Data on Taproot Ordinals points to higher Bitcoin fees, chain bloat

A jpeg of the taproot wizard was mined into the Bitcoin blockchain on February 1st, sparking a debate about the proper use of network resources, especially inefficiencies due to increasing block sizes.

This is made possible thanks to the Ordinals protocol, which allows jpegs, videos, and other data to be stored directly on the blockchain via Bitcoin-native digital artifacts, also known as “inscriptions.”

crypto slate Staff members Liam Wright, James Van Straten, and CommerceBlock CEO Nicholas Gregory discussed this issue on a recent episode of BitTalk, covering what this means for scaling and efficiency.

Using Glassnode data, CryptoSlate noted a recent spike in Taproot Inscriptions activity. This coincided with a surge in fees.

Bitcoin taproot adoption

of taproot A soft fork will be published in November 2021 to allow updates such as executable commands and certain new scripts. Essentially, the upgrade laid the foundation for smart contracts and dApps.

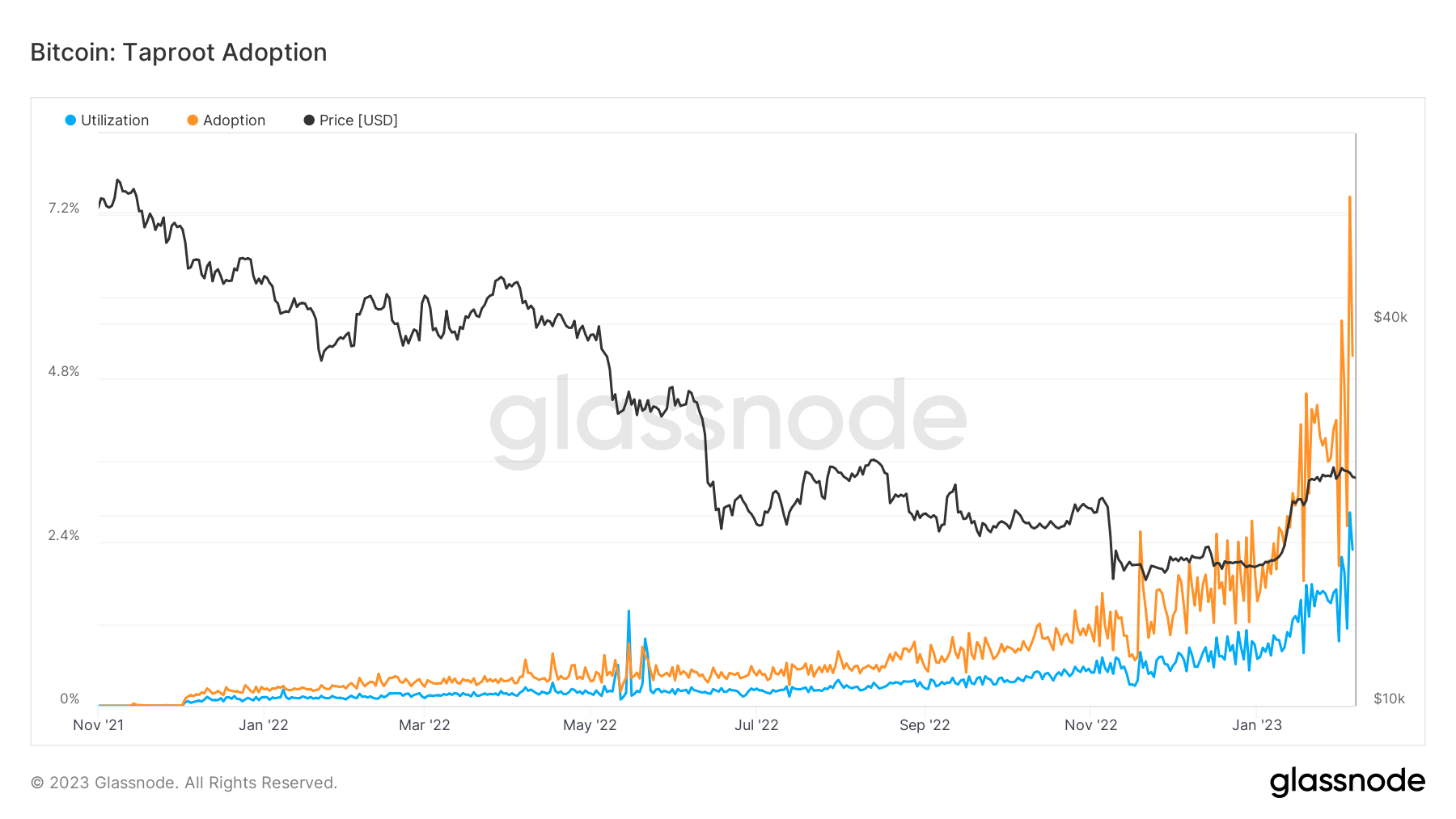

Taproot adoption refers to the number of transactions that consume at least one Taproot input relative to the total number of transactions. Together, utilization refers to the number of taproot inputs consumed relative to the total number of inputs consumed.

