Economic Equilibriums and Disruptions: MacroSlate Weekly

Local Banks and the Drama of the Debt Ceiling

In a week of ups and downs, small US banks have performed well as the country faces a major funding problem known as the “debt ceiling crisis.”

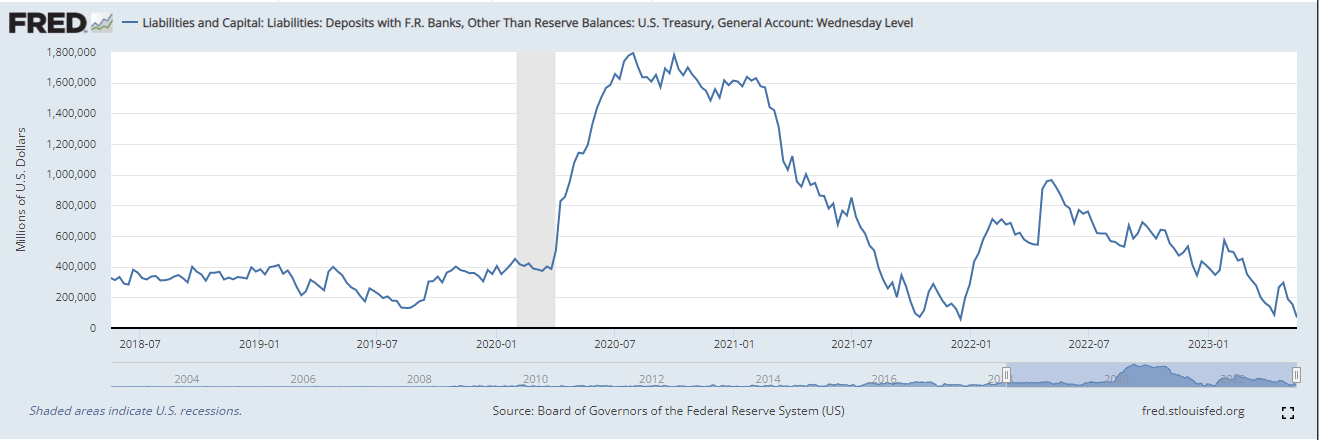

US government Fed savings were hit hard, dropping $53 billion on Monday to just $87 billion, very close to April’s pre-tax lows.

As the week went on, funds in government accounts fell by $11 billion on May 19, before dropping further to $57 billion.

But the good news is that people’s confidence in the banking sector seems to be growing for now. The popular bank-backed equity market fund (KREETF) surged more than 5.0% over the week, boosted by a $2 billion increase in deposits at Western Alliance Bank, according to Macroscope.

Japan’s inflation problem

In the midst of this, President Biden attended the G7 meeting held in Japan, and tough discussions are taking place between the leaders. They are trying to find a way to solve this money problem without putting the US government into default.

At the same time, Japan is dealing with rising inflation, which is now over 4%, the highest level in 40 years.

British central bank turmoil

Across the ocean, Bank of England (BoE) governor Bailey is trying to deal with high inflation in the UK, which means rising prices. While he remains focused on keeping inflation at 2%, he said it was an unusual time and that’s why inflation is now in the double digits.

Bailey believes inflation will fall as energy costs start to fall. Market watchers aren’t sure what to think, and expect one or two more modest rate hikes this year.

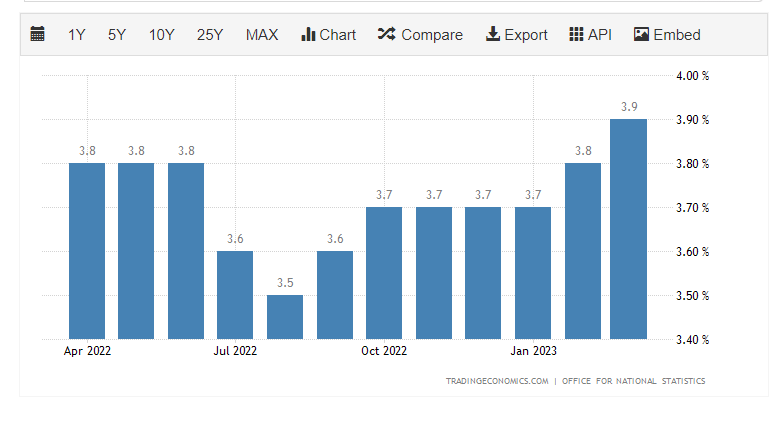

In other news from the UK, wages are still growing strongly despite not having much employment in businesses. Wages for those working in the government rose by 5.6%, the highest in 20 years, while those in the private sector also experienced a sizeable 7% rise. The unemployment rate rose slightly to 3.9%, but more people are actively looking for work. On the flip side, the number of job openings is currently declining, according to Macroscope.

The US housing market is cooling

In the United States, data shows sales of existing homes are declining while sales of new homes are rising. People with 30-year mortgages at 3% choose to keep their homes. As such, existing homes for sale are declining and new homes are being sold with the help of low-cost mortgages and discounts. The number of people applying for a mortgage to buy a home has dropped 26% since last year, according to Macroscope.

mixed news from china

In China, economic growth fell short of expectations in April. Factory production increased only 5.6% year-on-year, rather than the expected 10.9% increase. Similarly, retail sales and investments in buildings and infrastructure were also lower than expected. However, there was also good news. The unemployment rate fell to 5.2% and more homes were sold compared to the same period last year, according to Macroscope.

summary

In summary, as this macroeconomic narrative unfolds around the world, financial resilience and strategic adaptability remain at the core of these dynamic markets. From regional banks to central bank chambers to the heart of Asia’s economy, the future lies in the nuances and grand narratives of global economic activity.