Crypto hedge funds are bullish on Bitcoin and knee-deep in DeFi

Volatility, which has become synonymous with the cryptocurrency industry, has not discouraged institutions from joining it, as hedge funds investing in cryptocurrencies are the best ever. PwC 2022 Global Cryptographic Hedge Fund Report..

The annual report examines both traditional hedge funds and specialist crypto funds to better understand how the relatively new but highly dynamic sector of the industry works.

Rapid increase in the number of crypto hedge funds

According to a PwC study, there are currently over 300 cryptocurrency-focused hedge funds on the market. Some may attribute this growth to the maturity of the crypto industry, but the data in the report show that the launch of a new crypto hedge fund appears to correlate with Bitcoin (BTC) prices. Suggests.

According to the data, a number of funds were launched in 2018, 2020 and 2021, which was a very bullish year for Bitcoin, but much milder activity in the less bullish years. I did.

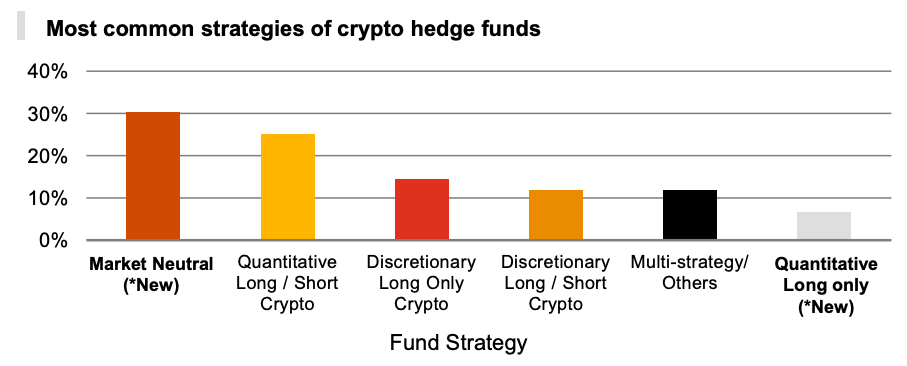

However, most new crypto hedge funds typically employ investment strategies that do not rely on rising markets. In a survey of more than 70 crypto hedge funds, PwC found that nearly one-third of them adopted a market-neutral investment strategy. These funds aim to make a profit regardless of market direction and typically use derivatives to mitigate risk and gain more specific exposure to the underlying asset.

The second most popular trading strategies are quantitative long and short strategies, where funds take both long and short positions based on a quantitative approach. Market making, arbitrage, and low lag trading are the most common strategies used. Despite being popular among hedge funds and offering good returns, these strategies limit funds to trading only more liquid cryptocurrencies.

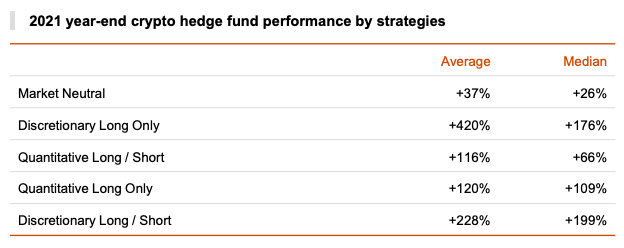

On a median basis, funds with discretionary long and short strategies performed best. According to PwC data, these funds had a median return of 199% in 2021. Looking at average returns, any long fund shows the best performance, with a return of 420% in 2021. Market-neutral funds have fallen significantly below the funds in other strategies. , The average return is only 37%.

PwC said the returns shown by any long and short funds were the best strategies for the market at the time, as Bitcoin returns peaked at 131% last year. I am.

However, with a median performance of 63.4% in 2021, PwC’s hedge fund sample was able to slightly exceed the price of Bitcoin, which rose about 60% throughout the year. Also, different strategies have different levels of performance, but all 2021 strategies have lower performance compared to 2020.

“The bull market in 2021 did not bring the same level of profits as in 2020, and BTC increased by only 60% from about 305% in the previous year.”

PwC said that hedge fund value propositions are not limited to returns. What they provide to investors is protection against volatility, and the data in the report do not show whether the strategy was able to offer high or low volatility in return for cryptocurrencies. Hedge funds with low volatility can be more attractive to investors, even with low returns.

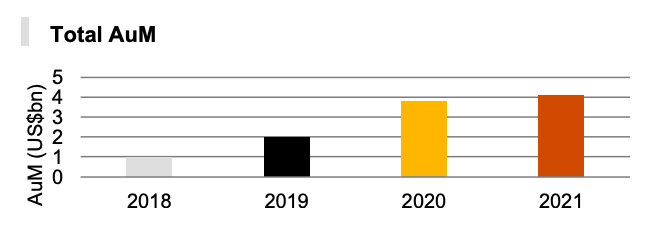

Increasing assets under management

Last year’s poor performance and high market volatility certainly did not affect the amount investors invest in hedge funds.

The report estimates that crypto hedge fund total assets under management (AuM) will increase by 8% in 2021 to approximately $ 4.1 billion. The median value of AuM for crypto hedge funds tripled from the previous year to $ 24.5 million in 2021, while the average AuM increased from $ 23.5 million in 2020 to $ 58.6 million in 2021. ..

