DeFiYield REKT list reveals 18% decrease in lost DeFi funds during September totaling $170M

Defi YieldDeFi investment and yield farming platform tracks exploited projects across the DeFi ecosystem through its REKT database. Since January 2022, he has tracked over $60 billion in lost or stolen funds at his 1,195 events, including Terra Luna. Ronin, Nomad, Wormhole Bridge.

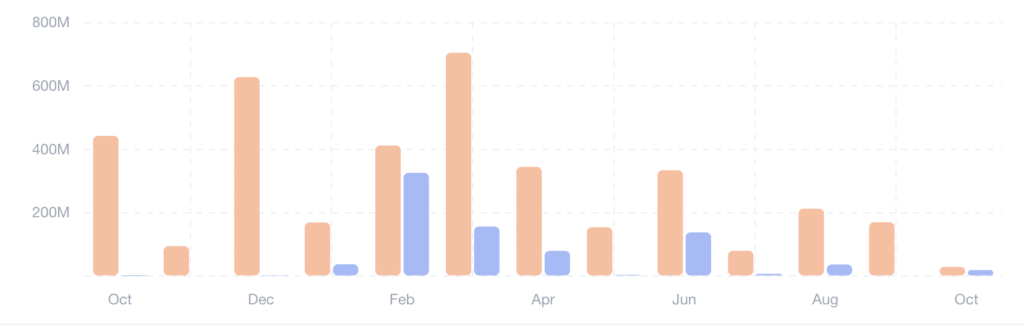

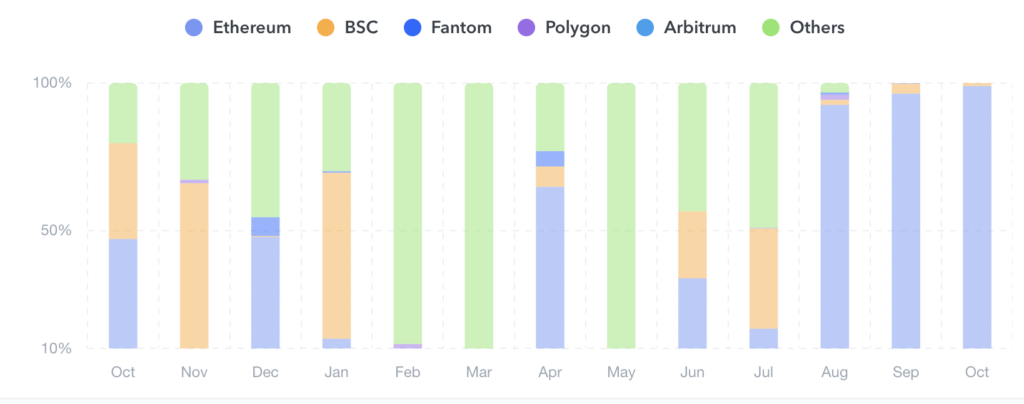

Approximately $2.4 billion was recovered during the same period, representing just under 5% of total losses. Until August, the majority of exploits occurred outside of his Ethereum ecosystem. However, since the beginning of August, over 90% of his lost funds have occurred within the Ethereum network, as shown in the chart below.

