Crypto markets are booming after historic XRP ruling; BTC and ETH both break critical barriers at 31k and 2k

After Ripple’s victory over securities regulators on July 13, Bitcoin and other cryptocurrency markets saw a significant rally.

As of 8:30 p.m. UTC, Bitcoin (BTC) rose 4.3% in 24 hours to reach a market cap of $31,594.31 and a market cap of $613.8 billion. The change represents a more than one-year high, as the asset has not seen price pars since June 2022.

Meanwhile, Ethereum (ETH) rose 6.9% in 24 hours to a market cap of $239.8 billion. Its price briefly exceeded $2,000.

Those gains were likely affected by the outcome of the lawsuit between Ripple and the US Securities and Exchange Commission, which ruled that Ripple’s XRP sales were not securities. XRP itself surged 73% in 24 hours to reach a market cap of $42.6 billion, making it the fourth largest cryptocurrency currently.

At least two major cryptocurrency exchanges, Coinbase and Gemini, have also announced that they will reintroduce XRP listings following Ripple’s legal victory. These decisions could further support the price of the XRP token.

The three coins named in unrelated SEC lawsuits against Coinbase and Binance are also among the top gainers today. Cardano (ADA) rose 19.5%, Solana (SOL) rose 17.3% and Polygon (MATIC) rose 17.8%. These gains are likely due to the more general optimism that cryptocurrency companies can win lawsuits against regulators.

Various other assets are also profitable. Stellar (XLM), which has been associated with Ripple since its early days but is otherwise an independent project, posted a 62.4% rise. The overall cryptocurrency market rose 6.5% in 24 hours, reaching a market cap of $1.3 trillion.

Liquidation amount reaches $236 million

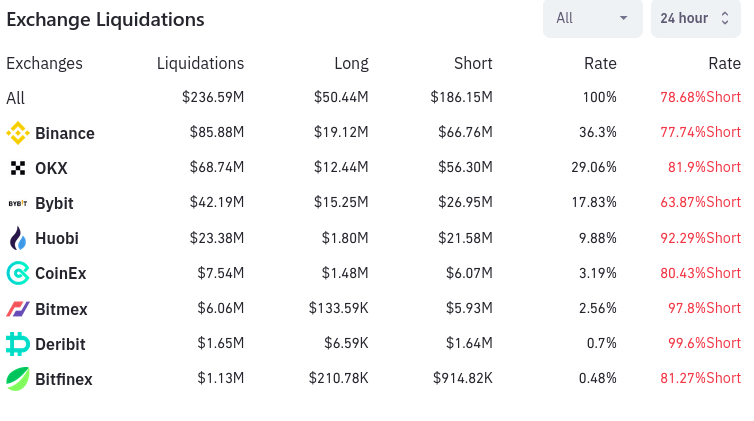

Meanwhile, the cryptocurrency market cleared $238.37 million in 24 hours. This total includes $52.01 million of long-term liquidations and $186.36 million of short-term liquidations. A total of about 66,800 traders were liquidated.

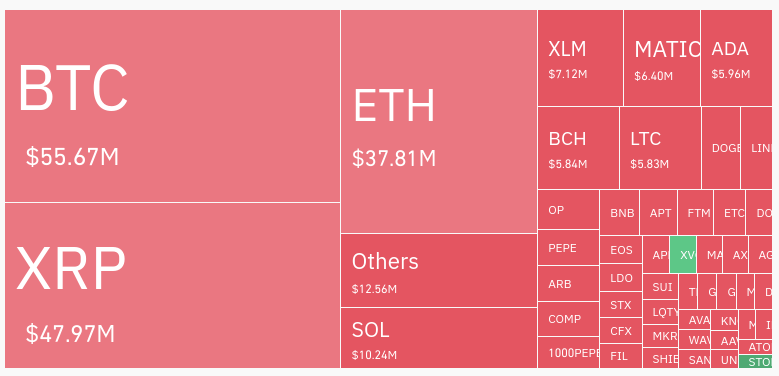

Three assets saw the most liquidations. Bitcoin saw liquidations of $55.67 million, Ethereum saw liquidations of $37.81 million, and XRP saw liquidations of $47.97 million.

Binance was responsible for liquidating $85.88 million, while OKX was similarly responsible for liquidating $68.74 million. Together, these two exchanges were responsible for about two-thirds of all liquidations across the cryptocurrency market.

Various other exchanges such as Bybit, Huobi and CoinEX took care of the rest of the liquidation, as shown below.

Today’s events represent rare positive news in the recent bear market of the cryptocurrency industry. While the far-reaching impact of the Ripple scandal is yet to be revealed, the latest developments appear to generate optimism among cryptocurrency investors.