Crypto investment products saw $17M outflows last week

According to CoinShares data, digital asset investment products registered a total of $17 million in small outflows from February 27 to March 3, marking the fourth consecutive week of outflows.

“Volume across investment products was low at $844 million per week” as sentiment in the region began to shift, the report quotes. Last week in the US he recorded a $7.6 million inflow, while in Europe he recorded $23 million worth of outflows.

Blockchain stock investors also showed bullish sentiment throughout the week, recording $1.6 million worth of inflows.

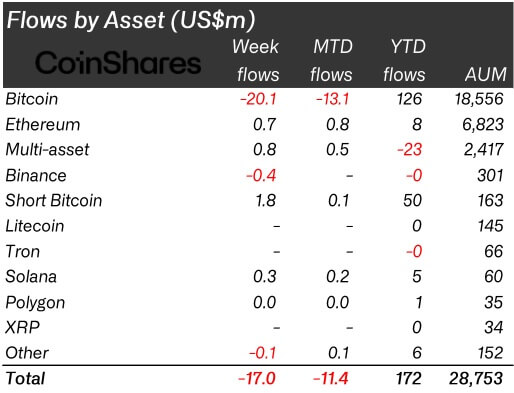

Flow by asset

Bitcoin (BTC)-based investment products recorded $20.1 million worth of outflows, while short bitcoins recorded a total inflow of $1.8 million. data clearly.

According to the data, Binance (BNB) and Cosmos (ATOM) also recorded $380,000 and $210,000 worth of outflows respectively.

On the other hand, most altcoins flowed in the same week. Ethereum (ETH) and Solana (SOL) based investment products recorded inflows of $700,000 and his $300,000 respectively. Multi-asset products also increased an additional $800,000.

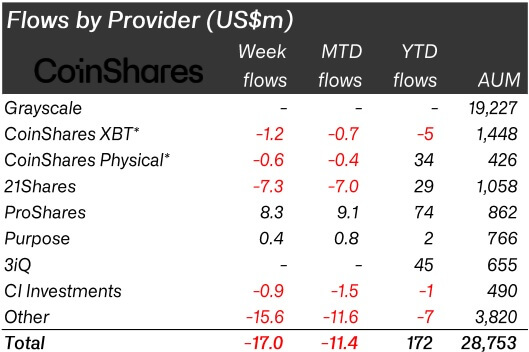

Flow by provider

The report also revealed that despite the positive sentiment experienced by altcoins, the majority of providers have recorded outflows.

All significant providers, except ProShares and Purpose, recorded outflows during the week of February 26th to March 3rd. CoinShares XBT and Physical saw a combined outflow of $1.8 million.

21Shares, CI Investments, and others posted $7.3 million, $0.9 million, and $15.6 million, respectively. Meanwhile, ProShares and Purpose increased by an additional $8.3 million and $400,000 respectively.