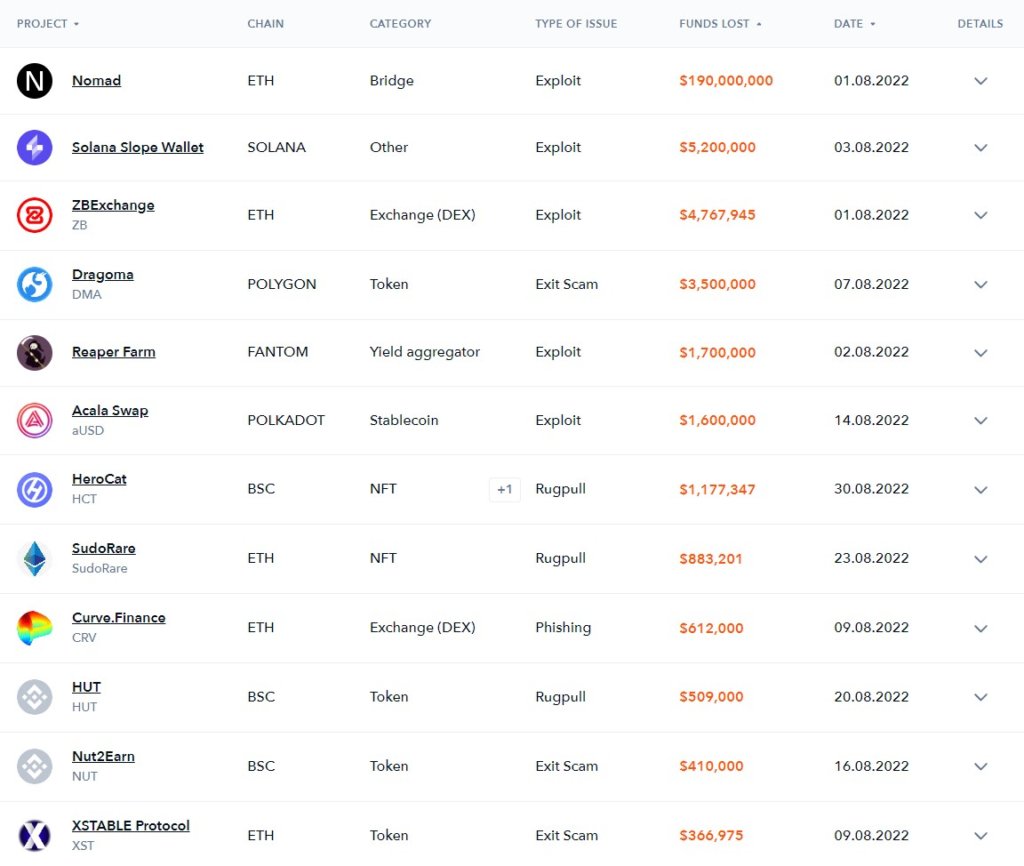

August saw a staggering loss of $212,927,092, of which the Nomad Bridge exploit accounted for $190 million. Other exploits included the Solana Slope wallet incident, ZBExchange, Reaper Farm, and Acala Swap. August’s most prominent exit scam totaled $3.5 million from Dragoma. There were also some high-value ragpulls from two of his NFT platforms, HeroCat and SudoRare.

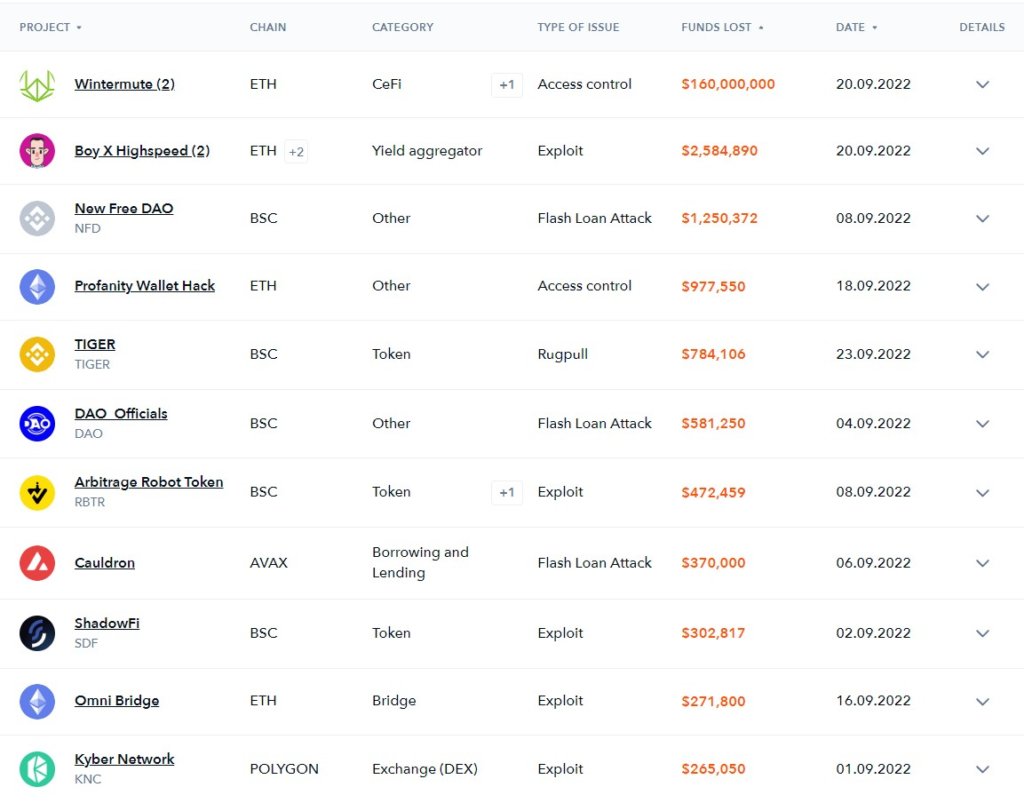

Stolen or lost funds dropped 18% in September, while $170 million was withdrawn from the DeFi ecosystem through exploits and hacks. Wintermute’s hack accounts for the bulk of his $160 million in lost funding. Another $977,550 was lost to the same profanity vanity address exploit which DefiYield categorized as an “access control” issue.

Unlike other exploits such as the Boy X Highspeed exploit which took advantage of the project’s smart contract issue, the Wintermute/Profanity exploit was due to poor account management.

Wintermute used a flawed tool to generate vanity Ethereum addresses with compromised cryptographic security, prioritizing gas price optimization over security. The Boy x Highspeed exploit was the second largest in September at $2,584,890.

September’s top 10 exploits included three flash loan attacks. New Free DAO, DAO Officials, and Cauldron were all hit with a $2,001,622 flash loan attack.

Many exploits transferred funds to Tornado Cash and interacted with sanctioned platforms, potentially tainting stolen funds. However, several significant hacks, including Wintermute, have left funds in the hands of hacker wallets.

So far in October, we lost an average of $5.9 million per day within a week. If the trend continues, October will break the downtrend.

October’s largest exploit was the Transit Swap smart contract hack, which reached $29 million. But with $18.9 million already collected, DeFi’s net loss in October was just $10.1 million.

The chart below tracks the downward trend in DeFi losses over the course of 2022. Both August and September saw nine-figure losses, but these months marked the lowest 2 on record this year. recording the month.