The chart below shows both adoption and usage increasing gradually, with an explosion around November 2022. Adoption and usage rates are hitting all-time highs at 7.5% and 2.8%, respectively.

Output spent

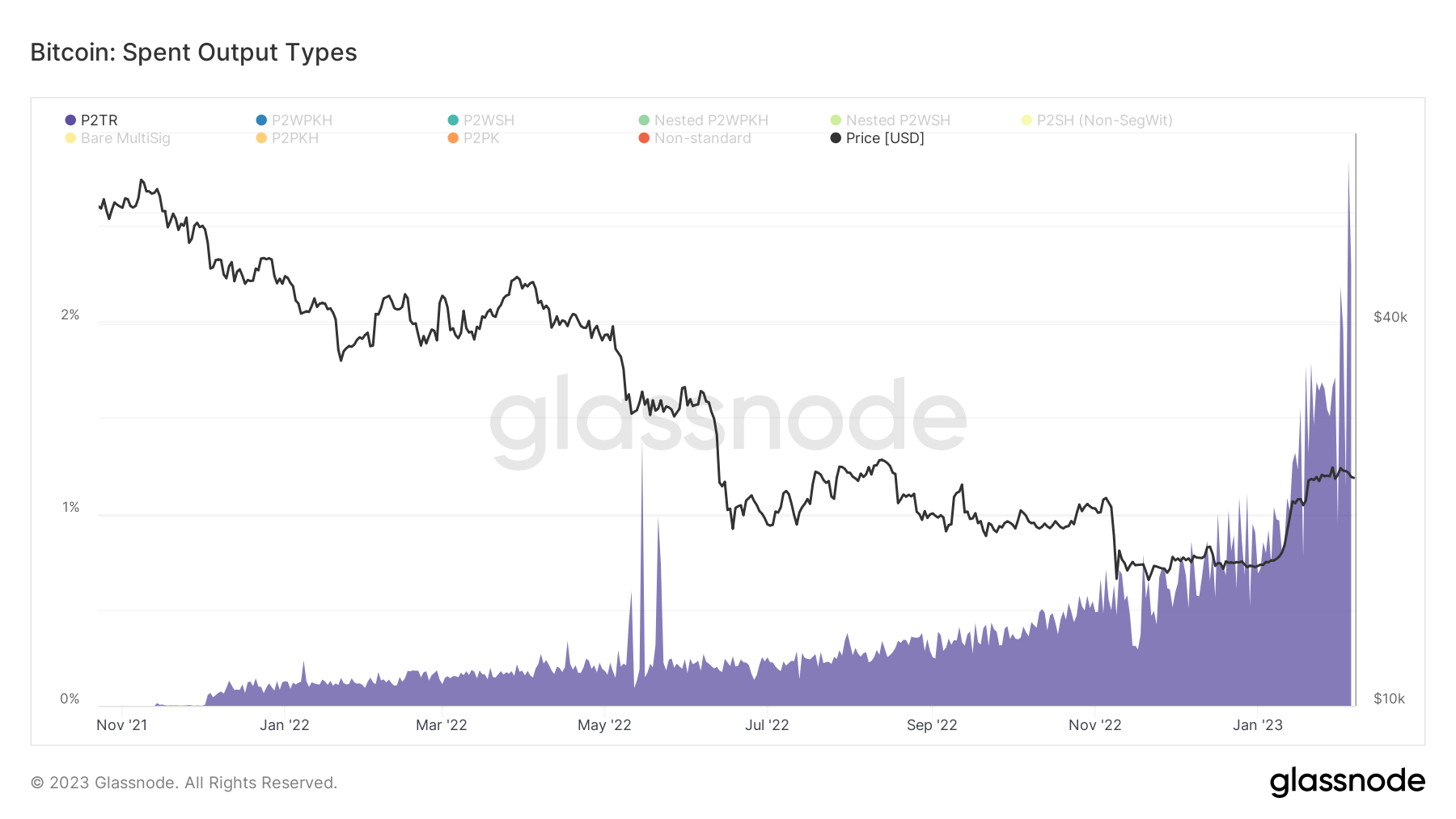

Unspent transaction output (UTXO) refers to the amount of digital currency remaining after a transaction. A type of accounting that tracks who owns what.

Following the Taproot soft fork, a new type of used output was introduced – P2TR (Pay Taproot) You can think of this as a new scripting method that handles sending Bitcoins via either Schnorr signatures or Merkelized Alternative Script Treesroot (MAST.).

The graph below shows the gradual increase in P2TR output since P2TR was introduced in November 2021. Activity increased significantly in late January, with Taproot now consuming 2.8% of total output, compared to just 1% two weeks ago.

The recent press coverage of the Ordinals controversy may have accelerated Taproot activity on the chain. However, on-chain indicators only suggest that Taproot activity is accelerating further, leaving no answer as to where this trend will lead.