Managing all these assets comes at a cost. Like traditional hedge funds, crypto funds charge investors 2% control and 20% performance fees.

“Cryptographic hedge fund managers are expected to charge higher fees due to less product savvy and increased operational complexity such as wallet opening and management. This will bring individual investors to the market. It’s harder to access, but it doesn’t seem to be the case. It was. “

PwC expects crypto funds to bear higher costs as the entire crypto market develops. As regulatory agencies around the world demand higher security and compliance standards, crypto hedge funds need to raise management fees to maintain profitability.

However, as more money and other institutions begin to enter the crypto space, the 20% success fee may continue to be low over the next few years. The average performance fee decreased from 22.5% to 21.6% in 2021. This shows that more new funds are entering this space and they are starting to compete to attract new clients.

One of the methods crypto funds may use to attract customers is to offer a diverse investment portfolio. Eighty-six percent of the funds said they invested in “stores of valuable cryptocurrencies” such as Bitcoin, while 78% said they invested in DeFi.

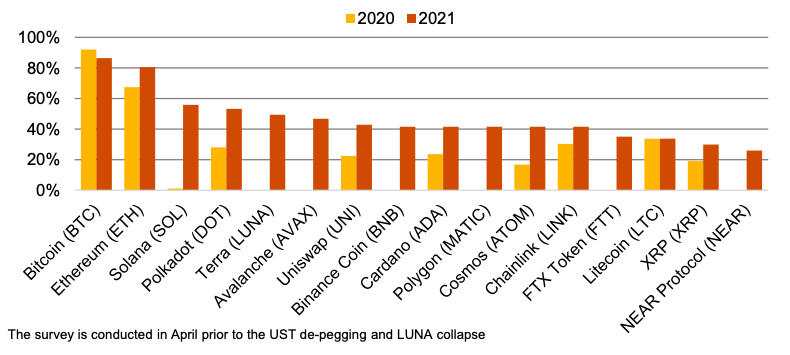

Less than one-third of funds state that half of their daily trading volume is BTC. Compared to 56% last year, it shows that the fund is rapidly diversifying into altcoin. After BTC and Ethereum (ETH), the top five altcoin crypto hedge funds traded were Solana (SOL), Polkadot (DOT), Terra (LUNA), Avalanche (AVAX), and Uniswap (UNI).

Since the PwC survey was conducted in April before these events took place, it is still unclear how the TerraUSD (UST) de-pegging and subsequent LUNA collapse affected these funds. The company believes that capital inflows into the crypto market will slow for the rest of the year as investors become more cautious.

“Many funds haven’t posted May 2022 returns yet, and it’s only after these are announced that we’ll be able to determine the impact of the collapse of Terra and the broader recession of the crypto market. Some funds are expected to have a bearish outlook already, or have been able to better coordinate and identify issues in Terra, manage their exposure and take short positions during this period. There is no reason to believe that the market has recovered before and will not recover again, “PwC Global Financial Services Leader John Garvey told CryptoSlate.

PwC believes that attention extends to Stablecoin. In addition to altcoin, stablecoin is also gaining significant popularity among hedge funds. The two largest stablecoins in terms of usage are USDC and USDT, which are used by 73% and 63% of funds, respectively. Just under one-third of crypto funds reported using TerraUSD (UST) in the first quarter of this year.

“Although the market capitalization of USDT is almost double that of USDC, hedge funds seem to prefer to use USDC, which we believe is due to the increased transparency that USDC provides with respect to the assets that support Stablecoin. “

The increase in stablecoin usage can be explained by a similar increase in decentralized exchange usage. According to a PwC report, 41% of crypto funds use DEX. It seems that people who are working on DeFi are flocking to Uniswap, as the data show that 20% of the funds are using the platform as their preferred DEX.

Bullish with Bitcoin

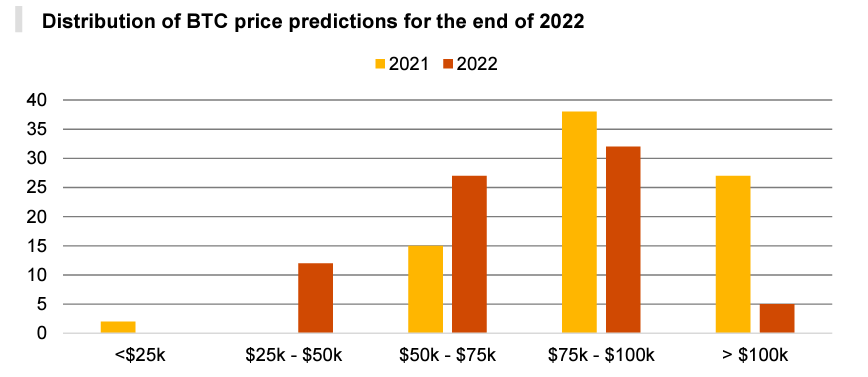

The market was fairly bearish at the time the PwC survey was conducted, but most crypto funds remained bullish on Bitcoin. When asked for an estimate of where the price of BTC will be at the end of the year, the majority (42%) put it in the range of $ 75,000 to $ 100,000. Another 35% predicted that it would range from $ 50,000 to $ 75,000.