial after being charged with embezzlement.

“Since I became the company’s board and chief executive officer, no ETH has been lost, so I’m actually responsible for what George and Jeff promoted on their side. I think there is, “says Ryan. He kept saying.

Terribilini is currently working with Algorand (ALGO), and Formosa Financial seems to be the only Machi Big Brother project he was involved in.

Machi X – Project # 3

Jeff Huang and Leo Cheng launched MachiX in October 2018. This is a social marketplace for intellectual property rights. However, due to Huang’s previous project, the Mithril and Formosa incidents, they struggled to get funding. Almost a year later, Formosa investors were notified by email about the embezzlement of 22,000 ETH.

Cream Finance-Project # 4

In 2020, Jeff and Leochen will join Cream Finance (cream), Compound Finance fork (COMP). Over $ 192 million was stolen from the project via exploits.

Wife’s Finances – Project # 5

My wife’s finances diverge from the Year Finance (YFI) And was founded by an “anonymous” team. Machi, Leo Cheng and Wilson Huang are the first members of the project’s Discord channel. Transaction records show that the Wifey deployer has sent multiple remittances to Wilson Huang. Four days later, Wifey Finance was abandoned.

Swag Finance-Project # 6

In October 2020, the adult entertainment website Swag.live was launched. When Cream Finance quietly listed with Swag as collateral, the lack of information about the list caused a lot of backlash on Crypto Twitter. All tokens were farmed, dumped and removed from Cream within a few weeks.

Mith Cash – Project # 7

December 30, 2020, Miss Cash, a fork of Basis Cash (BACThe Protocol (Algorithm Stablecoin) was launched by an “anonymous” team with Huang as an advisor. Mith Cash has grown to $ 1 billion in TVL just days after its release, but crashed violently as token holders cashed out their rewards.

Typhoon Cash-Project # 8

Typhoon Cash is Tornado Cash (Torn). The project had an anonymous team, but it was believed that Huang and his associates were behind it. The project was abandoned just a few weeks after the protocol began farming.

Mad Game – Project # 9

Huang has launched another popular loot-based game fork, the Heroes of Evermore. The project has an anonymous team with a profit of over 533.92 ETH. Team members secretly created the rarest NFTs.

Squid DAO – Project # 10

Squid DAO by the “anonymous” team Olympus DAO (Ohm) Huang is the first few owners (via his alias MachiBigBrother.eth). Huang closed the project in January this year.

The article states that Jeffrey Fan is currently involved in more projects such as X Finance, XY Finance, and Ape Finance. His blog post pointed to common themes of anonymous teams, forked projects, wallets funded through FTX, and short project lifecycles. ZACHXBT concludes the article by contacting Huang, who denied the post’s allegations.

CryptoSlate also contacted Jeffrey Huang to clarify the allegations, but he did not respond at the time of writing.