Data shows Bitcoin whales are massively selling holdings

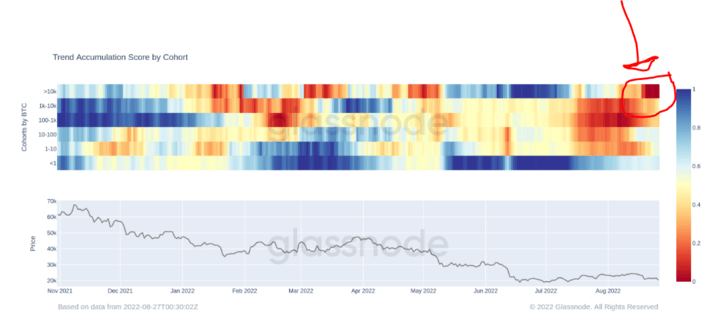

According to Glassnode data, the whale’s bitcoin (BTC) accumulation propensity score is currently flashing at zero, indicating that the whale has stopped acquiring more coins.

This data analyzes bitcoin accumulation trends from April 2020 to August 2022 and shows that bitcoin accumulation has slowed this month as whales are in deep red. .

According to available data, Bitcoin price traded between $20,000 and $25,000 in August.

A CryptoSlate investigation revealed that the whale had been accumulating coins in four different periods over the past two years.

Bitcoin whales generally refer to addresses with 1,000 or more BTC representing the primary holder.

Cumulative Propensity Score

Cumulative Propensity Score is a metric used to determine who is currently buying cryptocurrencies. It is a tool for ascertaining market sentiment, especially among different investors.

Scores are based on two factors. An entity’s participation score (total amount of tokens held by the entity) and balance change (the difference in holdings over a period of time (usually a month)).

Cumulative scores range from 0 to 1, with scores closer to 0 indicating more coin distribution and scores closer to 1 indicating more dominant holders in the network.

Shrimp accumulation slows down

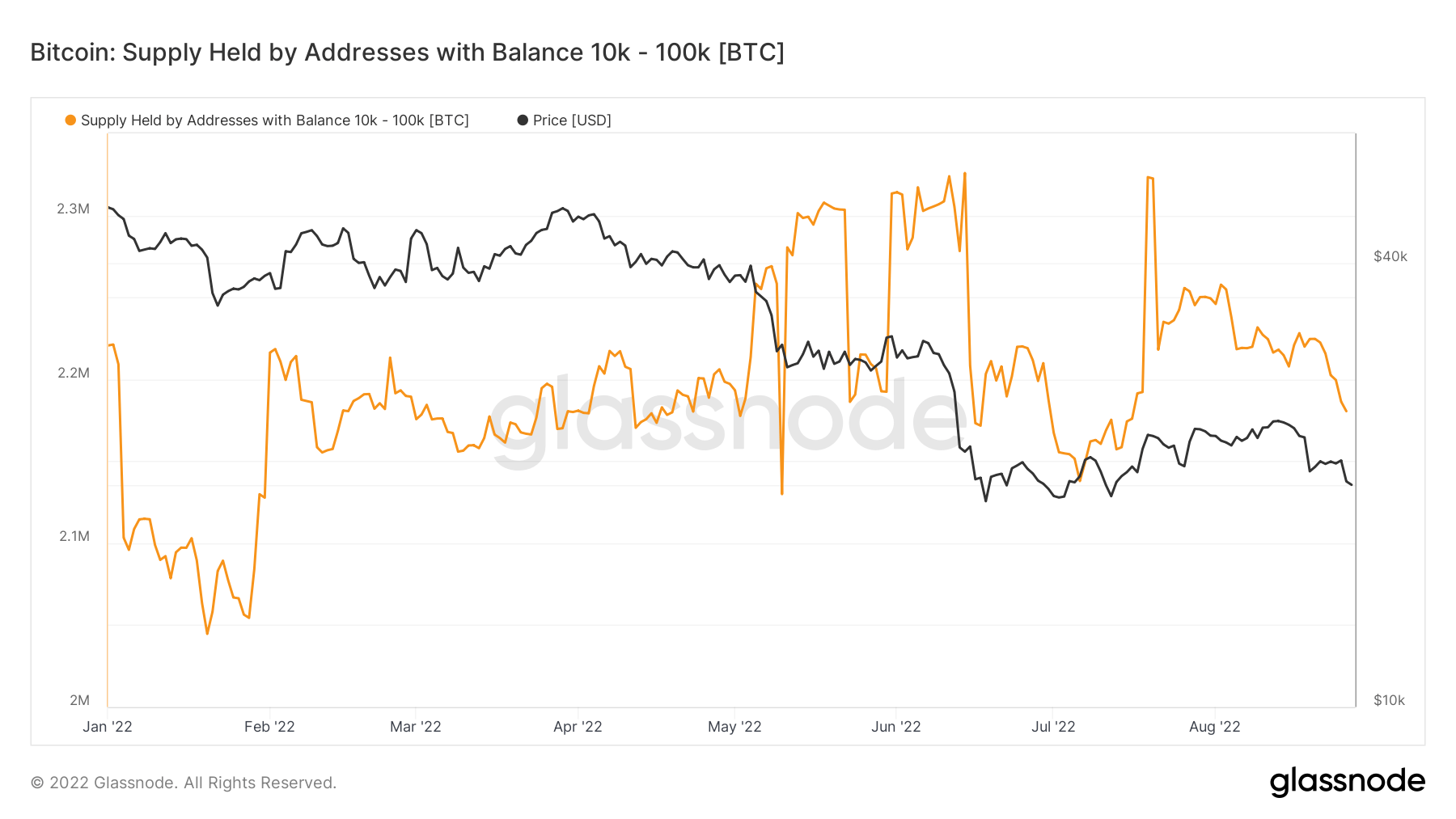

Whales stopped accumulating bitcoins and even sold their bitcoin holdings, but shrimp bitcoin accumulation is also slowing down.

Data show that bitcoin addresses have fluctuated between 2 million and 2.3 million this year, but have declined sharply since July.

Shrimp are holders of less than 1 bitcoin in their wallet.

Meanwhile, in July, Shrimp bought 60,000 BTC, the highest monthly accumulation for short-term Bitcoin holders since 2018.

Differences in how the two groups reacted to the same market conditions show how they perceive the situation.

As for whales, the current market uncertainty has forced them to sell their holdings, especially after US Federal Reserve Chairman Jerome Powell promised to inflict more “pain” on the US economy.

However, with assets struggling to break the $20,000 to $25,000 range, Shrimp sees this as an ideal entry point.