Crypto miners dump GPUs as token prices fall

according to PC gamerCryptographic miners are increasing the number of GPUs as token prices fall during a recession.

The knock-on effect has steadily reduced the cost of graphics cards as the market flooded with availability.

When analyzing European prices Tom’s hardware Reported differences in pricing between manufacturers. AMD’s products are currently on average 8% below retail prices, while Nvidia products are still above average retail prices by 2%.

Nonetheless, gamers who have long complained about pricing from the market will welcome development.

Cryptocurrency mining is broken

With the evolution of crypto mining, the proliferation of application-specific integrated circuit (ASIC) mining, digital asset mining has been split into two different camps.

The first is a mining company with the freedom and deep pockets to move its business to where conditions such as electricity costs and regulatory support are most favorable.

Some individuals approach crypto mining as a useful hobby. Still, due to fierce competition with the first camp, it tends to be frozen from mining ASIC tokens such as Bitcoin.

At least in the past, hobby miners have been able to compete by using GPUs to mine non-ASIC tokens. The most popular is Ethereum, others Includes Monero, Ravencoin and Ethereum Classic.

However, lower hash rates suggest that enthusiasts are leaving.

Hash rate drops sharply

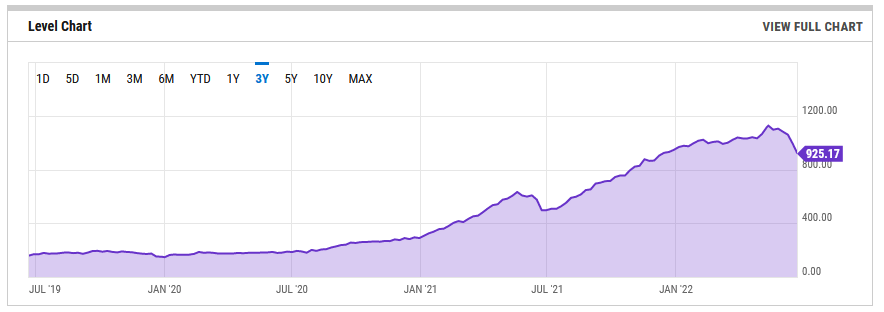

Analysis of the Ethereum hash rate shows a sharp drop to 925 TH / s. This represents an 18% drop from the all-time high of 1,127 TH / s on May 13.

The drop suggests that the miner is out of the network, for unknown reasons. For Ethereum, the transition to the Proof of Stake (PoS) consensus mechanism means that there are plans to make mining increasingly tricky and therefore unprofitable, known as difficulty bombs.

As the integration of Proof of Work (PoW) and PoS chains approaches, this becomes a source of pressure on miners. At the same time, falling token prices and rising global energy costs are also linked.

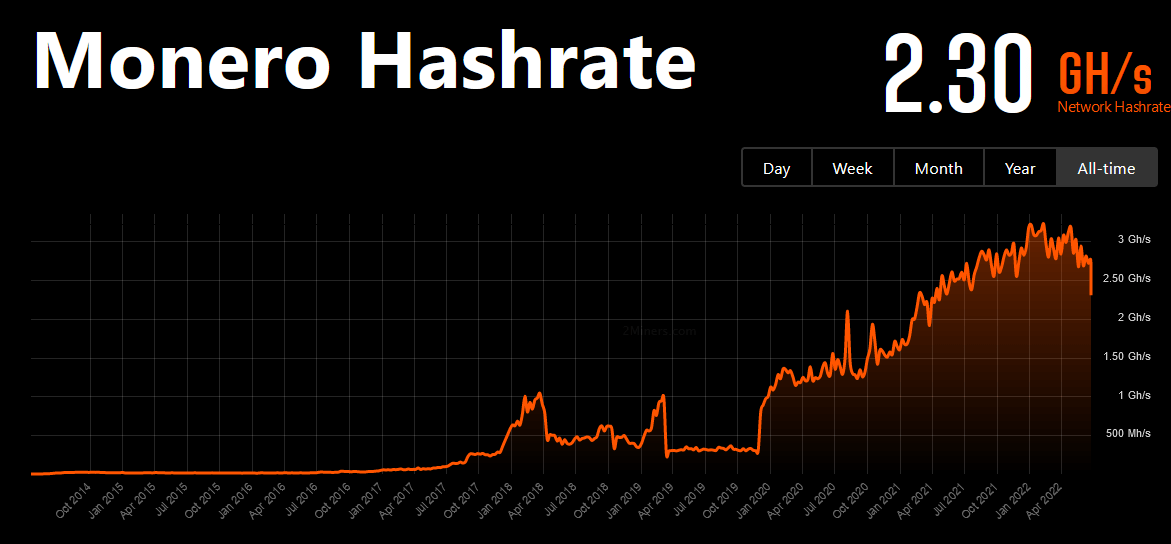

Similarly, Monero’s hash rate has dropped sharply. On February 4, Monero’s hash rate peaked at 3.22 GH / s, but has since declined by 29% to 2.30 GH / s.

Unlike Ethereum, Monero has no plans to move to PoS networks, suggesting that GPU mining spills are industry-wide and are driven primarily by profitability concerns.

Until the next bull cycle, gamers don’t have to blame GPU miners for stock shortages and price cuts.