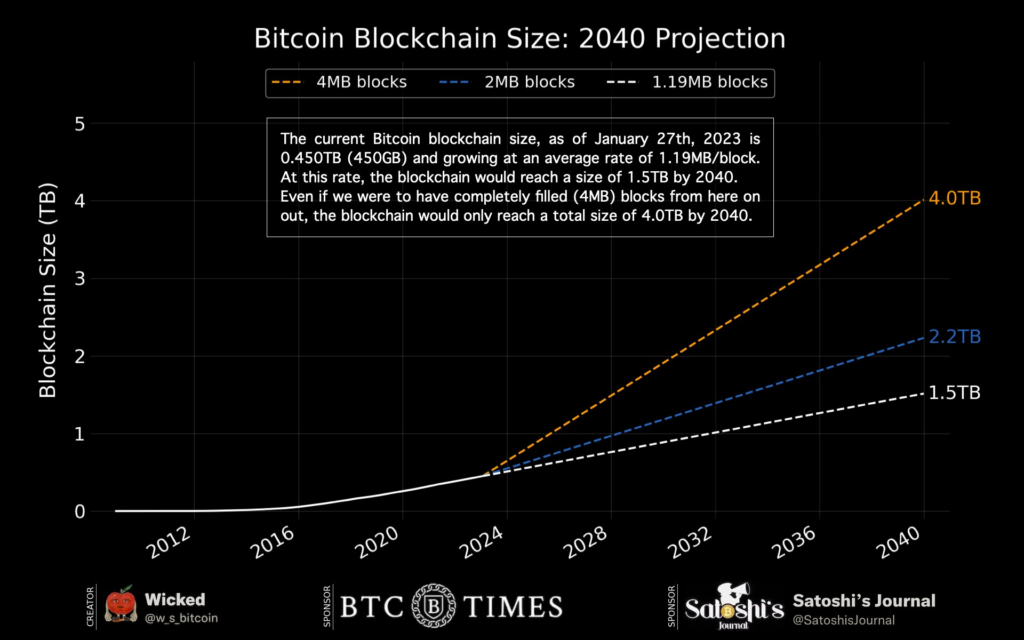

Instasize CEO, Hector Lopeznoted that the Taproot Wizard block is the largest ever, at 3.96 MB, taking up space and limiting the number of financial transactions.

Following this line of thinking, possible future scenarios could lead to increased fees, competition between financial transactions and jpegs, and even higher fees. Also, chain bloat increases as the block size increases.

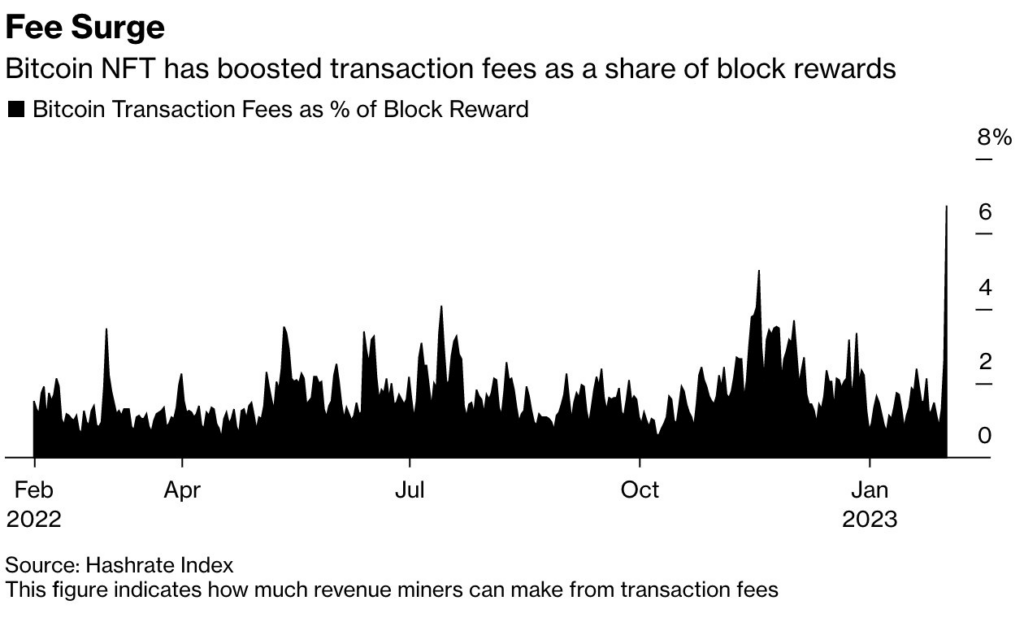

Hashrate Index data shows that Taproot activity is consistent with increasing transaction fees related to block rewards.

Furthermore, if each block in progress fully fills up to the 4 MB limit, projections will put the blockchain at 4 TB in size by 2040. This point repeats what others have said about improper use of network resources.

Regarding this issue, Gregory says a possible solution is to leave out the jpeg and node will not store that data. Anyone wishing to view the complete chain can do so via specific software designed for that purpose.

“We have to accept that all sorts of data can be put into unauthorized systems.”